Refrigerated Transport Market Share, Size, Trends, Industry Analysis Report

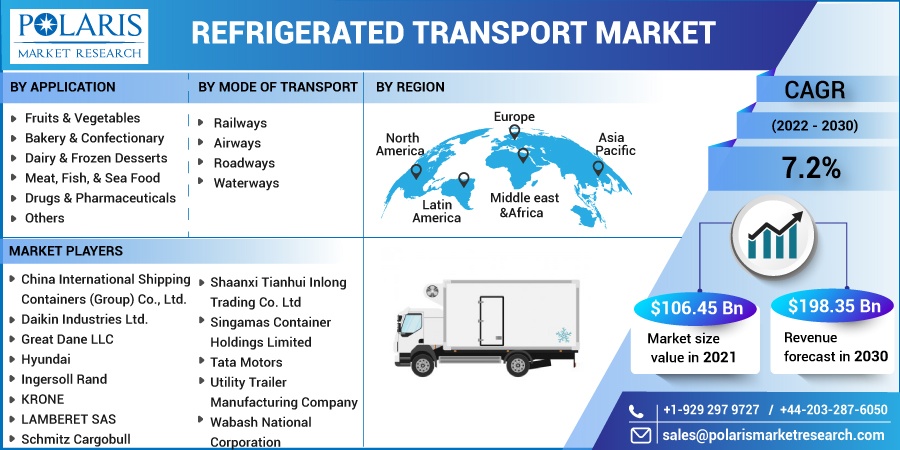

By Application (Fruits & Vegetables; Bakery & Confectionary; Dairy & Frozen Desserts; Meat, Fish, & Sea Food; Drugs & Pharmaceuticals; Others); By Mode of Transport; By Region; S

- Published Date:Jul-2022

- Pages: 114

- Format: PDF

- Report ID: PM2512

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

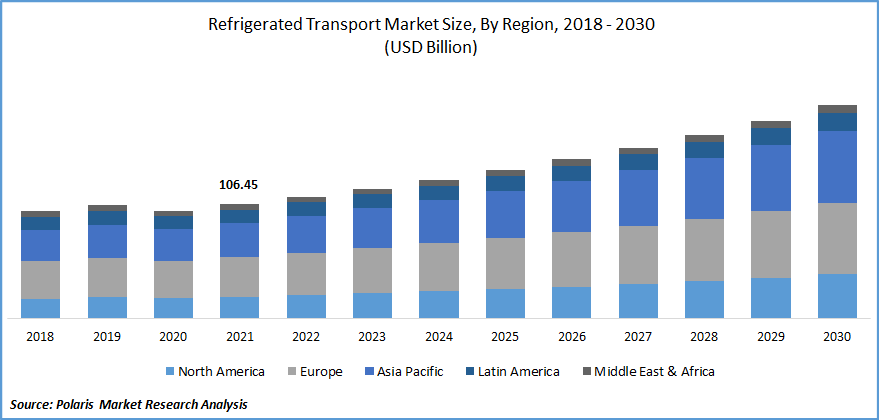

The global refrigerated transport market was valued at USD 106.45 billion in 2021 and is expected to grow at a CAGR 7.2% during the forecast period. Refrigerated transport is a temperature-controlled surface transport that refers to the freezing solutions used to maintain the quality and shelf life of the products, such as fresh agricultural products, seafood, photographic film, frozen food, chemicals, and pharmaceutical drugs.

Know more about this report: Request for sample pages

They are critical for extending the period of marketing, reducing transport bottlenecks during peak periods, avoiding overcapacity, and maintaining the quality of goods. This process involves the utilization of temperature-controlled warehouses for storage and cold-insulated vehicles for product distribution. These solutions are widely used to store fruits, meat, beef, vegetables, medicines, and drugs.

Transportation modes used are refrigerated trucks, refrigerated cargo, refrigerated railcars, and air cargo. This industry plays an important role in reducing the wastages of perishable products and commodities, overall providing remunerative prices to the farmers. The pharmacy industry plays an important role in increasing the efficacy of the drug throughout the supply chain.

Factors such as an increase in the number of refrigerated warehouses and growth in the pharmaceutical sector are expected to drive the growth of the industry. In addition, growth in the processed food sector is anticipated to boost the growth of the industry. However, major factors such as lack of standardization and high operational cost hinder the market growth. Furthermore, RFID technologies for industrial applications and the adoption of software for refrigerated transport provide lucrative growth opportunities for the industry players.

The outbreak of COVID-19 has majorly impacted the industry due to government restrictions. However, post lockdown, it has been observed that the governments worldwide have eased covid restrictions, which is resulting in a positive impact on refrigerated transport and is expected to observe a significant increment in the upcoming years till 2030.

Moreover, there has been a surge in demand for various perishable goods such as dairy products, fresh fruits and vegetables, confectionery, and bakery products, which have witnessed significant growth in recent years. These industry trends are projected to increase the demand for the market over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The industry is propelled by the increase in refrigerated warehouses, growth in pharmaceutical sectors, and development in food & beverage sectors. Dozens of warehouses comprising refrigerated goods are designed to ensure the ideal transportation conditions for temperature-sensitive food products.

Multiple export industries are dependent on the essential links that their solutions system provides. Businesses invest millions of dollars in their refrigerated transport operations to create effective, efficient, and reliable processes because end-to-end security is a weak link in the system. A single breakdown in this chain can lead to catastrophic losses of products and capital.

Moreover, online grocers are driving the demand for cold storage. Furthermore, a rise in sales of online groceries in the U.S. market is projected to boost the demand for up to 100 million sq. ft. of cold-storage space in the near future, according to a new report from CBRE. Thus, the increase in refrigerated warehouses fuels the growth of the industry.

Further, pharmaceutical companies are gradually focusing on product quality and sensitivity. Major factors such as the development of complex biological-based medicines and shipments of hormone treatments, vaccines, and complex proteins that require temperature-controlled transportation and warehousing. Such logistics of pharmaceutical products and medical devices is a growing part of the healthcare logistics industry.

Moreover, the rise in the need for effective services to maintain the quality of goods fuels the growth of the industry. In addition, the entire cold chain supply chain and logistics for the pharmaceutical industry are becoming more strategic and reliable. For instance, from 2011 to 2017, the number of heat-sensitive healthcare products shipped has increased by 45%; one in two healthcare products is shipped via the cold chain.

In 2018, global sales of biotechnology medicines and biological products were recorded to be more than 300 billion dollars. These high-value pharmaceutical products are mostly shipped via these solutions across the entire distribution network, thus driving the growth of the market in Asia Pacific.

Report Segmentation

The market is primarily segmented based on application, mode of transport, and region.

|

By Application |

By Mode of Transport |

By Region |

|

|

|

Know more about this report: Request for sample pages

Meat, Fish & Sea food accounted for the largest market share in 2021 under application

On the basis of application, the refrigerated transport market is categorized into Fruits & Vegetables; Bakery & Confectionery; Dairy & Frozen Desserts; Fish, & Sea Food; Meat, Drugs & Pharmaceuticals; and Others.

The meat, fish, and seafood segment accounted for the largest market share in 2021. Meat, fish, and seafood have a shorter lifespan if not stored at a suitable temperature; therefore, it is essential that these products are frozen till the time it has been used. Blast freezing can freeze huge amounts of fresh fish, meat, and seafood, increasing freshness and product shelf life.

Moreover, the drugs and pharmaceuticals segment is anticipated to experience lucrative growth in the market as different storage conditions, and strict temperature control is essential for the storage of drugs and pharmaceuticals goods.

The government has implemented transparent policies with technical regulations and standards for the assessment of quality and its consistency. In addition, Food and Drug Administration in the U.S. measures over the stability incited many of the key players. From 2011 to 2017, the number of heat-sensitive healthcare products rose by 45%, and around 50% of the pharmaceutical products are shipped via the cold chain channel.

The global sales of biotechnology medicines and biological products were recorded at more than 300 billion dollars in 2018. These high-value pharmaceutical products are shipped through the refrigerated method across the entire distribution network worldwide.

Waterways is expected to be the fastest growing segment during the forecast period

On the basis of mode of transport, the market has been segmented into railways, airways, roadways, and waterways. The waterways segment is estimated to be the fastest growing segment during the forecast period due to the low cost related to marine shipments. Since this mode of transport is the cheapest in comparison to other modes of transport and is more efficient; therefore, this segment has a huge scope for growth in the forecast period.

The European region lead the global refrigerated transport market by 2030

Europe refrigerated transport market is expected to be the highest market during the forecast period. Augmented global trade and a strong economic environment predominantly drive the market in the European region. An increase in demand for frozen food and the online retail market hold growth opportunities for the key players during the forecast period.

The rise in imports of perishable commodities such as vegetables and fruits in the region is another major factor that is contributing to the demand for refrigerated warehousing. the advanced packaging system have improved the shelf life of food products.

However, B2B accounts for a larger share of the market, an increase in online purchases of ready-to-eat food products is projected to drive the demand in the refrigerated transport market. Vendors have adopted techniques such as RFID and HACCP to enhance their efficiency, and with decreased size of shipments, vendors are likely to adopt more multi-compartment refrigerated vehicles over the forecast period.

Moreover, Germany is the best international location for the research, production, and distribution of pharmaceuticals at an exceptionally high level. In addition, Germany being a pharmaceutical hub has a major presence and demand for refrigerated warehouses, distribution centers, and logistics networks, which in turn makes Germany a major contributor to the European refrigerated transport market. In addition, Pfenning-logistics is one of the major players in Germany in branch deliveries to food retailers and discounters with temperature-controlled goods.

Competitive Insight

Some of the major players operating in the global market include China International Shipping Containers (Group) Co., Ltd., Daikin Industries Ltd., Great Dane LLC, Hyundai, Ingersoll Rand, KRONE, LAMBERET SAS, Schmitz Cargobull, Shaanxi Tianhui Inlong Trading Co. Ltd, Singamas Container Holdings Limited, Tata Motors, United Technologies Corporation (Carrier Corporation), Utility Trailer Manufacturing Company, VE Commercial Vehicles Limited, Wabash National Corporation.

Recent Developments

In August 2021, Thermo King launched the T-80E Series for refrigerated truck to offer greater performance in refrigeration capacity and precise temperature control.

In January 2019, Americold Acquired PortFresh Holdings and Plans to Develop State of the Art Facility to support temperature-controlled trade through the port of Savannah

Refrigerated Transport Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 106.45 billion |

|

Revenue forecast in 2030 |

USD 198.35 billion |

|

CAGR |

7.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Application, By Mode of Transport, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

China International Shipping Containers (Group) Co., Ltd., Daikin Industries Ltd., Great Dane LLC, Hyundai, Ingersoll Rand, KRONE, LAMBERET SAS, Schmitz Cargobull, Shaanxi Tianhui Inlong Trading Co. Ltd, Singamas Container Holdings Limited, Tata Motors, United Technologies Corporation (Carrier Corporation), Utility Trailer Manufacturing Company, VE Commercial Vehicles Limited, Wabash National Corporation. |