Space Launch Services Market Share, Size, Trends, Industry Analysis Report

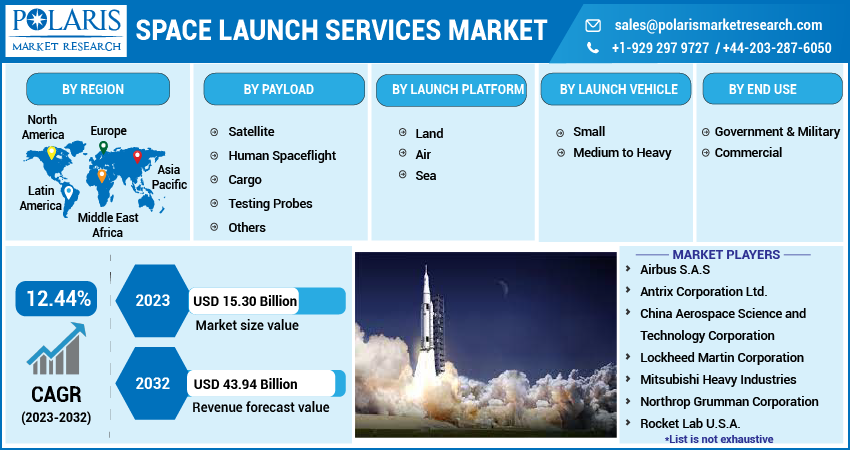

By Payload (Satellite, Human Spaceflight, Cargo, Testing Probes, and others); By Launch Platform; By Service Type; By Launch Vehicle; By End Use; By Region; Segment Forecast,2023 – 2032

- Published Date:Mar-2023

- Pages: 118

- Format: PDF

- Report ID: PM2862

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

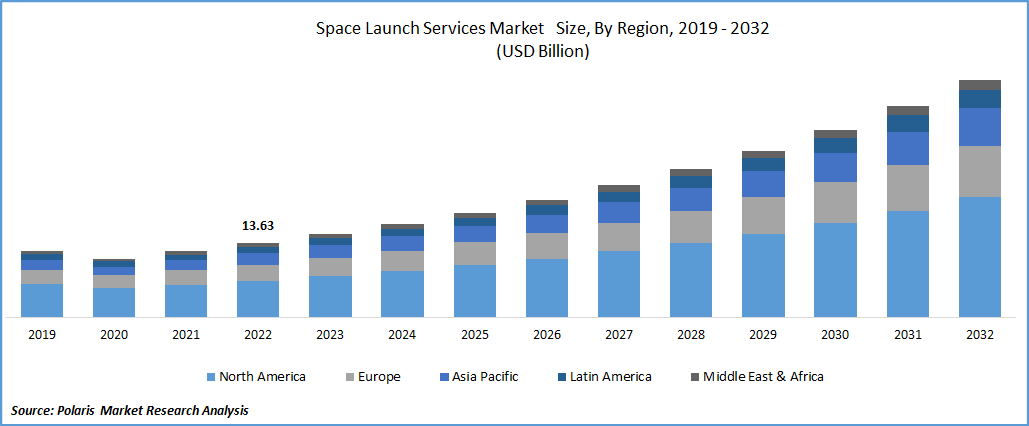

The global space launch services market was valued at USD 13.63 billion in 2022 and is expected to grow at a CAGR of 12.44% during the forecast period. The space launch services market has become an increasingly important component of the larger space economy, driven by the growing demand for satellite launches for various purposes, including communication, navigation, Earth observation, and scientific research. Private companies, such as SpaceX, Blue Origin, and Rocket Lab, have been major disruptors in the industry, challenging traditional government-operated launch service providers with innovative rocket designs, reusable technology, and aggressive cost-cutting measures. SpaceX has emerged as a dominant player in the industry, with its reusable rockets and aggressive pricing strategies winning contracts from government agencies and private companies alike.

Know more about this report: Request for sample pages

In addition to private companies, government-operated launch service providers also play a critical role in the industry. NASA, Roscosmos, and the ESA are some of the major government-operated providers of launch services, with a long history of launching spacecraft and advancing space exploration and scientific research. The rise of commercial space activities, such as the deployment of large constellations of small satellites for broadband internet access, has also contributed to the growth of the industry. The ability to launch satellites into orbit quickly and cost-effectively has become increasingly important, leading to a race among launch service providers to develop reusable rockets and other cost-cutting measures. The space launch services industry has seen significant growth in recent years. The demand for satellite launches is expected to continue growing, driven by the need for improved communication, navigation, and Earth observation capabilities, as well as scientific research and exploration.

New players are expected to enter the market, with numerous startups developing innovative launch technologies and strategies. The development of small launch vehicles, capable of launching smaller payloads into orbit at a lower cost, is also expected to be a major growth area in the industry. As the space launch services industry continues to grow and evolve, there will be increased pressure to innovate and reduce costs. The development of reusable rockets and other cost-cutting measures is expected to continue, and new launch technologies, such as hypersonic and air-breathing engines, may also become more prevalent.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The growth of the space launch services market is driven by various sectors, including commercial, government, and military. Each sector has unique requirements and applications for satellite launches, which contribute to the overall growth of the industry.

In the commercial sector, the deployment of large constellations of small satellites for broadband internet access has been a major driver of growth in the space launch services industry. Companies such as SpaceX, OneWeb, and Amazon's Project Kuiper are planning to launch thousands of small satellites into orbit to provide high-speed internet access to underserved areas. This has created a new market for low-cost satellite launches, which has driven the development of small launch vehicles and other cost-cutting measures.

In the government sector, the demand for satellite launches is driven by a range of applications, including communication, navigation, Earth observation, and scientific research. Government agencies such as NASA, the European Space Agency (ESA), and the Russian space agency Roscosmos are major customers for launch service providers, with a long history of launching spacecraft and advancing space exploration and scientific research.

The military sector is also a significant driver of growth in the space launch services industry, with a growing demand for military satellites for communication, surveillance, and intelligence gathering. Launch service providers such as SpaceX and United Launch Alliance (ULA) have won contracts to launch military satellites for the US Department of Defense, while countries such as China and Russia are also investing heavily in their military space programs.

Report Segmentation

The market is primarily segmented based on payload, launch platform, launch vehicle, end-use and region.

|

By Payload |

By Launch Platform |

By Launch Vehicle |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The satellite segment is expected to witness the fastest growth in 2022

The satellite segment is expected to witness the fastest growth in the space launch services industry. This is due to the increasing demand for satellites for various applications, including communication, navigation, Earth observation, and scientific research. One of the main drivers of growth in the satellite segment is the deployment of large constellations of small satellites for broadband internet access. Companies such as SpaceX, OneWeb, and Amazon's Project Kuiper are planning to launch thousands of small satellites into orbit to provide high-speed internet access to underserved areas. This has created a new market for low-cost satellite launches, which has driven the development of small launch vehicles and other cost-cutting measures. The Earth observation segment is also expected to see significant growth, with the increasing use of satellite imagery for environmental monitoring, disaster response, and other applications. The demand for high-resolution and near-real-time satellite imagery is driving the development of new remote sensing technologies and platforms, as well as the demand for more frequent satellite launches.

The air segment accounted for the largest market share in 2022

The air segment accounted for the largest market share in the space launch services industry due to its ability to launch from a range of locations, including remote areas, which can reduce launch costs and increase flexibility. Air launch systems also allow for greater control over the launch trajectory, which can be advantageous for certain types of payloads.

Some of the companies that have developed air launch systems include Orbital Sciences Corporation, Stratolaunch, and Virgin Orbit. Orbital Sciences developed the Pegasus air-launch system, which has been used to launch small satellites into low Earth orbit, while Stratolaunch and Virgin Orbit have developed larger air launch systems for medium and heavy payloads.

The demand in North America is expected to witness significant growth

North America is expected to witness significant growth in the space launch services industry in the coming years. The region is also seeing the emergence of new commercial launch service providers, which are catering to the rising demand for space missions. This includes companies such as Rocket Lab, Virgin Orbit, and Firefly Aerospace, which are developing small and medium-class launch vehicles for a range of applications. The increasing competition in the market is expected to drive down launch costs and increase access to space for a wider range of customers.

In Europe, there is also a growing number of new entrants in the space launch services market, as well as increasing technological advancements in launch technologies. Companies such as Arianespace, Rocket Factory Augsburg, and PLD Space are developing new launch vehicles and technologies to meet the demand for cost-effective and flexible launch solutions. Additionally, there is a growing trend toward offering integrative solutions to assist space missions with logistics and launch support, which is driving demand for mission management and pre- and post-launch support services.

Competitive Insight

Some of the major players operating in the global market include Airbus, Antrix Corporation, China Aerospace Science, Lockheed Martin, Mitsubishi Heavy Industries, Northrop Grumman, Rocket Lab, Safran, and Space Exploration.

Recent Developments

- In February 2023 Rocket Lab USA, Inc. launched services and space systems and introduced two brand-new, high-performance space systems products aimed at expanding the global market for small satellite components.

- In April 2021, Blue Origin, owned by Amazon founder Jeff Bezos, successfully launched its New Shepard rocket carrying the first astronaut crew on a suborbital flight.

- In August 2021, Arianespace, the French launch services company, successfully launched two telecommunications satellites for Brazil and South Korea.

Space Launch Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 15.30 billion |

|

Revenue forecast in 2032 |

USD 43.94 billion |

|

CAGR |

12.44% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Payload, By Launch Platform, By Launch Vehicle, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Airbus S.A.S, Antrix Corporation Ltd., China Aerospace Science, and Technology Corporation, Lockheed Martin Corporation, Mitsubishi Heavy Industries, Northrop Grumman Corporation, Rocket Lab U.S.A., Safran S.A., Space Exploration Technologies Corp. among others. |

FAQ's

Key companies in space launch services market are Airbus, Antrix Corporation, China Aerospace Science, Lockheed Martin, Mitsubishi Heavy Industries, Northrop Grumman, Rocket Lab, Safran, and Space Exploration.

The global space launch services market expected to grow at a CAGR of 12.44% during the forecast period.

The space launch services market report covering key segments are payload, launch platform, launch vehicle, end-use and region.

Key driving factors in space launch services market growing regulations and standardization of space travel.

The global space launch services market size is expected to reach USD 43.94 billion by 2032.