U.S. 5G Enterprise Market Size, Share, Trends, & Industry Analysis Report

By Access Equipment (Radio Node, Service Node, DAS), By Core Network Technology, By Services, By Organization Size, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6427

- Base Year: 2024

- Historical Data: 2020-2023

Overview

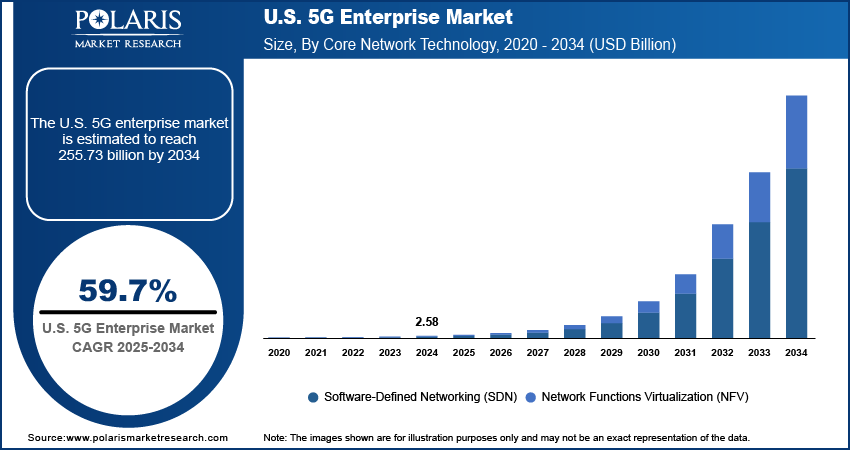

The U.S. 5G enterprise market size was valued at USD 2.58 billion in 2024, growing at a CAGR of 59.7% from 2025–2034. Key factors driving demand include enterprise digital transformation, ultra-reliable low-latency communications (URLLC), rising investment in private 5G networks, and rapid rise of the IoT and smart systems.

Key Insights

- The radio node segment held the largest revenue share in 2024, as it is fundamental for deploying seamless connectivity and enabling diverse enterprise applications.

- The small and medium enterprises segment is anticipated to experience significant growth, fueled by increasing need for scalable, affordable private network solutions.

- The manufacturing sector led the market in 2024, driven by its extensive integration of automation and Industry 4.0 initiatives requiring robust connectivity.

Industry Dynamics

- Growing enterprise investment in private 5G is driven by the demand for enhanced security, customized network control, and optimized data handling within dedicated connectivity infrastructure.

- The expansion of IoT and smart systems is accelerating U.S. 5G adoption, necessitating reliable, high-throughput connectivity for industrial and urban applications.

- High initial deployment costs and infrastructure complexity create significant financial and technical barriers for many enterprises adopting private 5G networks.

- The rapid growth of IoT and industrial automation drives substantial demand for reliable, low-latency 5G solutions tailored to smart factories and logistics.

Market Statistics

- 2024 Market Size: USD 2.58 billion

- 2034 Projected Market Size: USD 255.73 billion

- CAGR (2025-2034): 59.7%

AI Impact on 5G Enterprises Market

- AI dynamically manages traffic and allocates resources in real-time, dramatically improving network efficiency, reducing latency, and ensuring reliability for critical enterprise applications.

- AI analyzes network data to predict and prevent potential failures before they occur, minimizing downtime and enabling automated, self-healing network operations.

- AI continuously monitors network behavior to instantly identify and neutralize cyber threats, providing a more secure zero-trust environment for enterprise data.

- AI processes data locally at the 5G edge, enabling real-time analytics for smart factories and autonomous systems without cloud dependency.

5G enterprise is the application of fifth-generation wireless technology in a business environment to provide high-speed, low-latency service for advanced digital applications. The consistent increase in digital transformation across multiple industries boosts the growth of this market. In addition, an increasing number of companies are adopting 5G to modernize their operations, push cloud platforms, and improve business responsiveness. For example, in June 2025, Nokia partnered with Andorix as an Infrastructure provider to increase private 5G and neutral host network deployments in the U.S. real estate market. It enables real-time data processing for the seamless integration of IoT technology, with automation driving operational efficiencies that serve the demands of digital-first strategies. Furthermore, companies are aiming to enhance end-to-end connectivity, digitized work processes, and automated experiences to achieve their objectives. This shift makes 5G a platform that supports advanced enterprise solutions, helping organizations build operational resilience and boost innovation.

Ultra-reliable low-latency communications (URLLC) capability positions 5G as a transformational technology for mission-critical applications. URLLC enables tools to monitor machines, devices, and infrastructure, ensuring continuous connectivity between endpoints and maintaining extremely low latency while connected, enabling industries such as manufacturing, logistics, and healthcare to adopt applications where reliability and speed are crucial. A dependable, ultra-reliable connection provides the same level of connection as using an autonomous device programmed and being controlled from a remote location, with virtually no downtime. Therefore, URLLC, by providing reliable communication networks, contributes to enterprise efficiency and scalability. Moreover, the transformation that 5G provides for communications is essential to enterprises that want to move towards highly-connected, intelligent ecosystems.

Drivers & Opportunities

Rising Investments in Private 5G Networks: Rising investment in private 5G networks boosts the growth opportunities as enterprises aim to control their connectivity infrastructure, and in some cases, want improved security and customization as well. For instance, in June 2025, Nokia and Andorix collaborated to increase the number of private 5G and neutral host networks in the U.S. real estate market by leveraging improved connectivity and digital infrastructure for smart buildings. A private 5G network enables an enterprise to establish a designated and high-performance system of communication that is tailored for their business operations by the nature of their application, allowing secure zero-trust data usage and secure data handling, as well as optimized bandwidth allocation. In the U.S., industry sectors are shifting towards automation, robotics, and mission-critical applications that require ultra-reliable connectivity, such as manufacturing, energy, and logistics, which are more focused on shorter private 5G alternatives.

Rapid Growth in IoT and Smart Systems: The rapid rise of the IoT and smart systems is increasing the adoption of 5G enterprise solutions in the U.S. Connectivity is needed across platforms and devices that connect and improve business processes. The connected systems require a network capable of handling higher throughput with reliability, whether it's IoT or industrial IoT in a manufacturing plant, or smart infrastructure in a smart city. The market is witnessing increasing growth, as 5G technology allows enterprises to use real-time analytics, predictive maintenance, and intelligent decision-making. In the U.S. market, as 5G technology rises, the integration of IoT and smart technologies is changing how enterprises operate. Moreover, incorporating 5G with IoT and smart technologies is driving digital innovation and ecosystems that boost productivity, automation, and long-term sustainability through competitiveness.

Segmental Insights

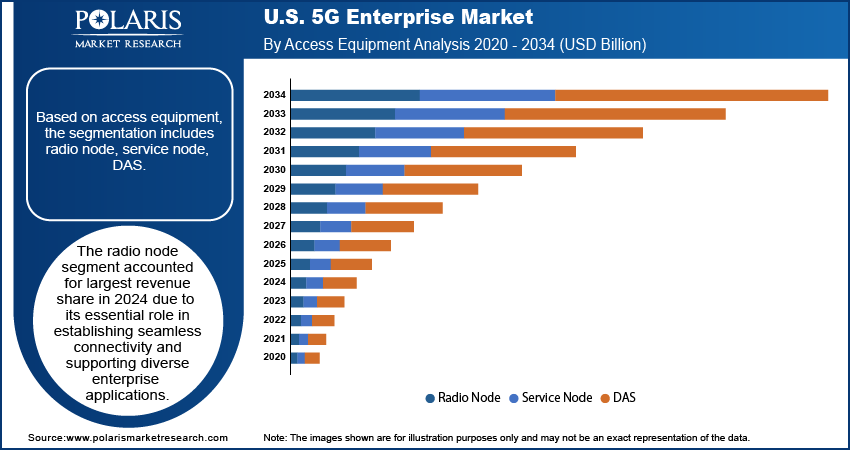

Access Equipment Analysis

Based on product, the segmentation includes radio node, service node, DAS. The radio node segment accounted for largest revenue share in 2024 due to its essential role in establishing seamless connectivity and supporting diverse enterprise applications. In the U.S., enterprises are increasingly adopting radio nodes to ensure flexible, high-capacity coverage that can handle growing data demands. Radio nodes are particularly valuable in supporting applications that require low latency and reliable connections, such as IoT deployments, cloud-based services, and automation systems. Their scalability and ease of integration into existing infrastructure make them a preferred choice for enterprises aiming to accelerate digital transformation.

Organization Size Analysis

Based on organization size, small and medium enterprises and large enterprises. The small and medium enterprises segment is expected to witness significant growth during the forecast period due to the rising demand for cost-effective and scalable connectivity solutions. In the U.S., SMEs are increasingly adopting 5G to modernize operations, enhance competitiveness, and enable digital-first strategies. The flexibility of 5G solutions allows these enterprises to adopt advanced technologies such as cloud computing, IoT, and AI without the need for heavy infrastructure investments. This shift supports improved productivity, efficient resource utilization, and greater customer engagement, positioning SMEs as an important growth contributor to the 5G enterprise landscape.

End Use Analysis

The segmentation, based on end use includes BFSI, media and entertainment, retail and ecommerce, healthcare and life sciences, government and defense, transportation and logistics, manufacturing, agriculture, IT and telecommunication, others. The manufacturing segment dominated the market in 2024 driven by the sector’s rapid adoption of Industry 4.0 technologies. Manufacturing enterprises increasingly rely on 5G-enabled systems to support smart factories, connected machinery, and predictive maintenance solutions that improve efficiency and reduce downtime. The ultra-reliable low-latency capabilities of 5G are critical for automation, robotics, and real-time monitoring of production processes. Therefore, by leveraging advanced connectivity, U.S. manufacturers are able to enhance operational agility, streamline supply chains, and achieve higher levels of productivity, making the sector a leading adopter of 5G enterprise solutions.

Key Players & Competitive Analysis Report

The competitiveness of the U.S. 5G enterprise market is rising with the emergence of telecom companies such as Verizon, AT&T, and T-Mobile, and infrastructure players such as Ericsson and Nokia. Vendor strategies depend on capitalizing on network slicing, private networks, and edge strategy investments in order to take revenue opportunities away from sectors such as logistics and manufacturing. Competitive intelligence and strategy increasingly evidences a focus on small and medium-sized businesses as a high-growth area with latent demand and a bulk of market opportunities. The telecom sector is undergoing a major disruption and trends with the application of AI and Open RAN modeling, which is potentially changing the future of industry ecosystems. Furthermore, building sustainable value chains is essential to success, and pursuing opportunities for expansion through partnerships will be critical to addressing economic and geopolitical volatility impacting deployments.

Major companies operating in the U.S. 5G enterprise industry include Affirmed Networks, Airspan Networks, American Tower, AT&T Inc., Ciena Corporation, Cisco Systems Inc., CommScope, Extreme Networks, Hewlett Packard Enterprise, Juniper Networks, Mavenir, Qualcomm Technologies Inc., T-Mobile, Verizon Communications, and VMware, Inc.

Key Players

- Affirmed Networks

- Airspan Networks

- American Tower

- AT&T Inc.

- Ciena Corporation

- Cisco Systems Inc.

- CommScope

- Extreme Networks

- Hewlett Packard Enterprise (HPE)

- Juniper Networks

- Mavenir

- Qualcomm Technologies Inc.

- T-Mobile

- Verizon Communications

- VMware, Inc.

Industry Developments

- March 2025: Alcatel-Lucent Enterprise, in partnership with Celona, launched a Private 5G solution offering secure, high-performance connectivity for complex enterprise environments, enhancing IoT, Industry 4.0, and mission-critical operations.

- February 2023: Hewlett Packard Enterprise has acquired Athonet aiming to enhancing and broadening its edge-to-cloud and telecommunications portfolios.

U.S. 5G Enterprise Market Segmentation

By Access Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Radio Node

- Service Node

- DAS

By Core Network Technology Outlook (Revenue, USD Billion, 2020–2034)

- Software-Defined Networking (SDN)

- Network Functions Virtualization (NFV)

By Services Outlook (Revenue, USD Billion, 2020–2034)

- Platform

- Software

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Small and Medium Enterprises

- Large Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Media and Entertainment

- Retail and Ecommerce

- Healthcare and Life Sciences

- Government and Defense

- Transportation and Logistics

- Manufacturing

- Agriculture

- IT and Telecommunication

- Others

U.S. 5G Enterprise Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.58 Billion |

|

Market Size in 2025 |

USD 3.78 Billion |

|

Revenue Forecast by 2034 |

USD 255.73 Billion |

|

CAGR |

59.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

|

FAQ's

The market size was valued at USD 2.58 billion in 2024 and is projected to grow to USD 255.73 billion by 2034.• The market size was valued at USD 2.58 billion in 2024 and is projected to grow to USD 255.73 billion by 2034.

The market is projected to register a CAGR of 59.7% during the forecast period.

few of the key players in the market are Affirmed Networks, Airspan Networks, American Tower, AT&T Inc., Ciena Corporation, Cisco Systems Inc., CommScope, Extreme Networks, Hewlett Packard Enterprise, Juniper Networks, Mavenir, Qualcomm Technologies Inc., T-Mobile, Verizon Communications, and VMware, Inc.

The radio node segment accounted for largest revenue share in 2024.

The small and medium enterprises segment is expected to witness significant growth during the forecast period.