U.S. Medical Grade Polypropylene Market Size, Share, Trends, Industry Analysis Report

By Type (Homopolymer Polypropylene, Random Copolymer Polypropylene, Impact Copolymer Polypropylene, Other Types), By Applications – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6231

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

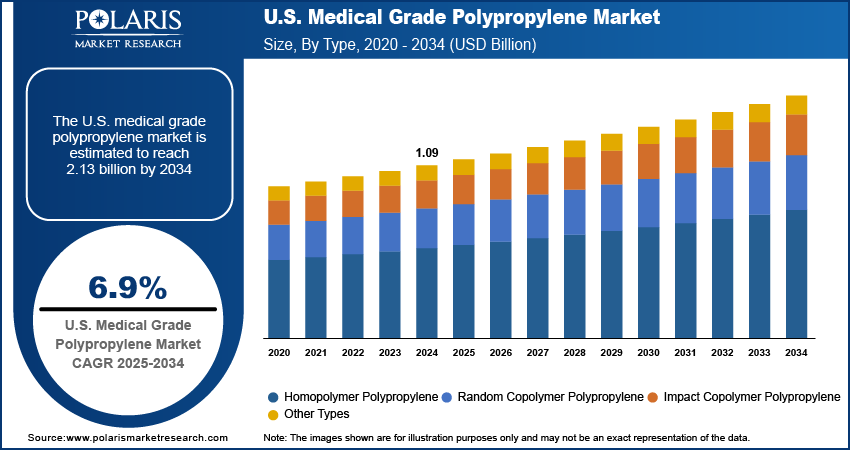

The U.S. medical grade polypropylene market size was valued at USD 1.09 billion in 2024 and is anticipated to register a CAGR of 6.9% from 2025 to 2034. The landscape is primarily driven by the increasing demand for safe, lightweight, and cost-effective medical devices and packaging. Another key driver is the rising focus on infection control, leading to a greater adoption of single-use medical products.

Key Insights

- By type, the homopolymer polypropylene segment held the largest share in 2024 due to its excellent rigidity, high strength, and chemical resistance, making it ideal for a wide range of rigid medical devices and components that require structural integrity and the ability to withstand various sterilization methods.

- By applications, the medical devices segment held the largest share in 2024, driven by the extensive use of medical grade polypropylene in manufacturing numerous critical items such as syringes, IV components, and surgical tools.

Industry Dynamics

- The increasing focus on infection control and patient safety has significantly boosted the demand for single-use medical devices. Materials that can be easily sterilized and disposed of, such as polypropylene, are crucial for preventing healthcare-associated infections (HAIs), making them highly sought after in hospitals and clinics.

- A growing global elderly population and the rising occurrence of chronic diseases are major factors contributing to higher healthcare needs. This demographic shift drives an increased demand for various medical devices, including diagnostic tools, surgical instruments, and drug delivery systems, which rely heavily on advanced material solutions.

- Technological advancements in medical device manufacturing continue to expand the applications for innovative materials. The development of new and improved medical equipment, often requiring lightweight, durable, and biocompatible components, directly fuels the demand for high-performance polymers that meet stringent industry standards.

Market Statistics

- 2024 Market Size: USD 1.09 billion

- 2034 Projected Market Size: USD 2.13 billion

- CAGR (2025–2034): 6.9%

AI Impact on U.S. Medical Grade Polypropylene Market Statistics

- AI-driven simulations help predict the performance of new polypropylene blends under chemical exposure, sterilization, and mechanical stress.

- The use of AI tools leads to reduced R&D timelines for developing biocompatible and sterilization-resistant grades.

- They reduce the need for costly physical prototypes.

- AI-based predictive maintenance, which leverages IoT sensors and ML models, helps foresee equipment issues in manufacturing setups, minimize unplanned downtime, reduce maintenance costs, and optimize production continuity.

- Market players in the U.S. are investing in digital platforms, AI-powered analytics, and cloud-based automation to support real-time monitoring and decision making.

The U.S. medical grade polypropylene market involves the production and supply of polypropylene polymers specifically designed and tested to meet the strict quality and regulatory requirements for use in healthcare applications. This includes materials used in manufacturing medical devices, pharmaceutical packaging, and other critical healthcare products.

Continuous advancements in polymerization techniques and minimally invasive surgeries are driving the growth. These technological improvements allow for the development of new polypropylene grades with enhanced properties, such as improved clarity, flexibility, and sterilization compatibility. This leads to the creation of more sophisticated and specialized medical products.

Another qualitative factor influencing this industry is the evolving regulatory landscape, especially regarding environmental sustainability. With increasing pressure to reduce the environmental impact of plastics, there is a growing demand for recycled or bio-based polypropylene options that still meet stringent medical standards. For instance, the National Institutes of Health (NIH) supports research into new materials for medical devices, including those with improved environmental profiles. This push for more sustainable materials, while not always a primary driver, plays a significant role in research and development, influencing long-term material choices and trends within the medical sector.

Drivers and Trends

Growing Demand for Medical Devices Driven by Aging Population and Chronic Diseases: The increasing number of elderly individuals in the U.S. directly translates to a higher incidence of age-related health conditions and chronic diseases, which boosts the demand for various medical devices. As people age, they often require more frequent medical interventions, diagnostic procedures, and long-term care solutions, all of which necessitate a wide array of medical products. This demographic shift creates a consistent and rising need for materials such as medical grade polypropylene, essential for manufacturing medical devices due to its versatility and safety.

The American Action Forum, in their "Primer: Chronic Disease Among Adults in the United States" published in July 2025, highlights that nearly 60% of U.S. adults have at least one chronic condition, and 40% suffer from multiple chronic diseases. The report also projects that the number of adults over 50 with at least one chronic condition is expected to nearly double from approximately 72 million in 2020 to 143 million by 2050. This significant increase in chronic disease prevalence directly drives the need for more medical devices, thereby fueling the demand for medical grade polypropylene.

Rising Emphasis on Infection Control and Single-Use Medical Products: The healthcare segment places a critical emphasis on preventing healthcare-associated infections (HAIs) to ensure patient safety and reduce healthcare costs. This focus has led to a widespread adoption of single-use medical devices and disposable components, as they significantly minimize the risk of cross-contamination between patients. Medical grade polypropylene is a preferred material for many such products due to its sterilizability, cost-effectiveness, and suitability for mass production.

To illustrate, the Centers for Disease Control and Prevention (CDC), through their 2022 National and State Healthcare-Associated Infections Progress Report, indicated significant declines in HAIs at U.S. acute care hospitals. For example, there was a 19% decrease in ventilator-associated events from 2021 to 2022. This ongoing progress in reducing HAIs is supported by the continued use of single-use devices, many of which are made from medical grade polypropylene, thus sustaining its demand. The consistent drive to prevent infections and ensure patient safety continually pushes the U.S. medical grade polypropylene market demand.

Segmental Insights

Type Analysis

Based on type, the U.S. medical grade polypropylene market segmentation includes homopolymer polypropylene, random copolymer polypropylene, impact copolymer polypropylene, and other types. The homopolymer polypropylene segment held the largest share in 2024. This dominance is primarily attributed to its inherent properties, which make it highly suitable for a wide range of medical applications. Homopolymer polypropylene offers excellent rigidity, high tensile strength, and good chemical resistance, making it an ideal choice for rigid medical devices, sterilization trays, and various components where structural integrity and durability are crucial. Its ability to withstand common sterilization methods, such as autoclaving and gamma irradiation, without significant degradation further reinforces its leading position. Manufacturers also favor homopolymer for its consistent processing characteristics and cost-effectiveness, contributing to its widespread adoption across the healthcare area for both single-use and reusable medical products.

The random copolymer polypropylene segment is anticipated to register the highest growth rate during the forecast period. This segment's accelerated growth can be attributed to its unique properties, which differentiate it from homopolymer and make it increasingly valuable for specific medical applications. Random copolymer polypropylene offers enhanced clarity, improved flexibility, and better impact resistance, particularly at lower temperatures. These characteristics make it highly desirable for applications requiring transparency, such as clear medical packaging, syringes, diagnostic vials, and IV components. As the demand for more sophisticated and user-friendly medical devices increases, along with a growing emphasis on visual inspection and patient comfort, the adoption of random copolymer polypropylene is expected to expand significantly during the forecast period.

Applications Analysis

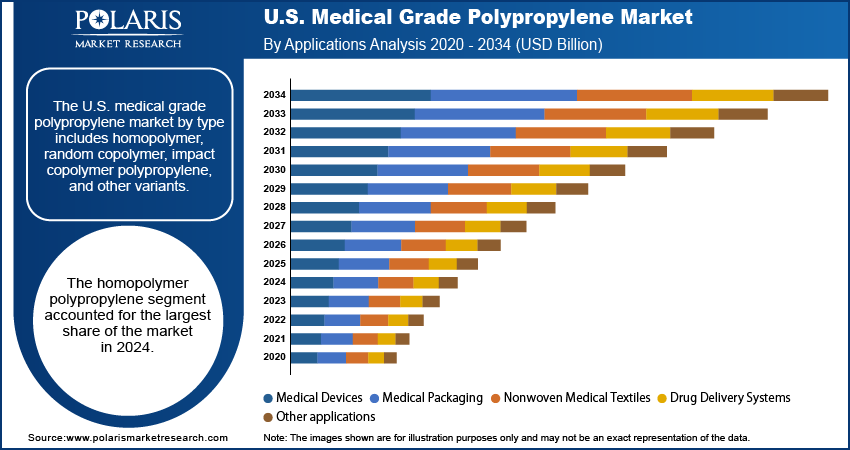

Based on applications, the U.S. medical grade polypropylene market segmentation includes medical devices, medical packaging, nonwoven medical textiles, drug delivery systems, and other applications. The medical devices segment held the largest share in 2024. This dominance stems from the extensive use of medical grade polypropylene in manufacturing a vast array of critical healthcare products. These include disposable syringes, IV components, surgical instruments, diagnostic kits, and various other single-use medical tools. Polypropylene's favorable properties such as its light weight, excellent chemical resistance, ease of sterilization (via methods such as autoclaving or gamma irradiation), and biocompatibility make it an ideal material for these applications. The increasing prevalence of chronic diseases and the aging population in the U.S. continue to fuel the demand for these essential medical devices, solidifying this segment's leading position within the market. Its cost-effectiveness and versatility in processing techniques such as injection molding also contribute significantly to its widespread adoption by medical device manufacturers.

The drug delivery systems segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily driven by the increasing complexity and innovation in pharmaceutical delivery methods. Medical grade polypropylene is increasingly favored for components in inhalers, pre-filled syringes, auto-injectors, and various other advanced drug delivery devices due to its excellent barrier properties, chemical inertness, and precise moldability. The rising demand for self-administration of medications, as well as the development of specialized drug formulations requiring precise and sterile delivery mechanisms, are key factors contributing to this segment's rapid expansion. As pharmaceutical companies continue to develop new and more efficient ways to deliver drugs, the demand for high-performance and reliable materials such as medical grade polypropylene in these systems will continue to surge during the forecast period.

Key Players and Competitive Insights

The U.S. medical grade polypropylene market features a competitive landscape with several key players striving for market share. These companies compete on factors such as product innovation, pricing strategies, global presence, and the ability to meet stringent regulatory standards for medical applications. The market is characterized by both large, established chemical companies and more specialized polymer producers. Collaboration with medical device manufacturers and pharmaceutical companies is also a key competitive differentiator, allowing suppliers to develop tailored solutions for evolving healthcare needs and expand their product portfolios.

A few prominent companies in the industry include LyondellBasell Industries N.V.; SABIC (Saudi Basic Industries Corporation); Exxon Mobil Corporation; Borealis AG (OMV AG); Braskem S.A.; INEOS Group Holdings S.A.; TotalEnergies SE; Mitsui Chemicals, Inc.; Sumitomo Chemical Co., Ltd.; and Hyosung Chemical Corporation.

Key Players

- Borealis AG (OMV AG)

- Braskem S.A.

- Exxon Mobil Corporation

- Hyosung Chemical Corporation

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- SABIC (Saudi Basic Industries Corporation)

- Sumitomo Chemical Co., Ltd.

- TotalEnergies SE

U.S. Medical Grade Polypropylene Industry Developments

March 2024: Braskem announced a collaboration to introduce certified bio-attributed and bio-circular polypropylene into the U.S. market.

U.S. Medical Grade Polypropylene Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Homopolymer Polypropylene

- Random Copolymer Polypropylene

- Impact Copolymer Polypropylene

- Other types

By Applications Outlook (Revenue – USD Billion, 2020–2034)

- Medical Devices

- Medical Packaging

- Nonwoven Medical Textiles

- Drug Delivery Systems

- Other applications

U.S. Medical Grade Polypropylene Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.09 billion |

|

Market Size in 2025 |

USD 1.17 billion |

|

Revenue Forecast by 2034 |

USD 2.13 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.09 billion in 2024 and is projected to grow to USD 2.13 billion by 2034.

The market is projected to register a CAGR of 6.9% during the forecast period.

A few key players in the market include LyondellBasell Industries N.V.; SABIC (Saudi Basic Industries Corporation); Exxon Mobil Corporation; Borealis AG (OMV AG); Braskem S.A.; INEOS Group Holdings S.A.; TotalEnergies SE; Mitsui Chemicals, Inc.; Sumitomo Chemical Co., Ltd.; and Hyosung Chemical Corporation.

The homopolymer polypropylene segment accounted for the largest share of the market in 2024.

The drug delivery systems segment is expected to witness the fastest growth during the forecast period.