U.S. Ophthalmic Spectacle Lenses and Equipment Market Size, Share, Trends, Industry Analysis Report

By Product (Ophthalmic Spectacle Lenses, Ophthalmic Spectacle Equipment), By Lens Type, By Lens Material, By Usage, By Equipment – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6166

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

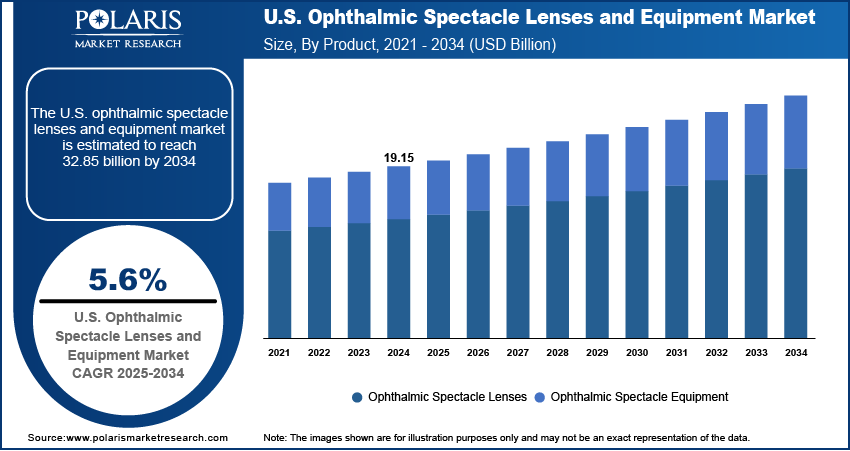

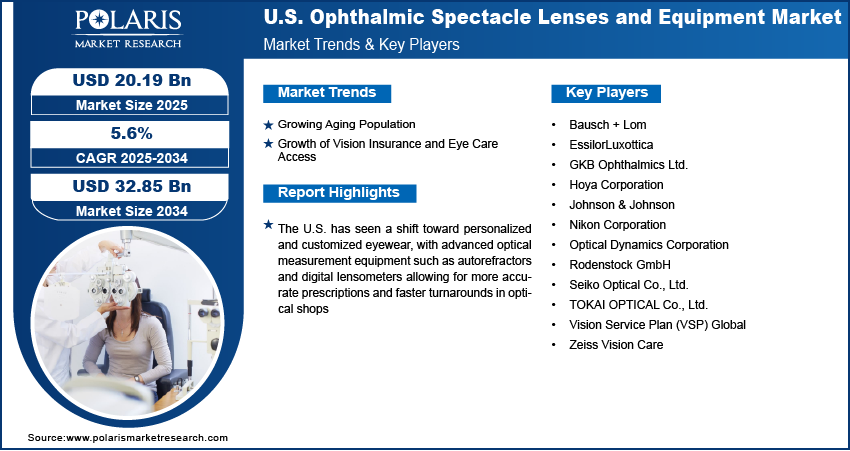

The U.S. ophthalmic spectacle lenses and equipment market was valued at USD 19.15 billion in 2024 and is expected to register a CAGR of 5.6% from 2025 to 2034. The market growth is driven by growing aging population and growth of vision insurance and eye care access.

Key Insights

- The ophthalmic spectacle lenses segment accounted for 79.69% regional share in 2024, driven by growing demand for vision correction across all age groups.

- The multifocal lens segment accounted for 40.05% regional share in 2024 as multifocal lenses are gaining popularity, especially among aging adults who need clear vision at multiple distances

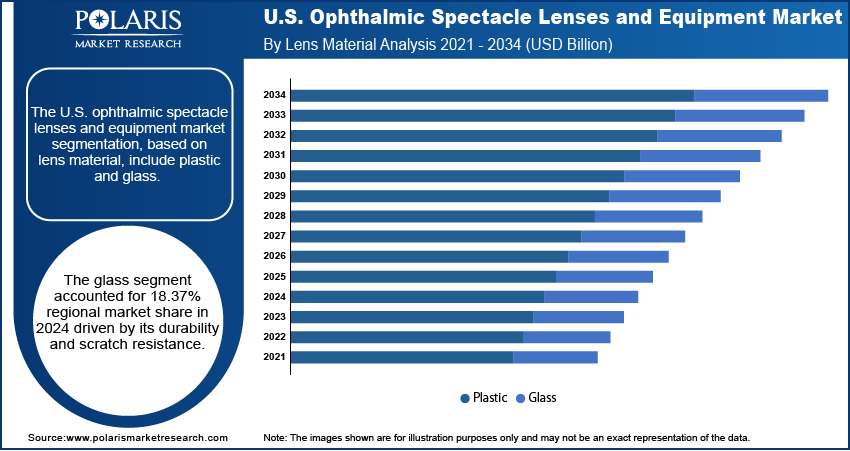

- The glass segment accounted for 18.37% regional market share in 2024, driven by its durability and scratch resistance

- The prescription spectacle lenses segment accounted for 77.70% share in 2024, as it is the primary solution for correcting individual vision problems

Industry Dynamics

- Growing aging population are fueling the industry growth.

- Growth of vision insurance and eye care access in the U.S. is fueling its adoption.

- Rising shift toward personalized and customized eyewear is boosting the growth

- The high costs of advanced lenses and equipment, limited insurance coverage, and intense market competition limit the growth.

Market Statistics

- 2024 Market Size: USD 19.15 billion

- 2034 Projected Market Size: USD 32.85 billion

- CAGR (2025–2034): 5.6%

To Understand More About this Research: Request a Free Sample Report

Ophthalmic spectacle lenses are vision-correcting lenses that are prescribed for hyperopia, astigmatism, and myopia and presbyopia treatment. These lenses are fitted into eyeglass frames and may include advanced features like anti-reflective coatings, photochromic tinting, or blue light filtering. Ophthalmic equipment refers to the tools and devices used by eye care professionals for eye exams, lens manufacturing, and fitting, including refractors, lens edgers, and diagnostic imaging systems.

The U.S. ophthalmic spectacle lenses and equipment market is the largest in North America, driven by a combination of high consumer demand, technological advancements, and healthcare policies that prioritize eye health. According to the Centers for Disease Control and Prevention (CDC), a report published in August 2023 stated that nearly 128 million adults in the U.S. have presbyopia, a figure that highlights the vast market potential. Additionally, the prevalence of refractive errors in the U.S. is significant, with conditions such as myopia and hyperopia affecting millions. The NIH reported in April 2024 that the incidence of myopia has been steadily increasing in the U.S., especially among younger populations, contributing to the rising demand for spectacle lenses.

The U.S. has seen a shift toward personalized and customized eyewear, with advanced optical measurement equipment such as autorefractors and digital lensometers allowing for more accurate prescriptions and faster turnarounds in optical shops. The increasing use of digital devices further drives the demand for blue light-blocking lenses, a market segment that has seen substantial growth due to concerns over digital eye strain. The U.S. industry is expected to see continued interest in lenses that address these emerging needs as digital screen time continues to rise.

Drivers & Opportunities

Growing Aging Population: The aging population continues to expand in the U.S., leading to a higher incidence of vision-related conditions such as presbyopia and cataracts. According to the World Bank, in 2024, 18% of the country’s population is 65 years and above. Older adults often require corrective lenses and regular eye exams, increasing the demand for spectacle lenses and ophthalmic equipment. Eye care professionals are focusing more on this demographic by offering specialized lenses and using advanced diagnostic tools. Longer life expectancy and improved healthcare access have made eye health a top priority for seniors, thereby driving the growth in the country.

Growth of Vision Insurance and Eye Care Access: Vision insurance plans have become more widespread, encouraging people to seek regular eye exams and corrective eyewear. Affordable coverage has made it easier for individuals to invest in high-quality lenses and access modern diagnostic services. Optical practices are benefiting from a larger patient base and increased purchasing power among insured consumers. Additionally, many providers include coverage for advanced lens options and eye care technologies. This broader access to care is fueling consistent demand for both ophthalmic lenses and in-office equipment, thereby fueling the growth of the industry in the country.

Segmental Insights

Product Analysis

The ophthalmic spectacle lenses segment accounted for 79.69% revenue share in 2024, driven by growing demand for vision correction across all age groups. These lenses are essential for treating common conditions such as nearsightedness, farsightedness, and astigmatism. Consumers are seeking both functional and stylish options, which has led to strong growth in customized and premium lenses. Frequent vision testing and a rise in eye care awareness are further encouraging regular lens replacements. This product segment continues to grow steadily due to its necessity in everyday life, supported by technological innovations and wider access to optical care services.

Lens Type Analysis

The multifocal lens segment accounted for 40.05% regional share in 2024 as multifocal lenses are gaining popularity, especially among aging adults who need clear vision at multiple distances. These lenses combine different prescriptions into one, allowing users to see near, intermediate, and far without switching glasses. Convenience and visual comfort make them an attractive option for individuals with presbyopia or complex vision needs. Improved designs, such as progressive addition lenses, offer smoother transitions between zones and fewer distortions. The demand for multifocal lenses continues to rise as consumer preference shifts toward all-in-one solutions for clearer vision, thereby driving the segment growth.

Lens Material Analysis

The glass segment accounted for 18.37% regional market share in 2024 driven by its durability and scratch resistance. Compared to plastic and polycarbonate alternatives, glass lenses offer clearer optics and superior resistance to wear. However, their heavier weight and breakability have limited mainstream use. Certain industrial and specialty eyewear markets still favor glass for its optical precision and heat resistance. While demand is lower than other materials, glass lenses hold a steady place in the market for users seeking premium clarity or specific performance features in extreme environments.

Usage Analysis

The prescription spectacle lenses segment accounted for 77.70% share in 2024 as it is the primary solution for correcting individual vision problems. Personalized lenses are crafted based on detailed eye exams, offering clear, accurate vision tailored to each user’s needs. Most consumers require these lenses for daily activities such as reading, driving, or working on screens. Continuous eye health monitoring and updated prescriptions help maintain visual comfort and reduce the risk of eye strain. Demand remains strong due to the widespread need for vision correction, regular vision changes over time, and the growing availability of advanced diagnostic equipment in clinics.

Key Players & Competitive Analysis

The U.S. ophthalmic spectacle lenses and equipment market is highly competitive, driven by innovation, brand strength, and integrated service offerings. Leading players include EssilorLuxottica and Zeiss Vision Care, both known for advanced lens technologies and extensive distribution networks. Johnson & Johnson and Bausch + Lomb leverage strong R&D capabilities and broad healthcare portfolios to expand their ophthalmic offerings. Hoya Corporation, Nikon Corporation, and Seiko Optical emphasize premium lens quality and precision optics, catering to high-performance needs. Rodenstock GmbH and TOKAI OPTICAL focus on individualized lenses and digital vision solutions. Vision Service Plan (VSP) Global plays a unique role as both manufacturer and vision care provider, integrating insurance and eyewear solutions. GKB Ophthalmics and Optical Dynamics Corporation add value through specialized equipment and lens coating technologies. Innovation in freeform design, blue light filtering, and sustainability continues to shape the competitive landscape, with strategic partnerships and digital platforms gaining traction.

Key Players

- Bausch + Lom

- EssilorLuxottica

- GKB Ophthalmics Ltd.

- Hoya Corporation

- Johnson & Johnson

- Nikon Corporation

- Optical Dynamics Corporation

- Rodenstock GmbH

- Seiko Optical Co., Ltd.

- TOKAI OPTICAL Co., Ltd.

- Vision Service Plan (VSP) Global

- Zeiss Vision Care

U.S. Ophthalmic Spectacle Lenses and Equipment Industry Developments

May 2025: Bausch + Lomb launched the Zenlens Chroma HOA scleral lens in the U.S., delivering wavefront-guided correction for higher-order aberrations. Collaborating with Advance Medical and OVITZ, the company streamlined integration into practices for improved patient outcomes.

October 2024: Johnson & Johnson launched the TECNIS Odyssey IOL in the U.S., expanding access to its full vision range technology. Built on the TECNIS platform, the lens delivered enhanced contrast and seamless vision, benefiting over 14,000 eyes during rollout.

U.S. Ophthalmic Spectacle Lenses and Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Ophthalmic Spectacle Lenses

- Ophthalmic Spectacle Equipment

By Lens Type Outlook (Revenue, USD Billion, 2020–2034)

- Single-Vision Lens

- Multifocal Lenses

- Progressive Lenses

- Bifocal Lenses

- Trifocal Lenses

- Others

By Lens Material Outlook (Revenue, USD Billion, 2020–2034)

- Plastic

- Polycarbonate

- CR-39 Plastic

- Others

- Glass

By Usage Outlook (Revenue, USD Billion, 2020–2034)

- Prescription Spectacle Lenses

- Non-prescription Spectacle Lenses

By Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Lens Fabrication Equipment

- Lens Generators

- Edging Machines

- Others

- Lens Coating Equipment

- Anti-Reflective Coating Machines

- Hard Coating Equipment

- UV Coating Equipment

- Others

- Optical Measurement Equipment

- Refractors & Autorefractors

- Lensometer

- Others

- Others

U.S. Ophthalmic Spectacle Lenses and Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 19.15 Billion |

|

Market Size in 2025 |

USD 20.19 Billion |

|

Revenue Forecast by 2034 |

USD 32.85 Billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 19.15 billion in 2024 and is projected to grow to USD 32.85 billion by 2034.

The market is projected to register a CAGR of 5.6% during the forecast period.

A few of the key players in the market are Bausch + Lomb; EssilorLuxottica; GKB Ophthalmics Ltd.; Hoya Corporation; Johnson & Johnson; Nikon Corporation; Optical Dynamics Corporation; Rodenstock GmbH; Seiko Optical Co., Ltd.; TOKAI OPTICAL Co., Ltd.; Vision Service Plan (VSP) Global; and Zeiss Vision Care.

The ophthalmic spectacles segment dominated the market share in 2024.

The glass segment is expected to witness the fastest growth during the forecast period.