Switchgear Market Share, Size, Trends, Industry Analysis Report

By Insulation (Gas-insulated, Vacuum-insulated, Air-insulated, Others); By Voltage; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 117

- Format: PDF

- Report ID: PM2638

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

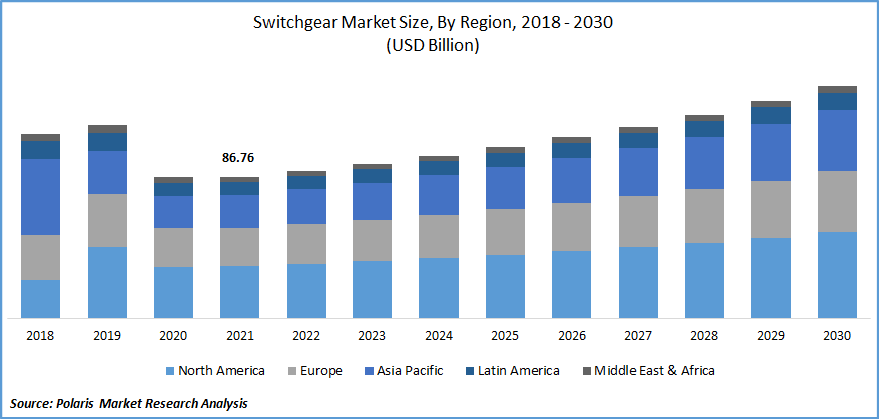

The global switchgear market was valued at USD 86.76 billion in 2021 and is expected to grow at a CAGR of 5.8% during the forecast period. Switchgear is a switching device developed for the management of power systems. These can control, safeguard, and isolate circuits to protect equipment from electrical overload. It regulates current flow to avoid threats of faulty currents and short circuits. Switchgear interrupts power flow in case of an electrical surge to protect the electrical system and prevent any damage. Switchgears are utilized for testing and fault clearing.

Know more about this report: Request for sample pages

Examples of switchgear include fuses, relays, switches, isolators, and circuit breakers. The evolution of electrical distribution networks has increased the demand for switchgear. Switchgears enable safe operations while assisting in the continuity of service and superior convenience in commercial and residential applications.

Switchgears are also widely used in utility and industrial sectors to manage electrical faults and de-energize equipment for maintenance. When an electrical fault is experienced, a circuit breaker detects the anomaly to suspend the power flow, providing greater safety and efficiency.

Low and medium-voltage switchgear is commonly used in most applications. Low voltage switchgear is used to regulate systems up to 1 kilovolt. This switchgear is utilized across buildings, healthcare facilities, industrial organizations, and water and wastewater units. Medium voltage switchgear is utilized in indoor and outdoor systems up to 75 kilovolts. Insulating technologies used in this switchgear include Air-insulation, gas-insulation, and vacuum insulation. The rise in energy demand and the strengthening of distribution and transmission networks over the years has increased the demand for switchgear.

The spread of the COVID-19 virus influenced the global market. The global market suffered from supply chain disruptions and reduced demand from commercial and industrial sectors. Reduced supply of raw materials and lack of workforce further hampered the market growth. Lockdown restrictions caused limitations in the movement of goods, causing a delay in raw material acquisition and distribution of finished goods.

Shutting manufacturing activities in several countries, transportation delays, and disturbed supply chains further contributed to limited growth during the pandemic. However, post-pandemic, the global switchgear market is expected to grow owing to economic growth and the adoption of automation solutions.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market is expected to experience growth during the forecast period owing to energy demand and growing urbanization. An increase in industrialization, especially in developing countries, has resulted in greater demand for switchgear in the industrial sector. The development of power distribution infrastructure, greater need for energy efficiency, and growth in the industrial sector boost the market growth. The rising adoption of renewable energy sources has also resulted in greater demand for the product.

Countries across the world are moving toward the adoption of power-efficient energy systems. Implementation of strict regulations associated with energy use and the adoption of enhanced and resilient energy systems further support the growth of the market. Superior efficiency and safety offered by switchgear and an increase in the adoption of automation solutions for improved performance have increased the demand for the product.

Supportive government regulations, the adoption of distributed power systems, and a greater need to reduce the carbon footprint have accelerated market growth. Rising demand from developing countries, technological advancements, and investment growth are expected to contribute to industry growth in the coming years.

Report Segmentation

The market is primarily segmented based on insulation, voltage, end-use, and region.

|

By Insulation |

By Voltage |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Gas-insulated segment is expected to witness significant growth in the coming years

Based on insulation, the global switchgear market has been segmented into gas-insulated, vacuum-insulated, air-insulated, and others. The gas-insulated segment is expected to experience significant growth during the forecast period. These products are equipped with high-voltage components such as circuit breakers and disconnectors to operate efficiently and safely in limited spaces. These switchgears find applications in offshore platforms, industrial units, hydropower plants, and building extensions, among others.

High voltage segment to experience significant growth during the forecast period

On the basis of voltage, the global market has been segmented into low, medium, and high. The high voltage segment is expected to exhibit substantial growth during the forecast period. High voltage switchgears are used in power systems operating with a voltage above 36kV. High voltage circuit breakers are integrated into these switchgears to offer safe and reliable operation. Increasing improvements in the infrastructure of substations and power plants have increased the demand for the product from this segment.

Transmission & distribution utilities segment accounted for a major market share

Based on end-use, the global market is segmented into transmission & distribution utilities, industries, commercial & residential, and others. The transmission & distribution utilities accounted for a significant market share in 2021. A substantial rise in electricity demand and greater adoption of smart grids supports the growth of this segment. There have been developments in the improvement of transmission and distribution infrastructure, resulting in increased demand for the product.

Growth in population and urbanization has led to an increase in energy demand. The rise in the adoption of renewable energy sources has been observed across various countries to address the growing energy need through sustainable energy sources. Rise in the adoption of smart cities, increasing aging infrastructure, and integration of automation and intelligent systems in electric power distribution are factors accelerating the demand for the product in this segment.

Asia Pacific generated significant revenue in 2021

Asia Pacific dominated the global market in 2021 on account of rise in urbanization and industrialization. The economic growth in developing nations like India and China contributes to greater energy demand, thereby increasing the application of the product in renewable energy and power. Increase in application in transmission and distribution utilities and integration of smart technologies further contributes to market growth in the region.

Several market players in Asia-pacific are introducing new products to address growing demand in the region. In October 2021, Panasonic Life Solutions India launched a new range of the product called UNO Plus range. The new range includes miniature circuit breaker, residual current operated circuit breaker, and distribution boards. In January 2021, ABB India developed a new line, Formula DIN-Rail, comprising miniature circuit breakers, residual current circuit breakers and isolators aimed at application in the electrical retail market.

Competitive Insight

The major industry players are ABB, Alstom SA, CG Power & Industrial Ltd., Eaton, Fuji Electric, General Electric, Hitachi, Hubbell Incorporated, Hyosung Corporation, Hyundai Electric and Energy Systems Co., Legrand, Mitsubishi Electric, Powell, Schneider Electric, Siemens, and Toshiba.

These leading players are investing in research and development of new products to enhance their offerings in the market. Acquisitions and collaborations are also observed in the industry, enabling the to strengthen market presence and enter new geographic regions.

Recent Developments

In September 2021, HPL Electric & Power introduced new switchgears to strengthen its portfolio in the market. The products include DC Switch Disconnector up to 1500V DC and 800V AC, which are available in 2 3 & 4 Pole configurations.

In July 2019, Eaton acquired Innovative Switchgear Solutions, Inc. to strengthen its presence in North America. The acquisition also enabled the company to expand its offerings of medium-voltage solutions.

Switchgear Market Report Scope

|

Report Attributes |

Details |

|

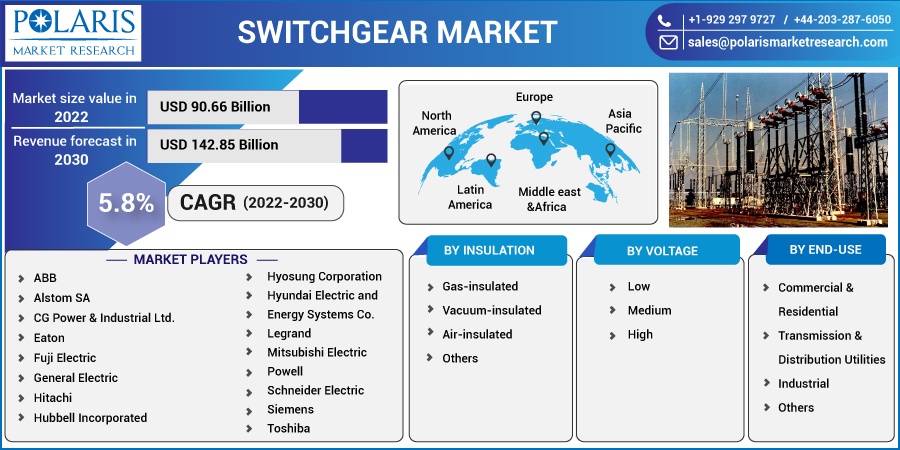

Market size value in 2022 |

USD 90.66 billion |

|

Revenue forecast in 2030 |

USD 142.85 billion |

|

CAGR |

5.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Insulation, By Voltage, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ABB, Alstom SA, CG Power & Industrial Ltd., Eaton, Fuji Electric, General Electric, Hitachi, Hubbell Incorporated, Hyosung Corporation, Hyundai Electric and Energy Systems Co., Legrand, Mitsubishi Electric, Powell, Schneider Electric, Siemens, and Toshiba. |