U.S. Antibiotics Market Size, Share, Trends, Industry Analysis Report

By Drug Class (Cephalosporin, Penicillin, Fluoroquinolone, Macrolides, Carbapenems, Aminoglycosides, Sulfonamides, 7-ACA, Others), By Type, By Action Mechanism – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6145

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

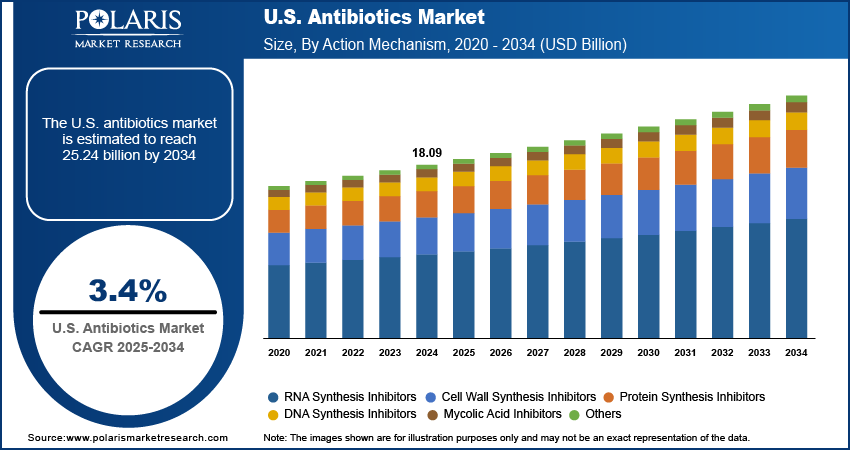

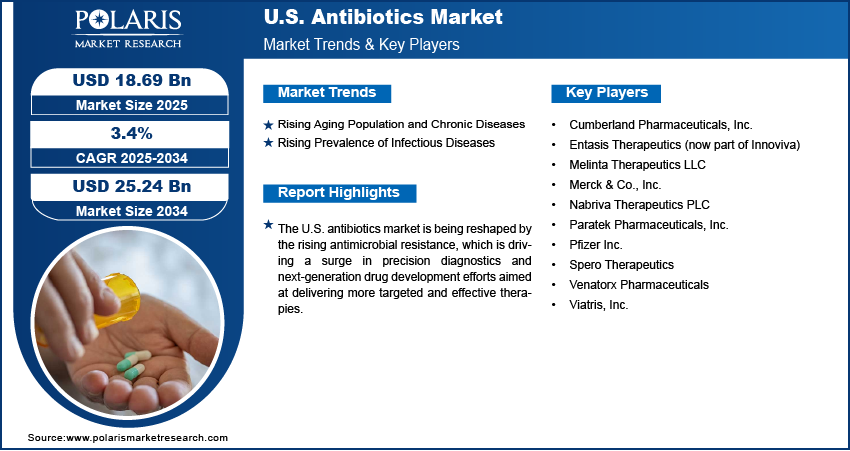

The U.S. antibiotics market size was valued at USD 18.09 billion in 2024, growing at a CAGR of 3.4% from 2025 to 2034. Key factors driving demand for antibiotics in the U.S. include increasing surgical/medical procedures, a growing aging population prone to chronic conditions, and rising cases of infectious diseases. These trends collectively increase needs for treatment, prevention, and innovative solutions across the healthcare system.

Key Insights

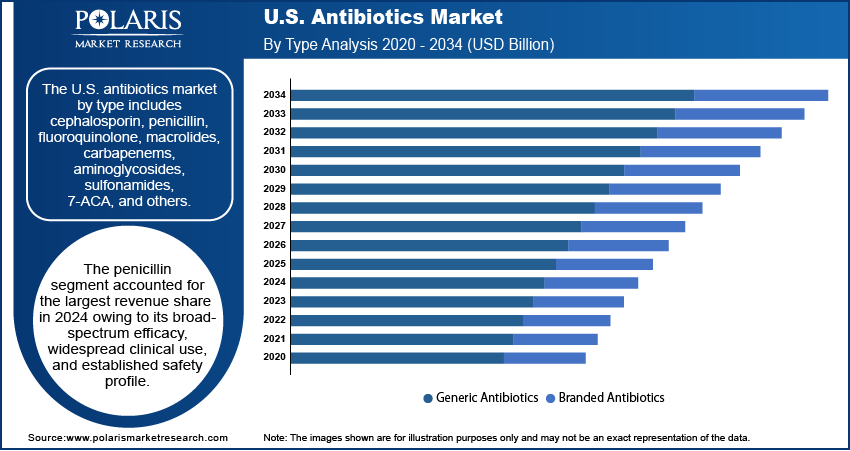

- The penicillin segment accounted for the largest revenue share in 2024 owing to its broad-spectrum efficacy, widespread clinical use, and established safety profile.

- The generic antibiotics segment dominated the revenue share in 2024, driven by increasing cost-containment efforts within the U.S. healthcare system and growing demand for affordable treatment options.

- The RNA synthesis inhibitors segment is expected to witness the fastest growth during the forecast period, driven by the increasing focus on combating resistant bacterial strains and the need for novel antimicrobial targets.

Industry Dynamics

- Aging population and rising number of people affected by chronic diseases have weak immunity, which increases bacterial infection risks, driving antibiotic demand.

- Surging cases of infectious diseases such as respiratory, urinary, skin, and bloodstream boost the need for effective antibiotics across all age groups.

- Rising antibiotic resistance reduces drug effectiveness, requiring costly R&D for new treatments while older antibiotics lose efficacy.

- Growing demand for novel antibiotics and government funding (such as the PASTEUR Act) creates potential for innovative therapies and market expansion.

Market Statistics

- 2024 Market Size: USD 18.09 Billion

- 2034 Projected Market Size: USD 25.24 Billion

- CAGR (2025–2034): 3.4%

To Understand More About this Research: Request a Free Sample Report

Antibiotics are pharmaceutical agents used to prevent and treat bacterial infections by inhibiting the growth or destroying harmful bacteria in the body. In the U.S., the demand for antibiotics is driven by the rising volume of surgical and advanced medical procedures, such as organ transplantation, cancer treatments, and complex orthopedic surgeries. According to a January 2024 U.S. HHS report, the number of organ transplants increased to over 46,000 procedures in 2023, marking an 8.7% rise from 2022 and a 12.7% increase compared to 2021. This growth reflects advancements in transplant medicine and the expansion of healthcare capacity. These medical interventions often require prophylactic or therapeutic antibiotic support to prevent postoperative infections and complications. The necessity for reliable and effective antibiotic regimens continues to grow as surgical procedures become more complex and prevalent, driven by an aging population and an increasing chronic disease burden, thereby fueling overall demand.

Drivers and Opportunities

Rising Aging Population and Chronic Diseases: The rising aging population and the increasing prevalence of chronic diseases are driving the U.S. antibiotics market opportunities. Older adults and individuals suffering from chronic conditions are more susceptible to bacterial infections due to weakened immune responses. According to a July 2025 CDC report, 194 million U.S. adults (76.4%) had at least one chronic condition in 2023, including 93.0% older adults. Conditions such as diabetes, cardiovascular disease, and respiratory disorders often require recurrent hospital visits or long-term care, increasing the risk of infections that necessitate antibiotic intervention. Furthermore, the elderly frequently undergo medical procedures or are prescribed immunosuppressive treatments, further increasing their vulnerability to infection. As a result, this demographic shift is contributing to a sustained demand for effective and targeted antibiotic therapies.

Rising Prevalence of Infectious Diseases: The rising prevalence of infectious diseases across the U.S. is boosting the need for antibiotic treatments. Bacterial infections affecting the respiratory tract, urinary system, skin, and bloodstream continue to pose serious health challenges across various age groups. In July 2025, the CDC reported 1,309 measles cases in the U.S., reflecting an increasing need for antibiotics. Factors such as urbanization, increased population density, and antimicrobial resistance are boosting the spread and complexity of infectious diseases. This persistent burden has highlighted the need for timely diagnosis and effective antibiotic regimens, thereby reinforcing the crucial role of antibiotics in maintaining public health and driving market growth.

Segmental Insights

Drug Class Analysis

Based on drug class, the U.S. antibiotics market is segmented into cephalosporin, penicillin, fluoroquinolone, macrolides, carbapenems, aminoglycosides, sulfonamides, 7-ACA, and others. The penicillin segment accounted for the largest revenue share in 2024 owing to its broad-spectrum efficacy, widespread clinical use, and established safety profile. Penicillin has remained a cornerstone in the treatment of a wide range of bacterial infections, particularly in primary care environments. Its high prescription volume is driven by its affordability, low toxicity, and effectiveness against common pathogens. Moreover, the continued preference for penicillin in treating respiratory tract infections, skin infections, and certain sexually transmitted diseases has solidified its dominant market position. Its well-understood pharmacological profile and accessibility further contribute to its high adoption across healthcare facilities nationwide.

Type Analysis

In terms of type, the segmentation includes branded antibiotics and generic antibiotics. The generic antibiotics segment dominated the revenue share in 2024, driven by increasing cost-containment efforts within the U.S. healthcare system and growing demand for affordable treatment options. The expiration of patents for several branded antibiotics has enabled the introduction of cost-effective generics, promoting wider patient access without compromising therapeutic efficacy. Hospitals and outpatient clinics have increasingly adopted generic formulations to manage budgets while maintaining quality care. Additionally, government and insurance policies that favor the use of generics have accelerated their growth, making them the preferred choice among both providers and consumers in the antibiotics sector.

Action Mechanism Analysis

The U.S. antibiotics market segmentation, based on action mechanism, includes cell wall synthesis inhibitors, protein synthesis inhibitors, DNA synthesis inhibitors, RNA synthesis inhibitors, mycolic acid inhibitors, and others. The RNA synthesis inhibitors segment is expected to witness the fastest growth during the forecast period, driven by the increasing focus on combating resistant bacterial strains and the need for novel antimicrobial targets. These antibiotics interfere with bacterial transcription processes, providing an alternative approach to treating infections that are no longer responsive to traditional cell wall or protein synthesis inhibitors. RNA synthesis inhibitors are gaining momentum with increasing awareness and clinical emphasis on developing next-generation antibiotics to address antimicrobial resistance. Their potential to treat persistent and complex infections, coupled with ongoing research and innovation in this class, positions them as a promising growth area in the evolving U.S. antibiotics landscape.

Key Players and Competitive Analysis

The U.S. antibiotics market is shaped by competitive intelligence and strategy, with major players focusing on revenue growth and expansion opportunities amid economic and geopolitical shifts. Emerging antibiotics markets in U.S. present latent revenue opportunities, while developed markets face supply chain disruptions and industry trends such as antimicrobial resistance. Small and medium-sized businesses leverage strategic investments to compete, while larger firms prioritize future development strategies and sustainable value chains. Technological advancements drive innovation, but pricing insights and vendor share research highlight intense competition. Expert insights suggest growth projections depend on addressing latent demand and optimizing product offerings. Regional footprint and competitive positioning remain critical, with business transformation shaping the industry ecosystem. Revenue forecasts indicate steady growth; however, macroeconomic trends and disruptions could impact the total addressable market potential.

A few major companies operating in the U.S. antibiotics market include Cumberland Pharmaceuticals, Inc.; Entasis Therapeutics (now part of Innoviva); Melinta Therapeutics LLC; Merck & Co., Inc.; Nabriva Therapeutics PLC; Paratek Pharmaceuticals, Inc.; Pfizer Inc.; Spero Therapeutics; Venatorx Pharmaceuticals; and Viatris, Inc.

Key Players

- Cumberland Pharmaceuticals, Inc.

- Entasis Therapeutics (now part of Innoviva)

- Melinta Therapeutics LLC

- Merck & Co., Inc.

- Nabriva Therapeutics PLC

- Paratek Pharmaceuticals, Inc.

- Pfizer Inc.

- Spero Therapeutics

- Venatorx Pharmaceuticals

- Viatris, Inc.

U.S. Antibiotics Industry Developments

February 2025: AbbVie announced FDA approval of EMBLAVEO (aztreonam/avibactam), the first IV monobactam/β-lactamase inhibitor antibiotic for adults with resistant Gram-negative cIAI when alternatives are limited. The approval addresses critical antimicrobial resistance challenges, though based on limited clinical data.

U.S. Antibiotics Market Segmentation

By Drug Class Outlook (Revenue, USD Billion, 2020–2034)

- Cephalosporin

- Penicillin

- Fluoroquinolone

- Macrolides

- Carbapenems

- Aminoglycosides

- Sulfonamides

- 7-ACA

- Others

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Branded Antibiotics

- Generic Antibiotics

By Action Mechanism Outlook (Revenue, USD Billion, 2020–2034)

- Cell Wall Synthesis Inhibitors

- Protein Synthesis Inhibitors

- DNA Synthesis Inhibitors

- RNA Synthesis Inhibitors

- Mycolic Acid Inhibitors

- Others

U.S. Antibiotics Segment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 18.09 Billion |

|

Market Size in 2025 |

USD 18.69 Billion |

|

Revenue Forecast by 2034 |

USD 25.24 Billion |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 18.09 billion in 2024 and is projected to grow to USD 25.24 billion by 2034.

The market is projected to register a CAGR of 3.4% during the forecast period.

A few of the key players in the market are Cumberland Pharmaceuticals, Inc.; Entasis Therapeutics (now part of Innoviva); Melinta Therapeutics LLC; Merck & Co., Inc.; Nabriva Therapeutics PLC; Paratek Pharmaceuticals, Inc.; Pfizer Inc.; Spero Therapeutics; Venatorx Pharmaceuticals; and Viatris, Inc.

The penicillin segment accounted for the largest revenue share in 2024.

The RNA synthesis inhibitors segment is expected to witness fastest growth during the forecast period.