Usage Based Insurance Market Share, Size, Trends, Industry Analysis Report

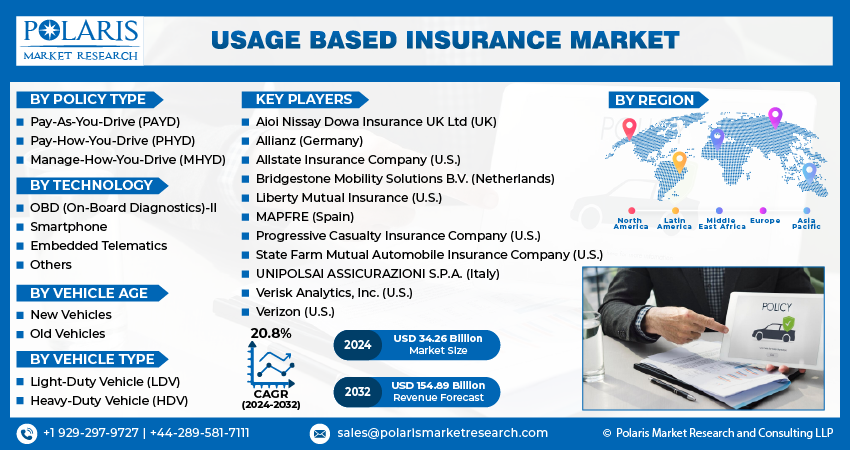

By Policy Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD)); By Technology; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4630

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

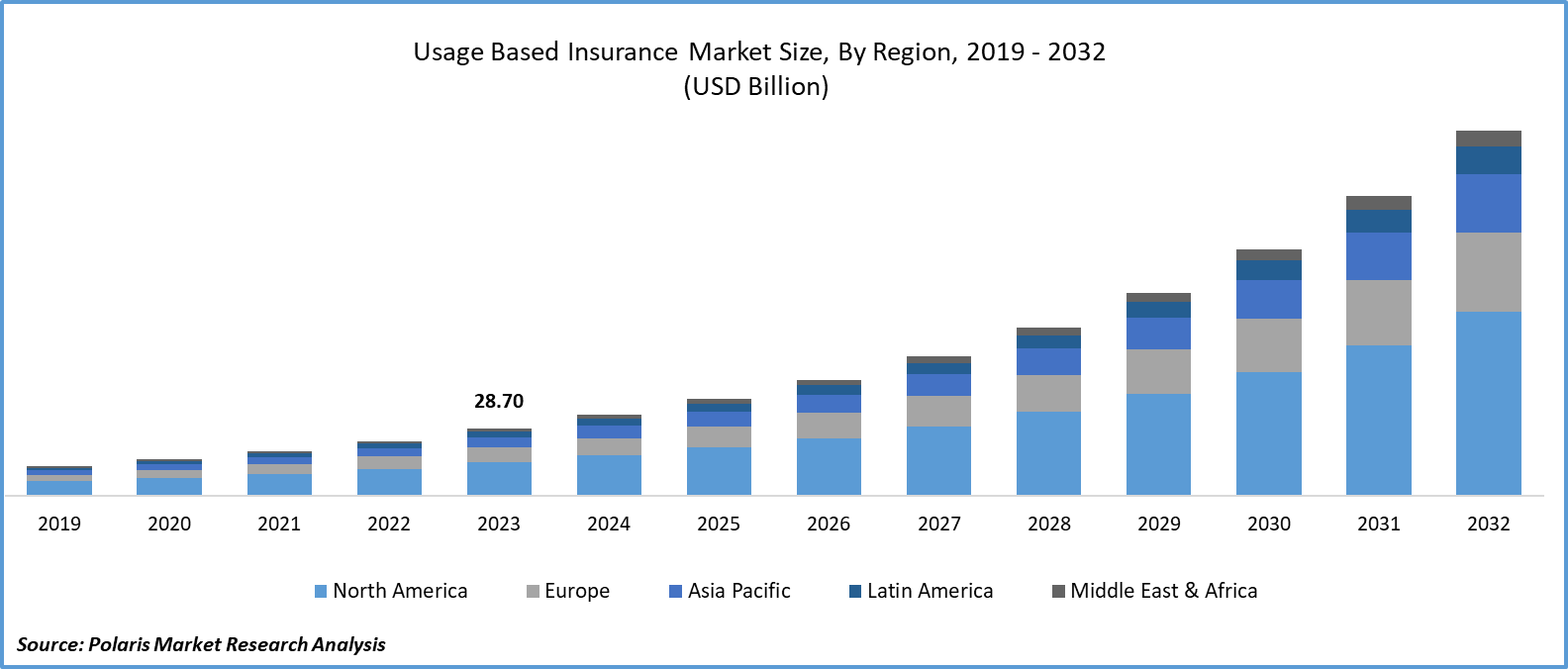

Usage based insurance market size was valued at USD 28.70 billion in 2023. The market is anticipated to grow from USD 34.26 billion in 2024 to USD 154.89 billion by 2032, exhibiting a CAGR of 20.8% during the forecast period.

Market Overview

The growing adoption of usage based insurance owing to the unique benefits of this insurance over the traditional insurance is a primary factor responsible for the market growth. Moreover, an increasing shift of consumers from traditional insurance model to usage based insurance will propel the market growth during the forecast period. Furthermore, rising production & distribution of vehicles coupled with the surging demand for customized insurance plans are also contributing to the usage based insurance market growth.

For instance, according to the recent statistics published by the International Organization of Motor Vehicle Manufacturers, in 2022, the production of vehicles in Malaysia and Indonesia witnessed an increase of around 46.0% and 31.0% compared to 2021.

The ability to monitor and analyze driving behavior in real time with the help of smartphone-centric solutions contribute to the market growth. Moreover, the benefit of usage based insurance to reduce cost savings for the policyholders is attracting a large population pool towards this insurance. Furthermore, factors such as regulatory support and increasing awareness related to the exceptional benefits provided by this data-driven model of insurance are propelling the growth of usage based insurance market.

To Understand More About this Research: Request a Free Sample Report

However, the high costs associated with the implementation and initial infrastructure required for usage based insurance limits the market growth. Moreover, problems related to privacy of customers during the data collection process and chances of cyber-attacks are expected to restrain the growth of usage based insurance market during the forecast timeframe. Furthermore, this technology fails to recognize whether hard braking and acceleration is used for defensive action or reckless driving. Such drawbacks are expected to impact the market growth negatively.

Growth Factors

Exceptional Benefits of Usage Based Insurance Over Traditional Insurance is Driving the Market Growth

Usage based insurance is one of the leading causes of the revolution taking place in the insurance sector. Usage based insurance is a personalized insurance that calculates the premium depending on the factors including driving behavior and distance travelled. The advantages such as rewards for safe driving, reduction in claim frauds, customized cost of insurance, and encouragement of better driving habits are expected to contribute to the growth of usage based insurance market during the forecast timeframe. Moreover, the ability of this insurance in accurate analysis of the accident cause and damage are attracting the millennial and GenZ. For instance, according to the consumer study conducted by Edelweiss General Insurance, millennials and GenZ across India want usage based insurance that rewards safe driving. Such strong intention to buy usage based insurance will boost the market growth in the upcoming years.

Regulatory Support and Strong Focus of Government Towards Usage Based Insurance will Prove Beneficial for the Market Growth

The increasing popularity of usage based insurance over traditional systems is attracting the insurers across various countries. The promising benefits provided by this insurance is also encouraging the regulatory bodies to implement usage based insurance in various countries. This insurance improves the driving skills and promote safer driving behaviour, which ultimately attracts the regulatory bodies. For instance, in July 2022, Insurance Regulatory and Development Authority of India (IRDAI) notified that Insurance companies could offer Usage Based Insurance (UBI) as add-ons to their own damage policies. This revolutionary change in motor insurance industry will significantly contribute to the increased growth of usage based insurance market in the coming years.

Restraining Factors

Several Disadvantages of Usage Based Insurance May Limit the Market Growth

However, there are several drawbacks to usage-based insurance. One of major disadvantages of this insurance system is the concern about customer privacy. The devices that are plugged into the cars track distance and location. Hence, the growing concern among potential customers about the misuse of this information will limit the expansion of usage based insurance market. Moreover, failure of this insurance system to record certain details such as hard braking and acceleration for defensive things will limit its adoption. For instance, some circumstances when child or animal is running into the road or in case of medical emergency, the policyholder could be punished for committing a perfectly reasonable and safe act.

Report Segmentation

The market is primarily segmented based on policy type, technology, vehicle age, vehicle type, and region.

|

By Policy Type |

By Technology |

By Vehicle Age |

By Vehicle Type |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Policy Type Insights

Pay-As-You-Drive (PAYD) Segment Captured the Largest Share of Usage Based Insurance Market

The Pay-As-You-Drive (PAYD) segment held the largest market share in 2023. In this type, the premium of a customer is calculated based on distance covered. The large share of this segment is owing to the option provided for selecting the slab of distance as per the usage of an individual. Moreover, advantages such as own damage and third-party liability coverage, the flexibility to enhance the car insurance policy by adding extra coverage, and the ability to receive maximum discounts based on the number of miles driven are anticipated to support the segmental growth in the coming years.

By Technology Insights

The Smartphones Segment is Expected to Witness Significant Growth in the Coming Years

The smartphones segment is projected to register the significant CAGR during the forecast period. Nowadays, smartphones can send the information and are connected to cars. The availability of inbuilt sensors such as GPS, accelerometers, and gyroscopes in smartphones is propelling the segmental growth. Moreover, a large storage capacity, superior processing power, and cloud-integration leading to the reduction in data handling & storage costs will prove beneficial for the segmental growth.

By Vehicle Age Insights

The New Vehicles Segment is Expected to Gain Significant Popularity in the Usage Based Insurance Market

The new vehicles segment is anticipated to experience significant growth during the projected years. The segmental growth is attributed to the increasing demand for usage based insurance from millennials and GenZ and rising production and sales of new vehicles. For instance, according to the recent statistics published by the International Organization of Motor Vehicle Manufacturers, in 2022, the production of new vehicles in Mexico increased by 9.8% compared to 2021. Moreover, the strong focus of automotive manufactures towards production of cars with pre-installed telematic devices, connected car technology, and sensors will prove beneficial for the growth of usage based insurance market.

Regional Insights

North America Usage Based Insurance Market was the Largest in 2023

North America accounted for the considerable share of the market in 2023. The large share of this region is attributed to the increasing popularity of the usage based insurance owing to the unique benefits provided by them. Moreover, the growth in the number of vehicles sold and rising government initiatives to promote this insurance systems will positively influence the market growth in the coming years. Furthermore, increasing focus of market players towards innovative marketing strategies coupled with the growing availability of apps to assist the drivers is propelling the market growth. For instance, in February 2022, Mercury Insurance made its usage-based insurance app, MercuryGO available in New Jersey, U.S. With the help of skill scores provided by this app, drivers can get immediate feedback on their driving habits.

Asia Pacific is the Fastest Growing Market

Asia Pacific region is projected to be the fastest-growing market in the coming years. The highest rates of car ownerships in this region coupled with the increasing need for cost-effective insurance solutions are expected to fuel the market growth during the forecast period. Moreover, increased affordability to low risk customers and reduction in fraudulent claims are the benefits that drives the adoption of usage based insurance in Asia Pacific region. Furthermore, strategic initiatives such as collaborations and partnerships among market players to provide usage based insurance in Southeast Asia will propel the market growth. For instance, in December 2020, Mitsui Sumitomo Insurance Group (MSIG) and automotive marketplace Carro announced their partnership to introduce the first usage based car insurance programme in Southeast Asia.

Key Market Players & Competitive Insights

Launch of New Policies and Collaborations are Strengthening the Market Share of the Companies

In terms of competitive scenario, the usage based insurance market is consolidated. The companies such as Progressive Casualty Insurance Company, UNIPOLSAI ASSICURAZIONI S.P.A., Allstate Insurance Company, Liberty Mutual Insurance, and State Farm Mutual Automobile Insurance Company account for the significant share in the market. The increasing focus of companies towards the launch of new usage based insurance policies and growing collaborations between the market players are the factors responsible for the competitive environment in the market. For instance, in December 2020, Progressive Casualty Insurance Company offered Snapshot ProView which is a voluntary usage based insurance and fleet management program for small business owners.

Some of the major players operating in the global market include:

- Aioi Nissay Dowa Insurance UK Ltd (UK)

- Allianz (Germany)

- Allstate Insurance Company (U.S.)

- Bridgestone Mobility Solutions B.V. (Netherlands)

- Liberty Mutual Insurance (U.S.)

- MAPFRE (Spain)

- Progressive Casualty Insurance Company (U.S.)

- State Farm Mutual Automobile Insurance Company (U.S.)

- UNIPOLSAI ASSICURAZIONI S.P.A. (Italy)

- Verisk Analytics, Inc. (U.S.)

- Verizon (U.S.)

Recent Developments in the Industry

- In February 2023, Zuno General Insurance announced its plans to expand its ‘usage-based insurance products’ portfolio.

- In February 2022, State Farm Mutual Automobile Insurance Company and Ford introduced Drive Safe & Save Connected Car for consumers with eligible connected Ford or Lincoln vehicles, to benefit from usage-based insurance (UBI).

Report Coverage

The usage based insurance market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, policy type, technology, vehicle age, vehicle type, and their futuristic growth opportunities.

Usage Based Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 34.26 billion |

|

Revenue forecast in 2032 |

USD 154.89 billion |

|

CAGR |

20.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Usage Based Insurance Market report covering key segments are policy type, technology, vehicle age, vehicle type, and region.

Usage Based Insurance Market Size Worth USD 154.89 Billion By 2032

Usage based insurance market exhibiting a CAGR of 20.8% during the forecast period.

North America is leading the global market

key driving factors in Usage Based Insurance Market are Regulatory support and a strong focus of government towards usage based insurance