Synchronous Condenser Market Share, Size, Trends, Industry Analysis Report

By End-Use; By Cooling Technology, By Type; By Reactive Power Rating; By Starting Method; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 112

- Format: PDF

- Report ID: PM2524

- Base Year: 2024

- Historical Data: 2020-2023

What is synchronous condenser market size?

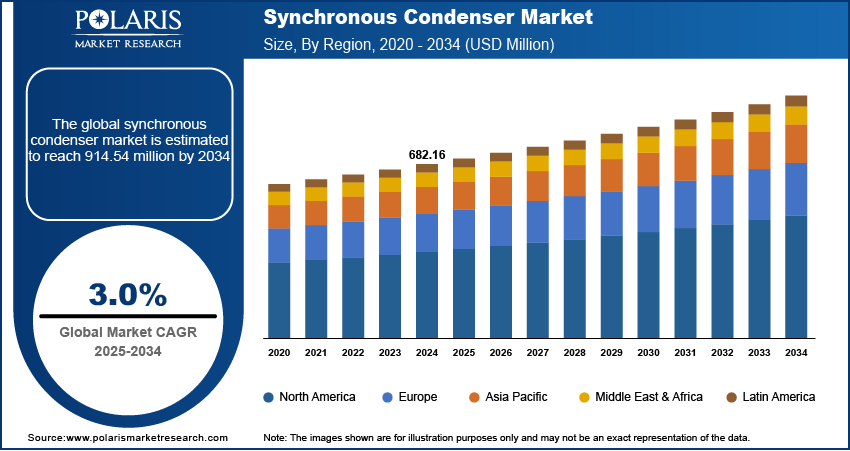

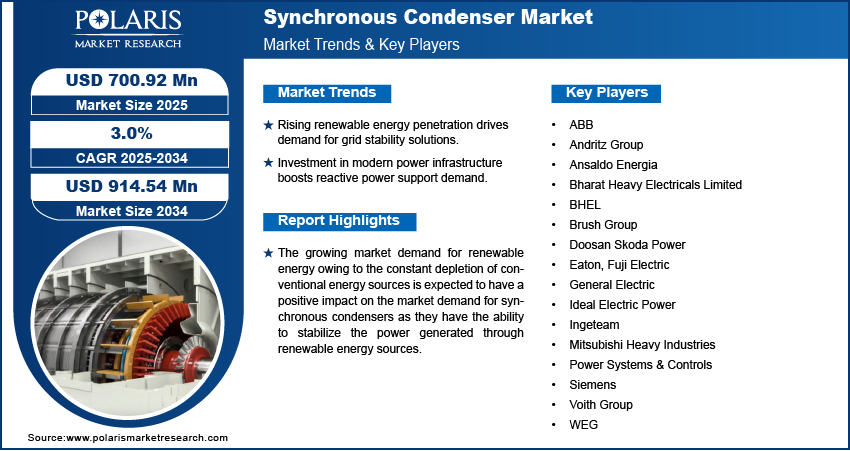

The global synchronous condenser market was valued at USD 682.16 million in 2024 and is expected to grow at a CAGR of 3.0% during the forecast period. The increasing demand and installations of renewable energy plants and growing penetration of synchronous condensers to steady the network by voltage recovery during faults is expected to drive market demand over the forecast period.

Key Insights

- By type, the new synchronous condenser segment held the largest share in 2024, as they incorporate advanced materials and designs that offer higher efficiency and are often smaller in size.

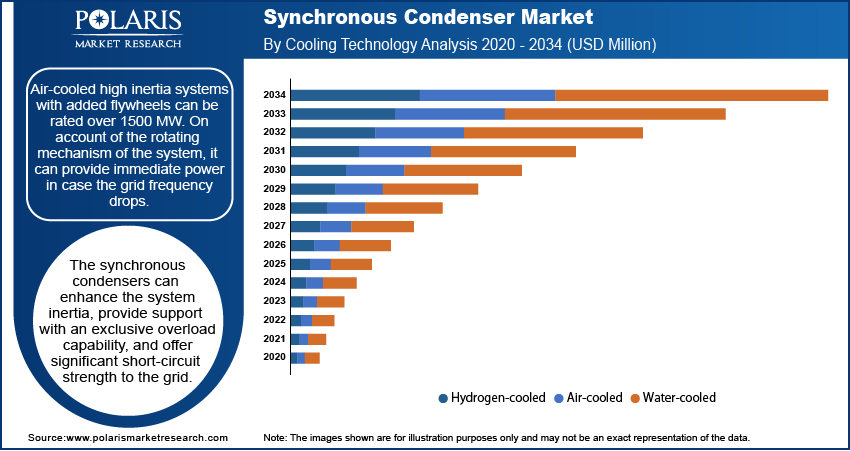

- By cooling technology, the air-cooled segment held the largest share in 2024 due to the superior thermal conductivity of air cooled systems.

- By starting method, the static frequency converter (SFC) segment held the largest share in 2024 because it offers precise control over the startup process.

- By reactive power, the above 200 MVAr segment held the largest share in 2024. This dominance is driven by the increasing complexity and size of power grids and the need for high-capacity systems.

- By end-use, the electrical utilities segment held the largest share in 2024 due to their critical role in power transmission and distribution (T&D) systems.

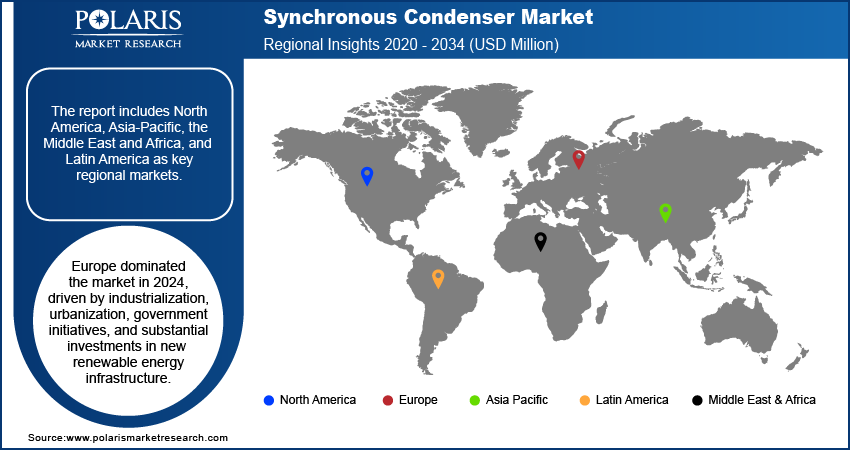

- By region, the Europe region held the largest share in 2024, driven by significant investments in new power infrastructure. This growth is primarily fueled by rapid industrialization and urbanization, along with government initiatives to expand renewable energy capacity.

Industry Dynamics

- Increasing penetration of intermittent renewable energy sources, like wind and solar power, necessitates devices that can provide system inertia and voltage support to maintain grid stability.

- Growing global investment in modernizing aging power transmission infrastructure and expanding High-Voltage Direct Current (HVDC) systems creates demand for robust, centralized reactive power support.

- The decommissioning or conversion of old synchronous generator-based conventional power plants reduces the total system inertia and short-circuit capacity available on the grid.

Market Statistics

- 2024 Market Size: USD 682.16 million

- 2034 Projected Market Size: USD 914.54 million

- CAGR (2025-2034): 3.0%

- Europe: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The growing market demand for renewable energy owing to the constant depletion of conventional energy sources is expected to have a positive impact on the market demand for synchronous condensers as they have the ability to stabilize the power generated through renewable energy sources. In addition, the system is also useful as they produce reactive power, proving effective for renewable energy sources.

The COVID-19 pandemic had an adverse impact on nearly all industries across the globe. Strict lockdowns and restrictions on day-to-day routines led to a sudden slowdown in economic activities which resulted in the decline across several industrial sectors. Similarly, the market demand for synchronous condensers saw a decline as the ongoing renewable energy installation projects came to a standstill.

Industry Dynamics

Which are the factors driving the synchronous condenser market?

Growth Drivers

As per statistics published by British Petroleum, renewable energy generation grew by 16.5% in 2021 from the previous year to 3,657.2 terawatt-hours. In addition, the growing market demand for hydroelectricity is also expected to witness significant growth owing to the increasing adoption across North America and Europe. As a result, the use of synchronous condensers is expected to witness growth with the need for the stabilization of energy generated through renewable sources.

Synchronous condenser market demand in the past few years has been low as the technology was on the verge of becoming obsolete. However, as the product is now being used to stabilize variable and intermittent power generated through renewable sources, the demand for the synchronous condenser market is increasing in the energy sector.

Report Segmentation

The market is primarily segmented based on type, cooling technology, starting method, reactive power rating, end-use, and region.

|

By Type |

By Cooling Technology |

By Starting Method |

By Reactive Power Rating |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

New synchronous condensers segment accounted for the largest market share in 2024

The growing demand for new systems is expected to account for a higher share as compared to its counterpart owing to the increasing demand for the synchronous condenser in electrical utilities. As the system has the ability of power factor correction and grid stability, the demand for new condensers is also expected to witness a higher market share over the forecast period.

As governments across the globe are trying to reduce the impact of power generation on the environment, the adoption of renewable energy is increasing steadily worldwide. Furthermore, this growing adoption is likely to change the power generation mix, with renewable energy accounting for a higher share by 2030 as compared to the current scenario. As a result, the demand for new systems is likely to witness growth.

Air-cooled technology is expected to account for the largest revenue share in 2034

Air-cooled high inertia systems with added flywheels can be rated over 1500 MW. On account of the rotating mechanism of the system, it can provide immediate power in case the grid frequency drops. The synchronous condensers can enhance the system inertia, provide support with an exclusive overload capability, and offer significant short-circuit strength to the grid.

Water-cooled technology is expected to witness steady growth owing to the increasing demand for synchronous condensers for electrical utilities. The rising installation of the systems outdoors is expected to drive the demand for air-cooled technology. However, the growing technological innovations are expected to slow the growth of water-cooled technology over the forecast period.

200 MVAr segmented is expected to witness higher growth as compared to its counterparts

The growing demand for high-capacity synchronous condensers is expected to drive the demand for the 200 MVAr segment over the forecast period. Increased cost efficiency and short-circuit capacity are expected to further drive the demand for the systems with a 200 MVAr reactive power rating. In addition, the increasing demand for the segment is likely to augment the demand for hydrogen-cooled technology.

100 MVAr reactive power rating is expected to account for a significant market share in 2021, owing to the growing demand for smaller units for microgrid resilience and transmission modularity. In addition, the increasing need for smaller units in the industrial sector is expected to impact segment revenue growth positively.

Electrical utilities accounted for the largest market share in 2024

Electrical utilities accounted for the highest revenue share in 2024, owing to the increasing demand for electricity across the residential and commercial sectors. In addition, the growing adoption of renewable energy sources in mainstream power generation is expected to drive the demand for the synchronous condenser market in the electrical utilities segment.

The industrial sector is also gaining traction owing to the increasing manufacturing and other related activities post-peak COVID-19 pandemic. As a result, the need for reduced turnover time and eliminating power outage problems which can hamper the production process, is expected to drive the demand for synchronous condensers. In addition, with the growing use of renewable energy to reduce the impact on the environment, the need for synchronous condenser systems is rising in the sector.

North America is expected to witness the fastest growth over the forecast period

The demand in North America is expected to witness significant growth over the forecast period owing to the increasing integration of renewable energy sources with the mainstream power generation grid. In addition, the growing adoption of microgrids is also expected to complement the market growth over the forecast period.

Europe accounted for the largest revenue share in 2024, owing to the higher adoption of renewable energy as a primary power generation source. Europe accounted for the highest share in power generation through renewable energy sources, owing to which the use of synchronous condensers in the region was a stabilizer of variable power.

Competitive Insight

Who are the major players in the synchronous condensers market?

Some of the major players operating in the global market include ABB, Andritz Group, Ansaldo Energia, Bharat Heavy Electricals Limited (BHEL), Brush Group, Doosan Skoda Power, Eaton, Fuji Electric, General Electric, Ideal Electric Power, Ingeteam, Mitsubishi Heavy Industries, Power Systems & Controls, Siemens, Voith Group, and WEG.

Recent Developments

In June 2024, GE Vernova Inc. announced plans to build two 115 kV synchronous condenser facilities to enhance grid stability in New York.

In September 2021, ABB and Statkraft bought a specified level of uptime for two ABB synchronous condenser systems that are getting installed in Liverpool that will play a crucial role in upholding the stability of the UK grid.

In February 2022, Quinbrook Infrastructure Partners commissioned a synchronous condenser at Rassau, South Wales. The company partnered with Siemens Energy and Welsh Power to provide stability to the grid, including short circuit power and inertia.

Synchronous Condensers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 682.16 million |

| Market size value in 2025 | USD 700.92 million |

|

Revenue forecast in 2034 |

USD 914.54 million |

|

CAGR |

3.0% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Cooling Technology, By Starting Method, By Reactive Power Rating, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ABB, Andritz Group, Ansaldo Energia, Bharat Heavy Electricals Limited (BHEL), Brush Group, Doosan Skoda Power, Eaton, Fuji Electric, General Electric, Ideal Electric Power, Ingeteam, Mitsubishi Heavy Industries, Power Systems & Controls, Siemens, Voith Group, and WEG |

FAQ's

? The global market size was valued at USD 682.16 billion in 2024 and is projected to grow to USD 914.54 billion by 2034.

? The global market is projected to register a CAGR of 3.0% during the forecast period.

? Europe dominated the market share in 2024.

? The new segment accounted for the largest share of the market in 2024.