Surgical Robot Market Size, Share, Trends, Industry Analysis Report

By Product Type (Robotic Systems, Laparoscopy Robotic Systems, Orthopedic Robotic Systems), By Application, By End-User, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM1922

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

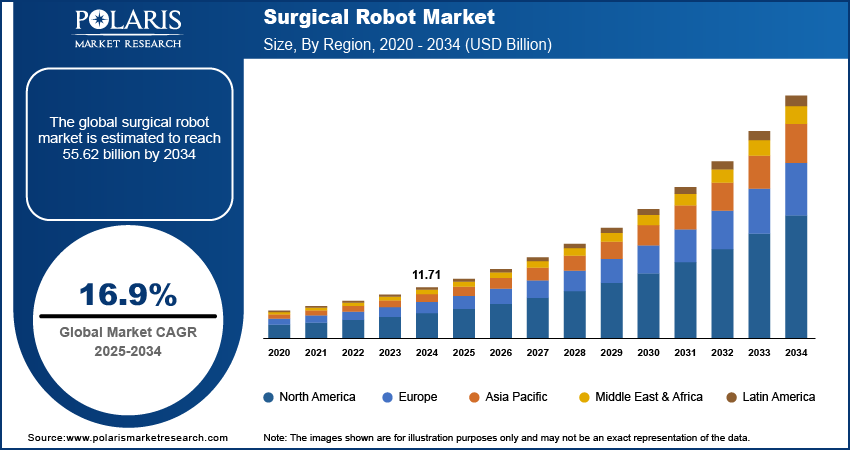

The surgical robot market size was valued at USD 11.71 billion in 2024 and is expected to register a CAGR of 16.9% from 2025 to 2034. The market for surgical robots is primarily driven by technological advancement in medical devices by leading players in the market. Further, rising number of complex surgeries propels the demand for surgical robots.

Key Insights

- The instruments and accessories segment is expected to experience the highest CAGR during the forecast period. This is due to the constant need to repurchase instruments and accessories for maintenance, repairs, or modifications.

- The hospitals segment dominated the market in 2024. This growth is attributed to the increase in the number of surgical procedures related to chronic diseases and injuries.

- In 2024, North America accounted for the largest revenue share. The large number of hospitals and the presence of key players in the region contributed to the leading position.

- The industry in Asia Pacific is projected to register a substantial CAGR during the forecast period. The growth is primarily attributed to rising partnerships between global and local players.

Industry Dynamics

- Increasing demand for minimally invasive surgeries is driving the adoption of surgical robots.

- Rising investments in the medtech sector is propelling the market size.

- Lack of skilled workforce hinders the demand for surgical robots.

- Technological advancements in surgical robots are expected to offer lucrative opportunities in the coming years.

Market Statistics

2024 Market Size: USD 11.71 billion

2034 Projected Market Size: USD 55.62 billion

CAGR (2025–2034): 16.9%

North America: Largest market in 2024

AI Impact on Surgical Robot Market

- Artificial intelligence (AI) algorithms analyze patient data and surgical history. It helps surgeons with predictive insights during surgeries.

- Machine learning (ML) and computer vision enhance accuracy, minimize the risk of human error, and reduce recovery times.

- The adoption of AI facilitates intuitive interaction between robotic systems and surgeons, which streamlines complex procedures.

- AI-integrated robots are used for laparoscopic procedures.

To Understand More About this Research: Request a Free Sample Report

Surgical robots are advanced medical devices that are designed to assist doctors during complex surgical procedures. Major companies worldwide with large research and development facilities have started targeting new scopes of technology and current areas of applications, which are anticipated to fuel the surgical robot market in the forecast years. For instance, in 2020, Sina Robotics and Medical Innovators introduced robotic telesurgery. Robotic telesurgery involves using robotic systems and telecommunication technology to perform surgical procedures remotely. Surgeons control robotic arms from a distance, allowing precise and minimally invasive operations, improving access to expert care, and enhancing patient outcomes. If a surgeon wants to perform surgery on patients situated on different continents, it is possible with robotic telesurgery. This advancement in technology has led to the expansion of the surgical robot market

The surgical robot market is expected to grow due to the increased number of complex surgeries globally attributed to chronic diseases or injuries. The increasing geriatric populations with chronic conditions in major countries have led to a higher number of surgeries performed annually, which is anticipated to boost the demand for the surgical robot in the near future. For instance, according to the World Health Organization, the number of inpatient surgical procedures performed in the European region reached an estimated 15 million procedures in 2020, up from an estimated 5 million in 2009. Similarly, an estimated 32 million surgeries are performed in India annually. In May 2024, the Government of Saskatchewan reported that more than 96,000 surgeries were performed in the country during 2023–2024, marking the highest number of surgeries ever performed in a single year. Therefore, growing number of complex surgeries is anticipated to drive the surgical robot market growth.

Market Drivers

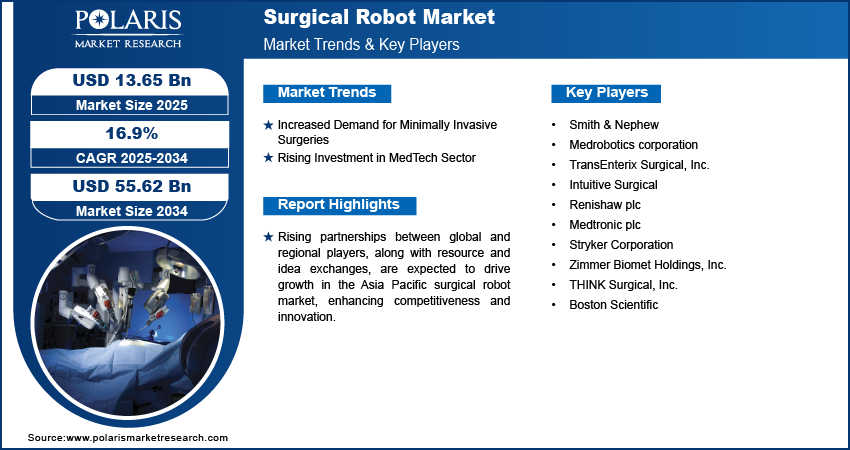

Increased Demand for Minimally Invasive Surgeries

There is an increasing demand for minimally invasive surgeries to manage chronic diseases and avoid complications related to complex surgeries, due to which the demand for the surgical robot is growing. For instance, according to the American Society of Plastic Surgeons, a total of 23 million minimally invasive cosmetic surgeries were performed in 2022, an increase from 8 million such surgeries before 2019. This represents an increase of 15 million surgeries and a 188% change between 2019 and 2024 over six years. Minimally invasive surgeries, which involve smaller incisions and reduced trauma compared to traditional surgeries, are increasingly favored due to their numerous benefits. Patients experience shorter recovery times, less pain, and fewer complications, all of which contribute to a faster return to normal activities and improved overall outcomes. As awareness of these advantages spreads, patient preference shifts towards minimally invasive options, compelling healthcare providers to adopt advanced robotic systems to meet this demand and provide optimal care. Consequently, an increase in demand for minimally invasive surgeries is anticipated to drive the surgical robot market in the forecast years.

Rising Investment in MedTech Sector

Increased investment in the medical device industry is significantly boosting the surgical robot market by fueling technological advancements and enhancing surgical outcomes. As funding grows, it accelerates the development of sophisticated robotics, artificial intelligence, and machine learning technologies, thereby enhancing the precision and capabilities of surgical robots. For Instance, in May 2024, Kotak Alternate Asset Manager Ltd. invested 48.2 million USD in medical device manufacturer Biorad Medisys to set up a new manufacturing plant. Moreover, expanded healthcare infrastructure often incorporates these advanced systems, driven by increased investment and overall healthcare expenditure. The competitive dynamics among manufacturers, driven by higher investment, lead to more innovative and cost-effective solutions, while regulatory and clinical support accelerates the introduction of new robotic systems. Additionally, investment in training and support services ensures that healthcare professionals are adept at using these advanced technologies, further promoting their adoption and simultaneously accelerating surgical market growth during the forecast period.

Segment Insights

Market Breakdown by Product Type Insights

The surgical robot market segmentation based on product type includes robotic systems, laparoscopy robotic systems, orthopedic robotic systems, neurological robotic systems, and instruments and accessories. The instruments and accessories segment is expected to experience significant growth with a high CAGR during the forecasted period. This is due to the constant need to repurchase instruments and accessories for maintenance, repairs, or modifications. For instance, according to the Journal of Minimal Access Surgery, maintaining the da Vinci surgical robot system costs around 1 million USD every year.

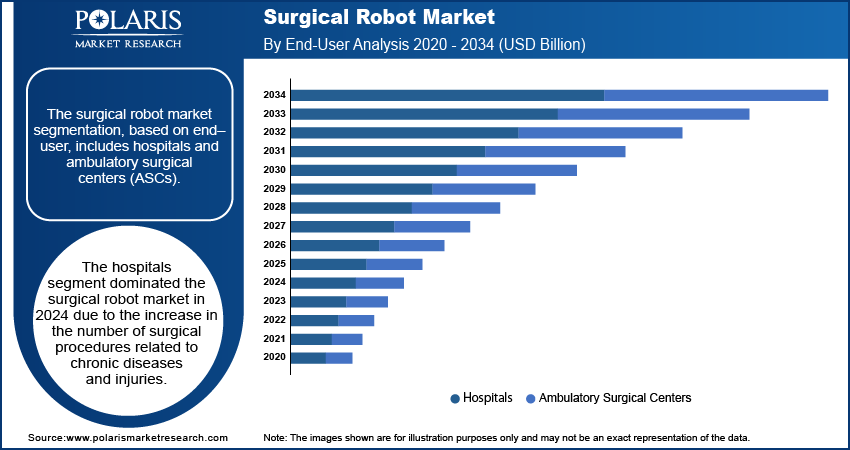

Market Breakdown by End–User Insights

The surgical robot market segmentation, based on end–user, includes hospitals and ambulatory surgical centers (ASCs). The hospitals segment dominated the surgical robot market in 2024. This growth is attributed to the increase in the number of surgical procedures related to chronic diseases and injuries. Hospitals are mainly in demand for surgeries due to their better availability of resources and skilled workforce. Therefore, hospitals are considered major consumers in the surgical robot market.

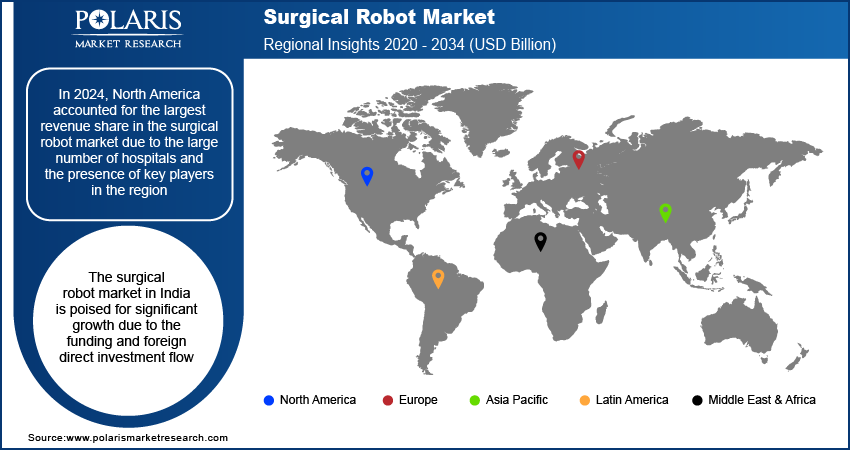

Market Breakdown by Regional Insights

By region, the study provides the surgical robot market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the surgical robot market due to the large number of hospitals and the presence of key players in the region. For instance, according to the American Hospital Association and the Government of Canada, there were 7,066 hospitals in North America as of 2024. Of these, 6,120 were located in the United States and 946 in Canada. Of the 946 hospitals in Canada, 317 were large, with an average of 939 beds; 230 were tiny, with an average of 30–40 beds; 71 were micro, with an average of 15 beds. The remaining 328 hospitals were medium-sized. As of 2024, there were 916,752 beds in the United States. Moreover, major players involved in mergers and acquisitions and expanding product offerings with the latest technology are anticipated to fuel the surgical robot market in North America.

Asia Pacific is projected to register a substantial CAGR during the forecast period, primarily due to rising partnerships between global and local players. These partnerships facilitate the exchange of established resources of global players and innovative ideas and technologies from startups. In 2024, MedTech Innovator, a US-based non-profit organization established to accelerate medical device companies worldwide, launched a program called 'MedTech Innovator Asia Pacific 2024 Cohort.' The main purpose of the program is to support startups with funding and by leveraging available networks. The program's leadership team, which includes investors, providers, and senior executives from world-class multinationals and medtech companies, will partner with startups. The most innovative startups will receive a reward of 3 million USD cash awards and the opportunity to partner with global players. Consequently, increasing partnerships between global and regional players, along with the exchange of ideas and resources, is expected to empower regional players with competitive and resource advantages and contribute to the surgical robot market growth in Asia Pacific.

The surgical robot market in India is poised for significant growth due to the funding and foreign direct investment flow. For instance, according to India Brand Equity Foundation, the foreign direct investment inflow in medical device manufacturing companies was 3.28 billion USD between 2000-2024. According to WIR 2024, India is the second-largest host country in terms of number of international project finance deals. In the second quarter of 2023, the FDI inflow into the hospital sector increased by 90%, rising to 1.08 billion USD from 570.6 million USD in the same quarter of 2022. Additionally, India and Russia have set a bilateral trade target of 30 billion USD for 2025, by which trade between the two countries is expected to increase by 5 billion USD per annum. As a result, the entry of new players with advanced technology is anticipated to increase, leading to overall surgical robot market growth in India in study years.

Key Players & Competitive Insights

The surgical robot market is continuously evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative medical devices and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and new applications, greater emphasis on sustainability, and the rising requirement for tailor-made single-use products in diverse industries. Major players in the surgical robot market include Smith & Nephew; Medrobotics Corporation; TransEnterix Surgical, Inc.; Intuitive Surgical; Renishaw plc; Medtronic plc; Stryker Corporation; Zimmer Biomet Holdings, Inc.; THINK Surgical, Inc.; and Boston Scientific.

Medtronic, headquartered in Dublin, Ireland, is a prominent global leader in medical technology, committed to improving patient outcomes across various therapeutic areas. Established in 1949, the company specializes in developing and manufacturing a diverse range of advanced medical devices, including pacemakers, insulin pumps, spinal implants, robotic surgical systems, and deep brain stimulation systems. Medtronic's innovations are pivotal in treating conditions related to cardiovascular health, diabetes, neurological disorders, and spinal issues. With a presence in over 150 countries, the company leverages its extensive expertise and research capabilities to address critical healthcare challenges. Medtronic’s mission is to alleviate pain, restore health, and extend life, reflecting its dedication to enhancing the quality of care and advancing medical science. Through continuous innovation and a focus on patient-centered solutions, Medtronic plays a crucial role in shaping the future of healthcare on a global scale. In April 2024, the company launched its new Live Stream function for the Touch Surgery ecosystem, featuring AI-driven enhancements for post-operative analysis. Unveiled in April and showcased at DeviceTalks Boston, this technology supports secure live streaming of surgeries, offering immersive virtual learning and expert insights for procedures like laparoscopic cholecystectomy and robotic-assisted hysterectomy. The platform is now available in the US and Western Europe.

Smith & Nephew is a global medical technology company headquartered in London, England, specializing in advanced wound management, orthopedic reconstruction, and sports medicine. Established in 1856, the company is known for its innovative solutions that aim to improve patient outcomes and enhance the quality of care. Smith & Nephew’s product portfolio includes advanced wound care dressings, arthroscopic instruments, joint reconstruction implants, and trauma devices. With a strong commitment to research and development, the company operates in over 100 countries, focusing on providing advanced technologies and services to address a broad range of medical needs and challenges. In June 2024, the company launched its CORIOGRAPH Pre-Operative Planning and Modeling Services, offering a customized solution for partial and total knee arthroplasty. This new service is designed for use with the CORI Surgical System, which uniquely allows surgeons to opt for either image-free or image-based registration, eliminating the necessity for a pre-operative MRI scan. The launch marks a significant advancement in personalized surgical planning and robotic-assisted orthopedic procedures.

List of Key Companies

- Smith & Nephew

- Medrobotics corporation

- TransEnterix Surgical, Inc.

- Intuitive Surgical

- Renishaw plc

- Medtronic plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- THINK Surgical, Inc.

- Boston Scientific

Surgical Robots Industry Developments

June 2024: SS Innovations, based in Gurugram, India, announced the launch of SSI Mantra 3, the latest generation of India's first indigenous surgical robotic system. This advanced model features five slimmer robotic arms and a 3D HD headset for enhanced precision. The company also achieved a milestone by completing India’s first human telesurgery trial, performing a robotic cholecystectomy over 5 kilometers using Airtel’s fiber-optic network

April 2024: Intuitive Surgical announced that its next-generation da Vinci 5 system has received FDA clearance and will undergo a limited launch. Featuring over 150 enhancements from its predecessor, the da Vinci Xi system boasts improved precision, imaging, ergonomics, and force feedback.

September 2021: Medtronic launched its Surgical Robotics Experience Center (SREC) in Gurugram, India, showcasing the Hugo™ RAS system for robotic-assisted surgeries. The center, the first of its kind in the Asia Pacific, aims to provide standardized training for the Hugo RAS system through a comprehensive curriculum. Medtronic's initiative underscores its commitment to advancing minimally invasive surgery and enhancing surgical training in India.

Surgical Robot Market Segmentation

By Product Type Outlook (USD billion, 2020- 2034)

- Robotic Systems

- Laparoscopy Robotic Systems

- Orthopedic Robotic Systems

- Neurological Robotic Systems

- Instruments and Accessories

By Application Outlook (USD billion, 2020- 2034)

- General Surgery

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- Others

By End–User Outlook (USD billion, 2020- 2034)

- Hospitals

- Ambulatory Surgery Centers (ASC’s)

By Regional Outlook (USD billion, 2020- 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surgical Robot Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.71 billion |

|

Market Size Value in 2025 |

USD 13.65 billion |

|

Revenue Forecast in 2034 |

USD 55.62 billion |

|

CAGR |

16.9% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End-User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |