Thermal Interface Materials Market Share, Size, Trends, Industry Analysis Report

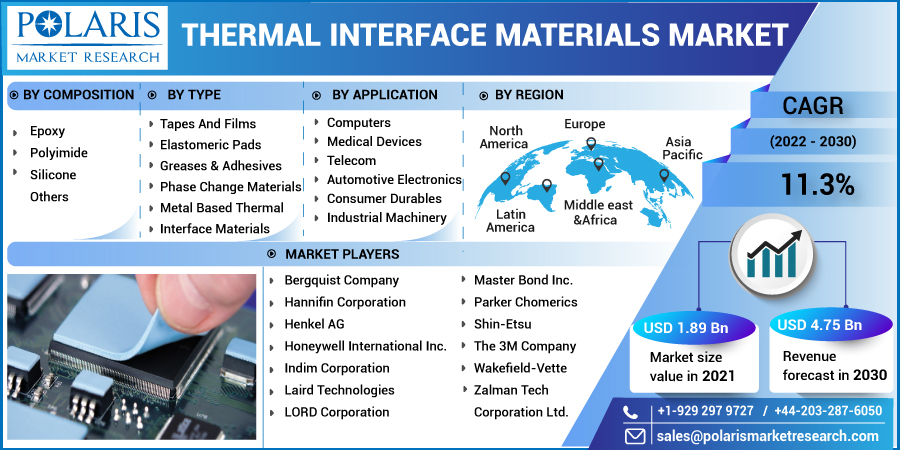

By Composition (Epoxy, Polyimide, Silicone, Others); By Type; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Aug-2022

- Pages: 115

- Format: PDF

- Report ID: PM2544

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

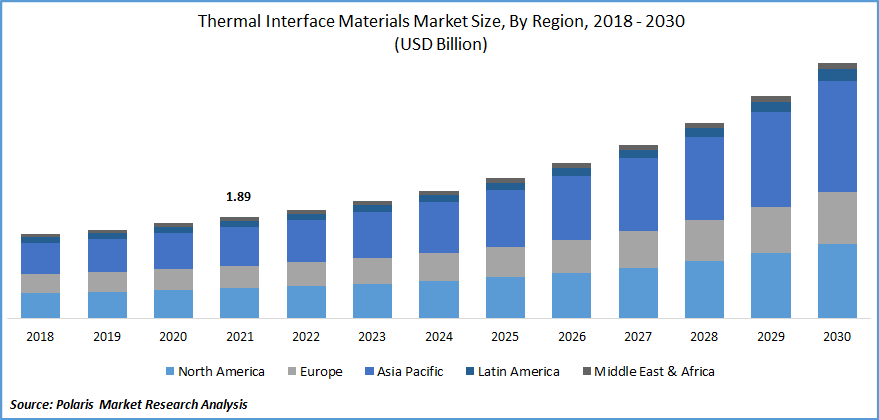

The global thermal interface materials market was valued at USD 1.89 billion in 2021 and is expected to grow at a CAGR of 11.3% during the forecast period. Thermal interface materials are used for filling gaps that are naturally formed between heat-generating components and associated heat sinks. These interface materials offer a conductive medium and eliminate air gaps for optimized heat transfer.

Know more about this report: Request for sample pages

Technological advancements in electronics lead to overheating. As stated by Moore’s law, the number of transistors on integrated circuit chips doubles every two years. The demand has increased for efficient management required in solutions with greater computing power and transistor density. Overheating in devices leads to several issues with product performance and component failure. The use of such material offers enhanced power capacity and reliability along with the reduced cost of the finished assembly.

An increase in emphasis on device miniaturization has resulted in a higher need for high-performance cooling. There has been an increasing trend of miniaturization and integration of electronic devices. It enhances heat transfer while improving the performance, durability, and stability of electronic devices.

There has been a steady demand for the industry during the pandemic owing to the rise in demand for consumer electronics such as laptops and smartphones. There was greater demand for medical devices using thermal interface materials during the pandemic.

However, the industry was negatively influenced by operational challenges, transportation delays, disruption of the supply chain, and workforce impairment. Negative impacts on industries such as automotive and industrial machinery hampered the growth of the market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising industrialization, greater adoption of automation technologies, and increasing penetration of electronic devices support the growth of the thermal interface materials industry. Miniaturization of electronic devices, advancements in the telecommunication sector, and the rising need for high-speed computing have resulted in increased demand for the industry.

Greater application in the medical sector and a rise in demand for such material from the automotive sector supports the growth of the industry. The rise in the penetration of electric vehicles and the introduction of stringent regulations to control carbon emissions would contribute to market growth during the forecast period.

The economic growth in developing nations, rise in disposable income of consumers, and high penetration of smartphones and other mobile devices accelerates the demand for the industry. There has been a rise in the adoption of automation solutions across industries such as manufacturing, industrial, and telecommunication sectors, leading to greater demand for these interface materials. Several companies are investing in technological advancements and research & development to launch innovative, affordable solutions in the market.

Report Segmentation

The market is primarily segmented based on composition, type, application, and region.

|

By Composition |

By Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Silicone segment accounted for the largest market share

Silicone dominated the global thermal interface materials market in 2021. The efficient performance offered by silicone across a wide range of applications has increased its adoption. Silicone offers high resistance to mechanical stress, vibrations, and shock. Silicone is widely used in different products such as greases & adhesives, pads, and gap fillers, among others.

In July 2021, Dow launched three silicone-based thermal interface materials aimed at electronics applications for electric and hybrid-electric vehicles. The products, DOWSIL TC-4551 CV Gap Filler, DOWSIL TC-2035 CV Adhesive, and DOWSIL TC-4060 GB250 Thermal Gel, are developed to offer enhanced performance in, greater conductivity, efficient heat dissipation, and improved productivity in electric and hybrid vehicles.

These silicone material solutions offer high reliability, safety, and performance. The DOWSIL TC-2035 CV Adhesive is used for the assembly of automotive electronics, such as advanced driver assistance systems units and electronic control units.

Greases & adhesives segment accounted for a significant share in 2021

The greases and adhesives segment accounted for a major share in the thermal interface materials market in 2021. Thermal greases and adhesives are conductive interface materials applied for the connection of a heat source with a thermal spreading device. These greases and adhesives are responsible for enhancing the effectiveness of a system's overall interface conductivity.

The demand for phase change material is expected to increase during the forecast period. Phase change materials absorb and release heat energy as they go through the process of phase change. Phase change interface materials melt and solidify at defined temperatures enabling efficient control of temperatures across applications. Greater application in the telecommunication, automotive, and medical sectors is expected to drive the growth of this segment during the forecast period.

The computers segment accounted for a significant market share

The thermal interface materials market is segmented into computers, medical devices, telecom, automotive electronics, consumer durables, industrial machinery, and others on the basis of application. The computer segment accounted for a significant market share in 2021. Greater demand for desktops and laptops, rise in penetration of offices, and increase in demand for online education boosts the demand for the industry in this segment.

The demand for the industry from the automotive segment is expected to increase during the forecast period. The rise in penetration of electric and hybrid vehicles, the introduction of stringent emission regulations, and the introduction of government schemes to promote the adoption of electric vehicles boost the growth of this segment.

In April 2022, Shin-Etsu Chemical Co., Ltd. introduced its new thermal interface silicone rubber sheet. The new TC-BGI Series is designed for applications in electric vehicles. The product is aimed at the development of small and light components. The product launch enabled the company to cater to the growing demand for electric vehicles and accommodate the requirement for high voltage systems in electric vehicles.

Asia-Pacific is expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience significant growth during the forecast period. The rise in urbanization, industrialization and greater demand for telecommunication and consumer devices support the growth of the thermal interface materials market in the region. Increasing application in medical devices and greater adoption of electric and hybrid vehicles further boost the adoption of thermal interface materials in Asia-Pacific. Introduction of initiatives to promote the adoption of renewable energy sources, investment in research and development by public and private organizations, and technological advancements further accelerate the market growth in the region.

Competitive Insight

Some of the major players operating in the global thermal interface materials market include Bergquist Company, Hannifin Corporation, Henkel AG, Honeywell International Inc., Indim Corporation, Laird Technologies, LORD Corporation, Master Bond Inc., Momentive Performance Materials, Parker Chomerics, Shin-Etsu, The 3M Company, The Dow Chemical Company, Wakefield-Vette, and Zalman Tech Corporation Ltd.

The leading market players are developing new products to expand their product offerings in the market. Some players are also taking initiatives through partnerships and collaborations to strengthen their market presence and cater to the growing consumer demand.

Recent Developments

In June 2022, Dow Corning Corporation introduced DOWSIL TC-4040 dispensable thermal pad. The new product offers high thermal conductivity and resistance against slumping. The product launch is aimed at enhancing the company’s product offerings in the market and cater to the growing consumer demand.

In April 2021, Parker Hannifin Corporation introduced THERM-A-GAP GEL 75. It is a single component dispensable thermal interface material suitable for use in high-powered electronics. The product is developed for applications such as automotive safety electronics modules, memory & power modules, telecommunications equipment, and power supplies.

In May 2022, Arieca, collaborated with ROHM Co., Ltd. for a joint research agreement aimed at the development of next-generation thermal interface materials for the xEV market. The research uses Arieca’s Liquid Metal Embedded Elastomer Technology for development of next-generation SiC power modules for xEV applications.

March 2024: Resonac Corporation made a public announcement about its plans to boost production capacity to 3.5 to 5 times its current level in order to develop materials for high-performance semiconductor chips, which will primarily be utilized as CPUs for artificial intelligence (AI). The company also aims to increase the production of thermal interface material (TIM) and non-conductive film (NCF).

February 2023: Indium Corporation unveiled its metal thermal interface materials (TIMs) with high performance for testing and burn-in at TestConX. With pure indium providing 86W/mK, Indium’s TIMs have better thermal conductivity than non-metals.

Thermal Interface Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.89 billion |

|

Revenue forecast in 2030 |

USD 4.75 billion |

|

CAGR |

11.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Composition, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Bergquist Company, Hannifin Corporation, Henkel AG, Honeywell International Inc., Indim Corporation, Laird Technologies, LORD Corporation, Master Bond Inc., Momentive Performance Materials, Parker Chomerics, Shin-Etsu, The 3M Company, The Dow Chemical Company, Wakefield-Vette, and Zalman Tech Corporation Ltd. |