White Cement Market Share, Size, Trends, Industry Analysis Report

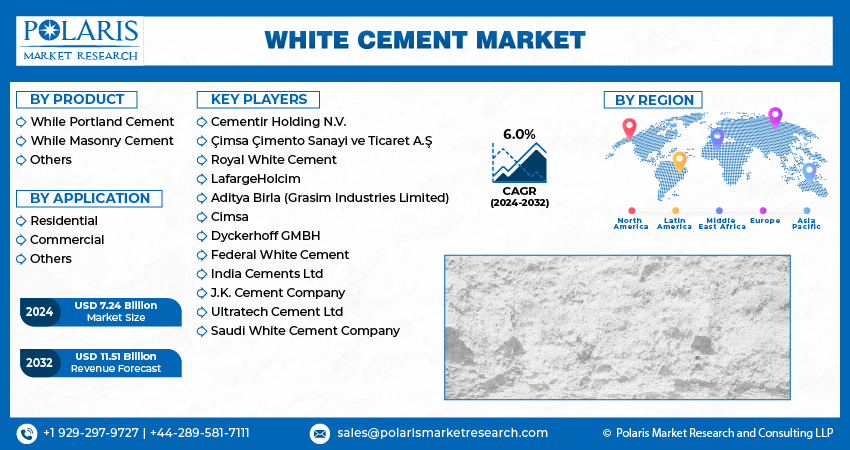

By Product (While Portland Cement, While Masonry Cement, Others), By Application (Residential, Commercial, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4258

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

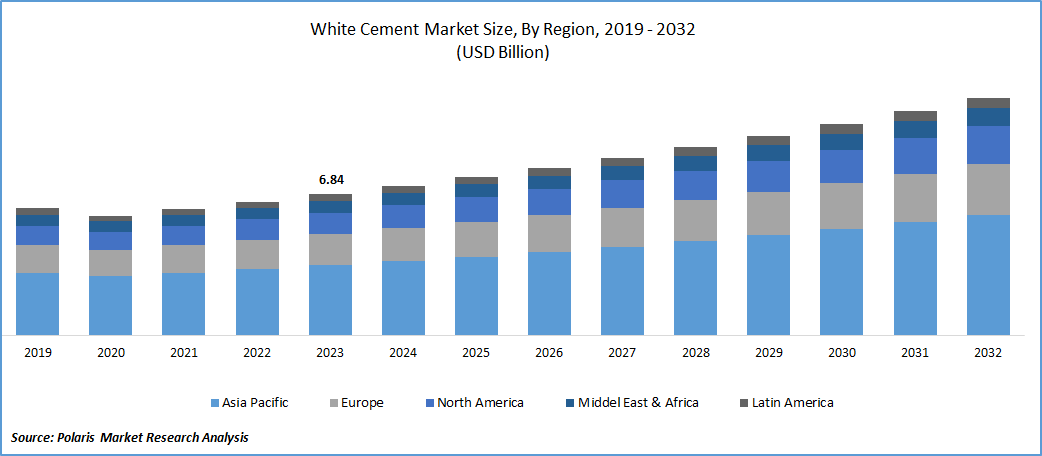

The global white cement market share was valued at USD 6.84 billion in 2023 and is expected to grow at a CAGR of 6.0% during the forecast period.

The rise in global construction spending is anticipated to fuel industry growth. White cement, crafted from non-iron raw materials such as China clay and white limestone, along with low-coloring component materials like Fe, Mn, Cr, and Ti, stands out for its essential characteristic: whiteness content. It is manufactured in separate kilns, making it more expensive than standard Portland cement.

White cement offers a wide array of noncombustible finishes, ranging from cement plaster (stucco) to masonry and decorative cast items. These finishes achieve color through a blend of white cement and pigments. Ornamental concrete pieces, like Cast Stone, are employed as building accents, mimicking natural cut stone. It serves as an architectural feature, trim, & facing for the buildings. Besides its use in new constructions, Cast Stone proves to be a cost-effective repair material for historic buildings, which were originally made from natural materials, that might not be readily available or durable enough for contemporary exposure conditions.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the white cement market based on SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

To Understand More About this Research: Request a Free Sample Report

The market's value chain includes raw material suppliers, manufacturers, distributors, and end-users. Raw material suppliers offer machinery, tools, limestone, and additives to manufacturers. The manufacturers are responsible for grinding, processing, and refining the raw materials to create white cement. The utilization of white cement is primarily influenced by construction practices within a country, the economic capacity of its residents, the country's GDP, and initiatives by manufacturers and other stakeholders to promote new applications of white cement in construction. In residential construction, the white cement market finds key applications in repair projects, tile installation, and prefabricated items due to its quality, versatility, aesthetic appeal, and range of available products.

Growth Drivers

Growing Construction Industry

In recent years, the U.S. market has experienced substantial growth, driven by rising demand for products in both commercial and residential construction projects. According to TST Europe, in 2022, commercial construction spending reached approximately USD 97.00 billion, while single-family residential building spending amounted to USD 404.00 billion. Additionally, multifamily residential construction spending in the U.S. was USD 119.00 billion in 2022, with a projected increase to USD 123.00 billion by the end of 2023, indicating a 4% rise in construction expenditure.

White cement is frequently used as a substitute for grey cement due to its added benefits like heat reflection and enhanced visual charm. Its demand is particularly high in nations with warm climates because it creates a white concrete surface that reflects more heat compared to standard grey concrete. Additionally, it is a readily accessible construction material that proves effective in diverse applications, enhancing the aesthetics and performance of pavements, buildings, and various other structures.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

White Portland Cement Segment Dominated the Market over the Forecast Period

White Portland cement segment held the largest share. White Portland cement, as the name implies, is a variety of cement distinguished by its white color. In terms of properties and texture, it is indistinguishable from standard grey Portland cement, differing solely in color and fineness. This segment is anticipated to experience growth during the forecast period due to its composition, including iron oxide and manganese oxide, which makes it well-suited for applications like designer flooring, paver tiles, stonecrete walls, grit wash walls, and tyrolean walls.

Employing white cement for architectural and decorative concrete offers the advantage of creating a neutral tinting base and ensuring consistent color outcomes. It comes in a spectrum of colors, ranging from pure whites to vibrant and pastel shades. White cement production adheres to the Portland Cement Specification outlined by the American Society for Testing and Materials (ASTM International) under the C 150 standard. While Types I and III are the most common, Types II and V are also produced.

Masonry cement will grow at a rapid pace. This is primarily due to its immediate usability at construction sites. It ensures consistent workability, enhances board life, and results in a cohesive mix. There are two main types of white masonry cement: Type N, primarily utilized in standard masonry construction, and Type S, employed in masonry structures requiring over double the strength of Type N.

By Application Analysis

Residential Segment Accounted for the Largest Share in 2023

Residential segment accounted for the largest market share. White cement finds extensive use in residential applications due to its superior compressive strength, minimal alkali content, and appealing aesthetics. The increasing housing sector in developing nations like India is poised to drive product demand, particularly in applications like cast-in-situ floorings, marble/tile installation, mosaic tile manufacturing, wall finishes, whitewashing, and repair work.

The promising expansion of the residential sector in emerging markets, facilitated by accessible home loans, is anticipated to significantly influence market growth in the next seven years. Furthermore, advancements in product offerings utilizing cutting-edge technology and simplified installation processes are expected to propel market growth within the residential application segment during the forecast period.

Commercial segment will grow at a rapid pace. This growth is attributed to the escalating demand for durable and cost-effective cement in high-traffic commercial sectors. The introduction of new products like Ready-Mix Concrete (RMC), various ready-to-use dry mix mortars, and stamped concrete has notably stimulated market expansion. Furthermore, white cement is becoming an economical choice in sectors due to the enhanced awareness of architectural concepts among end-users.

Regional Insights

Asia Pacific Region Accounted for the Largest Share of the Global Market in 2023

The strong demand for the product in both residential and non-residential construction sectors in emerging economies is set to drive market growth. The product has gained significant traction in the regional construction industry due to the widespread presence of leading manufacturers. In the third quarter of 2022, China's Ministry of Finance and National Development announced intentions to invest approximately CNY 500 billion (USD 74 billion) in enhancing state infrastructure, aiming to boost infrastructure expenditure.

North America registered a substantial growth rate. The region is poised for substantial growth in the upcoming years due to the rising construction activities in both residential and commercial sectors within the region. There is a notable trend towards domestic production of white cement, driven by the escalating demand for flooring and walling applications. Additionally, the requirement for upgrading existing buildings and structures in the region is anticipated to boost the demand for white cement in both residential and commercial constructions.

Key Market Players & Competitive Insights

To sustain their competitive edge and market presence, key players are employing diverse strategies such as expanding their businesses, making acquisitions, launching new products, and fostering collaborations.

Some of the major players operating in the global market include:

- Cementir Holding N.V.

- Çimsa Çimento Sanayi ve Ticaret A.Ş

- Royal White Cement

- LafargeHolcim

- Aditya Birla (Grasim Industries Limited)

- Cimsa

- Dyckerhoff GMBH

- Federal White Cement

- India Cements Ltd

- J.K. Cement Company

- Ultratech Cement Ltd

- Saudi White Cement Company

Recent Developments

- In June 2023, Dyckerhoff introduced Blue Star, a new white pozzolan cement designed to minimize CO2 emissions within its product range.

- In November 2022, Cementir has inaugurated its inaugural CO2 capture and storage (CCS) facility at the Aalborg cement plant. This pilot initiative aligns with the company's Climate Change Strategy, which includes a 30% reduction in the carbon emissions by 2030 and the ambitious goal of achieving net-zero emissions, by 2050.

White Cement Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.24 billion |

|

Revenue Forecast in 2032 |

USD 11.51 billion |

|

CAGR |

6.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of white cement in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The global white cement market size is expected to reach USD 11.51 billion by 2032b

Cementir Holding, Çimsa Çimento, Royal White Cement, LafargeHolcim, Cimsa, Dyckerhoff are the top market players in the market.

Asia Pacific region contribute notably towards the global White Cement Market.

The global white cement market is expected to grow at a CAGR of 6.0% during the forecast period.

The White Cement Market report covering key segments are product, application, and region.