U.S. Hospitality Mattress Market Size, Share, Trends, Industry Analysis Report

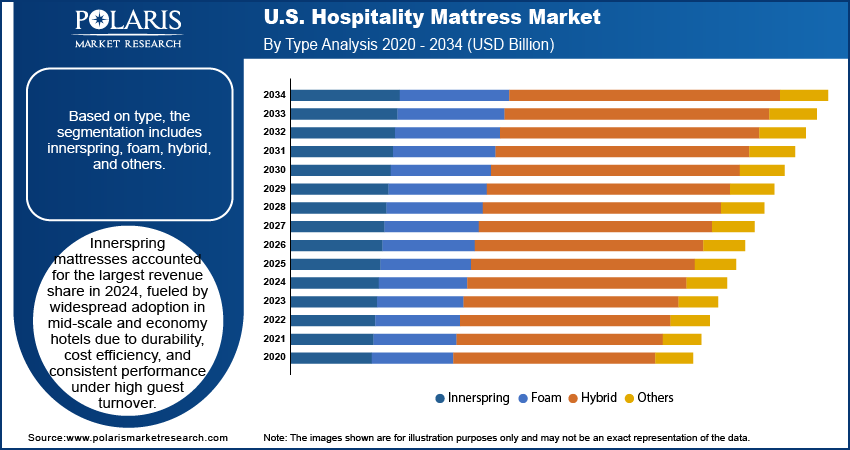

By Type (Innerspring, Foam, Hybrid, and Others), By Size, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6228

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The U.S. hospitality mattress market size was valued at USD 1.87 billion in 2024, growing at a CAGR of 4.97% from 2025 to 2034. Key factors driving demand for U.S. Hospitality Mattress include urbanization and infrastructure development coupled with government incentives and tourism infrastructure investments accelerating market expansion.

Key Insights

- The innerspring mattresses segment held the highest share in 2024, fueled by growing adoption in mid-scale and economy hotels, owing to durability, cost efficiency, and reliable performance under high guest turnover.

- The queen-size mattresses segment accounted for the largest market share in 2024, driven by an optimal balance of comfort, versatility, and cost-effectiveness, catering to a broad range of room categories in mid-scale and upscale properties.

Industry Dynamics

- Shift toward sustainable and eco-friendly hospitality solutions is fueling market growth as U.S. hotels increasingly adopt mattresses made from organic, recyclable, and low-emission materials to meet ESG goals.

- A strong tourism and business travel ecosystem is increasing the demand, with rising occupancy rates pushing hotels to invest in premium, durable mattresses that enhance guest comfort and brand reputation.

- Mattresses featuring air or foam chamber systems is creating lucrative opportunities for the market during the forecast period.

- The high initial investment costs of advanced hospitality mattresses are expected to hinder market growth, among budget and mid-scale hotel chains.

Market Statistics

- 2024 Market Size: USD 1.87 Billion

- 2034 Projected Market Size: USD 3.03 Billion

- CAGR (2025–2034): 4.97%

The U.S. hospitality mattress market represents a crucial segment within the national hospitality infrastructure, delivering specialized bedding solutions tailored to meet stringent comfort, durability, and hygiene standards required by hotels, resorts, and other accommodation providers. Product offerings span a wide range of constructions, including innerspring, flexible foam, latex, and hybrid designs, each engineered to enhance guest satisfaction and support brand positioning in an increasingly competitive lodging environment.

Rising discretionary income, coupled with favorable economic indicators and low unemployment rates, is fueling travel activity across the U.S. Higher hotel occupancy rates are propelling hospitality operators to invest in premium, durable, and guest-centric mattress designs that meet with evolving guest expectations for comfort and quality. These upgraded bedding solutions enhance sleep quality contributing to improved guest satisfaction scores, repeat bookings, and brand loyalty, making mattress procurement a strategic priority for property owners.

Public sector funding initiatives aimed at expanding tourism hubs, convention centers, cultural districts, and transportation connectivity are creating strong momentum in the hospitality construction pipeline. For instance, in 2023, the federal Travel, Tourism & Outdoor Recreation program allocated USD 750 million in grants, comprising USD 510 million for state grants and USD 240 million for competitive grants. These infrastructure developments are accelerating new hotel openings and fueling large-scale refurbishment projects across key urban, suburban, and resort markets. Therefore, consistent procurement cycles for hospitality mattresses are becoming more common, with strong demand in high-growth regions aiming to strengthen competitiveness as destinations for leisure and business travel.

Shift Toward Sustainable and Eco-Friendly Hospitality Solutions: Growing environmental awareness among travelers is pushing hotels, resorts, and boutique accommodations to adopt sustainable bedding solutions as part of broader operational strategies. This is increasing the demand for mattresses produced from organic fibers, recyclable materials, and low-VOC components, along with products carrying recognized environmental performance and safety certifications. Alignment with sustainability objectives while maintaining durability, comfort, and brand image is enabling eco-friendly mattress technologies to secure a stronger market position, attract environmentally conscious guests, and support compliance with evolving green certification requirements in the hospitality industry.

Strong tourism and business travel ecosystem: The U.S. hospitality mattress market is growing due to the strong tourism and business travel ecosystem that maintains high hotel occupancy levels throughout the year. As per the World Travel & Tourism Council (WTTC) 2024 Economic Impact Trends Report, the U.S. ranked as the world’s most powerful travel and tourism market in 2023, contributing an unprecedented USD 2.36 trillion to the national economy. Leading hotel chains are prioritizing bedding upgrades to strengthen brand loyalty and enhance guest retention, while the ongoing development of urban convention centers, leisure destinations, and corporate travel hubs is accelerating replacement and procurement cycles for hospitality mattresses.

Segmental Insights

Type Analysis

Based on type, the hospitality mattress market is segmented into innerspring, foam, hybrid, and others. Innerspring mattresses accounted for the largest revenue share in 2024, fueled by widespread adoption in mid-scale and economy hotels due to durability, cost efficiency, and consistent performance under high guest turnover. The segment’s dominance is strengthened by ease of maintenance and the ability to withstand frequent use without significant wear, making it a preferred choice for large hotel chains and budget accommodations.

Hybrid mattresses are projected to register the highest growth rate during the forecast period, driven by the combination of robust innerspring support with the comfort layers of foam or latex. This balanced firmness, effective motion isolation, and elevated guest comfort are making the category increasingly appealing for upscale and boutique properties aiming to differentiate through an enhanced sleep experience.

Size Analysis

Based on size, the market is categorized into single, double, queen, and king. Queen-size mattresses held the largest share in 2024, driven by a balance of comfort, versatility, and cost-effectiveness for a wide range of room categories in mid-scale and upscale properties. It offers ample sleeping space for couples while fitting comfortably in standard room layouts, contributing to their popularity among hospitality operators.

King-size mattresses are anticipated to register the fastest growth over the forecast period, fueled by the expansion of luxury and premium hotel segments that prioritize spaciousness and high-end guest experiences. The segment’s momentum is further supported by rising consumer expectations for premium bedding standards in resort and executive suite accommodations.

End Use Analysis

Based on end use, the U.S. hospitality mattress market is divided into hotels & resorts, vacation rentals, hostels, and others. Hotels & resorts represented the largest revenue-generating segment in 2024, fueled by continuous refurbishment cycles, brand-specific bedding standards, and investment in guest comfort as a competitive differentiator. Tourism growth, coupled with increasing occupancy rates in business and leisure travel markets, is further sustaining demand.

Vacation rentals are expected to record the highest CAGR during the forecast period, driven by the rapid growth of platforms such as Airbnb and Vrbo, along with property owners’ rising focus on offering hotel-like comfort to enhance guest satisfaction and reviews. This segment’s growth is also supported by increased penetration of professionally managed short-term rental operators who prioritize high-quality, durable mattresses.

Key Players & Competitive Analysis

The U.S. hospitality mattress market is highly competitive, with leading players such as Serta Simmons Bedding, LLC, Tempur Sealy International, Inc., Sleep Number Corporation (Select Comfort Corp.), and King Koil Licensing Company, Inc. dominating due to strong brand equity, diverse product portfolios, and extensive distribution networks serving hotels, resorts, and other lodging establishments nationwide. Tempur Sealy International, Inc. leads with a broad range of premium and mid-range hospitality mattress solutions, supported by advanced material innovations and strategic partnerships with major U.S. hotel chains. Serta Simmons Bedding, LLC leverages its extensive brand portfolio and large-scale domestic sustainable manufacturing capabilities to cater to luxury and economy hospitality segments. Sleep Number Corporation distinguishes itself through proprietary smart bed technology and adjustable comfort features, increasingly sought after by wellness-oriented hospitality brands. King Koil Licensing Company, Inc. is recognized for design-driven mattresses tailored for high-end boutique hotels and resorts, blending aesthetic appeal with ergonomic performance.

The market is witnessing a rising focus on sustainable and eco-conscious mattress production, influenced by hospitality operators’ ESG commitments and growing guest demand for environmentally responsible accommodations. Manufacturers are investing in sustainable materials such as organic cotton, natural latex, and recyclable foams, alongside the development of hybrid and modular mattress designs that enhance comfort, durability, and operational efficiency. Strategic alliances with hotel groups, co-branding initiatives, and customization of mattress specifications to suit local and brand-specific requirements are key competitive strategies, while market rivalry is intensifying in high-growth tourism states such as Florida, California, and Nevada.

Prominent companies in the U.S. hospitality mattress market include Beloit Mattress Company, Brooklyn Bedding, LLC, Casper Sleep Inc., Comfort Sleep Bedding, Corsicana Mattress Company, Kingsdown, Inc., MLILY USA, Purple Innovation Inc., Restonic Mattress Corporation, Saatva Inc. (Whitestone Home Furnishings, LLC), and Therapedic International.

Key Players

- Beloit Mattress Company

- Brooklyn Bedding, LLC

- Casper Sleep Inc.

- Comfort Sleep Bedding

- Corsicana Mattress Company

- King Koil Licensing Company, Inc.

- Kingsdown, Inc.

- MLILY USA

- Purple Innovation Inc.

- Restonic Mattress Corporation

- Saatva Inc. (Whitestone Home Furnishings, LLC)

- Serta Simmons Bedding, LLC

- Sleep Number Corporation (Select Comfort Corp.)

- Tempur Sealy International, Inc.

- Therapedic International

U.S. Hospitality Mattress Industry Developments

In June 2024, Pottery Barn, a flagship brand under Williams-Sonoma, in collaboration with Westin Hotels & Resorts launched the “Westin for Pottery Barn” collection, blending luxury hospitality aesthetics with home living. The line features high-end bedroom furniture, bedding, and bath accessories, all inspired by Westin’s wellness-centric philosophy.

U.S. Hospitality Mattress Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Innerspring

- Foam

- Hybrid

- Others

By Size Outlook (Revenue, USD Billion, 2020–2034)

- Single

- Double

- Queen

- King

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hotels & Resorts

- Vacation Rentals

- Hostels

- Others

U.S. Hospitality Mattress Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.87 Billion |

|

Market Size in 2025 |

USD 1.96 Billion |

|

Revenue Forecast by 2034 |

USD 3.03 Billion |

|

CAGR |

4.97% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 1.87 billion in 2024 and is projected to grow to USD 3.03 billion by 2034.

The market is projected to register a CAGR of 4.97% during the forecast period.

A few of the key players in the market are Beloit Mattress Company, Brooklyn Bedding, LLC, Casper Sleep Inc., Comfort Sleep Bedding, Corsicana Mattress Company, Kingsdown, Inc., MLILY USA, Purple Innovation Inc., Restonic Mattress Corporation, Saatva Inc. (Whitestone Home Furnishings, LLC), and Therapedic International.

The innerspring mattresses segment dominated the market revenue share in 2024.

The king-size mattresses segment is projected to witness the fastest growth during the forecast period.