SiC Fibers Market Share, Size, Trends, Industry Analysis Report, By Type (First Generation, Second Generation, Third Generation); By Form (Woven, Continuous, Others); By Usage (Composites, Non-Composites); By End-Use (Energy and Power, Aerospace and Defense, Industrial, Others); By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 111

- Format: PDF

- Report ID: PM2093

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

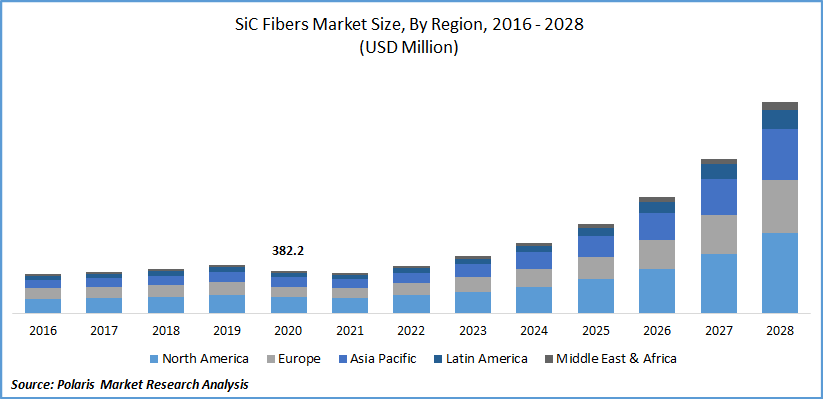

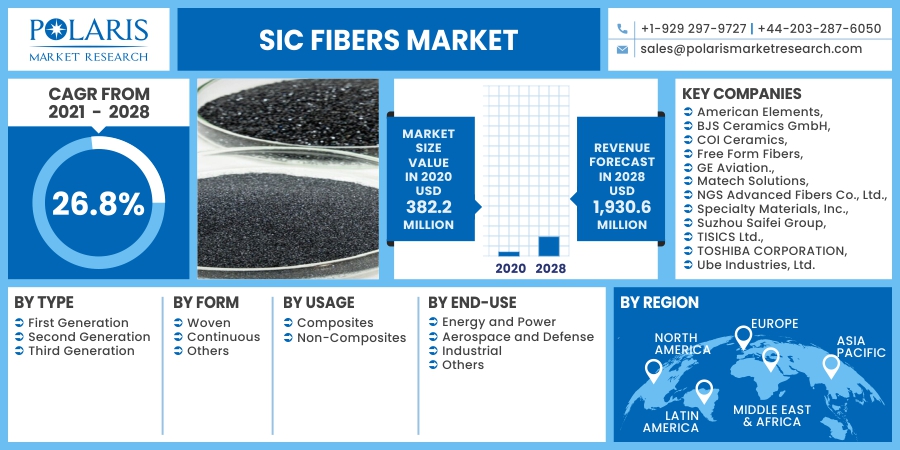

The global SiC Fibers market size was valued at USD 382.2 million in 2020 and is expected to grow at a CAGR of 26.8% during the forecast period. The adoption of SiC fibers has increased over the years owing to its strength-to-weight ratio, high modulus, oxidation-resistance, and high wettability. SiC fibers are increasingly being used in high-temperature and extreme pressure structural applications. These fibers offer properties such as high strength, lightweight, and greater chemical and thermal resistance. Some applications include aerospace and defense, transportation, energy and power, and industrial.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing application in manufacturing of gas turbine engines, greater need to develop fuel-efficient aircraft, and growing market demand from aerospace structural applications have contributed to the growth of the market. Increasing use of aircraft for dynamic operational environments and challenges in defense scenarios also boosts the market growth.

Growing use in component manufacturing for nuclear power plants, increasing investments for research and development, and technological advancements are some factors expected to offer market growth opportunities during the forecast period.

Alpha SiC fibers are utilized in high-temperature semiconductors, rockets, wear components, armor, abrasives, and turbine engines. They offer higher durability, tensile strength, and superior thermal conductivity. They offer chemical inertness and greater mechanical and thermal stability in radiation environments.

Alpha-SiC fibers exhibit extreme hardness, high elastic modulus, resisting corrosion, and abrasiveness. Use of SiC yarns results in greater performance, reduced weight, and higher fuel efficiency. Increasing application in manufacturing of commercial jets, growing air passenger traffic, and rising use in components of defense vehicles have supported the growth of the SiC market.

Know more about this report: request for sample pages

The COVID-19 pandemic has restricted the market growth of the SiC fibers industry. The market demand for SiC yarns has decreased during the pandemic owing to operational challenges, disruption of supply chain, and workforce impairment. Manufacturing activities have been halted due to various government regulations across the globe.

Termination of air travel due to global and regional travel restrictions has severely impacted the aviation industry, especially the small and midsize operators. Airlines are compelled to cancel orders for new aircraft and postpone repair and renewal of components. Other industries such as energy and power and industrial manufacturing have also declined, reducing the market demand for SiC yarns. After the end of the pandemic, the industry aims to get back on the ground through government support and initiatives, research and development, and growing applications.

Report Segmentation

The market is primarily segmented on the basis of type, form, usage, end-use, and region.

|

By Type |

By Form |

By Usage |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insights by Type

The type segment has been divided into first generation, second generation, and third generation. The market demand for third-generation SiC fibers is expected to increase during the forecast period. They offer improved properties of heat resistance, creep resistance, and oxidation resistance. These fibers provide superior performance and advantages, thereby increasing their use in engineering applications.

Insights by Form

The form segment has been divided into woven, continuous, and others. The continuous segment accounted for a major share in 2020. The continuous form offers high strength, heat and corrosion resistance, and greater performance in high-temperature environments. They are utilized in aerospace and military equipment for reinforcement and resistance to high temperatures. The market growth of this sector is fueled by rapid technological advancements in the aerospace industry and applications in advanced sports equipment.

Insights by Usage

On the basis of usage, the market is segmented into composites and non-composites. The composites segment dominated the global SiC fibers industry in 2020. Composites are used in various applications owing to greater performance, low thermal permeability, and creep-rupture. They are utilized in turbine engines, nuclear reactors, and sports equipment.

Insights by End-Use

On the basis of end-use industry, the market is segmented into energy and power, aerospace and defense, industrial, and others. The aerospace and defense sector dominated the global SiC fibers industry in 2020. SiC fibers are being used to manufacture different components for decreased weight and fuel consumption and increased overall efficiency. Government organizations of numerous countries have introduced several initiatives to support and promote prominent players to establish aircraft manufacturing facilities. This is anticipated to create new growth opportunities for international and local players operating in the commercial SiC fibers industry.

Geographic Overview

North America dominated the global SiC fibers in 2020. Rise in air traffic and increasing market demand for manufacturing of aircraft engines drive the growth in this region. The U.S. government has been using aircraft for various defense and security purposes, thereby increasing the need to modernize aircraft and improve efficiency. The presence of leading companies in the region, significant investment in research and development, and technological advancements are further expected to support the SiC fibers market growth during the forecast period.

Competitive Landscape

The leading players in the SiC fibers industry include American Elements, BJS Ceramics GmbH, COI Ceramics,Free Form Fibers, GE Aviation., Matech Solutions, NGS Advanced Fibers Co., Ltd., Specialty Materials, Inc., Suzhou Saifei Group, TISICS Ltd., TOSHIBA CORPORATION, Ube Industries, Ltd.

To expand their customer base and strengthen their market presence, these companies are expanding their presence across various regions and entering new markets in developing regions. To meet rising consumer demands, companies are also introducing new innovative products to the market.

SiC Fibers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 382.2 million |

|

Revenue forecast in 2028 |

USD 1,930.6 million |

|

CAGR |

26.8% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Form, By Usage, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

American Elements, BJS Ceramics GmbH, COI Ceramics,Free Form Fibers, GE Aviation., Matech Solutions, NGS Advanced Fibers Co., Ltd., Specialty Materials, Inc., Suzhou Saifei Group, TISICS Ltd., TOSHIBA CORPORATION, Ube Industries, Ltd. |