Stretch Sleeve & Shrink Sleeve Labels Market Share, Size, Trends, Industry Analysis Report

By Polymer Film (PVC, PETG, OPS, PE, Others), By Application, By Printing Technology, By Embellishing Type, By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 110

- Format: PDF

- Report ID: PM2244

- Base Year: 2024

- Historical Data: 2020 - 2023

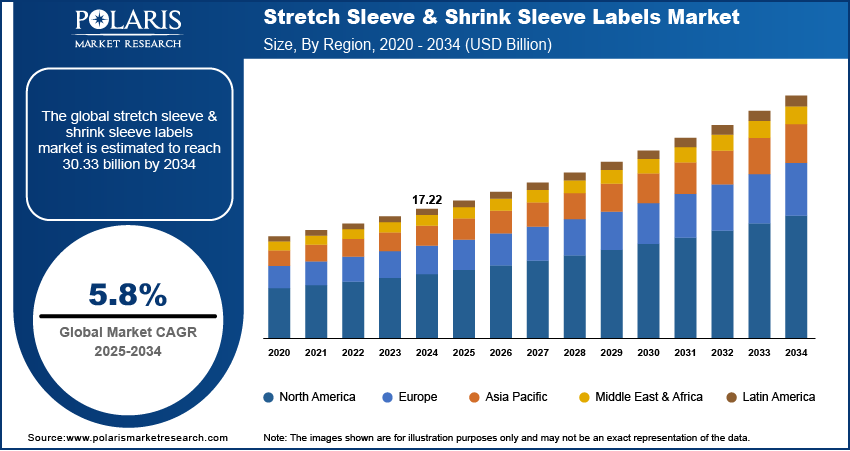

The global stretch sleeve & shrink sleeve labels market was valued at USD 17.22 billion in 2024 and is expected to grow at a CAGR of 5.8% during the forecast period. The key growth drivers for the global market are the increasing demand for polymer films, availability of additional printing space, anti-counterfeiting facilities, and 360 display.

Key Insights

- The PVC segment dominated the market in 2024. This is due to their superior dimensional stability, which is particularly beneficial for containers of various sizes.

- The food segment is projected to witness the fastest market growth due to the increasing demand for processed food, which has encouraged manufacturers to use stretch and shrink films widely.

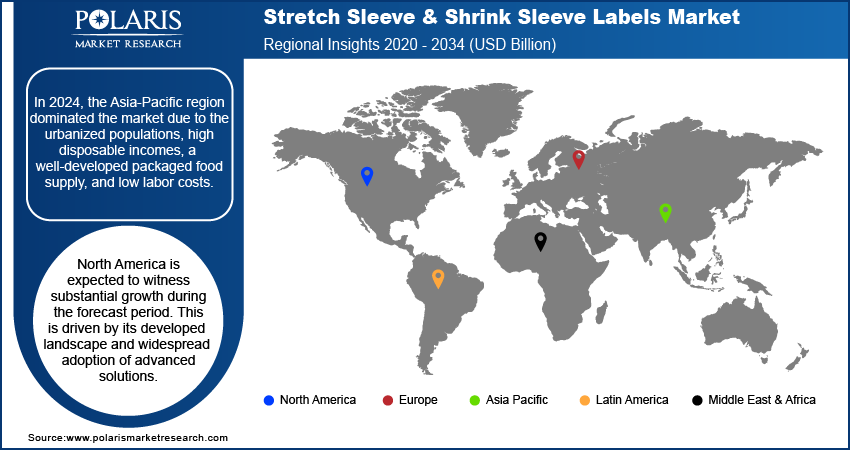

- In 2024, the Asia-Pacific region dominated the market due to the urbanized populations, high disposable incomes, a well-developed packaged food supply, and low labor costs.

- North America is expected to witness substantial growth during the forecast period. This is driven by its developed landscape and widespread adoption of advanced solutions.

Industry Dynamics

- Tamper-evident features and counterfeiting provide critical security for products that protect the brand and grow consumer trust. This leads to market expansion.

- The major challenge for labeling is the overall cost reduction to enable additional expansion opportunities through the use of high-efficiency and speed materials, with low labor costs.

- The downside is that specialized equipment requires a high initial investment, which can be a barrier to expansion for small manufacturers.

- Brands have the opportunity to align with environmental goals by attracting additional consumers due to the increasing demand for recyclable and sustainable sleeve films.

Market Statistics

- 2024 Market Size: USD 17.22 billion

- 2034 Projected Market Size: USD 30.33 billion

- CAGR (2025-2034): 5.8%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Stretch Sleeve & Shrink Sleeve Labels Market

- The creation and prototyping of complex labels is expected to be achieved through optimization of design workflows.

- Automated systems detect microscopic defects in prints to enhance quality control.

- Hyper-personalized labels for targeted marketing become easy with data analytics.

- Demand forecast and inventory optimization for label materials boosts the expansion opportunities by streamlining supply chains.

It is a flexible PVC band that expands to fit a container, and it is a printed film that tightens with the contraction of heat to seal 360 degrees. Innovations in digital printing technologies enable high-quality and custom designs to enhance appeal and differentiate products on shelves. This is due to a rise in urbanization, demand for packaged foods, revival of the labeling & packaging industry in emerging economies, and focus on the use of sustainable materials. Furthermore, the beverage industry utilizes these labels for security features and full-body graphics. Government requirements and safety features encourage brands to adopt these labeling solutions.

Additionally, the lightweight nature of these stretch-and-shrink sleeves, combined with their reasonable cost, is expected to drive the growth of stretch-and-shrink sleeve labels in the near future. Globally, governments have recognized food-related industries as vital; hence, the rise in demand for shrink and stretch sleeve labels is anticipated to remain stable during the forecast period.

Industry Dynamics

Growth Drivers

The fast-growing FMCG industry is a major consumer of stretch & shrink sleeve labels, as it transforms beverage packaging and labeling, thereby driving the market growth. The rise in consumption of beverages, along with packaged food, has boosted the demand for these labels.

According to an August 2025 report from the Ministry of Commerce and Industry, India's food processing sector is estimated to more than double from USD 307 billion in 2023 to USD 700 billion in 2030. The use of stretch and shrink films has increased, as they ensure the safe packaging of food products, enhance visibility, and secure transit due to the significant growth in demand for packaged food.

Moreover, the tamper-proof quality is also an important aspect of these labels, as they are primarily used as seals printed with quotations such as “only for adults”. Such products are widely used in the FMCG vertical. This also prevents various forms of malpractice, such as adulteration and the reuse of containers that are intended for disposal. Hence, this factor is creating a productive demand for the product in the forthcoming scenario.

Report Segmentation

The market is primarily segmented on the basis of polymer film, application, printing technology, embellishing type, and region.

|

By Polymer Film |

By Application |

By Printing Technology |

By Embellishing Type |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Segmental Insights

Polymer film Analysis

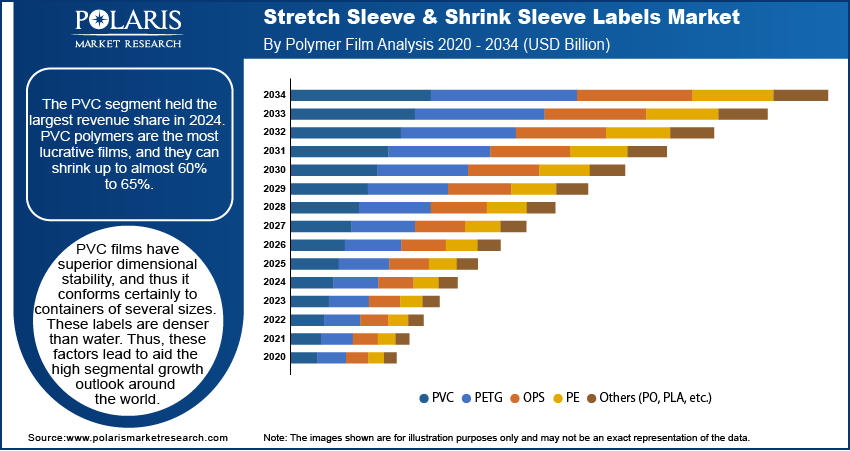

The PVC segment held the largest revenue share in 2024. PVC polymers are the most lucrative films, and they can shrink up to almost 60% to 65%. PVC films have superior dimensional stability, and thus it conforms certainly to containers of several sizes. These labels are denser than water. Thus, these factors lead to aid the high segmental growth outlook around the world.

The PVC segment is projected to show the fastest growth rate in the forecasting years. The rise in presence of both, the large and small suppliers of PVC, along with the versatile properties of PVC is further offered convenience to the end-users, which may propel the segment growth in the near future.

Application Analysis

Other beverage segment is recorded with the largest share in 2024 and is expected to lead the stretch sleeve & shrink sleeve labels market in the forecasting years. It is increasingly used as secondary packaging for many modern-day beverage products, including carbonated soft drinks. They are commonly used in other beverages packaging as they easily conform to a variety of shapes. It is being broadly used in juices & flavored drinks, specialty drinks, flavored water & energy drinks, and dairy products. Thus, these factors lead to aid the high segmental growth outlook around the world.

The food segment is also projected to constitute a considerable share in the fastest market growth in the forecasting years. In recent times, the demand for processed food has increased substantially all over the world. This factor has promoted manufactures to widely use stretch and shrink films on account of their benefits, such as better suitability, durability, and cost-effectiveness. Therefore, the use of stretch and shrink films is increasing since it provides better quality and safety to food manufacturers, thereby accelerating the demand for stretch sleeves & shrink sleeve labels worldwide.

Geographic Overview

The Asia-Pacific region accounted for the largest share of the global stretch sleeve & shrink sleeve labels market in 2024. This is due to the emerging economies of China and India, which have urbanized populations, high disposable incomes, a well-developed packaged food supply, and low labor costs. Associations like the Federation of Indian Chambers of Commerce and Industry (FICCI), All India Foods Processors' Association, and the USISPF, has created a conducive market environment in the region. The rapid expansion of consumer goods in China and India creates demand for innovation in packaging. Furthermore, the e-commerce industry relies on these labels for brand visibility and secure shipping. Initiatives for manufacturing and FDI further boost local production and adoption of these labels. Advances in printing technology in this region also make these options accessible to a wider range of businesses, enabling them to achieve market leadership.

North America is expected to witness substantial growth during the forecast period. This is due to its developed landscape and wide adoption of advanced solutions. This environment encourages enterprises to aim for efficiency and market differentiation through refined IT services. The rising investments in modernizing its IT infrastructure, such as AI and cloud computing, also enhance the region's expansion opportunities. Moreover, this robust ecosystem, with leading technology firms and supportive government regulations, supports the expansion of this region.

Competitive Insight

Some of the major players operating in the global market include Amcor, Bemis Company, Berry Global Inc, Bonset America Corporation, CCL Industries Inc, D&L Packaging, Edwards Label, Inc., Fort Dearborn Company, Fuji Seal International, Huhtamaki Oyj, Klockner Pentaplast, Macfarlane Group plc, Polysack Flexible Packaging Ltd., The Dow Chemical Company, Westrock Company.

Industry Developmets

April 2024: Nestlé updated its Nesquik ready-to-drink portfolio with a new recyclable shrink sleeve label featuring light-blocking print technology, making the bottle easier for consumers to recycle. The new shrink sleeve is made with materials that allow the bottle and sleeve to be recycled together.

February 2024: FCCL Industries opened its new sustainable sleeve label hub in Dornbirn, Austria. The new facility represents a USD 53.5 million investment with 10,000 square metres for production and a fully automated warehouse.

Stretch Sleeve & Shrink Sleeve Labels Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.60 billion |

| Market size value in 2025 | USD 14.60 billion |

|

Revenue forecast in 2034 |

USD 24.05 billion |

|

CAGR |

5.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, By Material Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Amcor, Bemis Company, Berry Global Inc, Bonset America Corporation, CCL Industries Inc, D&L Packaging, Edwards Label, Inc., Fort Dearborn Company, Fuji Seal International, Huhtamaki Oyj, Klockner Pentaplast, Macfarlane Group plc, Polysack Flexible Packaging Ltd., The Dow Chemical Company, Westrock Company. |

FAQ's

• The global market size was valued at USD 17.22 billion in 2024 and is projected to grow to USD 30.33 billion by 2034.

• The global market is projected to register a CAGR of 5.8% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market are Amcor, Bemis Company, Berry Global Inc, Bonset America Corporation, CCL Industries Inc, D&L Packaging, Edwards Label, Inc., Fort Dearborn Company, Fuji Seal International, Huhtamaki Oyj, Klockner Pentaplast, Macfarlane Group plc, Polysack Flexible Packaging Ltd., The Dow Chemical Company, and Westrock Company.

• The PVC segment dominated the market in 2024.

• The food segment is projected to witness the fastest market growth during the forecast period.