Railway Wiring Harness Market Share, Size, Trends, Industry Analysis Report

By Component (Wire, Connector), By Material (Aluminum, Copper), By Voltage, By Application, By Train Type, And Segment Forecasts, 2023- 2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM3789

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

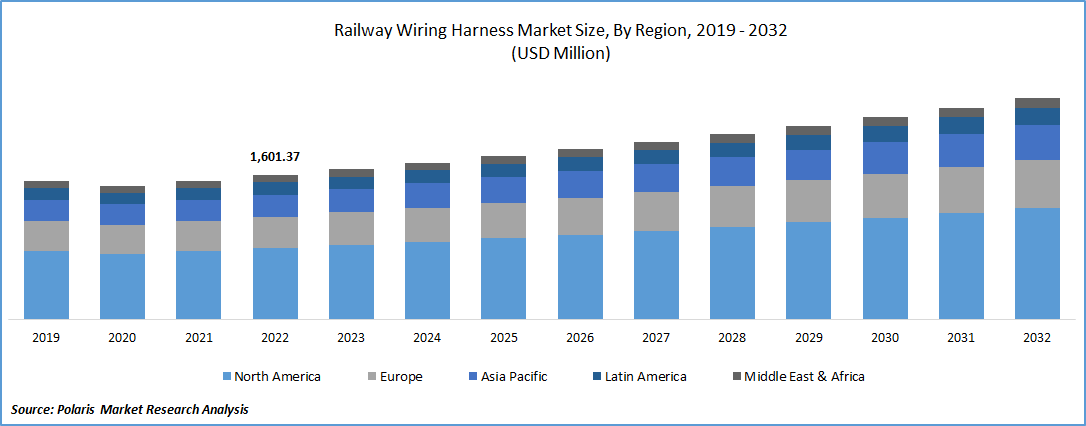

The global railway wiring harness market was valued at USD 1,601.37 million in 2022 and is expected to grow at a CAGR of 4.4% during the forecast period.

Wiring harnesses play a vital role in railway infrastructure as they are primarily utilized to securely transmit electric power and signals from the source to the intended system. This ensures a safe and efficient power transmission with minimal losses, making wiring harnesses a critical component in the railway network. The market is projected to experience substantial growth due to increasing developments and rapid advancements aimed at enhancing economies, energy efficiency, effectiveness, reliability, and overall quality of railway infrastructure and transportation. Additionally, the market is anticipated to be driven by continuous improvements in electrical and mechanical systems employed in the railway sector.

To Understand More About this Research: Request a Free Sample Report

The increasing trend of electrification in the transportation sector, regardless of the mode of transport, has resulted in the emergence of electric trains as a prominent player in the electric transport landscape, following road transport. Electric locomotives are now being recognized as a viable and efficient alternative to diesel locomotives, especially in mining and heavy-haul sectors, enabling long-distance journeys of up to 2,000 km or more.

With urban centers experiencing escalating traffic congestion worldwide, there is a pressing need to develop faster, more efficient, and more reliable transportation systems. Integrating advancements in technology, such as artificial intelligence and machine learning, with transportation systems holds great promise and is expected to drive market growth during the forecasted period. Although the railway industry is still in the early stages of automation, substantial investments are required for research and development of equipment that meets international standards for automation, safety, and quality. This entry barrier makes it challenging for new companies to enter the market, leaving the field predominantly open to major players.

Furthermore, the railway wiring harness market growth is anticipated to be accelerated by ongoing efforts to enhance transportation facilities. Railway wiring harnesses play a crucial role in ensuring passenger safety, making them indispensable in the construction of new railway lines. One noteworthy example is the extension of the Dubai Metro Red Line, scheduled for completion by the end of 2020, with an estimated project cost of USD 2.9 billion. This project exemplifies the significant demand for railway wiring harnesses as part of modern transportation infrastructure development.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Railway Wiring Harness Market : Growth Drivers

Rising demand for urban transportation

The demand for urban transportation, particularly metro/monorails, has seen exponential growth in the past two decades and is expected to continue in a similar trajectory during the forecast period. This increasing demand can be attributed to the expanding urban population and rising disposable incomes, which have fueled the need for efficient transportation systems. Countries like China and India, with their substantial potential, will likely be key focal points for this trend in the coming years. The market is poised to expand as a result of the growing global railway fleet. A clear indication of this is the Indian government's budget allocation of INR 1,10,055 crore for Indian railways in February 2021, which serves as a catalyst factor for market growth. This increased budget allocation indicates a strong commitment to improving railway infrastructure and will drive the demand for wiring harnesses in the industry.

Report Segmentation

The market is primarily segmented based on component, material, voltage, train type, application, and region.

|

By Component |

By Material |

By Voltage |

By Train Type |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

Wires segment accounted for the largest market share in 2022

The wires segment accounted for the largest global share in 2022. This is primarily due to the increasing utilization of wires in several applications, including facilitating power supplies and transmission of rail signals. The versatility and essential role of wires in these applications contribute significantly to their continued prominence in the market.

A terminal segment is likely to exhibit a significant growth rate over the coming years. Connectors used in railway wiring harnesses play a crucial role in vehicles integrated with advanced safety systems like braking systems and immobilizers. A significant driving factor for the increased sales of railway terminals is the growing development of advanced technologies, including driver assistance systems and safety features. Major companies in the industry are prioritizing the introduction of technological innovations that not only enhance operations but also lead to reduced energy consumption.

By Train Type Analysis

High-speed trains held the largest share in 2022

The high-speed trains segment held the largest share. The growth of this segment can be attributed to the increasing emphasis on high-speed rail programs and the active involvement of governments in initiatives aimed at improving transportation and modernizing railway infrastructure. Additionally, the advantages offered by high-speed rail/bullet trains, such as efficient freight transport and their ability to cover vast geographic areas in a short time with remarkable precision, are expected to drive the demand for these advanced rail systems further.

China, with its existing high-speed rail network spanning 20,000 km, and the country has ambitious plans to further extend it to over 30,000 km by 2020. This expansion initiative signifies the growing trend of countries investing in and expanding their railway infrastructure, which, in turn, is expected to drive the growth of the segment.

By Application Analysis

HVAC segment held the significant market share in 2022

The HVAC segment held a significant market share. This dominance is attributed to the critical role of high-quality wiring harnesses in HVAC systems, which must withstand harsh environmental conditions, including humidity and high temperatures. By employing HVAC harnesses, the requirement for extensive and intricate wiring is eliminated, resulting in reduced maintenance and installation costs for the entire system. This efficiency and cost-effectiveness make the HVAC harness an essential component in HVAC applications.

The infotainment harness segment will grow at a rapid pace. The increasing adoption of infotainment systems in railways offers passengers interactive and engaging services, which contributes to the rapid growth of this segment.

By Regional Analysis

Europe held the largest market share in 2022

Europe held the largest share in 2022. The region's leadership position is further bolstered by the continuous increase in investments directed towards rail infrastructure development. As evidence of this commitment, the European Commission reported rail infrastructure investments. These significant investments have played a crucial role in solidifying Europe's position as the market leader in the industry.

APAC region is emerging as the fastest-growing region. This is primarily due to government-bound investments in the railways sector. For instance, Indian Railways is developing technology in areas of signaling telecommunication, with 15,000 km being converted to automatic signaling 37,000 km with the introduction of 'KAVACH,' an indigenously developed "Train Collision Avoidance System".

Competitive Insight

The Railway Wiring Harness market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Hitachi Metals

- HUBER+SUHNER

- LEONI

- LS Cable & System

- Motherson

- NKT

- Prysmian Group

- Taihan Electric Wire

- TE Connectivity

Recent Developments

- In October 2022, HUBER+SUHNER acquired Phoenix Dynamics. This strategic move aims to strengthen HUBER+SUHNER's position in the railway wiring harness market and grant the company access to Phoenix Dynamics' specialized knowledge in custom cable assembly and design.

- In January 2022, NKT completed the acquisition of Ventcroft, a strategic move aimed at enhancing its capabilities in fire-resistant power cable technology. This acquisition enables NKT to effectively address the increasing demand for fire-resistant power cables in the railway industry, further solidifying its position in the market.

- In January 2022, Leoni, made a strategic decision to sell substantial parts of its business to BizLink. The successful completion of this deal is expected to significantly enhance Leoni AG's financial position, offering potential improvements for the company's overall financial stability.

- In September 2021, TE Connectivity, completed the acquisition of ERNI Group. This strategic move is set to bolster TE's expertise in comprehensive connectivity solutions, while also extending its customer reach and market presence. The acquisition marks a significant step in TE's growth strategy and reinforces its position as a key player in the industry.

Railway Wiring Harness Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,667.67 million |

|

Revenue forecast in 2032 |

USD 2,454.91 million |

|

CAGR |

4.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Component, By Material, By Voltage, By Train Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global railway wiring harness market size is expected to reach USD 2,454.91 million by 2032.

Key players in the railway wiring harness market are HUBER+SUHNER; LEONI; Taihan Electric Wire LS Cable & System.

Europe contribute notably towards the global railway wiring harness market.

The global railway wiring harness market is expected to grow at a CAGR of 4.4% during the forecast period.

The railway wiring harness market report covering key segments are component, material, voltage, train type, application, and region.