U.S. ATP Assays Market Size, Share, Trends, Industry Analysis Report

By Type [Luminometric ATP Assays, Enzymatic ATP Assays, Bioluminescence Resonance Energy Transfer (BRET) ATP Assays, Cell-based ATP Assays, Others], By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6131

- Base Year: 2024

- Historical Data: 2020-2023

Overview

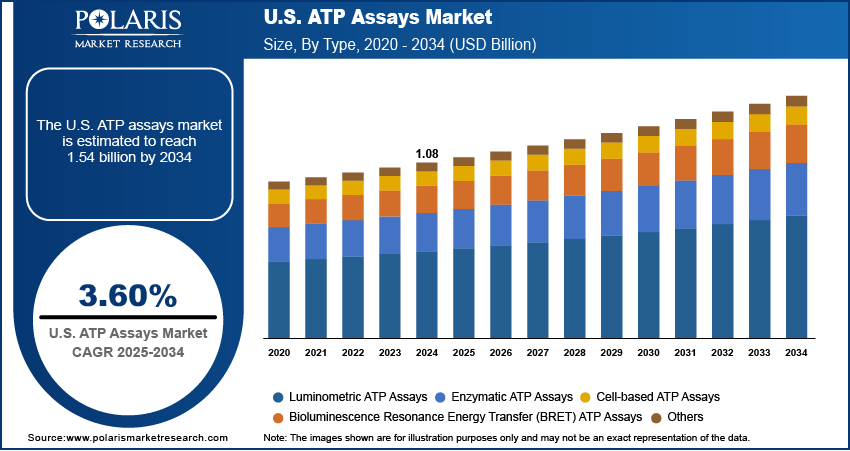

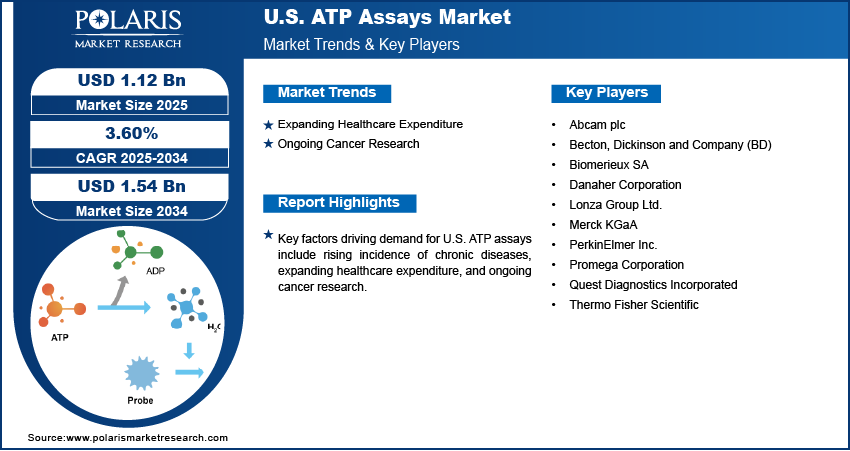

The U.S. ATP assays market size was valued at USD 1.08 billion in 2024, growing at a CAGR of 3.60% from 2025 to 2034. Key factors driving demand for U.S. ATP assays include the rising prevalence of chronic diseases, expanding healthcare expenditure, and ongoing cancer research.

Key Insights

- The luminometric ATP assays segment held the largest market share in 2024 due to its widespread adoption in research and diagnostic applications.

- The cell-based ATP assays segment is projected to grow at a robust pace in the coming years, owing to the rising focus on cell viability.

- The drug discovery and development segment dominated the revenue share in 2024, due to growing emphasis on precision medicine.

- The pharmaceutical and biotechnology companies segment accounted for a major market share in 2024 due to extensive use of adenosine triphosphate (ATP) assays in drug discovery.

Industry Dynamics

- The expansion of healthcare expenditure is fueling the adoption of ATP assays, as these assays are heavily utilized in drug discovery programs.

- The ongoing cancer research in the U.S. is driving the market growth as ATP assays play a key role in screening and validating potential anti-cancer compounds.

- The inability of ATP assays to differentiate between microbial and non-microbial ATP restrains the demand for ATP assays across the U.S.

- The growing focus on food safety and quality testing is projected to create a lucrative U.S. ATP assays market opportunity during the forecast period.

Market Statistics

- 2024 Market Size: USD 1.08 Billion

- 2034 Projected Market Size: USD 1.54 Billion

- CAGR (2025–2034): 3.60%

To Understand More About this Research: Request a Free Sample Report

ATP (adenosine triphosphate) assays are biochemical tests used to measure the presence and amount of ATP, the primary energy carrier in all living organisms. These assays detect ATP as a marker of metabolic activity, cell viability, or microbial contamination. The most common method involves bioluminescence, where the luciferase enzyme reacts with ATP to emit light, and the light intensity directly correlates with ATP concentration. Researchers and technicians use ATP assays across various applications, including drug discovery, environmental monitoring, food safety, and clinical diagnostics. In drug development, these assays evaluate the cytotoxicity or proliferation of cells, helping in screening potential therapeutics. ATP assays support the detection of infectious agents and evaluate treatment efficacy in healthcare and diagnostic settings. Industries such as food processing and water treatment are also using these assays to help monitor cleanliness and detect microbial contamination rapidly and accurately.

The U.S. ATP market is driven by the expansion of the biotechnology and pharmaceutical sectors, growing demand for cell-based research, and increasing adoption of rapid diagnostic tools. Pharmaceutical and biotech companies in the U.S. widely use ATP assays for drug screening, cytotoxicity testing, and cell proliferation studies, which are critical in accelerating drug discovery pipelines. Clinical laboratories and hospitals in the U.S. increasingly rely on ATP-based diagnostics for infectious disease detection and monitoring treatment responses. Technological advancements such as high-throughput screening platforms and automated ATP assay kits have improved efficiency and accuracy, appealing to both academic and commercial users. Moreover, the growing focus on personalized medicine is fueling demand for ATP-based diagnostics in the U.S.

The U.S. ATP assays market demand is driven by the rising incidence of chronic diseases. According to the Centers for Disease Control and Prevention (CDC), as of February 2024, an estimated 129 million people in the U.S. have at least one major chronic disease. This is propelling researchers and clinicians in the country to rely on ATP assays to measure cellular viability, proliferation, and metabolic activity, which are key indicators of chronic disease progression and treatment efficacy. Moreover, the growing incidence of chronic diseases in the U.S. is encouraging pharmaceutical companies to use these assays in drug discovery. Therefore, the expanding prevalence of chronic conditions is fueling the adoption of ATP-based testing in both research and clinical settings in the U.S.

Drivers & Opportunities

Expanding Healthcare Expenditure: Governments and private healthcare providers in the U.S. are allocating larger budgets to improve patient outcomes, which is driving the adoption of sensitive and efficient assay technologies such as ATP assays. Increasing funding is also supporting pharmaceutical and biotechnology companies in conducting large-scale drug discovery programs, where ATP assays play a crucial role in evaluating the efficacy and cytotoxicity of compounds. According to the American Medical Association, health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion. Academic and research institutions are further benefiting from enhanced research grants, which are allowing them to explore innovative applications of ATP assays in molecular biology, toxicology, and regenerative medicine. Thus, the expanding healthcare expenditure in the U.S. is fueling market growth.

Ongoing Cancer Research: Research institutions and pharmaceutical companies in the U.S. are expanding their efforts to discover novel cancer therapies, where ATP assays play a key role in screening and validating potential anti-cancer compounds. These assays enable researchers to quickly determine the metabolic activity of cancer cells and assess their response to various treatments, including chemotherapy and targeted therapies. Moreover, oncology research in the country is increasingly adopting ATP-based bioluminescent assays due to their sensitivity, speed, and compatibility with automated platforms. Therefore, the ongoing cancer research is fueling the U.S. ATP assays market revenue.

Segmental Insights

Type Analysis

Based on type, the segmentation includes luminometric ATP assays, enzymatic ATP assays, bioluminescence resonance energy transfer (BRET) ATP assays, cell-based ATP assays, and others. The luminometric ATP assays segment held the largest U.S. ATP assays market share in 2024 due to its high sensitivity, rapid results, and widespread adoption in research and diagnostic applications. The versatility of luminometric ATP assays in detecting ATP levels across various fields, including microbiology, oncology, and drug discovery, contributed to their high demand. Laboratories and pharmaceutical companies preferred luminometric assays as they provided reliable, quantitative data with minimal sample preparation, making them ideal for high-throughput screening. Additionally, advancements in luminescence detection technologies and the increasing demand for accurate ATP quantification in clinical diagnostics further fueled the segment’s growth.

The cell-based ATP assays segment is projected to grow at a robust pace in the coming years, owing to the rising focus on cell viability and cytotoxicity studies in drug development and cancer research. Researchers increasingly rely on cell-based assays to evaluate metabolic activity and screen potential therapeutics, as these assays closely mimic physiological conditions. The growing emphasis on personalized medicine and the need for robust preclinical testing methods are also contributing to the segment’s expansion. Furthermore, innovations in 3D cell culture are projected to enhance the relevance of cell-based ATP assays, positioning them as a critical tool for future biomedical applications.

Application Analysis

In terms of application, the segmentation includes drug discovery and development, clinical diagnostics, environmental testing, food safety and quality testing, and others. The drug discovery and development segment dominated the revenue share in 2024, due to increasing demand for high-throughput screening and the growing emphasis on precision medicine. Pharmaceutical and biotechnology companies extensively used ATP assays to assess cell viability, monitor drug efficacy, and identify potential cytotoxic effects during preclinical research. The rising number of oncology and infectious disease studies further accelerated adoption, as ATP quantification provided a reliable measure of metabolic activity in target cells. Additionally, advancements in automated assay systems streamlined workflows, making these assays crucial in fueling drug development.

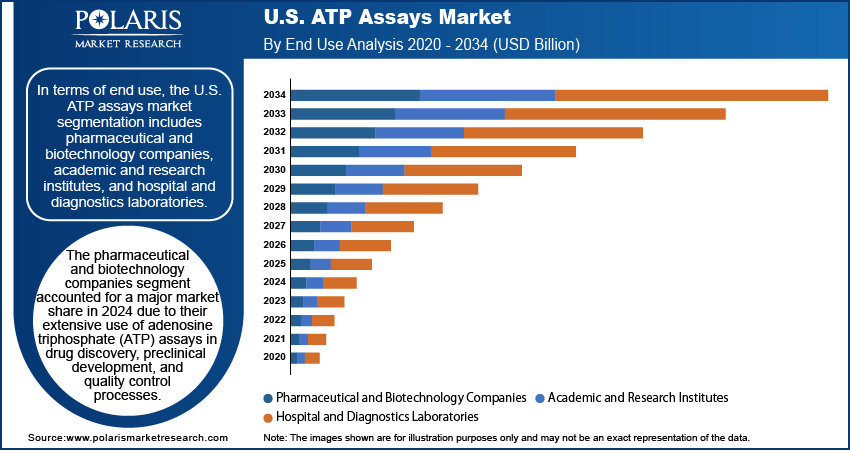

End Use Analysis

In terms of end use, the U.S. ATP assays market segmentation includes pharmaceutical and biotechnology companies, academic and research institutes, and hospital and diagnostics laboratories. The pharmaceutical and biotechnology companies segment accounted for a major market share in 2024 due to their extensive use of adenosine triphosphate (ATP) assays in drug discovery, preclinical development, and quality control processes. These companies rely on ATP-based bioluminescence assays to measure cell viability, cytotoxicity, and microbial contamination during various stages of research and production. The increasing number of drug pipelines, growing focus on biologics, and rising demand for high-throughput screening technologies have further fueled the adoption of ATP assay technologies in the segment. Additionally, the strong presence of major pharmaceutical firms and biotech startups in the U.S. has created an ecosystem that continuously invests in advanced assay technologies to accelerate innovation and improve R&D efficiency.

The hospital and diagnostics laboratories segment is expected to grow at a rapid pace during the forecast period, owing to the rising demand for rapid and accurate diagnostic tools, particularly in infectious disease detection and cancer screening. These facilities are increasingly utilizing ATP assays to detect microbial contamination in clinical samples and monitor the efficacy of sterilization. The growing emphasis on early disease detection, combined with advancements in point-of-care testing solutions, has significantly increased the adoption of assays in hospital settings. Furthermore, the shift toward value-based healthcare and increasing investments in diagnostic infrastructure across the U.S. continue to support the expanding role of ATP assays in hospital and diagnostic laboratories.

Key Players and Competitive Analysis

The U.S. ATP assays market is highly competitive, driven by the increasing demand for rapid microbial detection in pharmaceuticals, healthcare, food safety, and environmental monitoring. Key players, including Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, and Lonza Group Ltd., dominate the market, leveraging their extensive product portfolios, advanced technologies, and strong distribution networks. Danaher’s Hach division specializes in water quality testing, offering ATP assays for environmental and industrial applications. Merck KGaA, on the other hand, provides high-sensitivity assays for pharmaceutical and biotechnology research. Lonza Group is a key competitor in cell viability and contamination testing, particularly in the biopharmaceutical manufacturing sector.

The competitive landscape is intensified by technological advancements, including portable ATP detection devices and automation-integrated systems. Companies are investing in AI-driven analytics, cloud-based data management, and faster detection methods to differentiate themselves. Price competition is another critical factor, particularly in cost-sensitive segments such as food safety and water testing. Regulatory compliance also plays a significant role, as companies must ensure their assays meet stringent quality requirements.

A few major companies operating in the U.S. ATP assays market include Abcam plc; Becton, Dickinson and Company (BD); Biomerieux SA; Merck KGaA; Lonza Group Ltd.; PerkinElmer Inc.; Promega Corporation; Quest Diagnostics Incorporated; and Thermo Fisher Scientific.

Key Players

- Abcam Limited

- Becton, Dickinson and Company (BD)

- Biomerieux SA

- Biotium

- Lonza Group Ltd.

- Merck KGaA

- PerkinElmer Inc.

- Promega Corporation

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific

U.S. ATP Assays Industry Development

March 2025: Biotium, a provider of innovative fluorescent reagents and kits for life science research in the U.S., announced the release of the Steady-ATP HTS Viability Assay Kit for assessing cell proliferation.

U.S. ATP Assays Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Luminometric ATP Assays

- Enzymatic ATP Assays

- Bioluminescence Resonance Energy Transfer (BRET) ATP Assays

- Cell-based ATP Assays

- Others

By Application Mode Outlook (Revenue, USD Billion, 2020–2034)

- Drug Discovery and Development

- Clinical Diagnostics

- Environmental Testing

- Food Safety and Quality Testing

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Hospital and Diagnostics Laboratories

U.S. ATP Assays Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.08 Billion |

|

Market Size in 2025 |

USD 1.12 Billion |

|

Revenue Forecast by 2034 |

USD 1.54 Billion |

|

CAGR |

3.60% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.08 billion in 2024 and is projected to grow to USD 1.54 billion by 2034.

The market is projected to register a CAGR of 3.60% during the forecast period.

A few of the key players in the market are Abcam plc; Becton, Dickinson and Company (BD); Biomerieux SA; Danaher Corporation; Merck KGaA; Lonza Group Ltd.; PerkinElmer Inc.; Promega Corporation; Quest Diagnostics Incorporated; and Thermo Fisher Scientific.

The luminometric ATP assays segment dominated the market share in 2024.

The hospital and diagnostics laboratories segment is expected to witness the fastest growth during the forecast period.