Secure Access Service Edge Market Share, Size, Trends, Industry Analysis Report

By Organization Size (SMEs, Large Enterprises); By Vertical (Government, BFSI, Retail & eCommerce, IT & ITeS, Others); By Offering; By Region; Segment Forecast, 2022- 2030

- Published Date:Jan-2022

- Pages: 112

- Format: PDF

- Report ID: PM2238

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

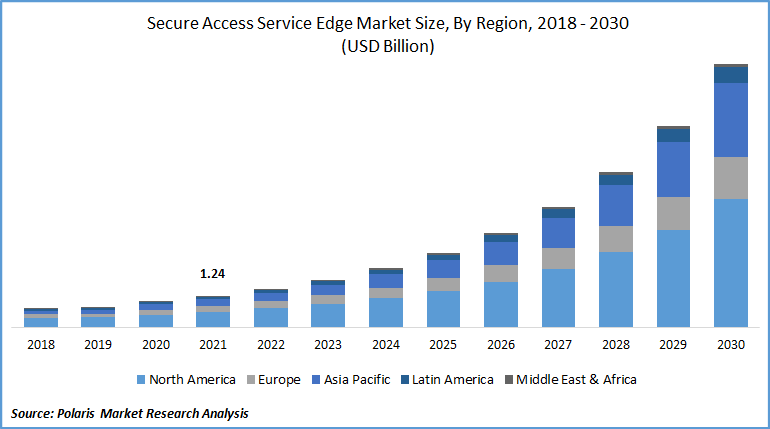

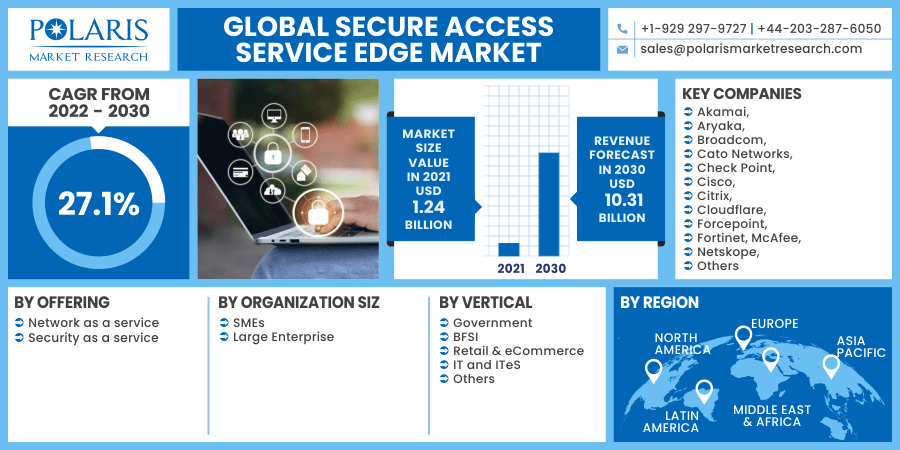

The global secure access service edge market was valued at USD 1.24 billion in 2021 and is expected to grow at a CAGR of 27.1% during the forecast period. Key factors influencing the market growth positively include the growing demand for a unified network security architecture that includes SD-WAN, SWG, ZTNA, and FWaaS capabilities and a scarcity of security tools and processes.

Know more about this report: request for sample pages

Also, laws and regulations of data protection are mandated to follow by secure access service edge providers, which help to drive the global secure access service edge industry. Whereas, rising mobile users all over the world and cloud-based service edge are becoming prominent among small-medium enterprises, creating opportunities for the global market in the projection period.

The COVID-19 outbreak had a positive impact on the secure access service edge market. In the wake of the COVID-19 pandemic, several governments across the globe adapted new strategies to work remotely. For a variety of companies, digital business practices have since become the new Business Continuity Plan (BCP). As a result of the rising use of BYODs service edge and worldwide internet penetration, individuals are more drawn to utilize digital technologies.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The growth can be attributed to the growing market demand for remote working due to the COVID-19 epidemic, which has demanded the development of a comprehensive security architecture that can provide secure data access on the go. Cloud computing advances are assisting in increasing corporate efficiency and improving security network administration. Businesses are rapidly embracing a cloud-based IT architecture after realizing the benefits of cloud computing. As a result, the secure access service edge industry expansion would be aided by the increasing use of cloud-based IT systems and solutions throughout the projected period. SASE, which is a new concept in the security world, has experienced tremendous growth.

Existing network designs have numerous access points for data storage across cloud platforms and servers and concerning apps. Managing and protecting these networks and secure access to such disparate data can be a difficult and time-consuming process. The work is becoming more difficult due to the ongoing deployment of new technologies and the rising acceptance of the BYOD trend across companies. SASE has the ability to combine networking and security features into a single platform or framework at this time.

In addition, legacy solutions such as the traditional VPN architecture do not provide appropriate security in the present scenario, when applications are dispersed over various clouds, and instead, raise the risk of cyberattacks. This has prompted a security architecture that ensures secure data transmission throughout the communication cycle. The SASE architecture can extend perimeter security features to the edge. As a result, implementing security within networks brings the secure access framework closer to the user, allowing for a more secure method to preventing unwanted access. The approach can also be easily synced with an organization's business processes, allowing IT experts to grant or restrict access to users dynamically.

Report Segmentation

The market is primarily segmented on the basis of offering, organization size, vertical, and region.

|

By Offering |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Offering

Security as a service edge segment held the largest share in the global secure access service edge market in 2021. According to Zscaler, Security as a Service (SaaS) edge is a cloud-based delivery of security solutions that are typically found in business intelligence and data centers or regional gateways. SaaS has become a necessary element of the market across the globe because it provides secure access to apps and service edges regardless of where they are located or where users connect.

Insight by Organization Size

The large enterprises are projected to hold the largest share during the forecast period. Large enterprises are reorganizing their security policies and architecture to include SASE technology to protect critical assets from a variety of cyber-attacks.

As they have a large workforce and associated networking equipment that is vulnerable to identity-related risk, large enterprises were early users of SASE due to the cost edges. SMBs must consider their financial restrictions; therefore, they choose cloud-based solutions in the secure access service edge industry. The requirements for SMEs can also be based on a variety of variables, such as revenue and ownership structure.

Geographic Overview

Geographically, in 2021, North America had the largest revenue share, and it is anticipated to continue to dominate the worldwide secure access service edge market during the forecast period. Continued technological advancements, aggressive IT infrastructure expenditure, and rising cloud usage are driving new market players to enter the regional market. The growing number of cyberattacks targeting major businesses and the negative impact of these assaults on the whole business are pushing up IT investment in North America.

Over the projection period, Asia Pacific is predicted to grow at a significant CAGR. The regional market is projected to increase due to companies in China, Japan, and India making huge expenditures to ensure the security of their IT infrastructure. The regional secure access service edge market is also being driven by the expanding digital workforce and the ongoing acceptance of the BYOD trend by businesses in Asia Pacific.

The regional market is projected to increase as a result of the security framework policies being implemented, particularly in Southeast Asia, in response to the rising threats of cyberattacks on key IT systems. For instance, in September 2020, SecureCraft, a Singapore-based value-added distributor, was entrusted with introducing Cato Networks' cloud-based networking and security solutions to the Singapore and Malaysian IT channel.

Competitive Insight

Some of the major players operating the market include Akamai, Aryaka, Broadcom, Cato Networks, Check Point, Cisco, Citrix, Cloudflare, Forcepoint, Fortinet, McAfee, Netskope, Palo Alto Networks, Proofpoint, Versa Networks, VMware, and Zscaler.

Secure Access Service Edge Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.24 billion |

|

Revenue forecast in 2030 |

USD 10.31 billion |

|

CAGR |

27.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Offering, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Akamai, Aryaka, Broadcom, Cato Networks, Check Point, Cisco, Citrix, Cloudflare, Forcepoint, Fortinet, McAfee, Netskope, Palo Alto Networks, Proofpoint, Versa Networks, VMware, and Zscaler. |