Specialty Gas Market Share, Size, Trends, Industry Analysis Report

By Product (High purity, Halogen, Nobel, Carbon, and Others); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3649

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

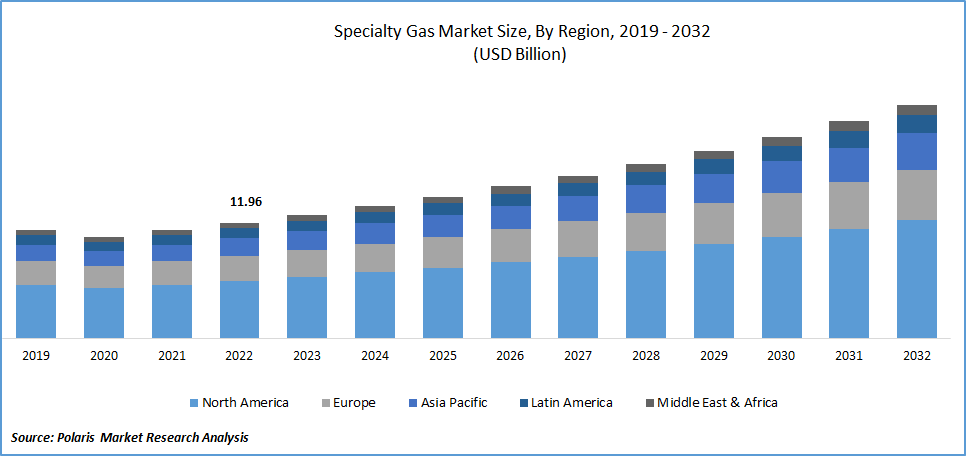

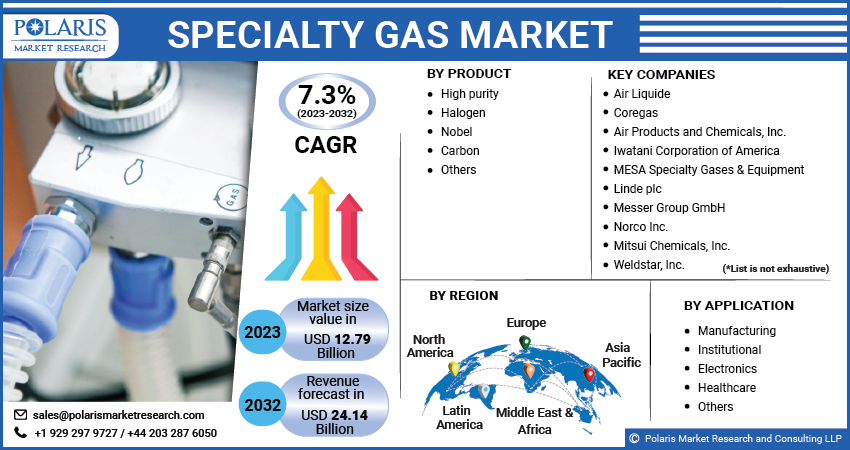

The global Specialty Gas market was valued at USD 11.96 billion in 2022 and is expected to grow at a CAGR of 7.3% during the forecast period.

The market is experiencing substantial growth due to its increasing adoption in various electronics, manufacturing, and healthcare sectors. The expansion of markets for semiconductors and displays is a major driving force behind the rising demand for specialty gases in electronics applications. As technology advances and the need for more sophisticated electronic devices increases, specialty gases are crucial for semiconductor manufacturing and display fabrication.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the Specialty Gas market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

To Understand More About this Research: Request a Free Sample Report

Additionally, the growing healthcare industry and advancements in clinical treatments are contributing to the market's growth. Specialty gases, including diagnostics, therapies, and laboratory research, are vital in medical applications. The need for accurate and reliable gas mixtures for medical devices and procedures fuels the demand for specialty gases in healthcare.

Moreover, the specialty gas industry serves diverse sectors such as petrochemical, oil & gas, analytical research, and consumer electronics. These industries require specific gas formulations, leading to sustained demand for specialty gases.

The COVID-19 pandemic had a negative impact on the market. The disruptions caused by the pandemic led to supply chain disruptions across various industries, including petrochemicals, oil & gas, consumer electronics, and manufacturing. With many countries implementing lockdown measures and restrictions, manufacturing operations were severely affected, resulting in reduced output levels and lower demand for specialty gases. The slowdown in industrial activities and the overall economic uncertainty caused by the pandemic had a detrimental effect on the specialty gas market, creating challenges for suppliers and manufacturers.

For Specific Research Requirements, Speak With a Resaerch Analyst

Industry Dynamics

Growth Drivers

The market is experiencing a significant boost in demand from the electronics industry. This surge in demand can be attributed to several factors. Firstly, rapid technological advancements and the increasing demand for electronic devices such as smartphones, tablets, and wearable gadgets drive the need for specialty gases in semiconductors and display manufacturing processes.

Specialty gases play an important role in semiconductor fabrication, including deposition, etching, and cleaning. These gases are used to create precise and controlled environments necessary for producing high-performance microchips and electronic components.

Furthermore, the growing trend of miniaturization and the development of advanced electronic devices with higher functionality require more complex manufacturing techniques. Specialty gases are utilized in various precision applications, such as lithography and thin film deposition, to achieve the desired performance and quality standards.

Additionally, the increasing adoption of technologies like 5G, the Internet of Things (IoT), and artificial intelligence (AI) drives the demand for specialty gases in the electronics industry. These technologies require advanced semiconductor devices and displays, fueling the need for specialty gases in their production.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The carbon gases segment held the largest revenue share in 2022

In 2022, the carbon gases segment held the largest revenue share in the market, and it is projected to maintain its dominant position throughout the forecast period. Carbon gases find extensive use in medical equipment like magnetic resonance imaging, nuclear magnetic resonance imaging, ophthalmology, and others. The demand for carbon gases is also high in industries such as electronics, manufacturing, healthcare, and chemicals.

The increasing application scope of carbon gases in instrument calibration drives the demand for these gases. Moreover, the high-purity gases segment is anticipated to exhibit the highest CAGR during the forecast period. High-purity gases are utilized for insulation, lighting, and cooling purposes in various industries, including electronics, metal processing, chemicals, and oil & gas. They play an important role in semiconductor manufacturing as well. With the expansion of the semiconductor industry, the demand for high-purity gases is expected to rise significantly.

The healthcare segment held the largest revenue share in 2022

In 2022, the healthcare segment held the largest revenue share in the market, and it is projected to maintain its dominant position throughout the forecast period. The healthcare industry relies on various specialty gases, including oxygen, medical air, medical nitrous oxide, and medical helium. These gases are essential for multiple medical applications and procedures.

The continuous growth of the healthcare sector, coupled with increased healthcare expenditure by governments worldwide, is expected to be a significant driver for the specialty gas market. The utilization of advanced medical technologies that require specialty gases also contributes to the market's growth. As governments invest in improving healthcare infrastructure and facilities, the demand for specialty gases in the healthcare sector will likely continue expanding.

Asia Pacific is expected to have significant growth over the forecast period

The Asia-Pacific region is expected to experience rapid growth in the market due to its high consumption in electronics, automotive, and healthcare industries. Fueled by increasing disposable incomes and demand for electronic products, the electronics sector is witnessing the highest growth rates in consumer electronics. China's electronics manufacturing businesses reported a significant year-on-year profit increase of 38.9% in 2021, contributing to the market's positive outlook.

Moreover, Japan's electronics sector, encompassing devices, components, and consumer/industrial equipment, witnessed a production value surge of nearly 10% to approximately USD 100 billion in 2021, as per the Japan Electronics and Information Technology Industries Association (JEITIA). This growth further supports the expansion of the specialty gas market in the region.

Furthermore, the automotive segment's expansion in China is expected to drive the demand for specialty gas. China, the largest producer of automobiles, manufactured a staggering 26,082,220 vehicles in 2021, according to the International Organization of Motor Vehicle Manufacturers (OICA). This robust automotive industry is another catalyst for the specialty gas market's growth in Asia-Pacific.

Competitive Insight

Some of the major players operating in the global market include Air Liquide, Coregas, Air Products and Chemicals, Inc., Iwatani Corporation of America, MESA Specialty Gases & Equipment, Linde plc, Messer Group GmbH, Norco Inc., YUEYANG KAIMEITE ELECTRONIC AND SPECLALTY RARE GASES CO., Mitsui Chemicals, Inc., SHOWA DENKO K.K., ILMO Products Company, Taiyo Nippon Sanso Corporation, Weldstar, Inc.

Recent Developments

In February 2023, Linde will construct and operate an on-site complex in Beaumont, Texas, supplying OCI's new blue ammonia facility with clean hydrogen and nitrogen, sequestering 1.7 million tons of CO2 emissions annually.

In February 2023, Air Products introduced the PRISM InertPro Nitrogen Membrane System at the Middle East Oil and Gas Show, offering a flexible modular platform with cutting-edge technology for efficient nitrogen applications in the industry.

Specialty Gas Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 12.79 billion |

|

Revenue forecast in 2032 |

USD 24.14 billion |

|

CAGR |

7.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Air Liquide, Coregas, Air Products and Chemicals, Inc., Iwatani Corporation of America, MESA Specialty Gases & Equipment, Linde plc, Messer Group GmbH, Norco Inc., YUEYANG KAIMEITE ELECTRONIC AND SPECLALTY RARE GASES CO., Mitsui Chemicals, Inc., SHOWA DENKO K.K., ILMO Products Company, Taiyo Nippon Sanso Corporation, Weldstar, Inc. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Specialty Gas market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

FAQ's

The Specialty Gas Market report covering key are product, application, and region.

Specialty Gas Market Size Worth $ 24.14 Billion By 2032.

The global Specialty Gas market is expected to grow at a CAGR of 7.3% during the forecast period.

Asia Pacific is Specialty Gas Market.

key driving factors in Specialty Gas Market are Growing Demand from Electronics Industry.