Specimen Validity Testing Market Share, Size, Trends, Industry Analysis Report

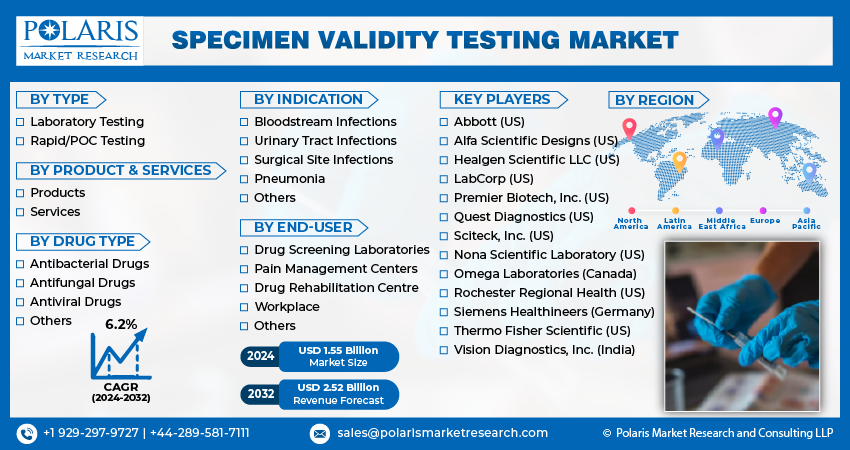

By Type (Laboratory Testing, Rapid/POC Testing); By Product & Service; By Drug Type; By Indication; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4792

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

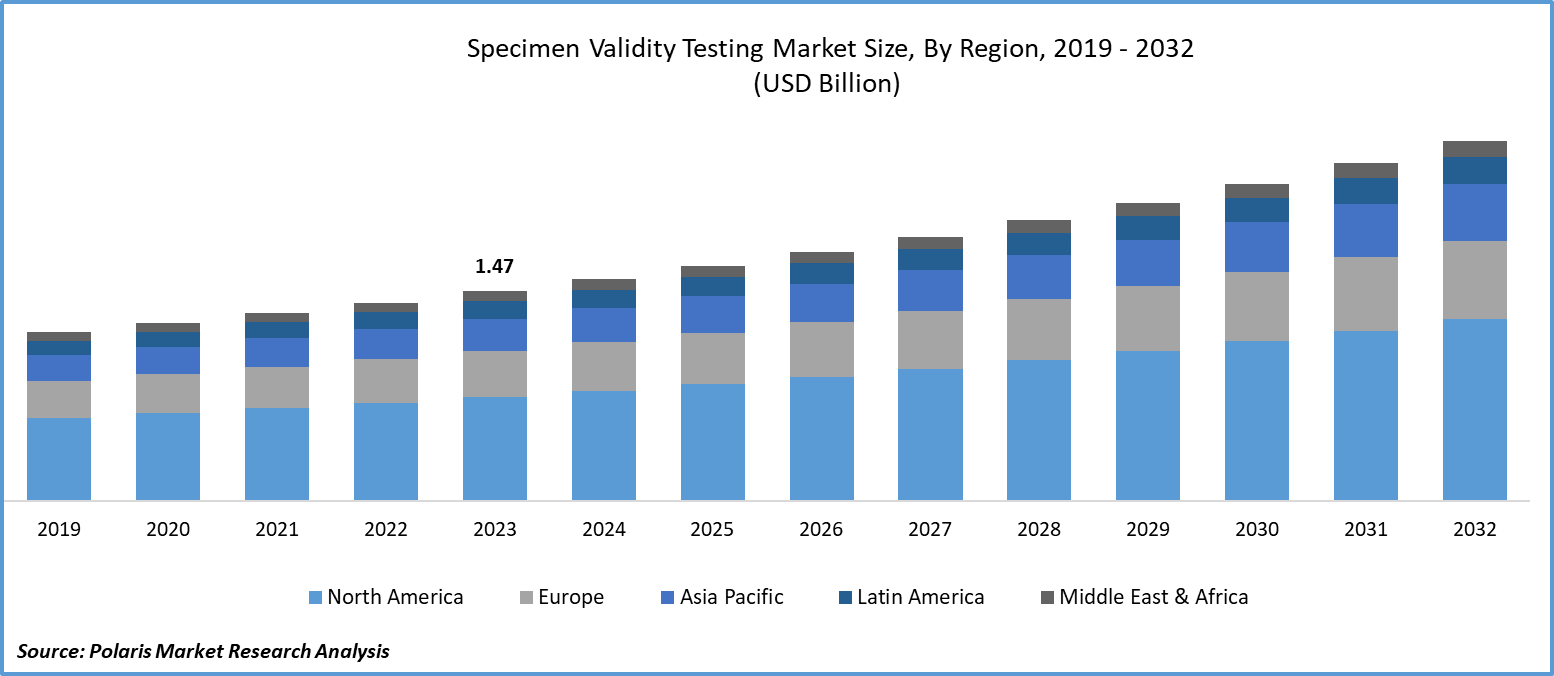

Global specimen validity testing market size was valued at USD 1.47 billion in 2023. The market is anticipated to grow from USD 1.55 billion in 2024 to USD 2.52 billion by 2032, exhibiting the CAGR of 6.2% during the forecast period.

Market Overview

The expansion of the global specimen validity testing market growth is highly attributable to the increasing need for prominent drug testing tools and the growing drug screening process in several areas. The availability of information through internet platforms is promoting awareness and the importance of specimen validity testing tools in the marketplace, leading to their adoption by a wider range of end users. Furthermore, the growing research and development activities are expected to drive new growth opportunities in the coming years.

- For instance, in July 2022, Mayo Clinic Laboratories unveiled its latest development: a high-resolution data-driven drug testing profile. The profile aims to assist physicians in gaining necessary data and using proper testing methods.

To Understand More About this Research: Request a Free Sample Report

Moreover, the rising incidence of criminal activities is revealing the necessity of testing the safety and integrity of samples, as it enables the regulator agents to understand the reliability of the sample and, in turn, the results. The rising concerns about safeguarding people from incorrect medical drug testing outcomes and the superior interests in punishing offenders and saving innocent people are anticipated to create significant growth opportunities in the next few years.

Growth Drivers

Rising government regulations to mitigate drug use

The ongoing initiatives by government organizations to lower the use of drugs by individuals and enhance safety in public areas are facilitating specimen validity testing market demand globally. For instance, The Indian government introduced the National Action Plan for Drug Demand Reduction during the period of 2018-25 to promote prevention, education, detection, and rehabilitation services for addicted persons. The intake of drugs by the drivers of railways, government buses, and the aviation industry can lead to huge human losses, creating an urgent need for specimen validity testing.

Increased use of illegal drugs

The growing use of illegal drugs, leading to rising crimes, is stimulating the need for effective medical tests that can detect drug intake. According to the World Drug Report 2023 published by the UN Office on Drugs and Crime, the number of people using drugs increased to 296 million in 2021, leading to a 23% rise over the past decade. In this matter, specimen validity testing tools are gaining momentum in the global market.

Restraining Factors

Growing awareness about the alternative drug screening tests

Lower knowledge about medical tests for identifying drug intake is causing a major obstruction to global specimen validity testing. Stringent regulations in pharmaceutical and healthcare settings are anticipated to limit its adoption. The growing demand for alternatives to urine drug screening tests, such as breathalyzers, saliva, and air follicle drug tests by professionals, can lower the use of specimen validity testing tools.

Report Segmentation

The market is primarily segmented based on type, product & service, drug type, indication, end user and region.

|

By Type |

By Product & Services |

By Drug Type |

By Indication |

By End-User |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Laboratory Testing segment is expected to witness the highest growth during the forecast period

The laboratory testing segment will grow rapidly during the specimen validity testing market forecast period due to the establishment of laboratories providing reliable drug screening test results. Most of the laboratories engaged in offering prominent and integral results are incorporating specimen validity testing tools, driven by their potential to verify the characteristics and legitimacy of urine. In addition, laboratory testing installs multiple pieces of testing equipment as it specializes in conducting medical tests, including specimen validity testing, compared to rapid testing.

The rapid/POC segment dominated the market, largely attributable to its ability to offer speedy and accurate urine sample results. The presence of government regulations in handling the drug screening process is positively driving the market growth. In 2006, the World Health Organization formulated ASSURED guidelines for some parts of point-of-care testing, including sexually transmitted infections. The proficiency to speed up the drug screening process and the rising need for integrity results are contributing factors driving segmental growth.

By Drug Type Analysis

Antiviral Drugs segment held the significant market revenue share in 2023

The antiviral drugs segment held the largest share due to the continuous rise in demand for antiviral drugs in the global marketplace. The rising prevalence of respiratory viruses, herpes, and HIV/AIDS is stimulating the necessity for urine screening tests, including specimen validity testing, as it is widely recognized as the primary task before conducting drug screening procedures. According to the available data, more than one million sexually transmitted infection cases are observed every day.

By Indication Analysis

Urinary Tract Infection (UTI) segment registered a dominant share in 2023

The urinary tract infection segment accounted for the larger share in 2023 and is expected to continue its growth trajectory during the study period. This can be attributable to the increasing incidence of urinary infection cases in the global market, driving the need for urinary testing. According to the Aster CMI Hospital, Bangalore, India, witnessed a 50% rise in the incidence of UTI. The demand for specimen validity tools is driven by their enormous ability to detect the specimen urine compared to a diluted one, which can avoid false treatment to the patients.

By End User Analysis

Drug Screening Laboratories segment is expected to witness significant growth

The drug screening laboratories held the largest share. This can be related to the presence of advanced healthcare infrastructure for drug testing and monitoring activities along with government regulatory policies. For instance, in November 2023, the new edition of Laboratory and Point-of-care diagnostic testing for sexually transmitted infections, including HIV, is released by the World Health Organization, providing accurate information about isolating, detecting, and diagnosing STIs, including HIV. Furthermore, the reliability of the sample is a huge concern in the drug screening process, as it can assist in solving crimes in public areas.

Regional Insights

North America region registered the largest share of the global market in 2023

The North American region dominated the market. The region’s growth can be largely attributed to its strong healthcare infrastructure and superior market players. The growing number of urine tests is facilitating the significant demand for specimen validity testing in the regional marketplace.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing consumption of illegal drugs in the countries. The existence of illicit drug transportation is encouraging government authorities to conduct compliance and accurate drug screening activities, which will fuel the adoption of these sample integrity testing tools in the region in the coming years.

Key Market Players & Competitive Insights

The research innovations to drive the competition

The specimen validity testing market development is moderately fragmented, with the existence of several players accounting for a smaller market share than others. The ongoing research progress by the companies to address the evolving concerns about false drug screening results is creating competition with the innovation of new specimen validity testing tools.

Some of the major players operating in the global market include:

- Abbott (US)

- Alfa Scientific Designs (US)

- Healgen Scientific LLC (US)

- LabCorp (US)

- Nona Scientific Laboratory (US)

- Omega Laboratories (Canada)

- Premier Biotech, Inc. (US)

- Quest Diagnostics (US)

- Rochester Regional Health (US)

- Sciteck, Inc. (US)

- Siemens Healthineers (Germany)

- Thermo Fisher Scientific (US)

- Vision Diagnostics, Inc. (India)

Recent Developments in the Industry

- In February 2022, Validity Diagnostics, a producer of diagnostic products, announced that it had received a patent from the United States Patent and Trademark Office related to the urine drug screen validity testing panels.

Report Coverage

The specimen validity testing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, product & service, drug type, indication, end user, and their futuristic growth opportunities.

Specimen Validity Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.55 billion |

|

Revenue forecast in 2032 |

USD 2.52 billion |

|

CAGR |

6.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Specimen Validity Testing Market report covering key segments are type, product & service, drug type, indication, end user and region.

Specimen Validity Testing Market Size Worth $2.52 Billion By 2032

Specimen Validity Testing Market exhibiting the CAGR of 6.2% during the forecast period.

North America is leading the global market

key driving factors in Specimen Validity Testing Market are Increased use of illegal drugs