Veterinary Imaging Market Share, Size, Trends, Industry Analysis Report

By Therapeutic Area (Orthopedics & Traumatology, Obstetrics & Gynecology, Oncology, Cardiology, Neurology, Dentistry, Others); By Product; By Animal Type; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 111

- Format: PDF

- Report ID: PM2331

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

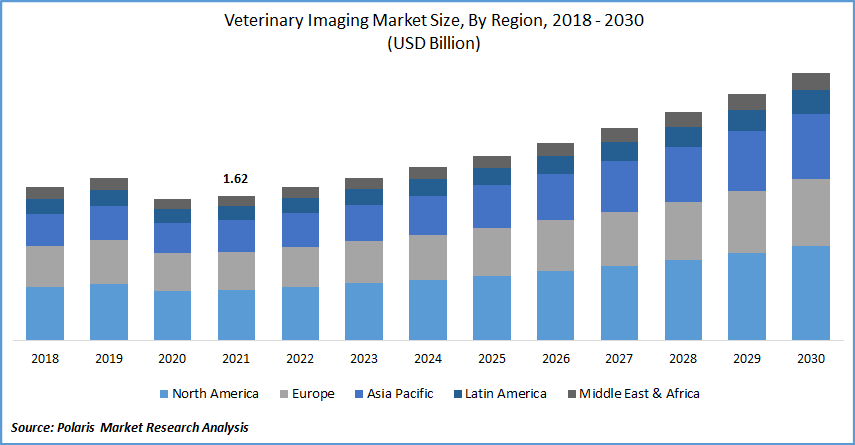

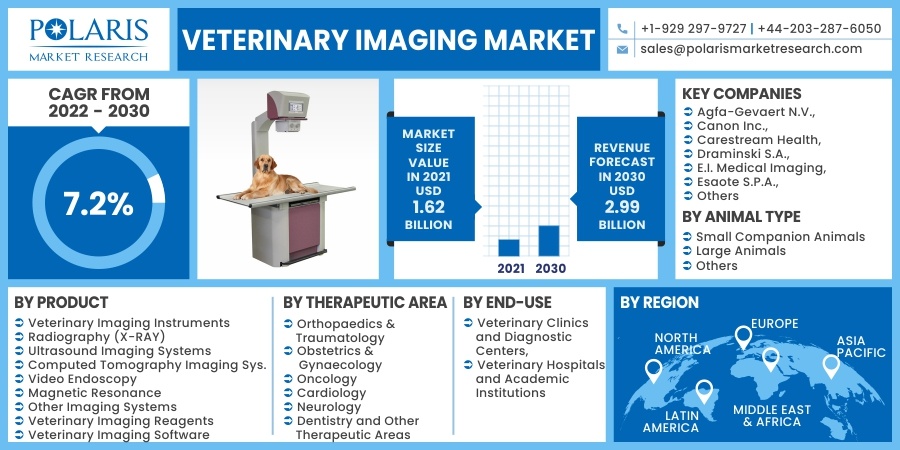

The global veterinary imaging market was valued at USD 1.62 billion in 2021 and is expected to grow at a CAGR of 7.2% during the forecast period. The increasing prevalence of veterinary diseases is driving the market growth during the forecast period. The need for these products has risen dramatically due to frequent disease outbreaks among animals.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Increased knowledge of such diseases and potentially early detection strategies to avert outbreaks are expected to boost the global industry growth in the coming years. Animal illnesses can kill people and destroy economies. The emergence of livestock sickness can be a huge economic burden for countries whose economies are heavily reliant on animals.

As a result, quick diagnosis of farm animals is critical. As a result, increased worries about veterinary diseases such as cardiovascular disease, cancer, and orthopedic disorders are likely to contribute to the global market's growth throughout the forecast period. Furthermore, veterinarian treatment is gradually shifting away from traditional X-ray films and digital radiography to shorten diagnosis turnaround time and provide greater convenience to pet owners and animals.

Digital radiography is a type of X-ray different from traditional projection radiography. Instead of photographic film, it uses digital X-ray detectors. The fundamental benefit of digital detectors is that a complete picture archiving and communication system (PACS) can be created, photos may be saved digitally, and they can be accessed at any time and from any location.

To stay up with the growing demand for digital radiography systems, industry participants in the veterinary imaging market are focused on forming partnerships/acquiring companies to develop innovative systems. However, advanced diagnostic instruments for animals necessitate the operation and use of trained and certified specialists. In some parts of the world, a scarcity of qualified specialists is one of the major challenges limiting demand for this equipment.

Both industrialized and developing countries face a shortage of professional and qualified workforce, making adopting such technology difficult. According to the South African Qualifications Authority (SAQA), the international norm for veterinarians per million people is between 200 and 400. However, in South Africa, the figure is closer to 60 to 70.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Companies in the marketplace are focusing on expanding their geographical reach through acquisitions and strategic agreements. For instance, in September 2021, Heska Corporation (US) stated that it had acquired a controlling stake in Biotech Laboratories USA LLC, bringing its global product line and intellectual property portfolio to a new level.

In addition, in August 2021, Esaote signed a strategic agreement with the Magnet Group, giving the latter and its members' full access to the company North America's business comprising of such products and services. Esaote expanded its consumer base and reached due to this relationship. As a result, the market expansion is being driven by important company acquisitions and innovations over the forecast period.

Report Segmentation

The market is primarily segmented based on product, therapeutic area, animal type, end-use, and region.

|

By Product |

By Therapeutic Area |

By Animal Type |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by End-Use

Based on the end-use segment, the veterinary hospital segment is accounted for the largest revenue share. During the forecast period, the availability of all imaging equipment to identify various diseases in animals and the increasing number of veterinary care experts in hospitals are expected to fuel the growth of this segment.

Geographic Overview

North America had the largest revenue share in the global veterinary imaging market. Some of the key contributions to the region's dominance are the high adoption of companion animals by the general public in the United States and Canada, large spending on pet care, expanding employment in the veterinary field, and attractive reimbursement scenarios.

According to new industry-wide expenditure estimates released at this year's Global Pet Expo in Orlando, Florida, Americans spent USD 100 billion on their dogs in 2020. Furthermore, due to the region's significant concentration on launching innovative items, the penetration of technologically advanced tomography products is higher. It is expected to help the market's growth in the region.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. The Asia-Pacific region offers lucrative prospects for key participants in the veterinary imaging market, increased knowledge of this tomography, and the growing adoption of companion animals, all of which contribute to market growth.

Furthermore, rising disposable income, improved animal health spending, the increased importance of livestock animals, increased demand for protein-rich animal food, increased meat, and dairy product consumption, and an increase in the number of veterinary hospitals with advanced tomography systems all contribute to market growth.

Competitive Insight

Some of the major players operating in the global market include Agfa-Gevaert N.V., Canon Inc., Carestream Health, Draminski S.A., E.I. Medical Imaging, Esaote S.P.A., Fujifilm Holdings Corporation, GE Healthcare, Heska Corporation, IDEXX Laboratories, Inc., Konica Minolta Inc., Mindray Medical International Limited, SAMSUNGMEDICALSOLUTION.COM, Sedecal, and Siemens Healthineers.

Veterinary Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.62 billion |

|

Revenue forecast in 2030 |

USD 2.99 billion |

|

CAGR |

7.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Therapeutic Area, By Animal Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Agfa-Gevaert N.V., Canon Inc., Carestream Health, Draminski S.A., E.I. Medical Imaging, Esaote S.P.A., Fujifilm Holdings Corporation, GE Healthcare, Heska Corporation, IDEXX Laboratories, Inc., Konica Minolta Inc., Mindray Medical International Limited, SAMSUNGMEDICALSOLUTION.COM, Sedecal, and Siemens Healthineers. |