Tokenization Market Share, Size, Trends, Industry Analysis Report

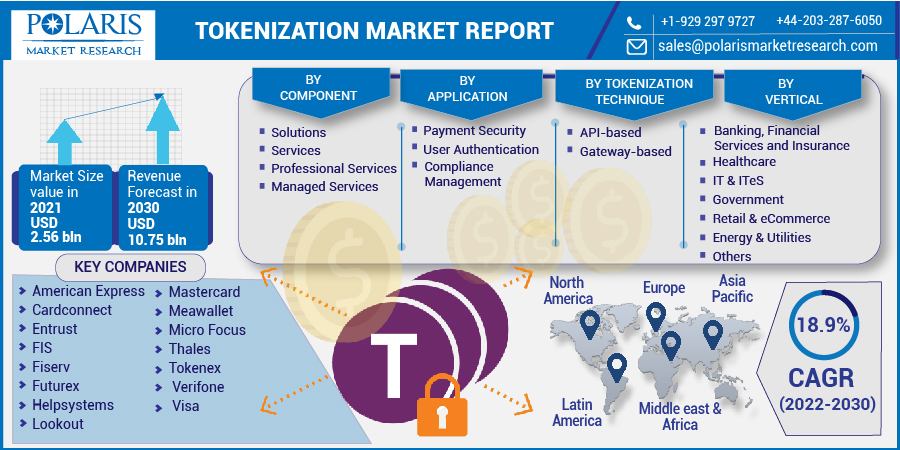

By Component (Solutions, Services); By Technique (API-based, Gateway-based); By Application; By Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 113

- Format: PDF

- Report ID: PM2417

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

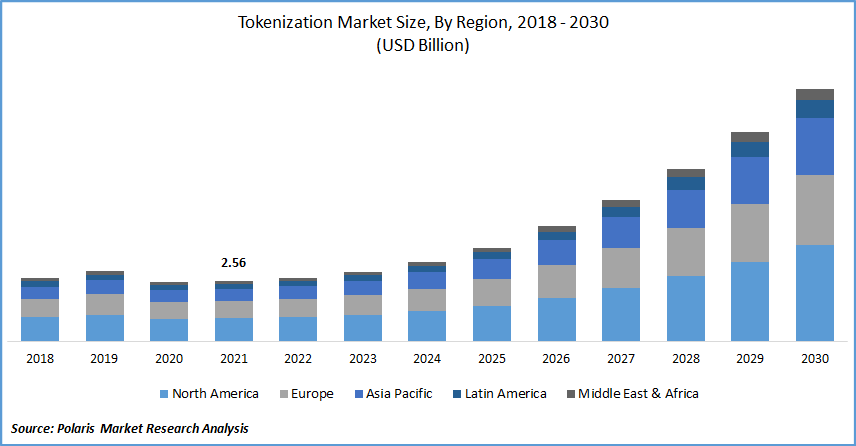

The global tokenization market was valued at USD 2.56 billion in 2021 and is expected to grow at a CAGR of 18.9% during the forecast period. Major players' increased adoption of cloud-based tokenization solutions and services and the introduction of cloud-based solutions will motivate industry growth over the study period. Removing sensitive information from an organization's data environments diminishes its risk and compliance scope even further.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Furthermore, by using the format-based length tokens as the placeholders for the original ones, sensitive data. Further, in October 2021, American Express and Goldman Sachs Transaction Banking (TxB) formed a partnership to provide its clients with the cloud-borne payments services that will assist the multiple payment terminals while also providing data and analytics in a single integrated platform.

TxB platform combines American Express's deep prepaid debit expertise and straightforward buying and selling to form strong digital treasury services for large enterprises. Thus, the collaboration among the major players for launching cloud-based solutions to secure organizations' data and payment modes is driving the tokenization market growth during the forecast period.

Industry Dynamics

Growth Drivers

Partnerships, collaborations, and mergers and acquisitions are among the major players in making safe payments, expansion of location, and investment. For instance, in December 2021, Mastercard and Google announced the introduction of tokenization, which will allow Google Pay users to transact using their Mastercard card payments securely. This allows Mastercard account holders to make payments using a secure digital token without being forced to share their credit or debit card details with a vendor, such as card information and expiry date.

In January 2022, Tokeny, a tokenization system based in Luxembourg, formed a partnership with Inveniam Capital Partners. Inveniam, Apex, and K20 Fund invested €5 million in the collaboration. This information underpins private market digital assets, providing them with integrity and allowing market participants to establish price discovery. The advantage for asset owners and managers is a more liquid asset that can unlock value.

Further, in June 2021, CyberRes, a Micro Focus division, announced the integration of Voltage SecureData with Amazon Macie. This new and different integration enables Amazon Web Services, Inc. (AWS) buyers to optimize data security onto data discovery, categorization, and low risk with effective safeguard and data privacy regulations. In September 2021, With the acquisition of CipherTrace, Mastercard will expand its capabilities underground into the field of digital assets.

To ensure that the crypto economy is ingrained with the same confidence and peace of mind that consumers experience today with more traditional payment methods, new technologies will necessitate new solutions and more potent intelligence. Thus, the strategies adopted by the major players across the globe, such as partnerships and collaborations, are driving the tokenization market growth during the forecast period.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, application, tokenization technique, vertical, and region.

|

By Component |

By Application |

By Tokenization Technique |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Vertical

Based on the vertical segment, the banking, financial services, and Insurance (BFSI) segment is expected to be the most significant revenue contributor. It shows many financial transactions, making them appealing targets for hacker attacks.

The financial services industry is constantly searching for advanced payment security to protect its workers, customers, assets, offices, branches, and operational processes from addressing this issue. As a result, the vertical accounts for a sizable portion of the tokenization market.

Geographic Overview

North America had the largest revenue share. The region's market is highly regulated with the existence of rules like the CCPA; cyberattack cases, with respect to payment frauds across numerous industries, are expected to drive demand for these solutions and services. People in the region are more attracted by the contact-less payment options with digital credit cards, flexible payment options, and robust payment infrastructure, inducing the industry growth.

Moreover, Asia Pacific is expected to witness a high CAGR over the forecast period. Due to the strong, widespread adoption of these solutions, the demand is anticipated to witness the fastest market. Japan and China, two of the region's most advanced nations, are indisputable market leaders in tokenization.

As a consequence of enhanced technological innovations, rising internet and popularity of mobile, and the growing presence of many organizations, Asia Pacific economies are experiencing exponential urbanization in payment innovation, particularly in eCommerce. Consumers in the region use various payment methods for online transactions both within and outside their home countries. As a result, Asia Pacific businesses see increased demand for secure payment methods.

Competitive Insight

Some of the major players operating in the global market include American Express, Cardconnect, Entrust, FIS, Fiserv, Futurex, Helpsystems, Lookout, Mastercard, Meawallet, Micro Focus, Thales, Tokenex, Verifone, and Visa.

Tokenization Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.56 Billion |

|

Revenue forecast in 2030 |

USD 10.75 Billion |

|

CAGR |

18.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Application, By Tokenization Technique, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

American Express, Cardconnect, Entrust, FIS, Fiserv, Futurex, Helpsystems, Lookout, Mastercard, Meawallet, Micro Focus, Thales, Tokenex, Verifone, and Visa |