U.S. Potassium Sorbate Market Size, Share, Trend & Industry Analysis Report

: By Form (Powder, Granular and Liquid), By Application (Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care) – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5908

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

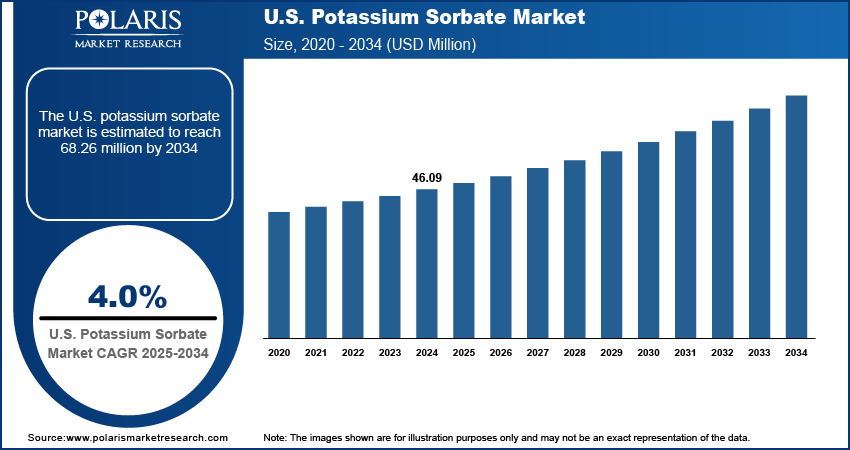

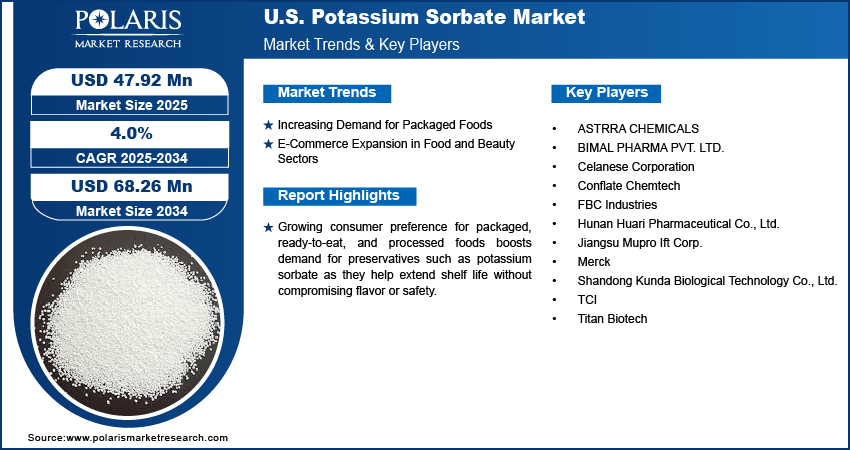

The U.S. potassium sorbate market size was valued at USD 46.09 million in 2024 and is projected to register a CAGR of 4.0% from 2025 to 2034. Growing consumer preference for packaged, ready-to-eat, and processed foods boosts demand for preservatives such as potassium sorbate as they help extend shelf life without compromising flavor or safety.

The U.S. potassium sorbate market involves the production, distribution, and application of potassium sorbate, a widely used preservative that inhibits the growth of mold, yeast, and microbes in food, beverages, personal care products, and pharmaceutical products. It plays a crucial role in extending product shelf life while maintaining safety and quality standards. The market is shaped by the rising focus on regulatory compliance, high demand for clean-label ingredients, and its versatility across end-use industries. Food manufacturers are increasingly using potassium sorbate due to its acceptance as a safe preservative in clean-label formulations. Its low toxicity and broad-spectrum antimicrobial activity make it ideal for health-conscious consumers.

To Understand More About this Research: Request a Free Sample Report

Upsurging demand for paraben-free and safe preservative alternatives in skincare and cosmetic products is encouraging formulators to adopt potassium sorbate for microbial stability. Additionally, increased formulation of liquid medicines and syrups is supporting the use of potassium sorbate for microbial growth control, ensuring product safety and compliance with FDA regulations.

Market Dynamics

Increasing Demand for Packaged Foods

Changing lifestyles and time-constrained routines are leading more consumers to prefer packaged, ready-to-eat, and convenience foods. According to the U.S. Department of Agriculture, the U.S. food-at-home CPI, which includes grocery and supermarket purchases, rose 0.2% in May 2025 and was 2.2% higher compared to May 2024. This reflects a steady increase in demand for packaged and at-home food products among U.S. consumers. These products require effective preservation methods to maintain freshness, prevent microbial growth, and extend shelf life. Potassium sorbate has become a preferred solution due to its proven ability to inhibit yeast, mold, and bacterial growth without altering the taste or texture of the product. Food processors rely on this preservative to meet shelf-life requirements while adhering to food safety regulations. Its broad usage across bakery items, dairy, processed meats, and sauces underscores its importance in preserving quality. Continued consumer preference for quick meal solutions is expected to keep driving this demand across retail and foodservice channels.

E-Commerce Expansion in Food and Beauty Sectors

Online shopping for food, cosmetics, and personal care products continues to surge, resulting in longer and more complex supply chains. In this environment, maintaining product integrity during transit and storage becomes critical. Potassium sorbate plays a vital role in protecting products from microbial spoilage across extended distribution periods. Its stability, effectiveness at low concentrations, and compatibility with a wide range of formulations make it suitable for online retail formats. Companies use it in items such as salad dressings, snacks, creams, and lotions to ensure safety and higher quality of products. According to the U.S. Census Bureau, in Q1 2025, e-commerce sales in the country reached USD 300.2 billion, an increase by 6.1% from Q1 2024, and accounted for 16.2% of total retail sales. Growing e-commerce penetration prompts manufacturers to rely more on dependable preservatives such as potassium sorbate, which drives the U.S. potassium sorbate market growth.

Segment Insights

Form Analysis

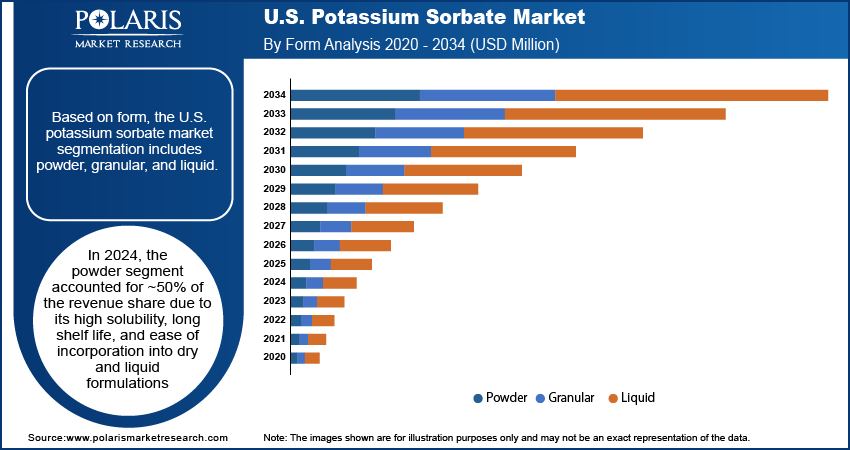

Based on form, the U.S. potassium sorbate market segmentation includes powder, granular, and liquid. In 2024, the powder segment accounted for ~50% of the revenue share due to its high solubility, long shelf life, and ease of incorporation into dry and liquid formulations. Food manufacturers often select the powder form for bakery products, dairy products, and processed foods where precise dosing and uniform dispersion are essential. Its minimal moisture content reduces the risk of premature microbial growth during storage, which adds to its appeal in large-scale food processing environments. The pharmaceutical and personal care sectors also favor the powder form for stable preservation in creams, syrups, and topical solutions, contributing to its strong market share.

The granular segment is gaining traction among manufacturers due to its easy handling, reduced dust generation, and suitability for automated dispensing systems. Its uniform particle size ensures consistent blending in bulk production processes, especially in beverages and liquid-based food applications. This format reduces processing time during manufacturing and is less prone to clumping, making it advantageous in high-speed industrial settings. Additionally, its relatively slower dissolution rate is desirable in specific applications where gradual release of the preservative is needed. Increased adoption of automation and formulation control across food and beverage production lines is supporting the segment growth.

Application Analysis

Based on application, the U.S. potassium sorbate market segmentation includes food & beverage, pharmaceuticals, cosmetics & personal care, industrial, and others. In 2024, the food & beverage segment accounted for ~36% of the revenue share due to its ability to extend product shelf life without compromising flavor or texture. Processed foods, baked goods, dairy items, and condiments benefit from its antimicrobial efficacy against molds and yeasts. Its GRAS (Generally Recognized as Safe) status by regulatory authorities such as the FDA reinforces confidence in its use across mainstream and clean-label products. Increasing demand for packaged and ready-to-eat foods fuels the need for preservatives that align with both consumer safety and industry efficiency standards, positioning potassium sorbate as a core preservative solution.

The pharmaceuticals segment is expected to register the highest CAGR during the forecast period. Pharmaceutical manufacturers are increasingly integrating potassium sorbate into liquid and semi-solid drug formulations, including oral syrups, suspensions, eye drops, and topical ointments. Its antimicrobial properties make it valuable in preventing contamination and ensuring the stability of products throughout their shelf life. Rising production of over-the-counter and prescription medications, combined with strict regulatory standards for microbial control, is pushing the segment forward. For instance, in 2022, the U.S. experienced an expenditure of USD 406 billion on retail prescription medications, net of rebates, as reported by the National Health Expenditure Accounts (NHEA). Growth in contract manufacturing and the expansion of pharmaceutical supply chains also contribute to increased adoption. The segment’s rapid expansion reflects growing awareness of potassium sorbate’s effectiveness as a safe and reliable preservative in complex formulations.

Key Players and Competitive Analysis

The competitive landscape of the U.S. potassium sorbate market is shaped by industry analysis that highlights a mix of established producers and new entrants pursuing market expansion strategies. Companies are investing in advanced manufacturing technologies to optimize purity levels and reduce production costs, allowing them to meet the growing demand across the food, pharmaceutical, and personal care industries. Strategic alliances are playing a critical role in improving distribution capabilities and expanding access to end-use sectors, particularly in regions with stringent preservative regulations. Joint ventures and mergers and acquisitions have emerged as key approaches to strengthening vertical integration, ensuring raw material security, and scaling operations. Post-merger integration efforts are focused on streamlining supply chains and enhancing operational efficiency to improve profit margins. Innovation in formulation techniques and customized preservative solutions, particularly for clean-label and organic products, is becoming a competitive differentiator. The adoption of sustainable production practices and the integration of environmentally friendly technologies are further reshaping competitive dynamics. Market participants are also leveraging digital platforms and real-time supply management systems to respond more efficiently to fluctuating demand and regulatory changes. Continuous investments in research and development (R&D) and compliance management enable companies to navigate evolving FDA regulations and consumer expectations around food-grade and pharma-grade preservatives, maintaining a strong foothold in the U.S. potassium sorbate market.

List of Key Companies

- ASTRRA CHEMICALS

- BIMAL PHARMA PVT. LTD.

- Celanese Corporation

- Conflate Chemtech

- FBC Industries

- Hunan Huari Pharmaceutical Co., Ltd.

- Jiangsu Mupro Ift Corp.

- Merck

- Shandong Kunda Biological Technology Co., Ltd.

- TCI

- Titan Biotech

U.S. Potassium Sorbate Industry Development

In April 2025, L3Harris Technologies signed a Memorandum of Understanding (MoU) with Zamil Shipyards to enhance local maritime engineering by integrating autonomous technology into current and future vessels. This initiative aligns with Saudi Arabia’s General Authority for Military Industries’ goal of promoting localization in related industries.

U.S. Potassium Sorbate Market Segmentation

By Form Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Powder

- Granular

- Liquid

By Application Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Food & beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial

- Others

U.S. Potassium Sorbate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 46.09 million |

|

Market Size in 2025 |

USD 47.92 million |

|

Revenue Forecast by 2034 |

USD 68.26 million |

|

CAGR |

4.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in kilotons; Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 46.09 million in 2024 and is projected to grow to USD 68.26 million by 2034.

The U.S. market is projected to register a CAGR of 4.0% during the forecast period.

A few of the key players are ASTRRA CHEMICALS; BIMAL PHARMA PVT. LTD.; Celanese Corporation; Conflate Chemtech; FBC Industries; Hunan Huari Pharmaceutical Co., Ltd.; Jiangsu Mupro Ift Corp.; Merck; Shandong Kunda Biological Technology Co., Ltd.; TCI; and Titan Biotech.

In 2024, the powder segment accounted for ~50% of the revenue share due to its high solubility, long shelf life, and ease of incorporation into dry and liquid formulations.

In 2024, the food & beverage segment accounted for ~36% of the revenue share due to its ability to extend product shelf life without compromising flavor or texture.