Sealing Membranes Market Size, Share, Trends, & Industry Analysis Report

: By Product Type (Sheet Membranes and Liquid-Applied Membranes), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5737

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

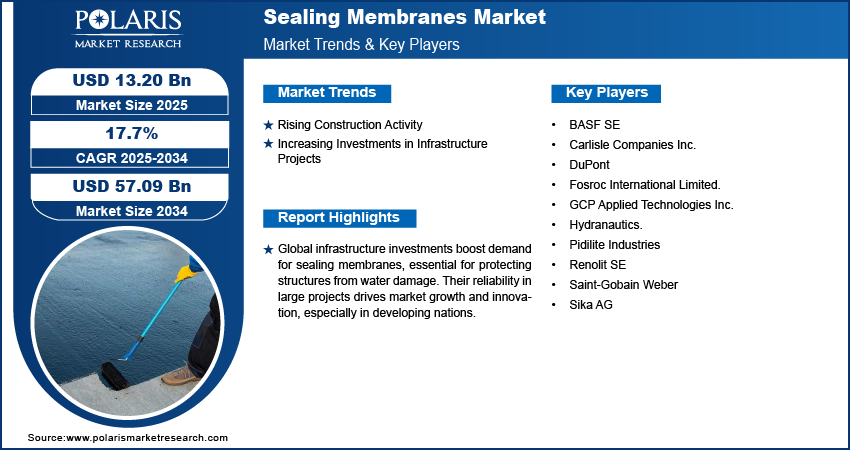

The global sealing membranes market size was valued at USD 11.26 billion in 2024, growing at a CAGR of 17.7% during 2025–2034. The growth is driven by rising construction and infrastructure projects, and increasing government investments.

A sealing membrane is a protective layer applied to surfaces such as roofs, walls, or basements to prevent water, moisture, and air from penetrating a structure. It helps enhance durability and prevents damage caused by leaks or dampness.

Governments worldwide are enforcing stricter building codes to ensure safety, durability, and environmental compliance. These regulations mandate the use of effective waterproofing systems, including sealing membranes, to prevent water ingress and associated risks. This compliance is driving construction companies to adopt advanced sealing technologies to avoid penalties and liability issues. The demand for high-quality sealing membranes is rising as regulations are evolving, thereby driving the growth of the industry.

.webp)

To Understand More About this Research: Request a Free Sample Report

Advancements in sealing membrane technology, such as self-adhesive sheets, liquid-applied membranes, and integral crystalline waterproofing, have improved ease of application and performance. New materials are offering better flexibility, durability, and environmental resistance, which are making sealing membranes more effective and reliable. These advancements are meeting the evolving needs of construction projects exposed to harsh weather and chemical environments, thereby expanding demand for sealing membranes.

Industry Dynamics

Rising Construction Activity

Construction activities are rising worldwide due to rising urbanization, population growth, and disposable income. According to the United States Census Bureau, the construction spending in April 2025 in the US alone was USD 2,152.4 billion. With the increasing construction activities, there is a rising need for effective waterproofing solutions to protect these structures from water damage as new buildings, bridges, tunnels, and commercial complexes are constructed. Sealing membranes help extend the lifespan of constructions by preventing leaks, dampness, and corrosion, making them essential in modern building projects, thereby driving the growth of the sealing membrane industry.

Increasing Investments in Infrastructure Projects

Governments worldwide are investing heavily in infrastructure development, including roads, bridges, tunnels, airports, and public buildings. According to the Commonwealth of Australia, in 2024-25, the Australian government committed USD 16.5 billion in infrastructure projects. These projects require robust waterproofing solutions to protect concrete and steel structures from water damage and corrosion, ensuring safety and longevity. Sealing membranes play a major role in these large-scale projects by providing effective moisture barriers. The demand for reliable sealing membranes is rising as infrastructure spending is increasing, especially in developing countries aiming to improve transportation and urban facilities, driving growth.

Segmental Insights

By Product Analysis

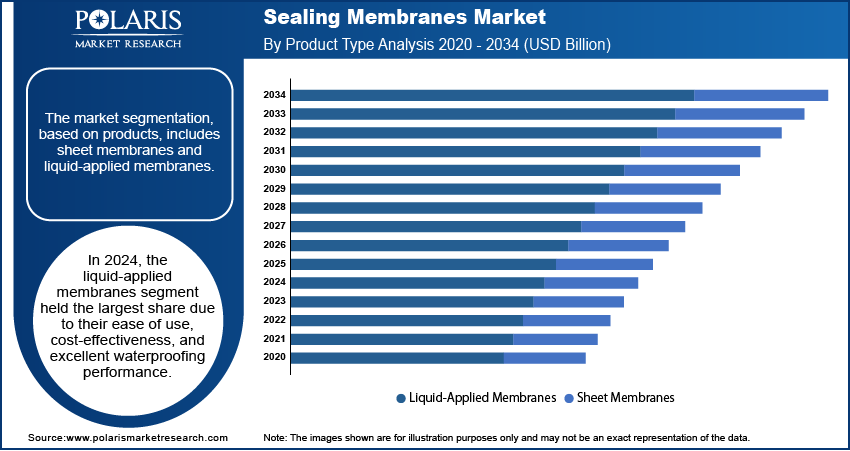

The segmentation, based on products, includes sheet membranes and liquid-applied membranes. In 2024, the liquid-applied membranes segment held a larger share due to their ease of use, cost-effectiveness, and excellent waterproofing performance. These membranes are applied as a liquid, forming a seamless and flexible barrier that adheres to various surfaces such as concrete, brick, and stone. They are widely used in both new construction and renovation projects because they reduce labor time and adapt to complex shapes. The ability to create a uniform layer without joints or seams gives liquid-applied membranes a major advantage, especially in areas such as balconies, roofs, and wet rooms.

The sheet membranes are expected to grow significantly during the forecast period, due to their superior durability and controlled thickness. These pre-formed membranes are made of materials such as HDPE, PVC, or TPO and are ideal for applications that demand high resistance to moisture, chemicals, and structural movement. The demand for sheet membranes is increasing with rising awareness of long-term performance and the need for reliable waterproofing in large-scale infrastructure projects. Their growing use in tunnels, basements, and commercial rooftops, along with advancements in adhesive technology, is expected to drive the segmental growth.

By End Use Analysis

The segmentation, based on end use, includes residential, commercial, and industrial. The residential segment held the largest share in 2024 due to the increasing construction of houses, apartments, and housing complexes across urban and semi-urban areas. Homeowners are more aware of the importance of waterproofing to prevent leaks, mold, and structural damage. Sealing membranes are commonly used in bathrooms, kitchens, terraces, and basements to protect buildings from moisture. The rising demand for affordable housing and government-supported residential projects in developing nations further supports this segment's growth.

The commercial segment is expected to witness significant growth during the forecast period, driven by the rapid expansion of commercial spaces such as office buildings, malls, hospitals, hotels, and educational institutions. These structures often require high-performance sealing solutions for large roofs, underground parking, and high-traffic areas. Sealing membranes are becoming essential as businesses are investing in modern infrastructure that demands long-lasting protection from water damage. Additionally, stricter construction standards and the growing focus on sustainable, leak-free buildings are expected to drive the adoption in this segment during the forecast period.

Regional Analysis

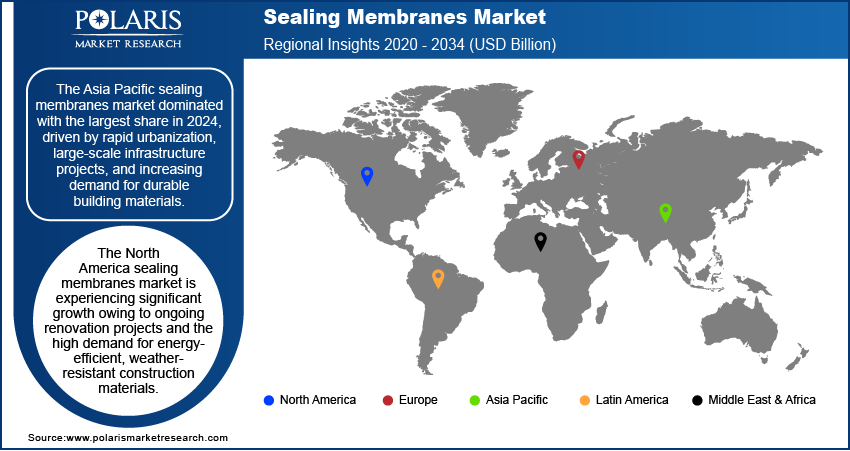

The Asia Pacific sealing membranes market dominated with the largest share in 2024, driven by rapid urbanization, large-scale infrastructure projects, and increasing demand for durable building materials. Countries such as China, Japan, and South Korea are investing heavily in residential, commercial, and industrial construction. The growing need for waterproofing in tunnels, metro lines, high-rise buildings, and public infrastructure has boosted the use of sealing membranes across the region. Additionally, rising awareness of sustainable construction and supportive government policies have fueled the growth of the industry in the region.

The India sealing membranes market is expected to witness significant growth during the forecast period, due to booming construction activities and government-led infrastructure programs such as Smart Cities and Housing for All. The country’s tropical climate and seasonal heavy rainfall are creating a strong need for effective waterproofing solutions in both urban and rural areas. More builders and homeowners are adopting advanced sealing membranes as awareness of water damage prevention increases. Growth in the real estate sector, along with rising demand for modern, long-lasting materials, boosts the demand for sealing membranes in India.

The North America sealing membranes market is projected to witness substantial growth during the forecast period, due to ongoing renovation projects and the high demand for energy-efficient, weather-resistant construction materials. Both the US and Canada are investing in modernizing aging infrastructure, such as bridges, public buildings, and transportation networks. The region further has strict building codes that require reliable waterproofing solutions, which encourages the adoption of advanced membrane technologies. Additionally, the growing popularity of green building certifications such as LEED is pushing contractors to choose eco-friendly sealing membranes, driving the growth in North America.

The Canada sealing membranes market is expected to experience significant growth in the coming years, driven by extreme weather conditions and the need for durable, moisture-resistant construction materials. Cold climates, snow, and freeze-thaw cycles create significant challenges for buildings and infrastructure, making waterproofing solutions critical. Increasing investments in housing, commercial real estate, and public infrastructure such as roads and tunnels are boosting the demand for high-performance sealing materials. Supportive government regulations, combined with a growing focus on sustainable and energy-efficient building practices, are further expected to drive the growth.

Key Players and Competitive Analysis

The sealing membrane market is competitive, with several global players offering innovative solutions across industries such as construction, infrastructure, and water treatment. Leading companies, such as Sika AG, BASF SE, and DuPont, are known for their strong R&D, wide product ranges, and global presence. These firms focus on high-performance membranes used in waterproofing and protective applications. Carlisle Companies Inc. and GCP Applied Technologies Inc. are also major players, especially in roofing and construction, where reliable sealing solutions are in high demand. Saint-Gobain Weber and Pidilite Industries cater to both global and regional markets, offering cost-effective options with strong local distribution networks. Fosroc International and Renolit SE bring expertise in specialized membranes for commercial and industrial use, while Hydranautics, a part of the Nitto Group, focuses more on water filtration and treatment membranes, giving it a unique niche in the market. The competitive landscape is driven by innovation, product performance, and sustainability. Companies are investing in eco-friendly, durable, and easy-to-apply membranes to meet the growing demand in both developing and developed regions. Strategic mergers, technological advancements, and regional expansions are key tactics shaping the industry.

Key Players

- BASF SE

- Carlisle Companies Inc.

- DuPont

- Fosroc International Limited.

- GCP Applied Technologies Inc.

- Hydranautics.

- Pidilite Industries

- Renolit SE

- Saint-Gobain Weber

- Sika AG

Industry Developments

In March 2024, Polyglass U.S.A. unveiled new roofing and waterproofing membranes, including Modifleece, PolyVap SAS, and Seal the Envelope, at the IIBEC 2024 Trade Show in Phoenix. The launch showcased innovative solutions designed to improve durability and sustainability in commercial roofing.

In March 2023, Bostik India launched its smart waterproofing solutions, SEAL & BLOCK. The event highlighted innovative technology designed to enhance building durability and sustainability from basement to roof.

Sealing Membranes Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Sheet Membranes

- Liquid-Applied Membranes

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Sealing Membranes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.26 Billion |

|

Market Size Value in 2025 |

USD 13.20 Billion |

|

Revenue Forecast by 2034 |

USD 57.09 Billion |

|

CAGR |

17.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.26 billion in 2024 and is projected to grow to USD 57.09 billion by 2034.

The global market is projected to register a CAGR of 17.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are BASF SE, Carlisle Companies Inc., DuPont, Fosroc International Limited, GCP Applied Technologies Inc., Hydranautics, Pidilite Industries, Renolit SE, Saint-Gobain Weber, and Sika AG.

The liquid-applied membrane segment dominated the market share in 2024.

The commercial segment is expected to witness the significant growth during the forecast period.