Autonomous Underwater Vehicle Market Size, Share, Trends, & Industry Analysis Report

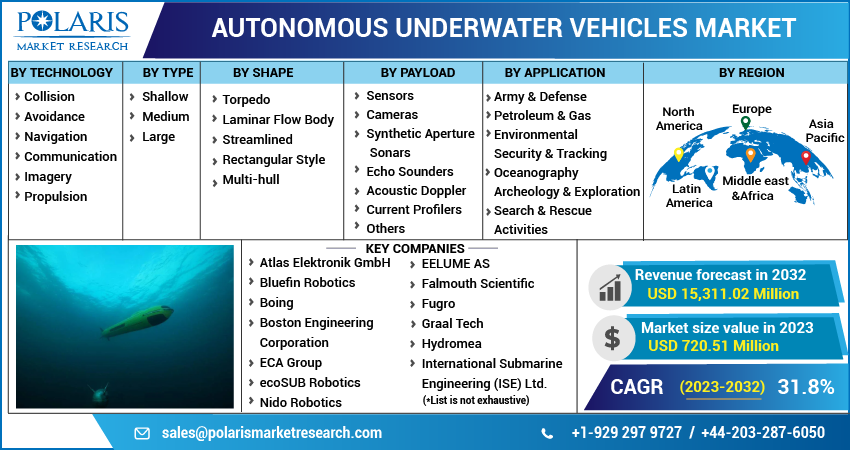

By Technology (Collision Avoidance, Navigation, Communication, Imagery, and Propulsion), By Type, By Shape, By Payload, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM1712

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global autonomous underwater vehicle market size was valued at USD 923.66 million in 2024, growing at a CAGR of 31.81% from 2025 to 2034. Key factors driving demand for autonomous underwater vehicle include increasing investment in oil exploration, growing military expenditure, and rising oceanographic research.

Key Insights

- The navigation segment held the largest revenue share in 2024 due to its ability to offer accurate mapping for complex underwater missions.

- The torpedo segment dominated the revenue share in 2024 due to its ability to offer superior hydrodynamics, speed, and maneuverability.

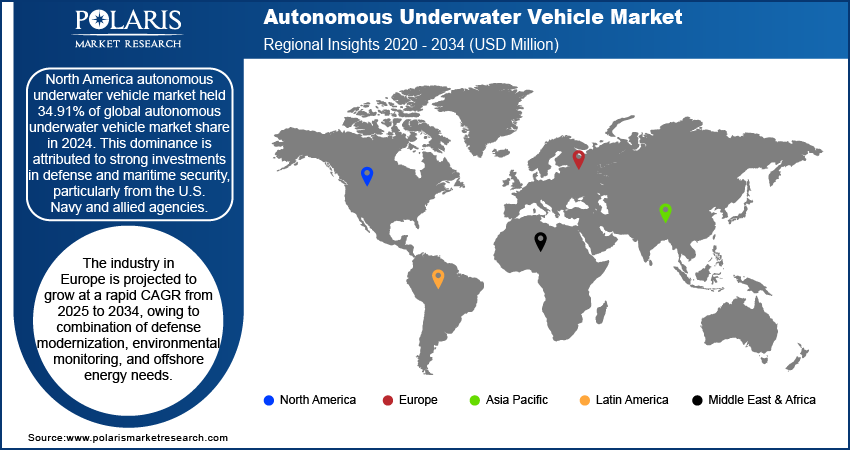

- North America autonomous underwater vehicle market held 34.91% of global autonomous underwater vehicle market share in 2024, owing to strong investments in defense and maritime security.

- U.S. held 72.22% of revenue share in the North America autonomous underwater vehicle landscape in 2024, due to ongoing defense modernization initiatives.

- The industry in Europe is projected to grow at a rapid CAGR from 2025 to 2034, owing to combination of defense modernization and rising investment in offshore energy.

Industry Dynamics

- Growing investment in oil exploration across the globe is boosting demand for autonomous underwater vehicles (AUVs) as it provides energy companies to survey and map the ocean floor in efficient and safer ways.

- Rising oceanographic research is fueling the adoption of AUVs as they enable long-duration missions, deep-sea exploration, and high-resolution mapping.

- Increasing need for underwater infrastructure inspection is projected to create a lucrative market opportunity.

- High development, operational, and maintenance costs is projected to hamper the demand for autonomous underwater vehicle.

AI Impact on Autonomous Underwater Vehicle Market

- AI enhances AUV navigation and decision-making, enabling real-time adaptability in complex underwater environments.

- Machine learning improves data analysis from sonar and sensors, increasing accuracy in object detection and seabed mapping.

- AI reduces reliance on human intervention, allowing longer, autonomous missions with minimal supervision.

- Predictive maintenance powered by AI boosts AUV reliability and operational efficiency.

Market Statistics

- 2024 Market Size: USD 923.66 Million

- 2034 Projected Market Size: USD 14,740.07 Million

- CAGR (2025-2034): 31.81 %

- North America: Largest Market Share

An autonomous underwater vehicle (AUV) is a self-propelled, unmanned, and programmable robotic system designed to operate underwater without direct human intervention. Equipped with advanced navigation, communication, and sensor technologies, AUVs can independently execute missions by following pre-programmed routes or adapting to environmental conditions in real time. These vehicles vary in size and capability, ranging from small units used for shallow water research to large, deep-sea models capable of reaching extreme ocean depths.

AUVs play a vital role in multiple industries and scientific applications. In defense and security, they conduct mine countermeasures, surveillance, and reconnaissance operations. In offshore oil and gas, AUVs inspect subsea pipelines, map seafloor infrastructure, and monitor environmental conditions to ensure safe and efficient operations. Marine researchers use them for oceanographic surveys, habitat mapping, and climate studies by collecting high-resolution data on water quality, salinity, and marine biodiversity. Additionally, they support undersea archaeology, cable inspections, and disaster response, such as locating wreckage or assessing seabed changes after natural calamities.

The global demand for autonomous underwater vehicle is driven by increasing military expenditure. Stockholm International Peace Research Institute, in its reports, stated that world military expenditure reached $2718 billion in 2024, an increase of 9.4 per cent in real terms from 2023. This is driving military organizations globally to allocate more funds to research, development, and procurement of AUVs, which offer cost-effective, high-efficiency solutions for missions like reconnaissance, seabed mapping, and underwater infrastructure protection. Additionally, with increased increasing military expenditure, naval forces are widely adopting AUVs to modernize their naval fleets and to reduce risks to human personnel and enables operations in hazardous or contested environments.

Drivers & Opportunities/Trends

Increasing Investment in Oil Exploration: Growing investment in oil exploration across the globe is boosting demand for autonomous underwater vehicles (AUVs) as it provides energy companies to survey and map the ocean floor in efficient and safer ways. In May 2022, ONGC announced its plan to invest USD 4 billion from FY22-25 to increase its exploration efforts in India. Oil and gas firms require detailed seabed data to identify potential drilling sites, assess geological formations, and monitor existing infrastructure. AUVs provide high-resolution imaging, precise navigation, and the ability to operate in deep waters where traditional methods fall short. The need for cost-effective, reliable, and non-invasive exploration tools are driving companies to adopt AUV technology, reducing operational risks and improving data accuracy. Therefore, as exploration budgets grow, especially in offshore and deep-sea projects, the demand for advanced AUVs rises, pushing manufacturers to innovate and expand their offerings.

Rising Oceanographic Research: Researchers conducting oceanographic research require precise, real-time data on marine ecosystems, climate change impacts, and underwater geology, which AUVs can collect more efficiently than traditional methods. AUVs enable long-duration missions, deep-sea exploration, and high-resolution mapping, making them essential for studying biodiversity, ocean currents, and pollution. Hence, as funding for oceanographic studies increases, universities, government agencies, and environmental organizations invest in AUV technology to enhance their research capabilities.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes collision avoidance, navigation, communication, imagery, and propulsion. The navigation segment held the largest revenue share in 2024 due to its ability to offer accurate mapping, positioning, and route planning for complex underwater missions. Energy companies, defense organizations, and oceanographic institutes invested heavily in advanced navigation systems to ensure efficient exploration in deep-sea environments where GPS signals do not function. The growing need to conduct precise seabed mapping for offshore oil and gas exploration, coupled with demand for safe pipeline inspections and cable-laying operations, drove the widespread adoption of high-performance inertial navigation systems. Researchers also relied on these systems to study marine ecosystems and climate change with high accuracy, further strengthening their dominance.

The collision avoidance segment is projected to grow at a rapid pace in the coming years, owing to the growing emphasis on autonomous operation. Rising offshore renewable energy projects, undersea mining, and expanding defense operations create greater risks of equipment collisions and mission failures. To address these challenges, manufacturers are integrating artificial intelligence, machine learning, and real-time sensor fusion into collision avoidance systems to improve decision-making and operational safety. The need for safe navigation around subsea structures and natural obstacles is projected to fuel the segment growth.

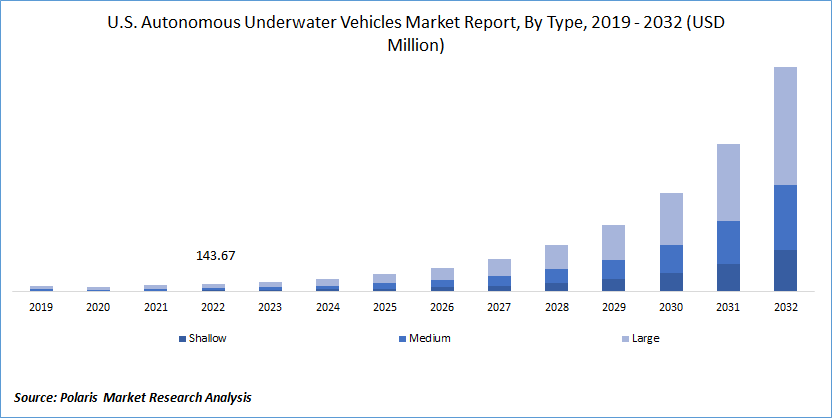

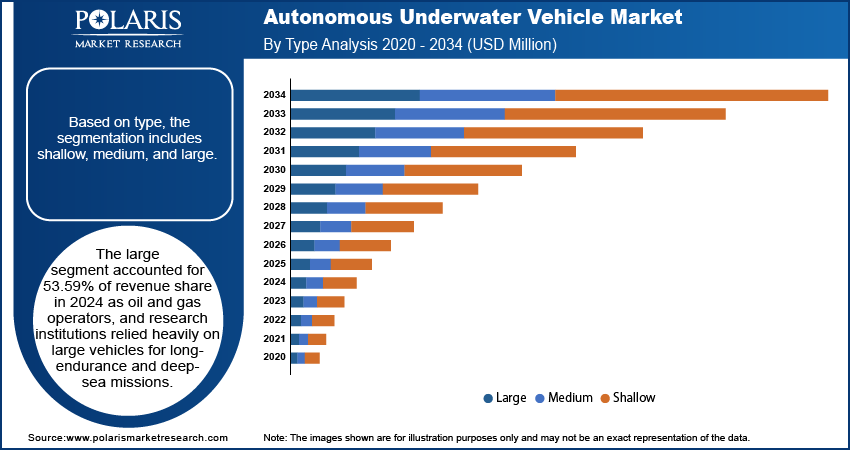

Type Analysis

Based on type, the segmentation includes shallow, medium, and large. The large segment accounted for 53.59% of revenue share in 2024 as oil and gas operators, and research institutions relied heavily on large vehicles for long-endurance and deep-sea missions. Large systems carried heavier payloads, supported advanced sensor integration, and traveled greater distances compared to shallow and medium variants. Energy companies deployed them extensively for deepwater pipeline inspections, offshore drilling support, and subsea infrastructure monitoring, while naval forces invested in them for mine countermeasure operations, anti-submarine warfare, and surveillance. The ability of large vehicles to operate at extreme depths with high stability and deliver detailed oceanographic data positioned them as the most preferred option across multiple critical applications such as subsea infrastructure monitoring.

Shape Analysis

In terms of shape, the segmentation includes torpedo, laminar flow body, streamlined rectangular style, and multi-hull. The torpedo segment dominated the revenue share in 2024 due to its design that provided superior hydrodynamics, speed, and maneuverability for a wide range of underwater missions. Defense organizations preferred this shape for surveillance, reconnaissance, and mine detection due to its streamlined structure and ability to travel long distances with minimal energy consumption. Oil and gas operators also favored torpedo-shaped systems for pipeline inspections and seabed surveys since they maintained stability in strong underwater currents. Research institutions benefited from the shape’s capacity to integrate advanced navigation systems and payloads without compromising efficiency. The proven reliability and versatility of this design ensured its dominance across both commercial and military applications.

Payload Analysis

Based on payload, the segmentation includes sensors, cameras, synthetic aperture sonars, echo sounders, acoustic doppler current profilers, and others. The sensors segment held 28.19% of the revenue share in 2024, due to their versatility in delivering critical data across diverse underwater missions. Operators equipped vehicles with a wide range of sensors, including depth, temperature, pressure, and conductivity sensors, to gather real-time environmental data essential for navigation, surveillance, and oceanographic studies. The oil and gas industry used them extensively for seabed mapping, subsea infrastructure monitoring, and pipeline inspections, while defense agencies relied on them for mine detection and situational awareness. Research institutions also invested heavily in sensor-equipped vehicles to track marine ecosystems and climate-related changes.

The synthetic aperture sonars segment is projected to hold 18.23% of revenue share in 2034, owing to their ability to generate high-resolution imagery of the seabed and underwater objects. Industries increasingly require synthetic aperture sonars to support activities such as deep-sea mining, offshore renewable energy site assessments, and detailed geological surveys. Defense organizations also prioritize these payloads for mine countermeasure operations and covert surveillance as they provide superior detection capabilities compared to conventional sonar systems. Synthetic aperture sonars reduce mission time by covering larger areas with greater precision, which enhances both efficiency and safety, leading to their greater adoption.

Regional Analysis

North America autonomous underwater vehicle market held 34.91% of global autonomous underwater vehicle market share in 2024. This dominance is attributed to strong investments in defense and maritime security, particularly from the U.S. Navy and allied agencies. According to a report by STOCKHOLM INTERNATIONAL PEACE RESEARCH INSTITUTE, military spending by the USA rose by 5.7% in 2024. North American countries, especially the United States and Canada, increasingly adopted AUVs for submarine detection, mine countermeasures, and underwater surveillance to enhance national security. Additionally, the region’s strong presence of major AUV manufacturers and research institutions fosters innovation and technological advancements. Growing offshore energy exploration activities in the Gulf of Mexico and Arctic waters further stimulated demand, as AUVs are used for seabed mapping, pipeline inspection, and environmental monitoring.

U.S. Autonomous Underwater Vehicle Market Insight

U.S. held 72.22% of revenue share in the North America autonomous underwater vehicle landscape in 2024, due to defense modernization initiatives and the need for advanced undersea warfare capabilities. The U.S. Department of Defense and Navy invested significantly in autonomous systems to maintain undersea dominance, particularly in response to growing geopolitical tensions. AUVs are deployed for intelligence gathering, anti-submarine warfare, and oceanographic research. Beyond defense, the oil and gas industry in the country utilized AUVs for offshore infrastructure inspection, especially in deepwater drilling operations. Academic and scientific institutions also contributed to demand by using AUVs for marine research, climate studies, and ecosystem monitoring. Supportive government funding and public-private partnerships further accelerated the development and deployment of next-generation AUVs across various sectors.

Asia Pacific Autonomous Underwater Vehicle Market

The Asia Pacific market is projected to hold 29.23% of global autonomous underwater vehicle market share in 2034, driven by increasing maritime security concerns, territorial disputes, and rising defense budgets among key nations such as Japan, South Korea, India, and Australia. Countries in the region are investing in naval modernization programs that include AUVs for coastal surveillance, harbor protection, and anti-submarine operations. Simultaneously, expanding offshore oil and gas activities, particularly in Southeast Asia, are driving commercial demand for underwater inspection and surveying. The region’s growing technological capabilities and local manufacturing efforts are further enhancing accessibility and adoption of AUV systems.

China Autonomous Underwater Vehicle Market Overview

The demand for autonomous underwater vehicle in China is being driven by its strategic focus on strengthening naval capabilities and asserting influence in the South and East China Seas. The People’s Liberation Army Navy (PLAN) is actively integrating AUVs into its fleet for reconnaissance, mine detection, and undersea warfare. The country is also investing heavily in indigenous AUV development through state-backed research programs and collaborations with academic and industrial partners. In the civilian sector, China is leveraging AUVs for offshore energy exploration, deep-sea mining, and oceanographic research as part of its broader "Blue Economy" initiative. Government support, coupled with advancements in domestic robotics and AI, is enabling rapid innovation and deployment, positioning China as a major country in the APAC AUV market.

Europe Autonomous Underwater Vehicle Market

The industry in Europe is projected to grow at a CAGR of 31.73% from 2025 to 2034, owing to combination of defense modernization, environmental monitoring, and offshore energy needs. NATO member states and individual European countries are enhancing their maritime defense capabilities, utilizing AUVs for mine countermeasures, border surveillance, and submarine tracking in response to regional security challenges. The North Sea and Mediterranean regions are witnessing commercial use of AUVs in offshore wind farm installations, oil and gas pipeline inspections, and subsea cable maintenance. Additionally, European Union-funded scientific projects focused on climate change, marine conservation, and deep-sea exploration are increasing reliance on AUVs for data collection.

Key Players & Competitive Analysis Report

The autonomous underwater vehicle (AUV) market features a competitive landscape dominated by established defense and marine technology firms. Key players include General Dynamics Corporation, Lockheed Martin Corporation, and The Boeing Company, which leverage their defense expertise to develop advanced AUVs for military applications. Kongsberg Discovery and Teledyne Marine Technologies Incorporated are leaders in commercial and scientific AUVs, offering high-precision systems for oceanographic research. Ocean Infinity and Fugro utilize AUVs extensively in offshore surveying and subsea inspections, driving innovation in autonomous operations. Blue Robotics has emerged as a disruptor with cost-effective, accessible AUVs for smaller organizations and academia. International players like SAAB AB and Exail bring specialized capabilities in navigation and underwater communications. Oceaneering International bridges traditional ROV services with growing AUV integration. The market is characterized by strategic partnerships, technological differentiation, and increasing demand across defense, energy, and scientific sectors.

Major companies operating in the autonomous underwater vehicle industry include Blue Robotics, Exail, Fugro, General Dynamics Corporation, HII, Kongsberg Discovery, Lockheed Martin Corporation, Ocean Infinity, Oceaneering International, SAAB AB, Teledyne Marine Technologies Incorporated, and The Boeing Company.

Key Companies

- Blue Robotics

- Exail

- Fugro

- General Dynamics Corporation

- HII

- Kongsberg Discovery

- Lockheed Martin Corporation

- Ocean Infinity

- Oceaneering International

- SAAB AB

- Teledyne Marine Technologies Incorporated

- The Boeing Company

Industry Developments

August 2025, Saab announced that it signed a contract with the Swedish Defence Materiel Administration (FMV) for a larger uncrewed underwater vehicle.

March 2024, HII announced the REMUS 130, a new unmanned underwater vehicle (UUV) model based on the highly successful HII REMUS series of UUVs at the Oceanology International 2024 conference and exhibition.

Autonomous Underwater Vehicle Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Collision Avoidance

- Navigation

- Communication

- Imagery

- Propulsion

By Type Outlook (Revenue, USD Million, 2020–2034)

- Shallow

- Medium

- Large

By Shape Outlook (Revenue, USD Million, 2020–2034)

- Torpedo

- Laminar Flow Body

- Streamlined Rectangular Style

- Multi-hull

By Payload Outlook (Revenue, USD Million, 2020–2034)

- Sensors

- Cameras

- Synthetic Aperture Sonars

- Echo Sounders

- Acoustic Doppler Current Profilers

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Army & Defense

- Petroleum & Gas

- Environmental Security & Tracking

- Oceanography

- Archeology & Exploration

- Search & Rescue Activities

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Autonomous Underwater Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 923.66 Million |

|

Market Size in 2025 |

USD 1,227.35 Million |

|

Revenue Forecast by 2034 |

USD 14,740.07 Million |

|

CAGR |

31.81% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 923.66 million in 2024 and is projected to grow to USD 14,740.07 million by 2034.

The global market is projected to register a CAGR of 31.81% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Blue Robotics, Exail, Fugro, General Dynamics Corporation, HII, Kongsberg Discovery, Lockheed Martin Corporation, Ocean Infinity, Oceaneering International, SAAB AB, Teledyne Marine Technologies Incorporated, and The Boeing Company.

The large segment dominated the market revenue share in 2024.

The synthetic aperture sonars segment is projected to witness the fastest growth during the forecast period.

The synthetic aperture sonars segment is projected to witness the fastest growth during the forecast period.