France Macarons Market Size, Share, Trends, Industry Analysis Report

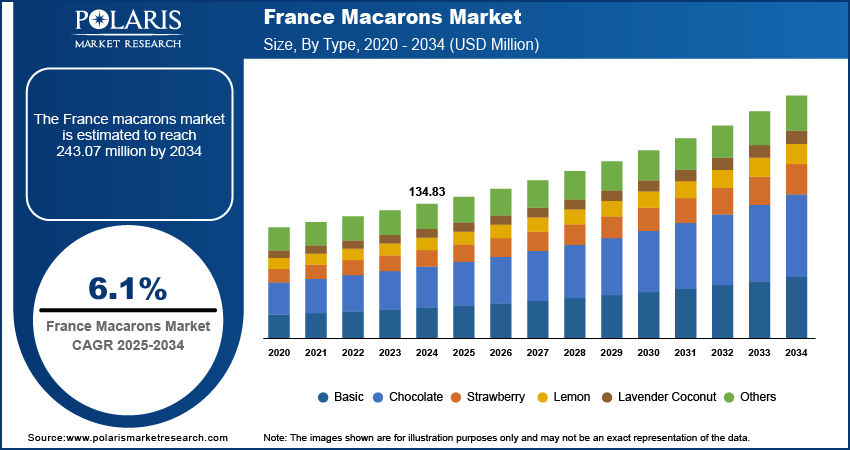

By Type (Basic, Chocolate, Strawberry, Lemon, Lavender Coconut, Others), By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5919

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

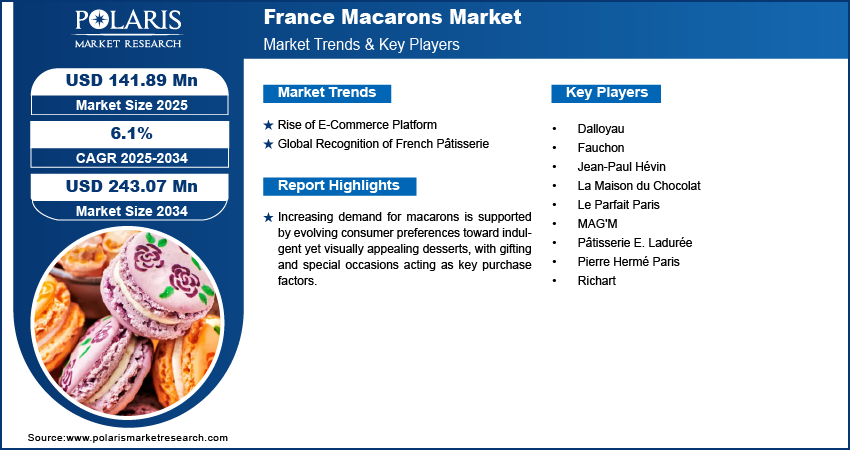

The France macarons market was valued at USD 134.83 million in 2024 and is expected to register a CAGR of 6.1% from 2025 to 2034. The market growth is driven by the rising penetration of e-commerce platforms and global recognition of French pâtisserie.

Macarons are delicate French confections made with almond flour, egg whites, and sugar, featuring a smooth, crisp shell and a soft, chewy interior. They are typically filled with ganache, buttercream, or jam in a variety of flavors.

The macaron's visual appeal plays a crucial role in its marketability. Their vibrant colors and elegant designs make them popular choices for special occasions, gifts, and social media sharing. This aesthetic quality improves consumer enjoyment and serves as a powerful marketing tool, particularly in the age of digital media, where visual content drives consumer engagement. As a result, businesses that invest in the artistic presentation of macarons often see increased brand recognition and customer loyalty.

The France macarons market has experienced dynamic growth driven by rising consumer interest in premium and artisanal confectionery products. France, as the originator of the macaron, holds a strong cultural and culinary position that continues to influence market demand both locally and abroad. These present a robust landscape where quality, innovation, and branding play critical roles in shaping competitive advantage.

Demand for macarons is supported by evolving consumer preferences toward indulgent yet visually appealing desserts, with gifting and special occasions, acting as key purchase drivers. The expansion of online retail platforms and direct-to-consumer sales channels has opened new avenues for growth, allowing brands to reach broader audiences beyond traditional brick-and-mortar locations. Innovations in flavor profiles and healthier alternatives, such as vegan and gluten-free options, are further broadening the consumer base, thereby driving the France macarons market growth.

Industry Dynamics

Rise of E-Commerce Platform

The rise of e-commerce has significantly impacted the France macarons market demand. According to E-Commerce Europe, the e-commerce sales reached EUR 175 billion or USD 206.35 billion in 2024, with 9.6% YoY growth. Online platforms allow consumers to access a wider variety of macaron options, including customizable assortments and nationwide delivery services. This convenience has expanded the customer base beyond traditional brick-and-mortar stores, enabling small and medium-sized enterprises to reach a broader audience. Moreover, online sales data provides valuable insights into consumer preferences, allowing businesses to tailor their offerings more effectively.

Global Recognition of French Pâtisserie

The recognition of French pâtisserie plays a major role in driving the demand for macarons. France is widely known as the home of fine desserts and pastries, and this reputation adds value to French products such as macarons. International customers associate French pâtisserie with elegance, quality, and tradition. Consequently, French macarons are viewed as luxury items and symbols of culinary excellence. This strong brand image helps French macaron makers expand into global regions, especially in countries where French cuisine is highly admired, such as Japan, the U.S., and parts of the Middle East. Many tourists seek authentic food experiences while visiting France, and tasting or buying macarons is often part of that journey. The prestige of French pastry culture continues to boost both local sales and export opportunities for macaron brands, thereby driving the growth.

Segmental Insights

Type Analysis

The chocolate segment accounted for 30.48% revenue share in 2024 as chocolate macarons remain one of the most popular and classic varieties in France. Their rich, smooth taste appeals to a wide range of consumers across all age groups. Many French pâtisseries, such as Ladurée and local artisan bakeries, offer chocolate macarons as a staple flavor. Consumers appreciate the balance of a crisp shell and velvety chocolate ganache, often made with high-quality dark chocolate. The enduring appeal of chocolate as a familiar and indulgent treat keeps demand strong. Seasonal variations, such as dark chocolate with orange or chili, further help maintain interest among repeat buyers in France, thereby driving the segment growth.

The strawberry segment is expected to account USD 30.20 million by 2034 due to the fruity, refreshing taste of strawberry flavored macarons. Many French consumers associate them with seasonal freshness and lighter dessert options for this bakery product. These macarons feature natural fruit purées or jams, aligning with the growing demand for clean-label and authentic ingredients. Macarons of strawberry flavor are further a popular choice for gift boxes and celebrations due to their vibrant color and broad appeal. French pâtisseries frequently experiment with combinations such as strawberry-basil or strawberry-cream, keeping the flavor fresh and modern while preserving its strong base popularity among both locals and tourists, thereby driving the segment growth.

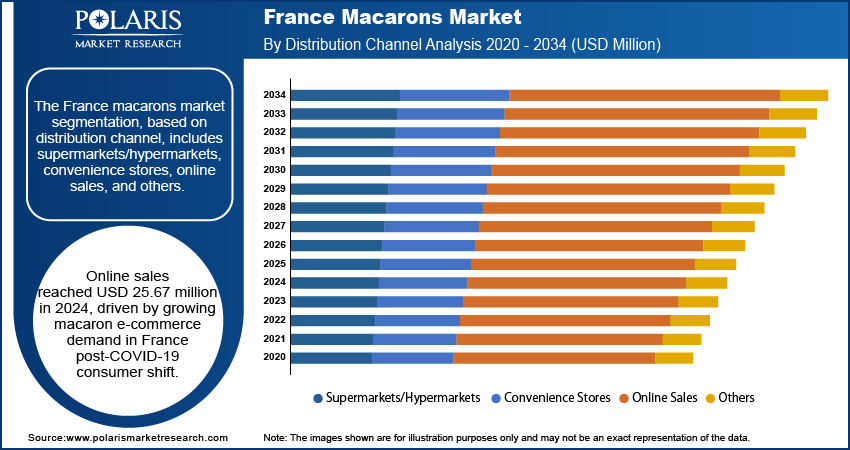

Distribution Channel Analysis

The supermarket/hypermarket segment accounted for 40.62% market share in 2024 as supermarkets and hypermarkets play an important role in making macarons more accessible to everyday consumers. Large retail chains such as Carrefour, E.Leclerc, and Monoprix stock packaged macarons in the refrigerated dessert or frozen sections. These offerings are more affordable and cater to impulse buyers or customers seeking convenient dessert options. Supermarket macarons meet growing demand for quick, accessible indulgence. French brands such as MAG’M have successfully tapped into this segment by offering good-quality macarons that balance price and flavor, making them popular for casual at-home consumption, thereby driving the segment growth.

The online sales segment accounted for USD 25.67 million revenue in 2024 as online sales have become a fast-growing channel for macaron purchases in France, especially since the COVID-19 pandemic shifted more consumers toward e-commerce. French pâtisseries offer direct-to-door delivery through their websites or platforms such as La Grande Épicerie and Amazon France. This allows customers to conveniently order premium macarons for gifting, special occasions, or personal enjoyment without visiting a store. Online sales further support regional producers in reaching nationwide audiences. Customization, attractive packaging, and express delivery options improve the online shopping experience, thereby driving the segment growth.

Key Players and Competitive Analysis

The French macarons market is highly competitive, led by the presence of prestigious pâtisseries that blend tradition with innovation. Ladurée and Pierre Hermé Paris dominate with global recognition and luxurious branding, often setting trends in flavor and presentation. Dalloyau and La Maison du Chocolat combine heritage with upscale positioning, offering macarons as part of a wider gourmet portfolio. Jean-Paul Hévin and Fauchon target premium segments through sophisticated flavor pairings and refined aesthetics. Richart focuses on design-forward, aromatic macarons, appealing to connoisseurs seeking elegance and complexity. MAG'M and Le Parfait Paris serve as agile competitors with strong export strategies, catering to both retail and professional clients. In this landscape, Franck Deville distinguishes itself through its commitment to 100% French ingredients, artisan craftsmanship, and global outreach. As demand grows for authentic, high-quality products, brands that emphasize traceability, sustainability, and innovation are likely to gain a competitive edge in both domestic and international markets.

Key Players

- Dalloyau

- Fauchon

- Jean-Paul Hévin

- La Maison du Chocolat

- Le Parfait Paris

- MAG'M

- Pâtisserie E. Ladurée

- Pierre Hermé Paris

- Richart

Industry Developments

September 2023: Franck Deville launched macaroons made with 100% French ingredients, showcasing artisanal expertise and reinforcing the brand’s dedication to quality and France’s culinary heritage.

France Macarons Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Basic

- Chocolate

- Strawberry

- Lemon

- Lavender Coconut

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Sales

- Others

France Macarons Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 134.83 Million |

|

Market Size in 2025 |

USD 141.89 Million |

|

Revenue Forecast by 2034 |

USD 243.07 Million |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 134.83 million in 2024 and is projected to grow to USD 243.07 million by 2034

The market is projected to register a CAGR of 6.1% during the forecast period.

A few of the key players in the market are Pâtisserie E. Ladurée, Pierre Hermé Paris, Dalloyau, Jean-Paul Hévin, La Maison du Chocolat, Fauchon, Richart, MAG'M, and Le Parfait Paris.

The chocolate segment dominated the market share in 2024.

The online sales segment is expected to witness the fastest growth during the forecast period.