White Inorganic Pigments Market Share, Size, Trends, Industry Analysis Report

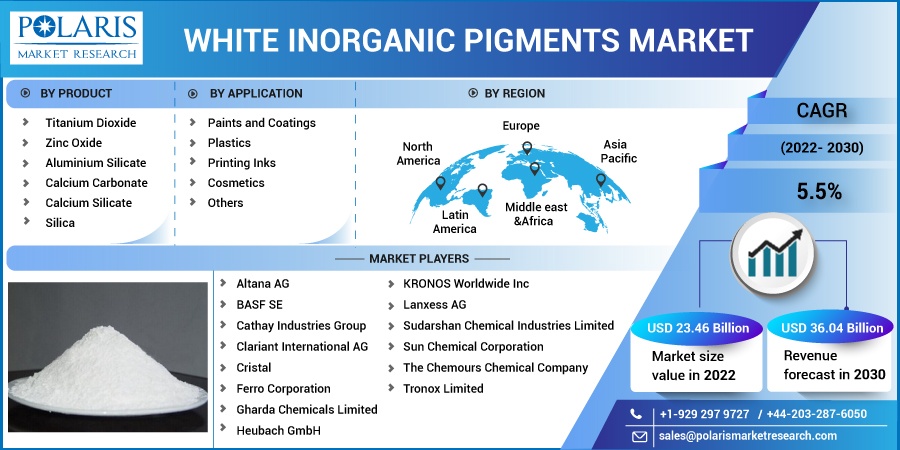

By Product (Titanium Dioxide, Zinc Oxide, Aluminum Silicate, Calcium Carbonate, Calcium Silicate, Silica, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 115

- Format: PDF

- Report ID: PM2646

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

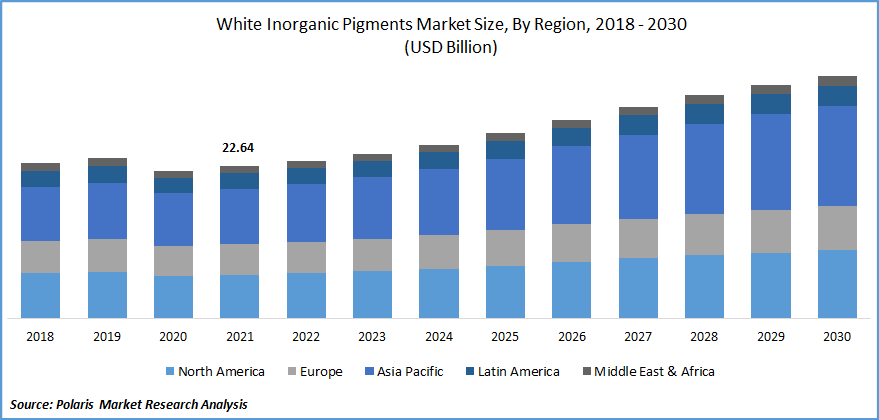

The global white inorganic pigments market was valued at USD 22.64 billion in 2021 and is expected to grow at a CAGR of 5.5% during the forecast period. White inorganic pigments are also known as opaque pigments, which are used to provide light, opacity, and colors to various products. The most prominent white inorganic pigment is titanium dioxide.

Know more about this report: Request for sample pages

They are utilized in paints and coatings, plastics, printing inks, cosmetics, and others. Increasing collaborations in the manufacturing segment, along with increasing applications of white inorganic pigments, are expected to support industry growth. Inorganic pigments are obtained from salts and minerals derived from carbonate, sulfate, oxide, and sulfide, among others.

These pigments are opaque, cost-effective, and do not fade on exposure to light. They are widely used in the industrial sector as a coloring agent. Titanium dioxide is a commonly used white inorganic pigment. It is used in paint colors. It is also widely utilized in plastics and coatings. It is capable of scattering visible light on account of its high refractive index.

It offers an opaque color with bright and reflective properties. It has an extremely high melting point and appears as pure white. It is a bright substance widely used for aesthetic designs. It exhibits photocatalytic activity under UV light, increasing its use in protective coatings. The demand for the industry has increased from consumer goods, automotive, construction, and aerospace industries.

The rise in the need for enhanced aesthetics, greater demand from the building and construction sector, and the rise in the construction of buildings, offices, and public infrastructure are factors driving the growth of the industry. Technological advancements associated with white inorganic pigments, material innovation, and growth in investments in R&D support the development of new advanced products.

The COVID-19 outbreak has negatively influenced the growth of the white inorganic pigments market. The industry suffered from travel restrictions, disruption of the supply chain, and operational challenges. Manufacturing activities were closed in several countries across the world. Construction activities were halted or delayed due to the imposition of a lockdown to contain the spread of the virus.

Reduced demand for the industry was observed from the automotive and construction sectors. Lack of raw materials, workforce impairment, and restrictions on the import and export of commodities further limited the industry's growth. However, the industry is expected to experience growth post-pandemic on account of economic growth and a rise in construction activities.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising population, industrialization, and urbanization have increased the demand for white inorganic pigments. Greater demand from the automotive sector for enhanced aesthetics, modernization of vehicles, and increasing development of luxury vehicles boost the market growth.

The strengthening construction sector, rise in demand for white inorganic pigments from developing countries, and increasing construction of residential and commercial buildings accelerate the demand for the industry. Greater development of public infrastructure, increase in the application of these inorganic pigments in personal care products and cosmetics, and rise in demand for consumer goods have encouraged industry players to introduce new innovative products in the white inorganic pigments market.

Economic growth in developing countries is driving the global market to expand their presence in these countries to leverage the availability of raw materials and labor. Technological advancements, investments in research and development, and widening application areas drive the demand for the industry.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

The Titanium Dioxide segment accounted for a major share in 2021

The titanium dioxide segment generated significant revenue in 2021. It is opaque white and exhibits non-toxic properties. It is popularly used in paints and coatings owing to its cost efficiency. It is used across various applications to impart white color strength and opacity. Titanium dioxide offers the property of scattering light UV resistance.

Its high demand is attributed to its non-reactiveness, non-toxicity, and luminous properties. It is also used in skincare and cosmetics products as a pigment and a thickener for creams. It is utilized in sunscreen on account of its transparency and UV absorption.

Paints & coatings segment accounted for the largest market share in 2021

The paints & coatings segment accounted for a major share in 2021. The industrial growth in developing countries and the rise in demand for white inorganic pigments from the automotive sector supports the growth of this segment. Industrialization, coupled with urbanization, has increased the demand for these pigments across various industries.

The rise in penetration of passenger vehicles, modernization of vehicles, and superior demand for luxury vehicles have boosted the industry's growth. An increase in disposable income, changing lifestyle of consumers, and growth in demand from the construction sector are factors expected to contribute to the industry growth during the forecast period.

Asia Pacific accounted for a major share in 2021

Asia Pacific dominated the global white inorganic pigments market in 2021. An increase in demand for paints and coatings, and plastics has been observed in the region. Strengthening the economy in countries such as Japan, India, and China, growing penetration of passenger vehicles, and growing application areas support the market growth in the region.

Easy availability of raw materials, urbanization, and industrialization in developing countries has increased the demand for white inorganic pigments. Increasing application in the automotive sector and presence of major market players in the region further boost the market growth.

Competitive Insight

Some prominent market players operating in the global white inorganic pigments market include Altana AG, BASF SE, Cathay Industries Group, Clariant International AG, Cristal, Ferro Corporation, Gharda Chemicals Limited, Heubach GmbH, KRONOS Worldwide Inc, Lanxess AG, Sudarshan Chemical Industries Limited, Sun Chemical Corporation, The Chemours Chemical Company, and Tronox Limited.

The leading companies are introducing new innovative products to cater to the growing demand from automotive, and plastics sectors. Acquisition is a significant strategy adopted by market players to strengthen their position in the market and enter new emerging economies.

Recent Developments

In August 2021, DCL announced the acquisition of Sun Chemical’s manufacturing facility U.S. The acquisition is aimed at expanding the company’s portfolio of specialty pigments for industrial coatings, automotive, and engineered plastics.

In June 2021, DIC Corporation completed the acquisition of BASF’s global pigments business. The acquisition of BASF Colors & Effects (BCE) is aimed at strengthening the company’s market porisiotn. It is expected to expand the company’s portfolio of high-performance pigments, effect pigments, and specialty inorganic pigments.

White Inorganic Pigment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 23.46 billion |

|

Revenue forecast in 2030 |

USD 36.04 billion |

|

CAGR |

5.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Altana AG, BASF SE, Cathay Industries Group, Clariant International AG, Cristal, Ferro Corporation, Gharda Chemicals Limited, Heubach GmbH, KRONOS Worldwide Inc, Lanxess AG, Sudarshan Chemical Industries Limited, Sun Chemical Corporation, The Chemours Chemical Company, Tronox Limited |