Smart Government Market Share, Size, Trends, Industry Analysis Report

By Solution (Government Resource Planning System, Security, Analytics, Remote Monitoring, and others), By Service, By Deployment, By Region; Segment others Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 116

- Format: PDF

- Report ID: PM2869

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

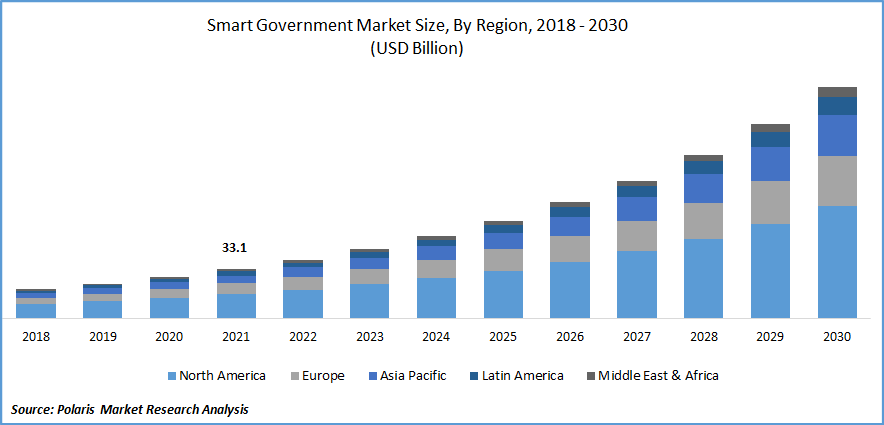

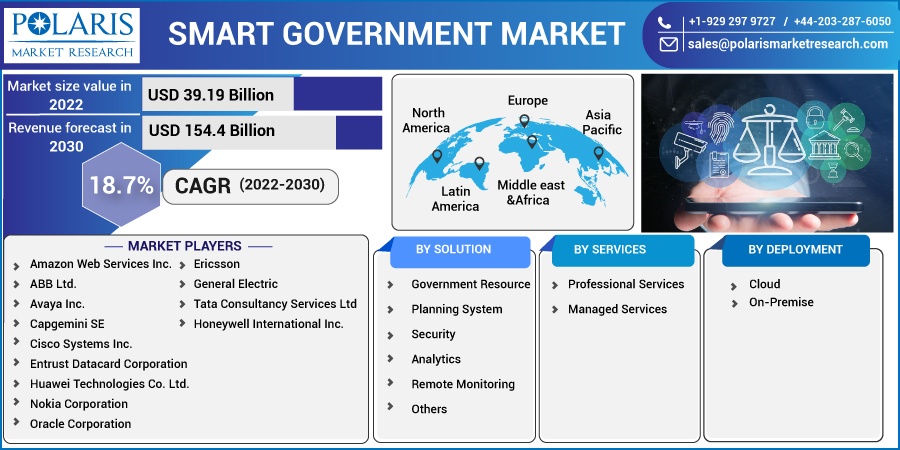

The global smart government market was estimated at USD 33.1 billion in 2021 and is projected to grow at a CAGR of 18.7% during the forecast period.

The development of information from various sources and the growing global interest in adopting modern & smart technologies are significant drivers of the global market. However, downtime caused by hardware failures, software misconfigurations, security breaches, and data loss reduces government workplace profitability. As a result, the cloud is a solid choice for government information capacity, as government budgets are limited and on-premises arrangements are becoming more expensive with an increasing volume of data.

Know more about this report: Request for sample pages

In addition, governments have a wealth of information, including client records, public plans, and strategies. As a result, it becomes necessary for the government to have a solid storage option to deliver all services on demand.

Furthermore, the smart government provides numerous benefits, such as wealth preservation through proactive management and appropriate strategies. Wealth transfers from generation to generation through strategic asset allocation and risk mitigation through diversification of investments. As a result, smart governments have the advantage of increasing demand globally.

The COVID-19 situation has also resulted in increased demands for smart government services as well as increased demand for existing services. Government developers were mobilized and committed to developing tools, apps, and services to aid in the fight against COVID-19. Among these newly developed services is distributing food and other essential products to those in need by improving the supply chain with smart government services. In addition, because of an increase in unemployment and other social benefit claims, several Member States saw an increase in online services such as digital ID and digital signatures.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market's rapid growth can be attributed to favorable government initiatives worldwide and the advent of technologies such as artificial intelligence (AI) and the Internet of Things (IoT). Rising demand for cloud computing even from countries that are regularly facing problems related to data security and privacy is also expected to boost the market’s growth. Moreover, rising data extraction from multiple sources that can be further processed for digital transformation is also driving the market during the forecast period. However, concerns about data theft and data privacy are expected to hinder the market growth of smart government. Hackers and data breaches are also expected to restrict the market.

Report Segmentation

The market is primarily segmented based on solutions, services, deployment, and region.

|

By Solution |

By Services |

By Deployment |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Remote Monitoring segment is expected to witness the fastest growth.

In 2021, the Remote Monitoring sub-part was anticipated to increase throughout the projected period due to the exceptional ability to monitor and track the health of deployed assets. In addition, other benefits of remote monitoring solutions, such as proactive solutions for asset failure situations, increased capacity and utilization, operational visibility, safety assurance, analysis, and reduced asset downtime, are driving the growth of the segment. Moreover, another reason for the segment's growth is the decreasing cost of sensors, which makes deploying such solutions feasible and cost-effective.

Professional Services accounted for the largest market share in 2021

It is anticipated that professional services will hold the largest market share and maintain their domination during the forecast period because of the increased deployment of smart solutions that necessitate technological consulting and ongoing support and maintenance. It is due to the increasing deployment of smart solutions, which require constant maintenance, support, and technical consulting, driving up demand for professional services.

The demand in North America is expected to witness significant growth

The global market in North America is estimated to expand appreciably during the forecast period due to increased penetration of smart technologies such as big data, the Internet of Things (IoT), analytics, and cloud computing. Furthermore, spending is increased in the North American regions for deploying smart solutions at various government levels. The Internet of Things (IoT) and cloud computing have accelerated this region's market growth, and the area is gaining significant traction in the smart government industry. Furthermore, the emergence of critical businesses that provide services and solutions for smart government is driving market growth in this area.

Furthermore, the United States is investing heavily in microgrid development in California, to get electricity come from zero-emission sources, by 2045. In the United States, smart mobility deployments are also on the climb. For example, Florida state legislators introduced a unanimous bill allowing companies such as Uber, Lyft, & General Motors to deploy self-driving vehicles.

Asia-Pacific is expected to hold the largest revenue share over the study period, due to the increasing penetration of smartphones & connected devices. Furthermore, governments across the region see cloud services as a way to improve government service by lowering unemployment, increasing responsiveness, and providing data and communication technology services at a lower cost.

Large corporations are locating their cloud data centers in Asia-Pacific due to the increasing popularity of smartphones and tablets. The governments of Australia and Singapore see cloud services as having the potential to improve government service delivery outcomes and provide ICT services at a lower cost. For example, in response to the coronavirus pandemic, the Indian government is using public financial management system (PFMS) technology to transfer funds to the bank accounts of 16 crore beneficiaries via direct benefit transfer (DBT), in April 2020.

Competitive Insight

Key players include, International Business Machines Corporation, SAP SE, Amazon Web Services, ABB Ltd., Avaya, Microsoft Corporation, Capgemini, Cisco Systems, Verizon, Entrust Datacard, Huawei Technologies, KAPSCH Group, Nokia Corporation, Oracle Corporation, Ericsson, General Electric, Tata Consultancy Services, Honeywell International, Itron Inc., Oracle Corporation, Osram Gmbh, Schneider Electric, Siemens, Telensa, and Vodafone Group.

Recent Developments

In February 2022, Virtana announced the development of a hybrid cloud management solutions program allowing its consumers to plan, execute, and manage their hybrid cloud applications. Furthermore, the company used a blend of artificial intelligence, machine learning, & data analytics to provide public, hybrid, & multi-cloud environments.

Smart Government Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 39.19 billion |

|

Revenue forecast in 2030 |

USD 154.4 billion |

|

CAGR |

18.7% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Solution, By Service, By Deployment, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

International Business Machines Corporation, Amazon Web Services Inc., ABB Ltd., Avaya Inc., Capgemini SE, Cisco Systems Inc., Entrust Datacard Corporation, Huawei Technologies Co. Ltd., Nokia Corporation, Oracle Corporation, Ericsson, General Electric, Tata Consultancy Services Limited, Honeywell International Inc., International Business Machines Corporation, Itron Inc., KAPSCH Group, Huawei Technologies Co., Ltd. Microsoft Corporation, Oracle Corporation, Osram Gmbh, SAP SE, Schneider Electric SE, Siemens AG, Telensa, Verizon, Vodafone Group plc, and others. |