U.S. Vaccine Storage & Packaging Market Size, Share, Trends, & Industry Analysis Report

By Function (Storage and Packaging), By End Use– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6363

- Base Year: 2024

- Historical Data: 2020-2023

Overview

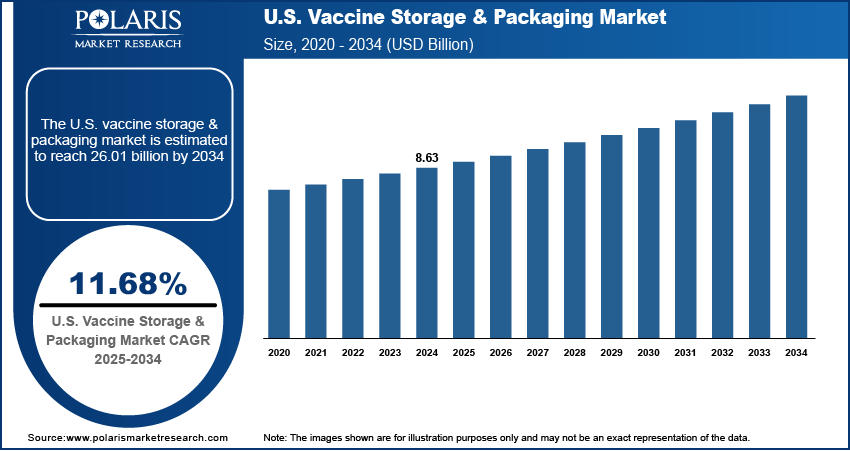

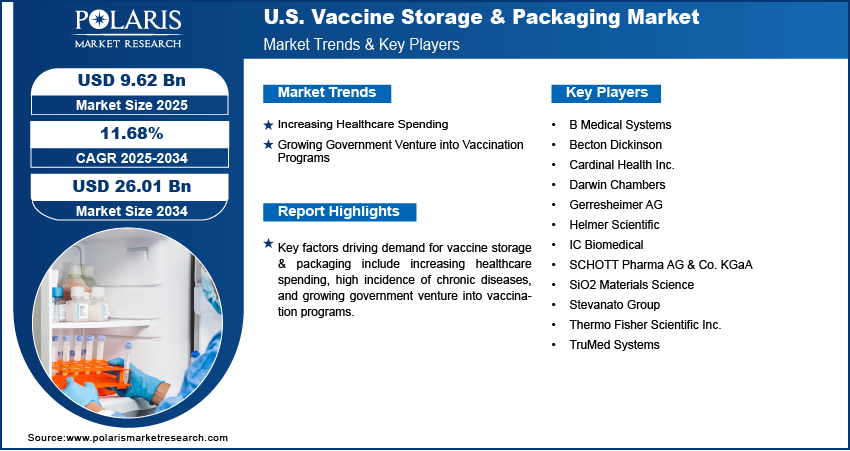

The U.S. vaccine storage & packaging market size was valued at USD 8.63 billion in 2024, growing at a CAGR of 11.68% from 2025 to 2034. Key factors driving demand for vaccine storage & packaging include increasing healthcare spending, high incidence of chronic diseases, and growing government venture into vaccination programs.

Key Insights

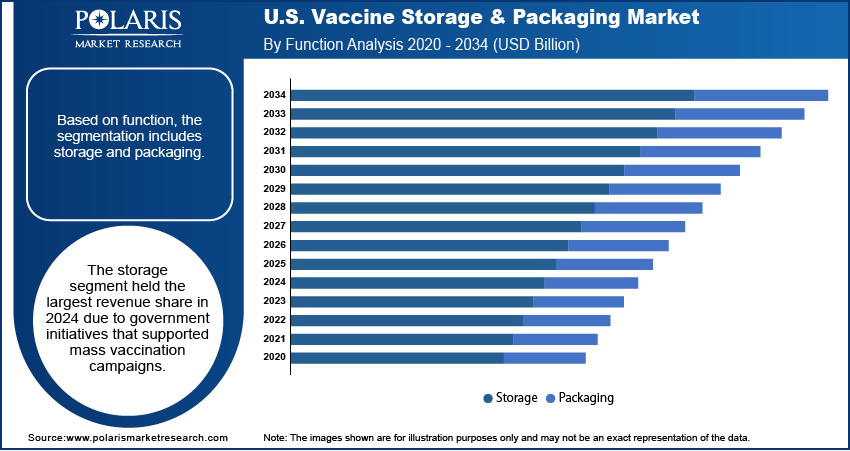

- The storage segment held the largest revenue share in 2024 due to government initiatives supporting mass vaccination campaigns.

- The distributors segment dominated the revenue share in 2024 due to their crucial role in ensuring vaccines reached healthcare facilities and immunization centers under strict temperature-controlled conditions.

Industry Dynamics

- The rising healthcare spending in the U.S. is driving demand for vaccine storage and packaging by propelling governments, hospitals, and private healthcare providers to invest more in advanced medical infrastructure.

- Growing government ventures into vaccination programs are fueling the demand for vaccine storage and packaging by expanding the scale and reach of immunization campaigns.

- Advancement in material science is creating a lucrative market opportunity.

- The risk of vaccine potency loss due to temperature excursions outside the recommended storage ranges, may hamper the market growth.

AI Impact on U.S. Vaccine Storage & Packaging Market

- AI optimizes cold chain logistics by predicting temperature fluctuations, ensuring vaccine integrity.

- Smart sensors with AI detect packaging breaches or storage deviations in real time.

- Predictive analytics enhances inventory management, reducing waste from expired vaccines.

- AI-driven automation improves packaging efficiency and traceability across supply chains.

Market Statistics

- 2024 Market Size: USD 8.63 Billion

- 2034 Projected Market Size: USD 26.01 Billion

- CAGR (2025-2034): 11.68%

Vaccine storage and packaging refer to the specialized systems, equipment, and materials used to maintain vaccines under controlled conditions to ensure their safety, potency, and effectiveness. Since vaccines are highly sensitive to temperature fluctuations, storage solutions such as refrigerators, freezers, insulated containers, and cold chain packaging are crucial. Packaging involves vials, prefilled syringes, and protective materials designed to prevent contamination and damage during handling and transportation. Proper vaccine storage and packaging guarantee that immunization programs achieve their intended impact by delivering viable doses to healthcare providers, pharmacies, hospitals, and remote regions without compromising product quality or patient safety.

The U.S. vaccine storage and packaging market plays a vital role in supporting one of the world’s largest immunization infrastructures. The country relies on robust cold chain logistics, temperature-controlled warehouses, and high-quality packaging materials, as demand for routine vaccinations, boosters, and advanced immunotherapies continues to rise. The U.S. Centers for Disease Control and Prevention (CDC) enforces strict guidelines for vaccine storage, ensuring compliance among healthcare providers and distributors. Expanding e-pharmacies, retail clinics, and government vaccination initiatives in the country are further fueling demand for reliable storage and packaging solutions.

The demand for vaccine storage & packaging in the U.S. is driven by the high incidence of chronic diseases. According to the Centers for Disease Control and Prevention, an estimated 129 million people in the US have at least one major chronic disease. This is driving healthcare agencies in the country to prioritize preventive measures, including vaccinations, to reduce complications and hospitalizations. This surge in vaccination campaigns targeting chronic disease-related infections is creating the need for storage and packaging to maintain vaccine efficacy. Patients with chronic diseases typically have weakened immune systems, making timely and effective vaccination crucial. This, in turn, is fueling the need for reliable cold chain logistics and secure packaging. Additionally, the development of specialized vaccines, such as those for shingles or pneumonia, is further propelling the need for temperature-controlled storage and tamper-evident packaging.

Drivers & Opportunities/Trends

Increasing Healthcare Spending: The rising healthcare spending in the U.S. is driving demand for vaccine storage and packaging by propelling governments, hospitals, and private healthcare providers to invest more in advanced medical infrastructure. According to the American Medical Association, health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion or $14,570 per capita. Higher spending is also leading to the adoption of advanced storage technologies, such as smart refrigeration and IoT-enabled monitoring systems, which ensure vaccines remain effective during storage and transportation. Growing healthcare spending is further encouraging medical facilities in the country to upgrade their storage capacities to accommodate a wider range of vaccines, including those for emerging diseases and specialized treatments. Additionally, increasing funding is supporting research and development in packaging innovations, such as temperature-controlled containers and tamper-proof designs, that enhance vaccine safety and accessibility.

Growing Government Venture into Vaccination Programs: Government involvement in vaccination programs in the U.S. is fueling the demand for vaccine storage and packaging by expanding the scale and reach of immunization campaigns. Governments in the country are investing in last-mile delivery solutions, such as portable cold boxes and insulated packaging, to ensure vaccines reach vaccination program locations safely. Stringent regulatory standards and public health goals are further pushing medical authorities to adopt innovative storage technologies and secure packaging, ensuring vaccine potency and safety throughout the supply chain. Therefore, the government-led vaccination initiatives are directly driving demand for reliable, scalable, and technologically advanced vaccine storage and packaging solutions.

Segmental Insights

Function Analysis

Based on function, the segmentation includes storage and packaging. The storage segment held the largest U.S. vaccine storage & packaging market share in 2024 due to government initiatives that supported mass vaccination campaigns. Hospitals, clinics, and immunization centers invested heavily in ultra-low temperature freezers, medical refrigerators, and advanced monitoring solutions to comply with Centers for Disease Control and Prevention (CDC) guidelines and ensure vaccine safety during handling. The surge in routine immunization programs, along with the need to safeguard sensitive mRNA-based vaccines, drove continuous demand for strong storage infrastructure.

The packaging segment is projected to grow at a robust pace in the coming years, owing to the rising focus on eco-friendly and recyclable packaging. Medical agencies in the country are increasingly relying on temperature-stable vials, prefilled syringes, and smart packaging with integrated data loggers to improve traceability and reduce the risk of spoilage. The rise of single-dose packaging formats, which minimize wastage and simplify administration during large-scale vaccination drives, is further expected to fuel segment growth.

End Use Analysis

In terms of end use, the segmentation includes retailers, forwarding & clearing agents, distributors, and others. The distributors segment dominated the U.S. vaccine storage & packaging market share in 2024 due to their crucial role in ensuring vaccines reached healthcare facilities, pharmacies, and immunization centers under strict temperature-controlled conditions. Distributors invested in advanced cold chain logistics, GPS-enabled tracking systems, and specialized refrigerated vehicles to minimize risks of temperature excursions. They also partnered with federal and state health agencies to expand vaccine access during mass immunization drives, which strengthened their dominance. The growing complexity of supply chains, particularly with mRNA vaccines requiring ultra-low temperature storage, further increased the reliance on distributors, contributing to their dominant position.

The retailers segment is estimated to grow at a rapid pace during the forecast period, owing to their increasing role in direct vaccine administration to the public. Pharmacies, supermarket clinics, and retail health chains continue to expand vaccination services, offering convenient and accessible points of care for millions of individuals. Retailers are investing in medical refrigeration systems and digital monitoring tools to ensure compliance with storage guidelines, which enhances consumer trust. The rise of seasonal flu vaccinations, COVID-19 boosters, and other adult immunizations administered at retail outlets is expected to drive segment growth. The growing partnerships between retail chains and vaccine manufacturers is also making retailers a key end user of vaccine storage & packaging solutions.

Key Players & Competitive Analysis Report

The U.S. vaccine storage and packaging market is highly competitive, driven by stringent regulatory standards and growing demand for temperature-sensitive vaccine distribution. Key players include Thermo Fisher Scientific Inc., Becton Dickinson, and Cardinal Health Inc., which dominate with comprehensive cold chain solutions. Companies such as B Medical Systems and Helmer Scientific specialize in advanced refrigeration systems, ensuring vaccine integrity. Packaging companies such as SCHOTT Pharma AG & Co. KGaA, Stevanato Group, and Gerresheimer AG focus on high-quality glass and polymer containers, addressing stability and safety. Innovators like SiO2 Materials Science offer cutting-edge container technologies with improved barrier properties. IC Biomedical and TruMed Systems provide specialized storage and validation services. Darwin Chambers supports with precision environmental chambers. The market is characterized by strategic partnerships, technological innovation, and a strong emphasis on compliance, scalability, and supply chain resilience to meet the evolving needs of public health.

Major companies operating in the U.S. vaccine storage & packaging industry include B Medical Systems, Becton Dickinson, Cardinal Health Inc., Darwin Chambers, Gerresheimer AG, Helmer Scientific, IC Biomedical, SCHOTT Pharma AG & Co. KGaA, SiO2 Materials Science, Stevanato Group, Thermo Fisher Scientific Inc., and TruMed Systems.

Key Companies

- B Medical Systems

- Becton Dickinson

- Cardinal Health Inc.

- Darwin Chambers

- Gerresheimer AG

- Helmer Scientific

- IC Biomedical

- SCHOTT Pharma AG & Co. KGaA

- SiO2 Materials Science

- Stevanato Group

- Thermo Fisher Scientific Inc.

- TruMed Systems

Industry Developments

September 2022, Becton, Dickinson and Company introduced a next-generation glass prefillable syringe (PFS) that sets a new standard in performance for vaccine PFS.

October 2021: Becton Dickinson announced an expansion of its injection production in the United States to ensure the safe and efficient operation of injection devices.

U.S. Vaccine Storage & Packaging Market Segmentation

By Function Outlook (Revenue, USD Billion, 2020–2034)

- Storage

- Storage Equipment

- Refrigerator

- Freezer

- Others

- Service

- Warehouse storage

- Transportation

- Storage Equipment

- Packaging

- Type

- Vaccine Bags

- Vials & Ampoules

- Bottles

- Corrugated Boxes

- Others

- Packaging Level

- Primary

- Secondary

- Tertiary

- Type

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Retailers

- Forwarding & Clearing Agents

- Distributors

- Others

U.S. Vaccine Storage & Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.63 Billion |

|

Market Size in 2025 |

USD 9.62 Billion |

|

Revenue Forecast by 2034 |

USD 26.01 Billion |

|

CAGR |

11.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 8.63 billion in 2024 and is projected to grow to USD 26.01 billion by 2034.

The market is projected to register a CAGR of 11.68% during the forecast period.

A few of the key players in the market are B Medical Systems, Becton Dickinson, Cardinal Health Inc., Darwin Chambers, Gerresheimer AG, Helmer Scientific, IC Biomedical, SCHOTT Pharma AG & Co. KGaA, SiO2 Materials Science, Stevanato Group, Thermo Fisher Scientific Inc., and TruMed Systems.

The storage segment dominated the market revenue share in 2024.

The retailers segment is projected to witness the fastest growth during the forecast period.