High-Performance Thermoplastics Market Size, Share, Trends & Industry Analysis Report

By Product Type (Polyamides, Polyphenylsufone, Sulfone Polymers, Liquid Crystal Polymers, Aromatic Polyketones, Polyethersulfone), By Application, By Region –Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM1518

- Base Year: 2024

- Historical Data: 2020-2023

What is the high-performance thermoplastics market size?

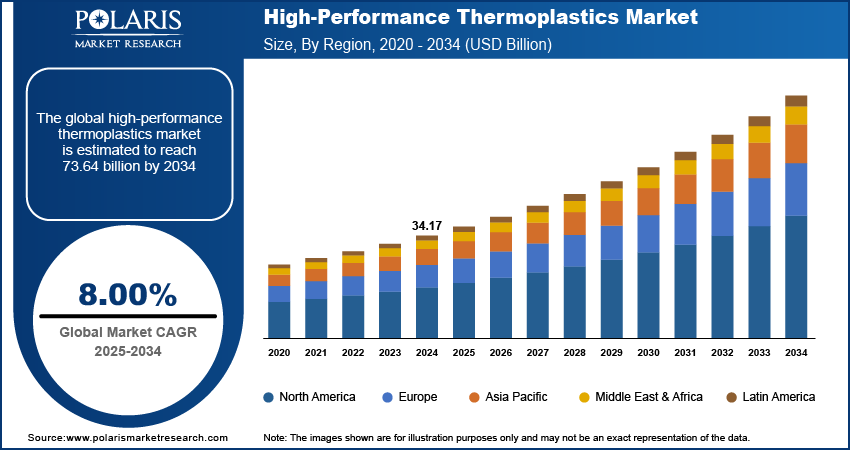

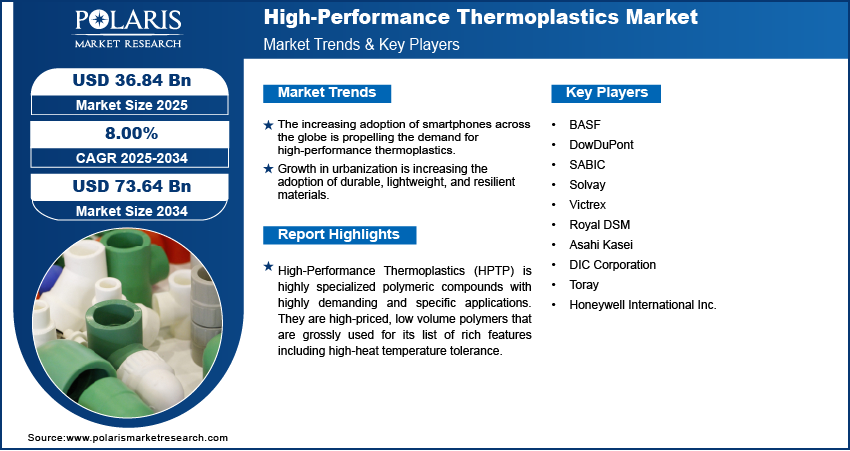

The global high-performance thermoplastics market size was valued at USD 34.17 billion in 2024 and is anticipated to grow at a CAGR of 8.00% from 2025 to 2034. Key factors driving demand for high-performance thermoplastics include an increase in the need for lightweight materials in the automotive and aerospace industries, advancements in 3D printing, and increasing use in medical devices.

Key Insights

- The polyamides segment held the largest revenue share in 2024 due to its usage in sports equipment, construction, electronics, and consumer goods.

- The aerospace segment dominated the revenue share in 2024 due to increasing demand for more lightweight aircraft structures.

- Asia Pacific accounted for a major revenue share in 2024, due to dense population and modernization of developing economies such as India and China.

- The market in North America is projected to grow at a rapid pace in the coming years, owing to the developed automotive industry.

Industry Dynamics

- The increasing adoption of smartphones across the globe is propelling the demand for high-performance thermoplastics. This is due to the usage of these materials in the development of slimmer, lighter, and durable smartphones.

- Growth in urbanization is increasing the adoption of durable, lightweight, and resilient materials. This is leading to high demand for high-performance thermoplastics.

- Increasing healthcare spending is creating a lucrative market opportunity.

- The high cost of high-performance thermoplastics compared to standard or commodity plastics may hamper the market demand.

Market Statistics

- 2024 Market Size: USD 34.17 Billion

- 2034 Projected Market Size: USD 73.64 Billion

- CAGR (2025-2034): 8.00%

- Asia Pacific: Largest Market Share

AI Impact on High-performance Thermoplastics Market

- AI helps in increasing innovation, efficiency, and demand.

- It helps in material design through predictive modeling.

- AI helps in reducing energy use and manufacturing costs.

- AI helps in predictive maintenance in extrusion and molding equipment.

To Understand More About this Research: Request a Free Sample Report

What Benefits and Obstacles Shape Market Landscape?

High-performance thermoplastics (HPTP) are highly specialized polymeric compounds with highly demanding and specific applications. They are high-priced, low-volume polymers that are grossly used for their list of rich features, including high-heat temperature tolerance. HPTPs are excessively priced in comparison to engineering thermoplastics and are equipped with more thermal resistance and excellent properties. These HPTPs can replace metal parts and are looked upon to be the lightweight material in the industry.

The main markets are electrical/electronics, automotive, aircraft/aerospace, industrial (including oil and energy), and health (medical/dental). These plastics are gaining excellent mobility on account of increased demand for them in the automotive and aviation industries. These plastics are made to resist severe conditions while gearing up for high efficiency simultaneously. High rigidity, high impact strength, high resistance to temperature, creep resistance, and better surface quality, together with a low count of rejection, are the most important features that come to depend upon in the end-uses. The electronics industry cannot do without heat pipes on account of the constant drive for miniaturization, higher temperature generation and greater stresses, consumer demand, increased durability, and rampant use of mobiles and electronic devices.

HPTPs are also used extensively in the defense industry, electrical and electronics, and consumer goods. The plastics and polymer industries have observed considerable development in product design and material science. This has made plastics lighter and put plastics in the bracket of metals with strength identical to that of metals. Technical advancements categorized by resin materials have contributed to a growing market that has the required characteristics to replace ceramic, advanced metal, and other metal parts.

The consequences of choosing the wrong material can prove to be costly in industries such as aerospace, where part failure can be devastating. High-performance thermoplastics are costly but provide greater thermal resistance than contemporary engineering polymers. Growth lies in that they offer greater thermal stability, which means that they have high melting points, heat deflection temperatures, glass transition temperatures, and a stronger burn coefficient of resistance. The medical industry requires HPTPs for driving reasons, including an aging population, stronger heat requirements, biocompatibility for implants, the use of more aggressive cleaners and disinfectants, increased lifetime durability, and others.

Restraints to the market include the high cost of manufacturing and a strict compliance network in place, which holds up market growth. Thermoplastics’ biodegradability is a serious environmental backlash, and hence the manufacture of thermoplastics and their disposal are highly controlled. Being a petrochemical derivative, thermoplastics undergo a lot of price variations that are anticipated to be yet another restraint for the market.

Know more about this report: request for sample pages

High-performance Thermoplastic Market Scope

By Product Type |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Which Product Type holds Largest Share?

The polyamide segment held the largest product segment for HPTP’s in 2024. Polyamide derivatives such as polyamide 6 and polyamide 66 are natural extensions of polymers and fill the void in industrial applications with their use in sports equipment, construction, electronics, and consumer goods. Polycarbonates are expected to witness considerable traction during the forecast period. The largest volume HPTP’s are high-performance polyamides (HPPAs). High-performance polyamides are designed for use in areas where engineering thermoplastics nylons are unsuitable, such as automotive engine coolant pumps, impellers, valves, and other applications. HPPA’s can withstand high temperatures and continuous contact with fluids because they are not prone to absorbing water. A significant factor driving polyamides is a high demand for automatic weight reduction that results from strict regulations and lower CO2 emissions.

What are Leading Applications in this Market?

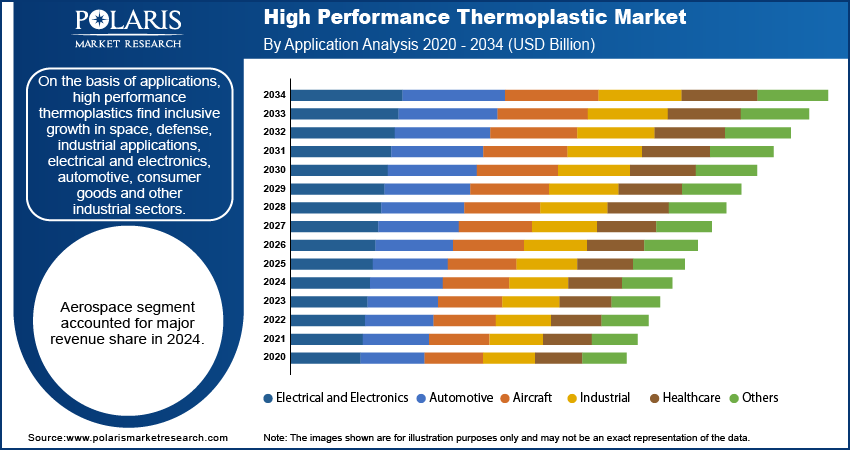

On the basis of applications, high-performance thermoplastics find inclusive growth in space, defense, industrial applications, electrical and electronics, automotive, consumer goods and other industrial sectors. The aerospace segment accounted for a major revenue share in 2024. An increasing demand for more lightweight aircraft structures has forced the aircraft industry to back the use of thermoplastics in component structures. The thermoplastics were initially used in military aerospace applications only, as they were considered too expensive. Strict environmental concerns and the rising cost of aviation fuel had civilian aircraft sit up and take notice of these lightweightand high-performance structures for use in the civilian aircraft industry.

How does Market Growth Differ by Region?

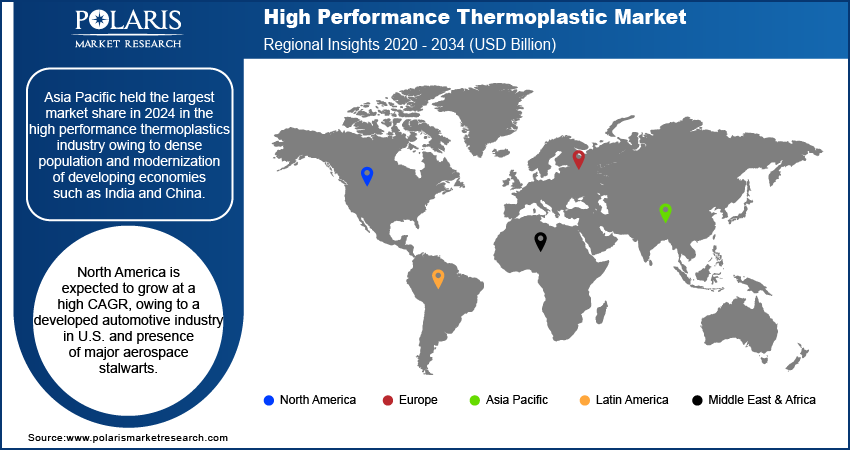

Asia Pacific held the largest market share in 2024 in the high-performance thermoplastics industry owing to the dense population and modernization of developing economies such as India and China. Constant innovative practice in industrial infrastructure has led to significant growth in end-use industries such as electronics, automotive, aerospace, and consumer goods. Technologically advanced nations in Asia Pacific, such as Japan, are observing rapid industrial growth during the forecast period in the region, which is estimated to propel the adoption of high-performance thermoplastics. The growing usage of smartphones and increasing urbanization in countries such as India and China contributed to the regional market dominance. Moreover, the high adoption of EV's in the region fueled the demand for high-performance thermoplastics in 2024.

North America is expected to grow at a high CAGR, owing to a developed automotive industry in the U.S. and the presence of major aerospace stalwarts. The advanced 3D printing sector in the region is also driving the industry growth. Contractors, developers, and builders in the region are heavily using high-performance thermoplastics to build a strong building base. Moreover, the growing adoption of portable electronics in countries such as the U.S. and Canada is further increasing demand for these advanced thermoplastics. The growing adoption of EVs, driven by rising focus on sustainable mobility in the region, is also leading to market growth.

What are the top players, opportunities, challenges, and risks in the U.S. high-performance thermoplastics market?

The U.S. high-performance thermoplastics market dominated in North America in 2024. Rising adoption of electric vehicles and growing demand from the aerospace industry propel the adoption of high-performance thermoplastics across the country. Also, the presence of strong industry players contributed to the dominance of the U.S. industry. The ecosystem includes raw material suppliers, shapes and parts specialists, manufacturers, distributors, and other service providers. Following tables provides comprehensive information on the stakeholders operating in the U.S. HPTP market ecosystem.

|

Tier/Category |

Key Players (U.S.) |

Core Products/Strengths |

Market Gaps/Risks |

Opportunity Zones (High-ROI) |

|

Base Resin Producers |

|

|

Highly concentrated U.S. PEEK/PEKK capacity Long certification cycles (aero, med) |

|

|

Compounders/Shape & Part Specialists |

|

|

Limited U.S. recycling & regrind/Few qualified semi-grade suppliers |

|

|

Additive/Advanced Manufacturing |

|

|

Low installed capacity/Slow medical approval cycles |

|

|

Distribution & Services |

Regional distributors

|

|

Dependence on imports for certain grades |

|

Competitive Landscape

The competitive landscape of the high-performance thermoplastics market is shaped by continuous advancements in materials science and a strong focus on specialized applications. Market players are competing by enhancing product quality and expanding application areas. Companies in the industry are emphasizing innovation in lightweight, durable, and chemical-resistant materials. They are doing this so that they can meet growing demand in automotive, aerospace, electronics, and healthcare. Strategic collaborations with end-use industries and investments in R&D support the creation of tailored thermoplastic solutions for high-stress environments. Geographic expansion and a focus on sustainability are also important in the market. Manufacturers aim to strengthen their global presence while addressing environmental concerns.

The key industry players in the high-performance thermoplastics market include BASF, DowDuPont, SABIC, Solvay, Victrex, Royal DSM, Asahi Kasei, DIC Corporation, Toray, and Honeywell International Inc.

Industry Developments

In October 2024, Envalior expanded the performance of its Tepex continuous fiber-reinforced thermoplastic composites.

In September 2024, Toray Advanced Composites announced the launch of Toray Cetex TC1130 PESU high-performance thermoplastic composite material to address the growing need for lightweight and sustainable materials in aircraft interior applications.

High-performance Thermoplastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 34.17 Billion |

|

Market Size in 2025 |

USD 36.84 Billion |

|

Revenue Forecast by 2034 |

USD 73.64 Billion |

|

CAGR |

8.00% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 34.17 billion in 2024 and is projected to grow to USD 74.64 billion by 2034.

• The global market is projected to register a CAGR of 8.00% during the forecast period.

• Asia Pacific dominated the market in 2024

• A few of the key players in the market are BASF, DowDuPont, SABIC, Solvay, Victrex, Royal DSM, Asahi Kasei, DIC Corporation, Toray, and Honeywell International Inc.

• The polyamide segment dominated the market revenue share in 2024.

• The automotive segment is projected to witness the fastest growth during the forecast period.