Drone Software Market Share, Size, Trends, Industry Analysis Report

By Solution (Application, System); By Platform; By Architecture; By Deployment; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2893

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

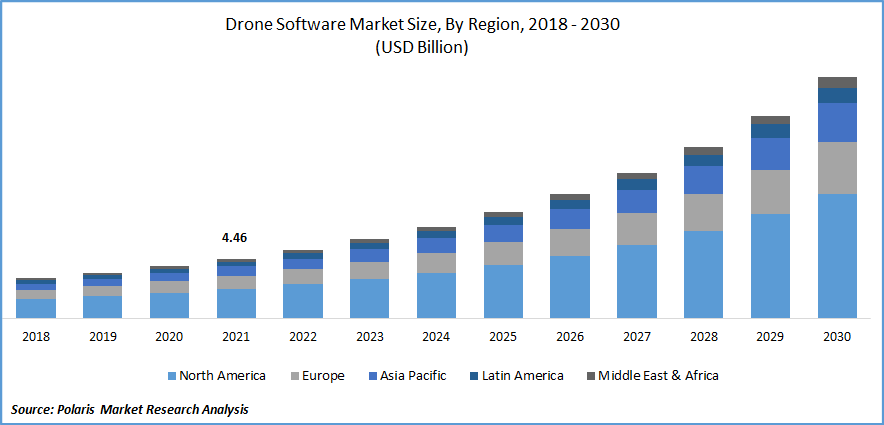

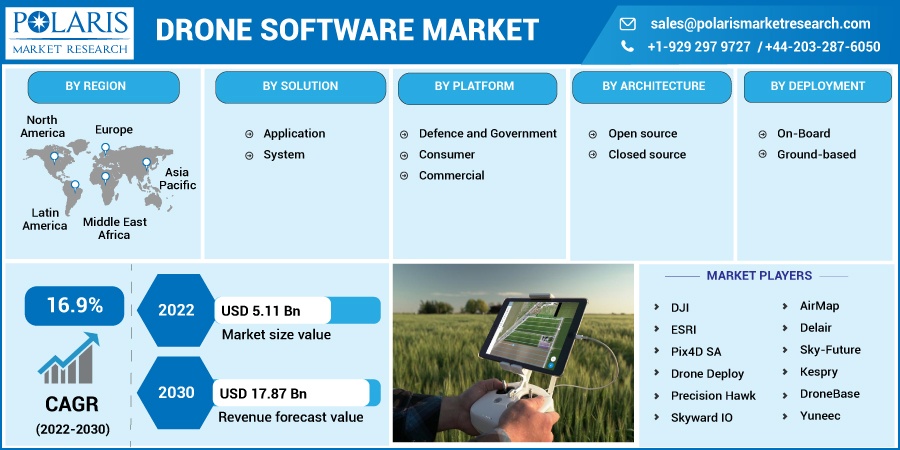

The drone software market was valued at USD 4.46 billion in 2021 and is expected to grow at a CAGR of 16.9% during the forecast period.

Favorable government schemes increased funding in software development, and rising cloud-based deployments in the form of Drone as a service (DaaS) are positively favoring the market growth. Several governments have introduced standard operating procedures in their respective countries, such as production-linked incentives for software development from innovative start-ups, funding for capacity development, and funding to small drone developers to develop critical components.

Know more about this report: Request for sample pages

The market is anticipated to increase due to rising demand for evacuation or rescue operations during man-made or natural disasters, increasing use of drones for photography and mapping, firefighting, traffic and weather monitoring, and rising demand for agriculture surveillance.

Unmanned aircraft, called drones, are composed of composite material and are controlled from the ground for various uses. The drones are outfitted with different techniques, including GPS, lasers, and infrared cameras. The term "ground cockpit" refers to remote ground control systems. When operating a quadcopter, the drone software offers additional capabilities. The software can aid in improving the drone's control capacity during flight and collecting pictures and movies. These days, drones have access to value-added experience due to very complex solutions. The software uses sensors to gather a variety of data.

Since drones can be used in dangerous and remote locations, the global market is booming as a result of these benefits. Additionally, the commercial and defense sectors are adopting drones, fostering the expansion of the worldwide global market. Also, businesses are making significant investments in R&D, fueling the expansion of the world drone software industry.

The Covid-19 pandemic has significantly affected the global market. Many software applications, such as package delivery, mapping, and inspection, have fueled the growth of market. Many countries used drone software during the covid-19 pandemic. Thus, they have relaxed their rules and regulations. The drone software is cost-efficient in terms of its software, hardware, and technology and is easily accessible compared to traditional methods.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Due to modern and advanced technologies in aerial vehicles, several industries have adopted drone software. They can fly at any geographic location, irrespective of altitude and range. These advantages are propelling the growth of the global market in many countries. Commercial applications like security, construction, and infrastructure, logistics, insurance,

In modern agriculture, drones have various uses, such as spraying operation, which is used for insecticide, foliar fertilizer, or seed. It can be carried out via navigation flight control or ground remote control. Data shows that many farmers are already benefiting from drone technology, and drones are quickly becoming an important tool for farmers. They have many advantages in agriculture. It can take off or land without any runway, fly at low altitudes, have high efficiency, penetrate through foggy weather over crops, and avoid the risk of getting affected by pesticides. By spraying technology, farmers can save up to 50% of pesticides and 90%of water consumption and therefore save many resources by using drones. Thus, the agriculture sector is driving the global market.

Report Segmentation

The market is primarily segmented based on solution, platform, architecture, deployment, and region.

|

By Solution |

By Platform |

By Architecture |

By Deployment |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Application segment is accounted for the largest revenue share in 2021

In terms of solutions, the application market segment accounted for more than 4/5th of the global market in 2021. Main applications of drones are power inspection, traffic monitoring, environmental and fire protection, and post-disaster rescue missions. Drones are adaptable, flexible, and transportable; therefore, they are for law enforcement investigations. They are used to keep an eye on unauthorized construction inquiries, waste disposal, and traffic control.

Regarding traffic inspections, swift accidents, and the capture of vehicles g emergency lanes, UAVs have significantly increased response efficiency. When a traffic accident occurs, the drone can take clear photographs, instantly recreate the accident scene, and offer data support to identify the guilty person. Small drones can come and perform their tasks quickly, whether they are on a big road or in a back street, or in an al. Thus, these applications of drones in traffic management propel the market growth.

The commercial segment is projected to grow at the highest CAGR during the forecast period

With the growing use of drones in the defense & commercial sectors, the market has changed in past few years. To support training and exercises and international contingency missions, the US Department of Defense employs around 11,000 drones. These aircraft come in various sizes and weights, with the smallest being the RQ-11B Raven and the largest being the RQ/MQ-4 Global Hawk/Triton.

Drones are increasingly utilized in the military for various purposes, including electronic interference, target detection, targeting, spying, and identification. Military Businesses like Northrop Grumman and General Atomics offer military drones with the necessary software. Commercial drone software providers are anticipated to release cutting-edge software with autopilot features and fleet management.

Open-Source segment is expected to hold the significant revenue share

Publicly accessible open-source software can be altered to meet the user’s needs. Because of its flexibility, this software is preferred by many drones. Drone-building groups provide open-source software like Dronecode/PX4, paparazzi UAV, and Open DroneMap, which enables users to create, modify and fix drone functionality. The cost of creating this software is lower; users typically do not need to rely on the firm creating the program for adjustments. Software that is not open source and must be purchased under a license is called closed-source software.

On-Board deployment segment is expected to have the largest revenue share

Onboard drones have embedded software with sensors and GPS. They fly autonomously and are controlled by using an embedded solution. Drone software is used to control flying operations from remote sensing. Ground-based control centers hold many unmanned aerial systems. It also controls various flights receiving radio signals from the ground control station.

North America is expected to hold the largest share during the forecast period

North America region witnessed a significant amount of growth. Since it is impossible for drones to carry out automatic “beyond visual line of sight flights, or to keep a record of flight data without software, software developers engaged in developing efficient & affordable software platforms. In various challenging situations, drones are utilized in Canada to conduct atmospheric research, including emergency and disaster monitoring, weather and atmospheric gas sampling, agricultural spraying, cartography and mapping, promotion, and advertising.

They are used for geophysical and marine research, imaging spectrometry, mineral prospecting, search and rescue operations, telecommunication relay platforms, and surveying and inspecting distant power lines and pipelines. Also, they are utilized for aviation and oceanographic research and weather reconnaissance.

Competitive Insight

Some of the major players operating in the global market include DJI, ESRI, Pix4D SA, DroneDeploy, Precision Hawk, Skyward IO, Yuneec, AirMap Inc. Delair, Sky-Future, Kespry and DroneBase.

Recent Developments

In April 2022, ESRI introduced StoryMaps, using its mapping technology. This solution adds a geographic perspective tracing their ancestors' footsteps, chronicling daily activities, or organizing a first significant trip after a pandemic.

In April 2022, DroneDeploy collaborated with Skydio, which joins the software of DroneDeploy with the capacity of Skydio drones.

In March 2022, PrecisionHawk partnered with the ESRI. This AI platform “PrecisionHawk” will be combined with ESRI's ArcGIS technology, advanced mapping, and spatial analytics tools, to create the greatest geospatial intelligence possible.

Drone Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 5.11 billion |

|

Revenue forecast in 2030 |

USD 17.87 billion |

|

CAGR |

16.9% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Solution; By Platform; By Architecture; By Deployment; By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

DJI, ESRI, Pix4D SA, Drone Deploy, Precision Hawk, Skyward IO, Yuneec, AirMap, Delair, Sky-Future, Kespry and DroneBase. |