U.S. Sterilization Monitoring Market Size, Share, Trends, Industry Analysis Report

By Technology (Biological Indicators, Chemical Indicators), By Product, By Method, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6246

- Base Year: 2024

- Historical Data: 2020-2023

Overview

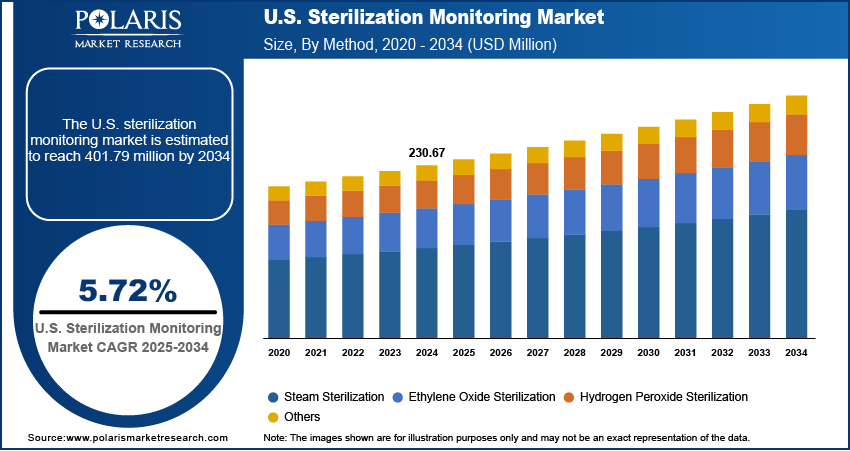

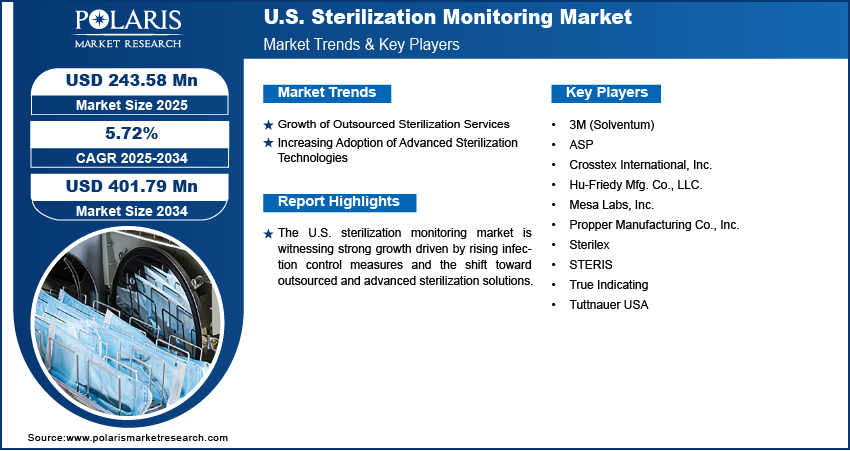

The U.S. sterilization monitoring market size was valued at USD 230.67 million in 2024, growing at a CAGR of 5.72% from 2025–2034. Key factors driving demand for sterilization monitoring in the U.S. include the rising incidence of chronic diseases, the expanding aging population across the country, increasing government healthcare spending, and advancements in biosurgical products.

Key Insights

- The biological indicators segment captured 57.17% of 2024 revenue, as they remain essential for sterilization validation.

- The sterilization strips segment led the market share in 2024 due to their versatility, user-friendly design, and broad application across multiple sterilization technologies.

- The hydrogen peroxide sterilization segment is expected to witness the strongest growth during the forecast period, due to its quick processing, eco-benefits, and ability to safely treat delicate instruments.

- The ambulatory centers segment would emerge as the fastest-growing end users during the forecast period, reflecting healthcare's ongoing transition to outpatient surgical services.

Industry Dynamics

- Healthcare facilities increasingly adopt third-party sterilization services to cut costs, ensure compliance, and focus on patient care, boosting market expansion.

- New low-temperature sterilization methods require precise monitoring solutions, driving demand for validation tools that ensure effectiveness while protecting delicate instruments.

- High costs of advanced sterilization monitoring systems limit adoption, especially among small clinics and rural healthcare providers with tight budgets.

- Growing demand for rapid biological indicators and smart tracking tech creates revenue potential for companies investing in faster, automated sterilization validation solutions.

Market Statistics

- 2024 Market Size: USD 230.67 million

- 2034 Projected Market Size: USD 401.79 million

- CAGR (2025–2034): 5.72%

AI Impact on U.S. Sterilization Monitoring Market

- AI tools can track various sterilization parameters such as temperature, pressure, and exposure time in real time.

- AI system predicts equipment failures, which minimizes downtime and helps in cost savings across hospitals.

- They continuously analyze data and flagging anomalies to ensure sterilization processes comply with regulatory standards. This process supports documentation and traceability for inspections and audits.

- AI verifies assembly of correct instruments and tray composition using RFID/barcode data, which reduces the possibility of human errors.

Sterilization monitoring refers to the process of verifying and validating the effectiveness of sterilization procedures to ensure the elimination of all microbial life on medical instruments and equipment. The U.S. sterilization monitoring market is witnessing robust growth, primarily driven by the increasing volume of surgical procedures and the need to minimize the risk of hospital-acquired infections (HAIs). According to an April 2024 NLM report, 11% of adults in the U.S. had a recent surgery, reaching 20% among seniors. Meanwhile, November 2022 data found HAIs affected 6.5% of hospital patients and 3.9% of long-term care residents. The demand for reliable sterilization processes becomes more critical to prevent postoperative complications as surgical volumes continue to rise across various specialties. Additionally, the constant challenge of HAIs has led healthcare providers to adopt strict monitoring protocols, thereby reinforcing the necessity for advanced sterilization assurance systems. The increasing regulatory scrutiny and compliance requirements further necessitate accurate and efficient sterilization monitoring tools in clinical environments.

The rising number of ambulatory surgical centers (ASCs) and dental clinics contributes to the U.S. sterilization monitoring market expansion opportunities. These outpatient care backgrounds are increasingly performing a wide array of procedures, many of which require strict compliance with infection prevention and sterilization protocols. Unlike larger hospital systems, ASCs and dental clinics often operate with limited staff and resources, making dependable and easy-to-use sterilization monitoring solutions essential for maintaining patient safety and regulatory compliance. The shift toward outpatient care has boosted the importance of scalable, cost-effective monitoring tools that ensure sterilization efficacy without disrupting the operational flow in smaller clinical environments.

Drivers & Opportunities

Growth of Outsourced Sterilization Services: The growth of outsourced sterilization services is driving the growth opportunities, as healthcare facilities increasingly turn to third-party providers for efficient, standardized, and compliant sterilization processes. Outsourcing enables hospitals, ambulatory care services, and clinics to reduce operational burdens, minimize in-house costs, and focus on core clinical functions. In November 2023, CleanRooms International (CRI) was selected to design ISO 7 Sterile Processing Cleanrooms for Instrumentum, an outsourced provider, enhancing surgical instrument sterilization to deliver high-quality sterile processing for hospitals and surgery centers. However, as sterilization responsibilities shift to external vendors, the demand for strict monitoring solutions grows to ensure accountability and compliance with regulatory standards. Sterilization monitoring systems play a crucial role in validating the effectiveness of outsourced services, thereby offering healthcare providers the assurance needed to maintain patient safety and avoid procedural disruptions.

Increasing Adoption of Advanced Sterilization Technologies: The increasing adoption of advanced sterilization technologies, such as low-temperature hydrogen peroxide systems and ozone-based sterilization, is also driving the demand for refined monitoring solutions. In June 2024, Getinge launched the Poladus 150, a low-temperature sterilization system designed for heat-sensitive instruments and operating at temperatures of 55°C or lower. Its advanced barrier technology prevents cross-contamination, ensuring safe reprocessing of all instrument types while reducing HCAI risks. These advanced technologies, while offering faster cycles and compatibility with heat-sensitive instruments, require precise validation to guarantee their efficacy. The need for compatible and accurate monitoring tools becomes essential to detect any deviations in sterilization parameters as healthcare facilities implement these newer systems. Consequently, manufacturers are developing more specialized indicators and integrators that align with the technical demands of these innovations, further accelerating the U.S. sterilization monitoring market growth.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes biological indicators and chemical indicators. The biological indicators segment accounted for 57.17% revenue share in 2024 due to attributed to its high reliability in validating sterilization effectiveness. These indicators utilize live microbial spores, providing a direct measure of the lethality of the sterilization process, particularly in critical healthcare environments where assurance of sterility is essential. Their use is especially important in applications requiring validation of low-temperature sterilization technologies, which demand more precise and dependable monitoring. The growing regulatory focus on biologically-based validation has further supported the segment’s strong positioning in the market.

Product Analysis

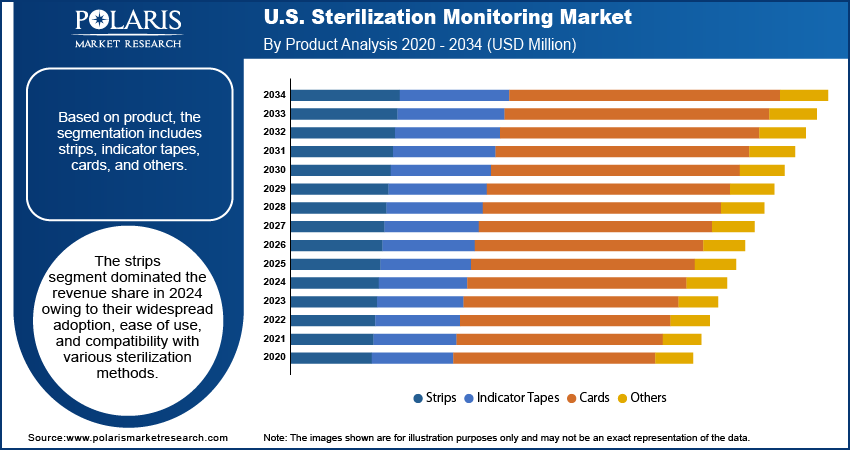

In terms of product, the segmentation includes strips, indicator tapes, cards, and others. The strips segment dominated the revenue share in 2024 owing to their widespread adoption, ease of use, and compatibility with various sterilization methods. These single-use indicators are favored across multiple healthcare environments due to their quick visual confirmation, cost-efficiency, and versatility. Their adaptability to both steam and gas-based sterilization methods makes them a preferred choice in routine sterilization processes. The demand for user-friendly and scalable solutions such as indicator strips remains strong as healthcare providers continue to prioritize operational efficiency and compliance.

Method Analysis

The segmentation, based on method, includes steam sterilization, ethylene oxide sterilization, hydrogen peroxide sterilization, and others. The hydrogen peroxide sterilization segment is expected to witness the fastest growth during the forecast period driven by its increasing use in sterilizing heat- and moisture-sensitive medical devices, as well as its shorter cycle times and environmentally friendly profile. The need for accurate and method-specific monitoring indicators is rising in parallel as healthcare facilities transition toward advanced, low-temperature sterilization solutions to accommodate a broader range of surgical instruments.

End Use Analysis

Based on end use, the segmentation includes hospitals & clinics, biopharma/biotech companies, ambulatory surgery centers, research and academic institutes, and other end use. The ambulatory surgery centers segment is expected to witness the fastest growth during the forecast period, fueled by the shift toward outpatient care and the increasing number of same-day surgical procedures. These centers often manage high patient throughput with limited resources, necessitating reliable, easy-to-implement sterilization monitoring tools to ensure patient safety and meet regulatory requirements. Demand for efficient and compliant sterilization monitoring solutions is expected to grow as ASCs continue to expand across regions to support decentralized care delivery.

Key Players & Competitive Analysis

The U.S. sterilization monitoring market is witnessing strategic investments and technological advancements as major players such as STERIS, 3M, and Getinge compete through innovative biological indicators and smart tracking systems. Emerging trends highlight a shift toward low-temperature sterilization solutions and automated monitoring platforms, creating revenue opportunities for both industry leaders and small and medium-sized businesses. Competitive intelligence reveals that vendors are focusing on sustainable value chains and expansion opportunities in developed markets, while addressing supply chain disruptions. Future development strategies highlight AI-powered sterilization validation and RFID-enabled indicators to meet latent demand for infection prevention. Regional footprint analysis shows concentrated growth in ambulatory surgical centers, with expert insights predicting increased adoption of rapid-read biological indicators. Vendor assessment indicates that differentiation through strategic partnerships and disruptive technologies will define competitive positioning. Pricing insights suggest cost pressures drive consolidation, while revenue growth analysis projects steady expansion due to strict regulatory requirements and rising surgical volumes.

A few major companies operating in the U.S. sterilization monitoring market include 3M (Solventum); ASP; Crosstex International, Inc.; Hu-Friedy Mfg. Co., LLC.; Mesa Labs, Inc.; Propper Manufacturing Co., Inc.; Sterilex; STERIS; True Indicating; and Tuttnauer USA.

Key Players

- 3M (Solventum)

- ASP

- Crosstex International, Inc.

- Hu-Friedy Mfg. Co., LLC.

- Mesa Labs, Inc.

- Propper Manufacturing Co., Inc.

- Sterilex

- STERIS

- True Indicating

- Tuttnauer USA

U.S. Sterilization Monitoring Industry Developments

- June 2025: Solventum launched the Attest Super Rapid VH₂O₂ Clear Challenge Pack, combining FDA-cleared biological and chemical indicators in a single-use transparent pack. The product supports sterilization monitoring, aligning with guidelines to reduce hospital-acquired infections through validated load-by-load verification.

- October 2023: ASP expanded its sterilization monitoring portfolio with new steam-focused products, including BIOTRACE readers/indicators, VERISURE chemical indicators, and SEALSURE tape. The solutions aim to enhance workflow efficiency and sterility assurance in healthcare sterile processing departments.

U.S. Sterilization Monitoring Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Biological Indicators

- Chemical Indicators

By Product Outlook (Revenue, USD Million, 2020–2034)

- Strips

- Indicator Tapes

- Cards

- Others

By Method Outlook (Revenue, USD Million, 2020–2034)

- Steam Sterilization

- Ethylene Oxide Sterilization

- Hydrogen Peroxide Sterilization

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals & Clinics

- Biopharma/Biotech Companies

- Ambulatory Surgery Centers

- Research and Academic Institutes

- Other End Use

U.S. Sterilization Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 230.67 Million |

|

Market Size in 2025 |

USD 243.58 Million |

|

Revenue Forecast by 2034 |

USD 401.79 Million |

|

CAGR |

5.72% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 230.67 million in 2024 and is projected to grow to USD 401.79 million by 2034.

The market is projected to register a CAGR of 5.72% during the forecast period.

A few of the key players in the market are 3M (Solventum); ASP; Crosstex International, Inc.; Hu-Friedy Mfg. Co., LLC.; Mesa Labs, Inc.; Propper Manufacturing Co., Inc.; Sterilex; STERIS; True Indicating; and Tuttnauer USA.

The strips segment dominated the revenue share in 2024.

The hydrogen peroxide sterilization segment is expected to witness the fastest growth during the forecast period.