Private 5G Network Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software & Services), By Operational Frequency, By Spectrum, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM1718

- Base Year: 2024

- Historical Data: 2020-2023

Overview

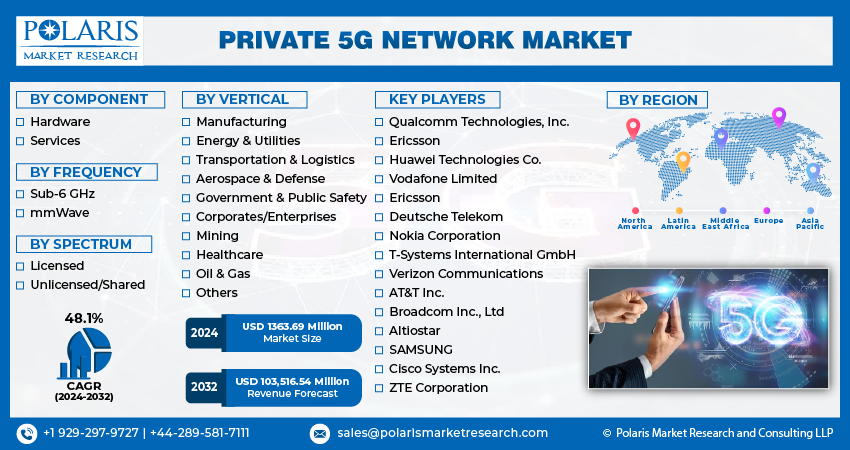

The global private 5G network market size was valued at USD 3.70 billion in 2024, growing at a CAGR of 48.7% from 2025 to 2034. Key factors driving demand include rising focus on industrial automation & Industry 4.0, upsurging collaborations among telecom-cloud provider, increasing adoption of private networks, and government-backed funding.

Key Insights

- The hardware segment dominated with 73.33% revenue share in 2024, driven by essential investments in radios, base stations, and core equipment for private 5G deployments.

- The mmWave segment is expected to register a CAGR of 47.7% during the forecast period, fueled by its ultra-low latency capabilities enabling innovative applications such as AR/VR and autonomous systems.

- The manufacturing segment captured a 27.80% share in 2024 as Industry 4.0 adoption accelerated demand for seamless connectivity in automation and robotics.

- North America led with 45.97% global share in 2024, supported by advanced infrastructure, key industry players, and early adoption of next-gen connectivity.

- The U.S. contributed 80.02% of North America's share, reflecting its robust tech ecosystem and enterprise 5G leadership.

- The Asia Pacific market is expected to record a CAGR of 50.0% by 2034, propelled by industrial growth, infrastructure projects, and Industry 4.0 integration.

- India's market grows through industrial digitization, manufacturing expansions, and smart infrastructure investments.

Market Dynamics

- Private 5G networks are gaining traction across the manufacturing, logistics, and energy sectors due to their superior control, security, and customization capabilities, enabling seamless mission-critical operations with dedicated bandwidth and ultra-low latency.

- Public funding and policy initiatives are accelerating private 5G deployment, with subsidies and spectrum allocations reducing barriers to entry and fostering infrastructure development in key industrial hubs.

- The integration of private 5G with AI/edge computing unlocks predictive maintenance and real-time automation, creating high-value use cases for various industries such as smart manufacturing and autonomous logistics.

- High upfront deployment costs and spectrum fragmentation hinder adoption, particularly for SMEs, due to complex infrastructure requirements and regulatory disparities across regions.

Market Statistics

- 2024 Market Size: USD 3.70 billion

- 2034 Projected Market Size: USD 193.79 billion

- CAGR (2025–2034): 48.7%

- North America: Largest market in 2024

AI Impact on Private 5G Network Market

- AI-driven analytics dynamically allocate bandwidth and predict traffic patterns, enhancing private 5G efficiency while reducing operational costs for enterprises.

- Machine learning monitors equipment health in real-time, preempting failures in industrial IoT deployments and minimizing downtime for critical operations.

- AI detects anomalies and cyber threats across private 5G networks, enabling proactive responses to vulnerabilities in sensitive industrial environments.

- Computer vision and AI optimize data flow for latency-sensitive applications like autonomous robotics, ensuring seamless Industry 4.0 integration.

A private 5G network is a dedicated, secure wireless communication system tailored for specific enterprises or organizations, enabling ultra-reliable, low-latency, and high-bandwidth connectivity. The rapid adoption of industrial automation and the rise of Industry 4.0 are driving the market growth. Enterprises increasingly demand resilient, high-performance networks to power interconnected machines, real-time analytics, and smart manufacturing systems. Private 5G services enables seamless integration of advanced technologies such as IoT technology, AI, and robotics on the factory floor, with the ability to support massive device connectivity and deterministic performance. This advancement empowers industries to enhance productivity, reduce downtime, and maintain operational agility while ensuring robust data security within controlled environments.

The increasing collaboration between telecom operators and cloud service providers is enabling advanced infrastructure capabilities for enterprise 5G adoption. Businesses gain access to scalable edge computing, faster deployment models, and flexible service delivery tailored to industry-specific requirements by integrating cloud computing resources with private 5G networks. In June 2023, Samsung and NAVER Cloud expanded their partnership to deploy Korea's first private 5G network for Hoban Construction, enhancing worksite safety and efficiency through drone monitoring, IoT concrete sensors, smart safety jackets, and real-time CCTV analytics. These collaborations accelerate time-to-market for private 5G solutions and also optimize network management through centralized orchestration and AI-driven automation. Moreover, the convergence of telecom expertise in network deployment with cloud providers' capabilities in data processing and analytics strengthens the value proposition of private 5G, making it a strategic enabler for digital transformation across diverse sectors.

Drivers & Opportunities

Increasing Adoption of Private Networks: The increasing adoption of private networks is boosting the growth opportunities, as enterprises across manufacturing, logistics, energy, and other sectors aim for greater control, security, and customization over their communication infrastructure. Unlike public networks, private 5G offers dedicated bandwidth, low latency, and enhanced reliability, enabling mission-critical applications to operate without disruption. This control allows organizations to prioritize network traffic, safeguard sensitive data, and ensure consistent performance tailored to specific operational needs. In February 2025, Rakuten Symphony partnered with Cisco, Airspan, and Tech Mahindra to expand its Open RAN solutions globally. The collaborations aim to accelerate cloud-native 5G deployments, combining Cisco’s Private 5G tech with Rakuten’s software, while Airspan and Tech Mahindra drive adoption. Therefore, as digital transformation accelerates, the ability of private networks to seamlessly integrate IoT devices, AI systems, and automation solutions further strengthens their appeal, making them an essential component of modern enterprise connectivity strategies.

Government-Backed Funding: Government-backed funding is driving the expansion opportunities, as public sector investments and policy initiatives are catalyzing the development and deployment of private 5G infrastructure. In December 2024, Amantya Technologies secured DoT funding to develop an indigenous 5G SA Core compliant with 3GPP Release 16/17 standards. The solution will support advanced features such as network slicing and URLLC, with cloud-agnostic deployment. Such support often includes spectrum allocation, grants, and incentives aimed at accelerating the adoption of next-generation communication networks across industries. Government initiatives encourage enterprises and technology providers to experiment with new 5G-enabled use cases, from smart manufacturing to advanced public safety systems, by reducing financial barriers and fostering innovation. This backing enables technological advancements and also ensures that private 5G adoption aligns with national priorities for digital competitiveness, economic growth, and infrastructure modernization.

Segmental Insights

Component Analysis

Based on component, the segmentation includes hardware, software & services. The hardware segment accounted for 73.33% revenue share in 2024. The dominance is attributed to the substantial investments in physical infrastructure required for deploying private 5G networks, such as radios, antennas, base stations, and core network equipment. These components form the backbone of network performance, enabling low latency, high reliability, and secure connectivity for enterprise-specific applications. Hardware adoption is further driven by the need to support dense device environments and demanding industrial use cases that require specialized equipment tailored to different operational settings. Demand for high-capacity and robust hardware solutions remains a critical growth factor in the private 5G ecosystem as industries increasingly integrate IoT, robotics, and AI-driven automation.

The software & services segment is expected to register a CAGR of 49.0% during the forecast period, driven by the rising demand for network management, orchestration, security solutions, and application integration. Enterprises are increasingly focusing on flexible, cloud-native software platforms that enable centralized control, scalability, and real-time analytics for network optimization. Additionally, professional services such as consulting, deployment, and managed services are becoming essential to ensure smooth integration with existing IT and OT systems. Additionally, the shift toward software-defined networking and the integration of AI for predictive maintenance and performance tuning are further enhancing the value proposition of software and services in private 5G deployments.

Operational Frequency Analysis

In terms of operational frequency, the segmentation includes sub-6 GHz and mmWave. The sub-6 GHz segment dominated the market with 82.68% share in 2024. The dominance is driven by its superior coverage capabilities, ability to penetrate obstacles, and balance between capacity and range, making it highly suitable for industrial and large-area deployments. This frequency range supports stable connections over wider geographical areas, which is critical for manufacturing plants, logistics hubs, and energy facilities that require uninterrupted communication. Furthermore, the sub-6 GHz spectrum is often more readily available and cost-effective, encouraging its adoption among enterprises seeking to deploy reliable private 5G networks without incurring high infrastructure costs.

The mmWave segment is projected to register a CAGR of 47.7% during the forecast period owing to its ability to deliver extremely high bandwidth and ultra-low latency, enabling advanced applications such as AR/VR, real-time analytics, and autonomous operations. Although its shorter range and limited penetration require denser infrastructure, mmWave technology is ideal for high-capacity environments such as smart factories, airports, and urban hubs where performance demands are at their peak. Moreover, the increasing availability of spectrum in the mmWave band and advancements in small cell technology are making it more feasible for enterprises to harness these capabilities for specialized, data-intensive use cases.

Spectrum Analysis

In terms of spectrum, the segmentation includes licensed and unlicensed/shared. The unlicensed/shared segment accounted for a 75.06% share in 2024 owing to its cost-effectiveness, ease of access, and flexibility in deployment for enterprises across diverse industries. This spectrum type allows organizations to establish private 5G networks without experiencing lengthy licensing procedures, making it particularly attractive for small to medium-sized deployments and pilot projects. Its adaptability enables quick rollouts in locations such as manufacturing sites, campuses, and remote facilities while still supporting robust connectivity for IoT devices and automation systems. Additionally, the growing development of technologies that minimize interference and optimize performance in shared spectrum environments further strengthens its adoption.

The licensed segment is expected to witness substantial growth during the forecast period. The growth is attributed to its ability to deliver guaranteed performance, enhanced security, and interference-free communication, critical for mission-critical applications. Enterprises operating in sectors such as defense, energy, and critical infrastructure are increasingly favoring licensed spectrum to ensure reliable connectivity under all conditions. This spectrum type provides full control over network quality and prioritization, enabling the seamless operation of latency-sensitive and high-bandwidth applications. Additionally, partnerships between enterprises and telecom operators for licensed spectrum access are facilitating broader adoption, particularly in large-scale and high-reliability private 5G deployments.

Vertical Analysis

The segmentation, based on vertical, includes manufacturing, food & beverages, energy & utilities, transportation & logistics, aerospace & defense, government & public safety, corporates/enterprises, mining, healthcare, oil & gas, and others. The manufacturing segment held a 27.80% share in 2024 attributed to the sector’s accelerated adoption of Industry 4.0 initiatives, which require seamless connectivity for automation, robotics, and real-time process monitoring. Private 5G networks enable manufacturers to operate with greater precision, efficiency, and flexibility by supporting machine-to-machine communication and predictive maintenance. The ability to integrate production systems with AI and IoT over a secure and dedicated network enhances productivity. It reduces downtime, solidifying manufacturing as the largest adopter of private 5G technology.

The healthcare segment is expected to register the highest CAGR of 49.1% during the forecast period. The growth is driven by the increasing use of connected medical devices, remote patient monitoring, and high-resolution imaging systems. Private 5G networks in healthcare settings enable secure, real-time data transmission for critical applications such as telemedicine, robotic surgeries, and emergency response coordination. The low latency and high reliability of these networks support life-saving operations while ensuring compliance with stringent data privacy regulations. Therefore, as hospitals and healthcare facilities adopt digital transformation, the role of private 5G in delivering advanced, patient-centric care is becoming increasingly significant.

Regional Analysis

The North America private 5G network market accounted for 45.97% of global market share in 2024. This dominance is attributed to its advanced technological infrastructure, strong presence of major industry players, and early adoption of next-generation connectivity solutions. The region’s well-established industrial base, spanning manufacturing, logistics, and energy, has been quick to implement private 5G networks to enhance operational efficiency and digital transformation initiatives. Robust R&D capabilities, combined with high enterprise readiness for automation, IoT technology integration, and AI-driven solutions, further strengthen market penetration. Additionally, favorable regulatory frameworks and the availability of licensed spectrum have accelerated large-scale deployments across multiple sectors, positioning North America as a global leader in private 5G adoption.

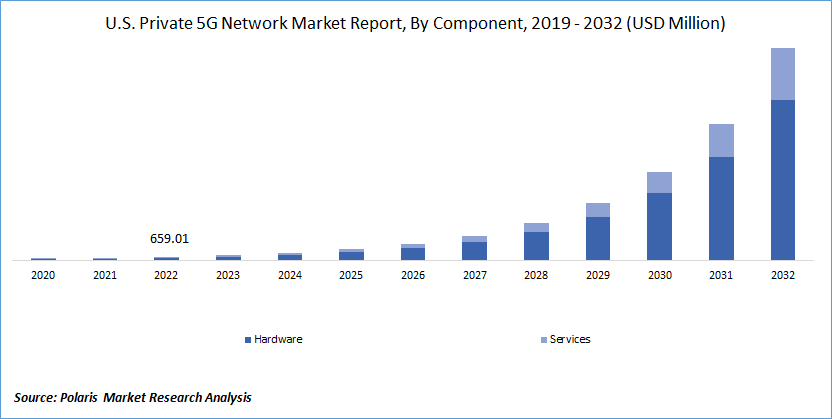

U.S. Private 5G Network Market Insights

The U.S. held a 80.02% share of the North America private 5G network landscape in 2024 due to its strong technological ecosystem, vast enterprise adoption of advanced connectivity solutions, and leadership in 5G innovation. High investments in automation, IoT integration, and AI-enabled operations across industries such as manufacturing, logistics, and healthcare have accelerated deployment. Additionally, the country benefits from favorable regulatory conditions and a mature infrastructure that supports large-scale private 5G implementations.

Asia Pacific Private 5G Network Market Trends

The market in Asia Pacific is projected to register the highest CAGR of 50.0% from 2025 to 2034, owing to rapid industrial expansion, large-scale infrastructure development, and the accelerating adoption of Industry 4.0 initiatives. According to India's Ministry of Communications December 2024 report, 5G services were launched nationwide on October 1, 2022, which now cover 779 of 783 districts with over 460,000 installed 5G base stations as of October 2024, reflecting the boosting adoption. The region’s diverse manufacturing hubs, logistics networks, and energy sectors are increasingly turning to private 5G networks to support automation, predictive maintenance, and real-time analytics. Growing investments in smart factories, ports, and urban infrastructure are driving demand for high-capacity, low-latency connectivity solutions. Furthermore, the region’s high mobile device penetration and innovation-driven approach to digitalization provide a strong foundation for large-scale private 5G deployment across multiple industries.

India Private 5G Network Market Overview

The market in India is expanding due to rapid industrial digitization, large-scale manufacturing initiatives, and growing investments in smart infrastructure. Enterprises across sectors such as automotive, energy, and logistics are adopting private 5G to improve efficiency, enable real-time monitoring, and support automation. The increasing focus on digital transformation and integration of IoT-enabled solutions is further enhancing the demand for secure, high-performance networks in the country.

Europe Private 5G Network Market Analysis

The private 5G network landscape in Europe held a 29.22% share in 2024 due to its strong focus on industrial modernization, data privacy, and sustainable digital transformation. The region’s industries, such as manufacturing, automotive, and energy, are leveraging private 5G to optimize production processes, enhance operational safety, and reduce environmental impact. In December 2022, Porsche Engineering and Vodafone Business deployed Europe's first 5G hybrid private network at Italy's Nardò Technical Center, enhancing vehicle testing capabilities with low-latency, high-bandwidth connectivity for connected car development. The presence of established technology ecosystems and collaborative research initiatives supports innovation in network solutions tailored to regional industrial needs. Moreover, Europe’s emphasis on secure, regulated communication infrastructure ensures that private 5G deployments align with strict compliance standards, making it a preferred choice for mission-critical and high-reliability applications.

UK Private 5G Network Market Trends

The growth of the UK market is driven by its strong focus on Industry 4.0, digital infrastructure modernization, and the adoption of secure communication networks in mission-critical sectors. Industries such as aerospace, automotive, and energy are leveraging private 5G to enable advanced applications, including predictive maintenance, robotics, and remote operations. The country’s focus on compliance, data security, and operational resilience supports the adoption of private networks for high-reliability use cases.

Key Players & Competitive Analysis

The private 5G network sector is witnessing intense competition as vendor’s leverage technological advancements to address latent demand and opportunities across industries. Ericsson, Nokia, and Huawei dominate in developed markets, offering end-to-end solutions for manufacturing and logistics. Cisco and Microsoft focus on cloud-integrated architectures to serve small and medium-sized businesses. Emerging markets such as India and Brazil present expansion opportunities, driven by government-led strategic investments in smart infrastructure and economic and geopolitical shifts favoring localized deployments. Industry trends highlight a shift toward sustainable value chains, with enterprises prioritizing energy-efficient networks and Open RAN adoption. Competitive intelligence and strategy reveal that partnerships, such as Rakuten-Cisco and NEC-AWS are critical to capturing high-growth markets and emerging technologies. Meanwhile, supply chain disruptions in semiconductor components challenge vendors to innovate with modular designs.

A few major companies operating in the private 5G network industry include Amazon; Cisco Systems; Ericsson; Fujitsu; Huawei Technologies Co., Ltd.; Mavenir; Microsoft; NEC Corporation; Nokia Corporation; and ZTE Corporation.

Key Players

- Amazon

- Cisco Systems

- Ericsson

- Fujitsu

- Huawei Technologies Co., Ltd.

- Mavenir

- Microsoft

- NEC Corporation

- Nokia Corporation

- ZTE Corporation

Private 5G Network Industry Developments

- June 2025: Istres collaborated with Ericsson, Spie, and Unitel to deploy a Private 5G network, cutting surveillance camera costs by 83% per unit. The system enhances real-time coordination and paves the way for AI-driven smart city applications, serving as a scalable model for similar urban areas.

- October 2024: NEC Corporation partnered with Cisco to launch a private 5G network solution combining Cisco's 5G SA Core with NEC's radio expertise. The collaboration targets enterprise deployments in Europe and the Middle East, offering end-to-end implementation and support services.

Private 5G Network Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Radio Access Network

- Core Network

- Backhaul & Transport Interconnecting

- Software & Services

- Installation & Integration

- Data Services

- Support & Maintenance

By Operational Frequency Outlook (Revenue, USD Billion, 2020–2034)

- Sub-6 GHz

- mmWave

By Spectrum Outlook (Revenue, USD Billion, 2020–2034)

- Licensed

- Unlicensed/Shared

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Food & Beverages

- Automotive

- Pharmaceuticals

- Electrical & Electronics

- Heavy Machinery

- Clothing & Accessories

- Other Manufacturing Verticals

- Energy & Utilities

- Transportation & Logistics

- Aerospace & Defense

- Government & Public Safety

- Corporates/Enterprises

- Mining

- Healthcare

- Oil & Gas

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Private 5G Network Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.70 Billion |

|

Market Size in 2025 |

USD 5.45 Billion |

|

Revenue Forecast by 2034 |

USD 193.79 Billion |

|

CAGR |

48.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.70 billion in 2024 and is projected to grow to USD 193.79 billion by 2034.

The global market is projected to register a CAGR of 48.7% during the forecast period.

North America accounted for 45.97% of the global private 5G network market share in 2024.

A few of the key players in the market are Amazon; Cisco Systems; Ericsson; Fujitsu; Huawei Technologies Co., Ltd.; Mavenir; Microsoft; NEC Corporation; Nokia Corporation; and ZTE Corporation.

The hardware segment accounted for 73.33% revenue share in 2024.

The mmWave segment is projected to register a CAGR of 47.7% during the forecast period