Wearable Sensors Market Size, Share, Trends, Industry Analysis Report

: By Sensor Type, Technology, Device (Smartwatch, Fitness Band, Smart Glasses, Smart Fabric, Smart Footwear, and Others), End Users, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM1470

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

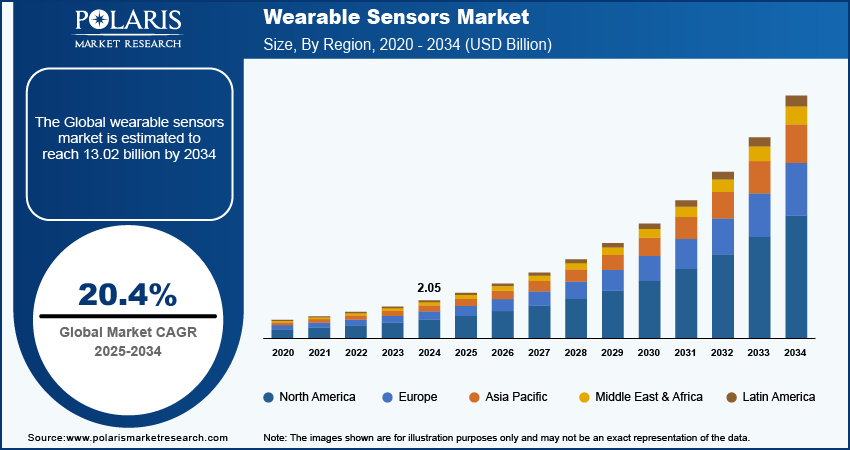

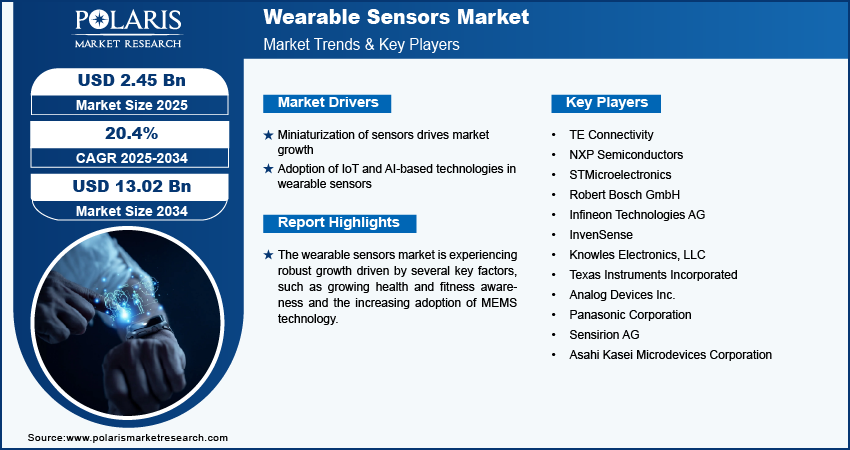

The wearable sensors market size was valued at USD 2.05 billion in 2024 and is projected exhibit a CAGR of 20.4% from 2025 to 2034. The wearable sensors demand is driven by several key factors, such as growing health and fitness awareness and the increasing adoption of MEMS technology. People are focusing on their well-being and actively seeking ways to monitor their health metrics.

Wearable sensors are advanced devices designed to monitor and collect data about an individual's physiological and biochemical parameters in real-time, often in a non-invasive manner. These sensors are integrated into various wearable technologies, such as smartwatches, fitness trackers, smart clothing, and even tattoo-like devices. They serve multiple purposes, including health monitoring, fitness tracking, and providing insights into personal well-being.

MEMS technology allows for the miniaturization of sensors, making them smaller, lighter, and more energy-efficient. This miniaturization enables seamless integration of these sensors into various wearable devices, enhancing their functionality and user comfort. The ongoing advancements in MEMS technology are expected to lead to the development of even more sophisticated and versatile sensors, further driving growth.

To Understand More About this Research: Request a Free Sample Report

Rising disposable incomes, especially in developing economies, are a major factor driving the industry. Wearable sensors that monitor physical activity, heart rate, and sleep patterns align well with this trend. People are now able to invest in advanced health and fitness trackers due to their improved financial situations. This growing willingness to spend on advanced wearable technology is leading to a significant increase in revenue.

Market Dynamics

Miniaturization of Sensors

The miniaturization of sensors is transforming the wearable devices by allowing sophisticated monitoring capabilities to be incorporated into smaller designs. This advancement makes wearable technology more appealing as devices can now perform complex functions. The ability to include powerful sensors in smaller packages caters to consumers looking for efficient and user-friendly health and fitness monitoring solutions. Miniaturization allows for the development of compact, comfortable, and functional wearable devices like the OHSU-ADI smartwatch, a device developed in December 2022 by Oregon Health and Science University (OHSU) in collaboration with Analog Devices, Inc (ADI). This smartwatch serves as an early detector of suicidality or depression among teenagers, offering precise, continuous health data unobtrusively, making it suitable for everyday use by individuals of all ages, thereby driving growth.

Adoption of IoT and AI-Based Technologies in Wearable Sensors

The adoption of IoT (Internet of Things) technologies and AI (artificial intelligence) technologies in wearable sensors significantly boosts their demand by enhancing functionality, improving user experience, and expanding applications in healthcare and personal wellness. AI algorithms improve the accuracy of data collected by wearable sensors, enabling better detection of health issues. For instance, AI corrects inaccuracies in heart rate measurements, ensuring reliable data for users and healthcare providers. This reliability increases trust in wearable devices, encouraging more consumers to adopt them.

Segment Analysis

Market Assessment by Sensor Type

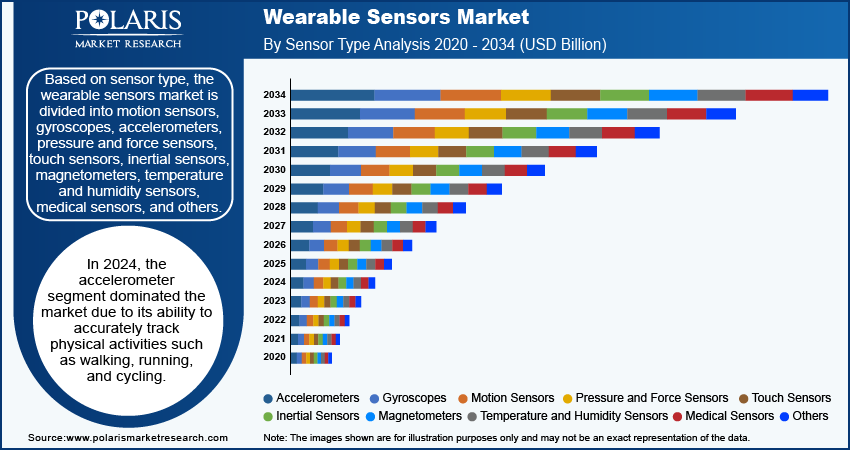

Based on sensor type, the market is segmented into motion sensors, gyroscopes, accelerometers, pressure and force sensors, touch sensors, inertial sensors, magnetometers, temperature and humidity sensors, health sensors, and others. In 2024, the accelerometers segment dominated in 2024 due to its ability to accurately track physical activities such as walking, running, and cycling. They provide precise measurements of movement and orientation, enabling wearable devices to differentiate between various types of physical activity. This capability is essential for fitness enthusiasts who seek detailed insights into their performance and activity levels. Moreover, the rise of smartwatches, which generally incorporate accelerometers, has significantly contributed to the demand for these sensors.

Market Evaluation by Device

Based on device, the market is segmented into smartwatches, fitness bands, smart glasses, smart footwear, smart socks and others. The fitness band segment is expected to experience significant growth. This growth is driven by increasing demand from young consumers for affordable fitness trackers and continuous technological advancements. In March 2023, Infineon Technologies introduced SECORA Connect X, a low-power NFC chip designed for fitness bands, rings, and smartwatches. This integrated solution enables secure contactless payments and wireless charging, ultimately enhancing user experience due to its compact size and efficiency, which boosts battery life. Such developments are expected to drive the segment growth.

Regional Insights

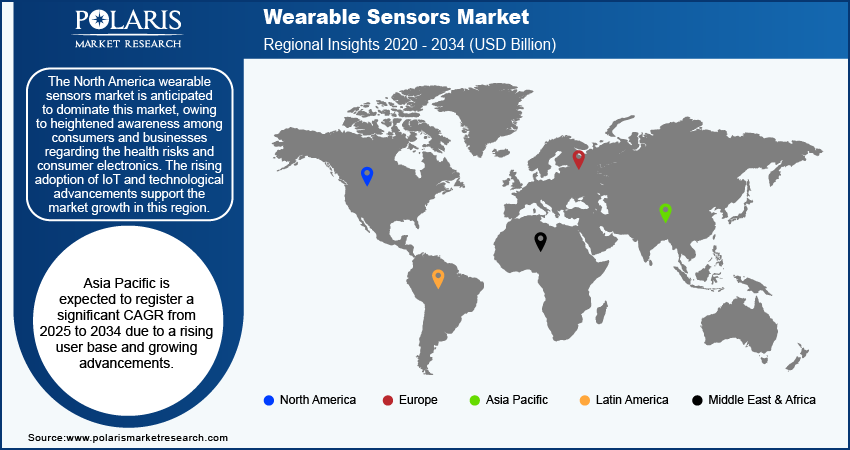

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America dominated the share, owing to heightened awareness among consumers and businesses regarding health risks and consumer electronics. The rising adoption of IoT and technological advancements also support the growth in this region.

The key players are merging, acquiring, and collaborating to strengthen their presence and serve better offerings in North America, further driving the market during the forecast period. The United States wearable sensors market has garnered the largest share in the region due to the rising consumer health awareness and growing healthcare sector.

The Asia Pacific wearable sensors market, is expected to register the fastest CAGR from 2025 to 2034 due to the growing user base and increasing disposable incomes. Moreover, growing urbanization, expanding e-commerce industry, and advancement in technology are propelling the growth of the region. China is expected to witness significant growth in the region during the forecast period, owing to the presence of major technology companies.

Key Players & Competitive Analysis Report

Major players are investing heavily in research and development in order to expand their product lines, which will help the market grow even more. Participants are also undertaking a variety of strategic activities to expand their global footprint, with important developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive environment, the wearable sensors industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers to benefit clients and increase the sector. In recent years, the market has witnessed some technological advancements. Major players in the include Infineon Technologies AG; Texas Instruments Inc.; Broadcom Limited; Asahi Kasei Microdevices Corporation; NXP Semiconductors N.V.; Robert Bosch GmbH; Invensense, Inc.; TE Connectivity Ltd.; Knowles Electronics, LLC; and Panasonic Corporation.

Infineon Technologies AG, headquartered in Neubiberg, Germany, is a leading global semiconductor company with around 58,000 employees. Founded as a spin-off from Siemens in 1999, Infineon specializes in semiconductor solutions across four main segments. The Automotive segment provides chips for electric vehicles, automated driving, and safety systems. The Green Industrial Power segment focuses on power semiconductors for energy generation, industrial drives, and renewable energy applications. The Power & Sensor Systems segment offers power management components, sensors, and connectivity solutions for consumer electronics and IoT devices. Lastly, the Connected Secure Systems segment delivers embedded security controllers for payment systems, government IDs, and secure connectivity. Infineon operates globally with more than 150 locations, serving regions in Europe, Asia Pacific, Greater China, Japan, and the Americas. Its innovative technologies drive advancements in electromobility, energy efficiency, and digital security, making it a key player in the semiconductor industry worldwide.

STMicroelectronics (ST) is a semiconductor company headquartered in Geneva, Switzerland, established in 1987. It designs and manufactures a variety of semiconductor products used in automotive, industrial, personal electronics, and communication applications. The company’s product range includes microcontrollers, analog and power devices, MEMS sensors, application-specific integrated circuits (ASICs), and smartcards. ST’s main business segments cover automotive systems, such as electric vehicle components and driver-assistance technologies; industrial uses, including factory automation and energy management; personal electronics, like mobile devices and wearables; and communication products, such as networking and wireless connectivity chips. The company operates manufacturing sites in Italy, Singapore, France, Morocco, the Philippines, Malta, Malaysia, and China. Its sales and marketing offices are located in more than 35 countries. The Asia Pacific region accounts for about 59% of its revenue, with the Americas and Europe making up the remainder. It recently introduced advanced wearable sensors for improved health and fitness tracking, ideal for consumer and medical applications.

List of Key Companies in Wearable Sensors Market

- Infineon Technologies AG

- Texas Instruments Inc.

- Broadcom Limited

- Asahi Kasei Microdevices Corporation

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Invensense, Inc. (TDK Corporation)

- TE Connectivity Ltd.

- Knowles Electronics, LLC

- Panasonic Corporation

- Analog Devices Inc.

Wearable Sensors Market Developments

January 2025: A wearable stress-detecting system, inspired by human pain perception and developed using a silver wire network, was launched by JNCASR to enable adaptive, intelligent sensing for healthcare and robotics applications.

May 2024: Asahi Kasei announced a new facility in Port Colborne, Ontario, Canada. This facility will be dedicated to manufacturing lithium-ion battery separators. This move demonstrates Asahi Kasei's commitment to supporting the market by improving battery technologies essential for portable and wearable devices.

January 2023: Asahi Kasei Corporation unveiled the AK09940A, a 3-axis magnetic sensor designed for superior motion tracking in AR/VR and wearables. Its exceptional low noise and power consumption enhance accuracy in these applications. The sensor excels at pinpointing subtle magnetic field changes, enabling precise fault and position detection. Notably, its energy efficiency makes it ideal for battery-powered wearables and IoT devices.

October 2023: Infineon Technologies AG introduced the XENSIV radar sensors for sleep tracking, which are integrated into wearables. They offer detailed sleep data on stages and respiration, improving user health awareness and boosting the market.

May 2024: Bosch Ventures made strategic investments in cleantech, including battery recycling technologies. According to Bosch, these investments are crucial for the development and maintenance of high-performance batteries used in wearable sensors, contributing to the overall sustainability and efficiency of wearable technology.

Wearable Sensors Market Segmentation

By Sensor Type Outlook

- Motion Sensors

- Gyroscopes

- Accelerometers

- Pressure and Force Sensors

- Touch Sensors

- Inertial Sensors

- Magnetometers

- Temperature and Humidity Sensors

- Medical Sensors

- Others

By Technology Outlook

- MEMS

- CMOS

- Others

By Device Outlook

- Smartwatch

- Fitness Band

- Fitness Bands

- Smart Glasses

- Smart Fabric

- Others

By End Users Outlook

- Consumer

- Healthcare

- Industrial

- Defense

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wearable Sensors Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.05 billion |

|

Market Size Value in 2025 |

USD 2.45 billion |

|

Revenue Forecast in 2034 |

USD 13.02 billion |

|

CAGR |

20.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The wearable sensors market size was valued at USD 2.05 billion in 2024 and is projected to grow to USD 13.02 billion by 2034

The market is projected to register a CAGR of 20.4% from 2025 to 2034.

North America is anticipated to dominate the market.

The key players in the market are Infineon Technologies AG; Texas Instruments Inc.; Broadcom Limited; Asahi Kasei Microdevices Corporation; NXP Semiconductors N.V.; Robert Bosch GmbH; Invensense, Inc.; TE Connectivity Ltd.; Knowles Electronics; LLC; and Panasonic Corporation.

The accelerometer segment dominated the market in 2024.

The fitness band segment is anticipated to experience significant growth in the market.