Reverse Logistics Market Share, Size, Trends, Industry Analysis Report

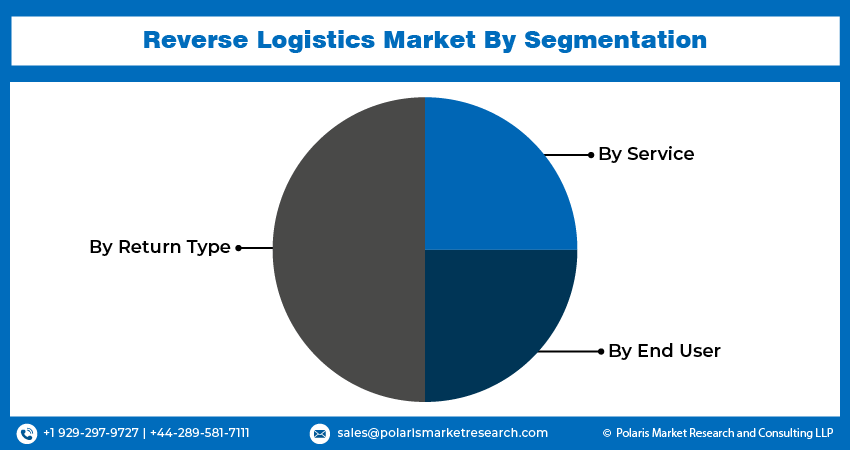

By Return Type (Recalls, Commercial Returns, Repairable Returns, End-of-Use Returns, End of Life Returns); By Service; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3641

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

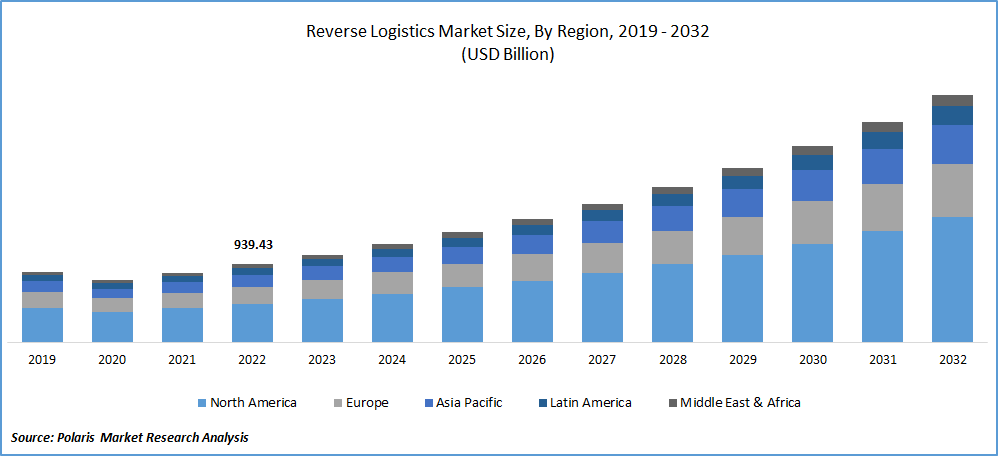

The global reverse logistics market was valued at USD 1053.76 billion in 2023 and is expected to grow at a CAGR of 12.30% during the forecast period.

Reverse logistics refers to the processes and activities involved in managing the flow of products or materials from the point of consumption to their origin or other designated destinations. It encompasses many activities that optimize the value recovery, proper disposal, or reuse of products, components, or materials.

To Understand More About this Research: Request a Free Sample Report

It manages the return of products from customers, retailers, or distributors due to various reasons such as defects, damages, recalls, or customer dissatisfaction. It includes activities like product inspection, repair, repackaging, and restocking. They are refurbishing or remanufacturing products or components to extend their lifecycle and reintroduce them into the market.

It properly disposes of products, components, or materials that cannot be reused or repaired. It involves recycling materials or safely disposing of hazardous substances by environmental regulations and guidelines, managing warranty claims, and providing product after-sales support. It involves processes such as repairing or replacing faulty products, ordering spare parts, and coordinating with service providers.

Managing the logistics aspects of reverse logistics, including packaging, transportation, and handling returned products or materials. It includes optimizing packaging materials, reverse supply chain network design, transportation logistics to minimize costs and environmental impact, and collecting, analyzing, and utilizing data related to reverse logistics operations to improve process efficiency, customer satisfaction, and decision-making. These include tracking product returns, exploring reasons for returns, and identifying opportunities for process improvement.

Industry Dynamics

Growth Driver

Collaborations in the marketplace play a crucial role in driving the growth of the reverse logistics market. Aramco & DHL Supply Chain recently entered into a shareholders' agreement to establish a new procurement & logistics hub in Saudi Arabia. This strategic partnership aims to enhance the supply chain services for sustainability & efficiency. It would be the first such center in the area, serving clients in the industrial, energy, chemical, and petrochemical industries. This collaboration sets the stage for increased demand for reverse logistics services through supply chain optimization, sustainability initiatives, sector-specific focus, and regional influence. As businesses recognize the value of efficient and sustainable reverse logistics practices, the market will experience further growth and development.

Report Segmentation

The market is primarily segmented based on return type, service, end user, and region.

|

By Return Type |

By Service |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

End-Of-Use Returns Segment Is Expected to Witness Fastest Growth During Forecast Period

End-of-Use Returns segment is expected to have faster growth for the market. Many end-of-use products still have residual value. Companies can recover value from these products by implementing efficient reverse logistics processes. Businesses can generate revenue and optimize their asset recovery through refurbishment, repair, or resale. This aspect is particularly appealing as it provides financial benefits and reduces losses associated with end-of-use products. Instead of treating products as waste, they are reintroduced into the value chain. This approach promotes resource efficiency, reduces the need for raw materials, and extends the lifespan of products. It fosters a more sustainable and circular approach to consumption and production, a key driver for the market's growth.

Reselling Segment Is Expected to Hold the Larger Revenue Share in Upcoming Years

Reselling segment is projected to witness a larger revenue share in the coming years as these services create new revenue streams for companies. Businesses can capture additional sales and revenue by effectively refurbishing and reselling returned products. This revenue generation contributes to the growth of the reverse logistics market as companies recognize the potential value in implementing reselling strategies and invest in the necessary infrastructure and processes. These services can enhance customer satisfaction and loyalty. When customers have the option to return products and know that there is a chance for them to be refurbished and resold, it instills confidence in the brand and its commitment to customer value. This, in turn, can lead to increased customer loyalty and repeat purchases, further propelling the market's growth.

E-Commerce Segment Projected to Witness Largest Market Share During Forecast Period

The E-Commerce segment holds the largest market share in the study period. The rise of e-commerce has led to a significant increase in online shopping. As more consumers opt for online purchases, product returns also increase. This surge in online shopping activities directly translates to a higher demand for reverse logistics services to handle returns efficiently. The e-commerce segment's growth fuels the need for robust reverse logistics capabilities. In the competitive e-commerce landscape, providing hassle-free returns has become crucial in attracting and retaining customers. E-commerce companies recognize the importance of offering convenient return processes to enhance customer satisfaction and build trust. Effective reverse logistics services enable them to meet these customer expectations, improve the overall customer experience, and gain a competitive advantage.

North America Garnered With the Highest Growth in 2022

North America garnered the highest growth in 2022. Government support and initiatives to provide a conducive environment drive the market's growth. The launch of the FLOW initiative by the Biden-Harris Administration drives the growth of the reverse logistics market in the United States and North America. Through enhanced collaboration and information sharing, streamlined supply chain operations, technology adoption, sustainability considerations, and government support, FLOW contributes to expanding efficient and effective reverse logistics processes. This ultimately fuels the growth of the reverse logistics market by driving demand for advanced solutions and services in this region. The government's backing encourages companies to invest in reverse logistics capabilities, adopt best practices, and comply with regulations. This support fosters a favorable ecosystem for the development and expansion of the reverse logistics market in the region.

Europe is projected to witness a significant growth rate for the market as it places a strong emphasis on sustainability and environmental responsibility. The region has implemented strict regulations and initiatives focused on waste reduction, recycling, and proper disposal of products. Reverse logistics services are critical in managing returns and enabling companies to comply with these sustainability initiatives, driving the demand for reverse logistics in the region. The sustained growth of online shopping in the European Union (EU) is a significant driver of the market in this region.

As per the annual survey of ICT use in households, it is evident that online shopping is gaining popularity in the EU. In 2022, 91% of individuals aged 16 to 74 in the EU had utilized the internet, with 75% engaging in online purchases for private use. This surge in online shopping activities directly contributes to the growth of the reverse logistics market in Europe, as the increased volume of purchases inevitably leads to a higher number of product returns that necessitate efficient reverse logistics processes.

Competitive Insight

Some of the major players operating in the global market include FedEx, UPS, DHL Supply Chain, XPO Logistics, CEVA Logistics, C.H. Robinson Worldwide, DB Schenker, Ryder System, Reverse Logistics Company, Liquidity Services, Genco, Genpact, Re-Teck, Inmar, eCycle Solutions, Optoro, The Retail Equation, Flextronics International, Walmart, Best Buy, Amazon, Dell Technologies, Apple, Samsung Electronics, LG Electronics, HP, Lenovo Group, Cisco Systems, Ingram Micro, Arrow Electronics, Avnet, Synnex, Tech Data, Digi-Key Electronics, Brightstar, Asurion, Blancco Technology, Hyla Mobile, Apto Solutions & ITRenew.

Recent Developments

- In December 2022, FedEx unveiled its new service, “FedEx Consolidated Returns,” in the U.S. It aims to provide merchants with a cost-effective and simplified e-commerce returns option they can offer their customers. The enhanced service is scheduled to be launched in early 2023.

- In May 2022, DHL Supply Chain unveiled a new recovery management solution to reduce electronic waste. This novel circular supply chain solution aids businesses in properly reusing, processing, or recycling used electrical components.

Reverse Logistics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1182.21 billion |

|

Revenue forecast in 2032 |

USD 2,986.17 billion |

|

CAGR |

12.30% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Return Type, By Service, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

FedEx, UPS, DHL Supply Chain, XPO Logistics, CEVA Logistics, C.H. Robinson Worldwide, DB Schenker, Ryder System, Reverse Logistics Company, Liquidity Services, Genco, Genpact, Re-Teck, Inmar, eCycle Solutions, Optoro, The Retail Equation, Flextronics International, Walmart, Best Buy, Amazon, Dell Technologies, Apple, Samsung Electronics, LG Electronics, HP, Lenovo Group, Cisco Systems, Ingram Micro, Arrow Electronics, Avnet, Synnex, Tech Data, Digi-Key Electronics, Brightstar, Asurion, Blancco Technology, Hyla Mobile, Apto Solutions & ITRenew. |

FAQ's

key companies in reverse logistics market are FedEx, UPS, DHL Supply Chain, XPO Logistics, CEVA Logistics, C.H. Robinson Worldwide, DB Schenker, Ryder System, Reverse Logistics Company, Liquidity Services, Genco, Genpact, Re-Teck, Inmar, eCycle Solutions.

The global reverse logistics market and is expected to grow at a CAGR of 12.3% during the forecast period.

The Reverse Logistics Market report covering key segments are return type, service, end user and region.

key driving factors in reverse logistics market are Increasing collaborations and partnerships.

The global reverse logistics market size is expected to reach USD 2,986.17 billion by 2032