U.S. Chemical Vapor Deposition Market Share, Size, Trends, Industry Analysis Report

By Category (CVD Services, CVD Equipment, CVD Materials); By End-use; By Technology; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM4974

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

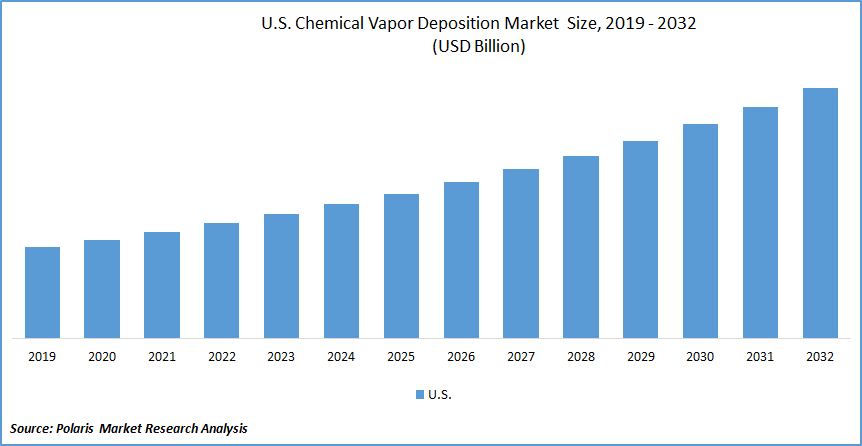

U.S. Chemical Vapor Deposition Market size was valued at USD 4.29 billion in 2023. The market is anticipated to grow from USD 4.63 billion in 2024 to USD 8.65 billion by 2032, exhibiting the CAGR of 8.1% during the forecast period.

U.S. Chemical Vapor Deposition Market Market Overview

The growing adoption of solar panels, data storage, cutting tools, and microelectronics is highly influencing the growth of the chemical vapor deposition market in the United States. The growing demand for high-performing electronic tools and small-size semiconductors is significantly driving technological advancements in the chemical vapor deposition market. Government agencies and major market players are increasing their investments in electronic materials development with a growing demand for semiconductors in the marketplace.

To Understand More About this Research:Request a Free Sample Report

- For instance, in October 2023, the U.S. Department of Energy announced an investment of USD 10 million in three new technologies to develop high-performance, efficient conducting tapes in the country. The study aimed to integrate new metal-organic chemical vapor deposition into the development of superconducting tapes.

However, the higher initial cost of investment and changing industrial needs are driving the importance of research and development activities in the chemical vapor deposition market. Due to the lower availability of funds, this significantly eliminates the small players. As this pertains further, there will be a significant obstruction to market growth.

Growth Drivers

Rising Production of Synthetic Diamonds

The cost-effectiveness of synthetic diamonds is gaining attention from consumers, including those in the United States. According to Carat, a jewelry brand, lab-grown diamonds are expected to account for 75% of the overall diamonds by 2050. This is fueling the need for chemical and electrical components that are utilized in the synthetic diamonds in the market.

Additionally, chemical vapor deposition is employed in coating cutting tools with a view to protecting equipment from corrosion and wear. This produces a higher thickness, density, and quality of rigid coating on the tools at high temperatures. The growing drilling, grinding, and milling are significantly boosting the need for coating materials, driving the demand for chemical vapor deposition in the United States.

Increasing Demand for Microelectronics

The United States is a developed country with established market players, advanced infrastructure, and a higher-income population. This is encouraging companies to innovate new entertainment and human assistance electronic tools with changing consumer preferences, significantly driving research activities on electrical components, particularly on chemical vapor deposition in the marketplace.

- According to the Consumer Technology Association at the Consumer Electronics Show 2024, the U.S. consumer technology industry is expected to grow by 2.8% in 2024 and reach USD 512 billion.

Restraining Factors

The Availability of Effective Alternatives is Likely to Impede Market Growth

The growth of the chemical vapor deposition (CVD) market is anticipated to face challenges due to increasing consumer interest in sustainable products and the emergence of alternative deposition technologies. As environmental concerns rise, consumers and industries are prioritizing eco-friendly solutions, leading to a preference for sustainable and less chemically intensive processes. Alternative deposition methods, such as spray pyrolysis and physical vapor deposition (PVD), are gaining traction due to their effectiveness and lower environmental impact.

These technologies offer competitive advantages, including cost efficiency, reduced energy consumption, and versatility in applications, which make them appealing substitutes for CVD. Consequently, the adoption of these alternatives is expected to impede the growth of the CVD market in the coming years. The shift towards more sustainable and efficient deposition technologies highlights the need for the CVD industry to innovate and adapt in order to maintain its market position amidst changing consumer preferences and technological advancements.

Report Segmentation

The market is primarily segmented based on category, end-use, technology, and region.

|

By Category |

By End-use |

By Technology |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Category Analysis

The CVD Equipment Segment is Expected to Witness the Highest Growth During the Fforecast Period

The chemical vapor deposition equipment segment will grow rapidly over the study period, owing to its capability to combine electronic materials and produce high-performing resins in the vacuum. It provides greater convenience to manufacturers engaged in producing electronic raw materials, driven by its ability to produce larger amounts of resins for longer durations.

The CVD services segment led the market with a substantial revenue share in 2023, largely attributable to its ability to offer adaptability and flexibility. Most companies use chemical vapor deposition services, as they are more often required to transpose other materials into thin resins. The zero cost of repair and maintenance of CVD equipment is further boosting the demand for CVD services in the United States.

By Technology Analysis

The Atomic Layer CVD Segment Accounted for the Largest Market share in 2023

The atomic layer CVD segment held the largest share in 2023 and is expected to maintain its dominance over the study period. This is due to its utilization in data storage, solar products, medical equipment, and microelectronics, driven by a lower temperature requirement, resin uniformity, and superior adhesive properties. Furthermore, the ability to produce customized thin films is boosting its demand in chip manufacturing activities.

By End-use Analysis

The Microelectronics Segment held a Significant Market Revenue share in 2023

The microelectronics segment held a significant revenue share in 2023, which was accelerated by the continuous rise in semiconductor adoption in defense and aerospace tools. The increasing demand for high connectivity and electrical conductivity devices by consumers in the United States is optimally influencing the growth of the chemical vapor deposition market.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The U.S. chemical vapor deposition market is consolidated. Key players are focused on developing newer technologies with high turnaround time and efficiency to meet changing end-use requirements. This phenomenon is also in the testing phases for several other applications. For instance, in November 2023, Samco Inc. introduced a new research center to meet the increasing demand for semiconductor equipment.

Some of the major players operating in the market include:

- Adeka Corporation

- Aixtron

- Angstrom Engineering Inc

- Applied Materials, Inc.

- CVD Equipment Corporation

- Denton Vacuum

- Lam Research Corporation

- Plasma-Therm LLC

- SAMCO

- Veeco Instruments Inc.

Recent Developments in the Industry

- In September 2023, researchers conducted a review on the use of transferred chemical vapor deposition technology on graphene in the production of nitride epitaxy and its challenges in the manufacturing of semiconductors.

- In September 2023, a study published in Energy Nexus Journal focused on reviewing the recent developments in the production of vanadium dioxide materials by using chemical vapor deposition technology.

Report Coverage

The U.S. chemical vapor deposition market report emphasizes key regions across the globe to understand the product for users better. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, category, technology, end-use, and futuristic growth opportunities.

U.S. Chemical Vapor Deposition Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.63 billion |

|

Revenue Forecast in 2032 |

USD 8.65 billion |

|

CAGR |

8.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The key companies in U.S. Chemical Vapor Deposition Market are Adeka Corporation, Aixtron, Angstrom Engineering, Applied Materials, CVD Equipment Corporation

U.S. Chemical Vapor Deposition Market exhibiting the CAGR of 8.1% during the forecast period

U.S. Chemical Vapor Deposition Market report covering key segments are category, end-use, technology, and region

The key driving factors in U.S. Chemical Vapor Deposition Market are Rising production of synthetic diamonds

U.S. Chemical Vapor Deposition Market Size Worth $ 8.65 Billion By 2032