U.S. Allergy and Autoimmune Disease Diagnostics Market Size, Share, Trends, Industry Analysis Report

By Products & Services (Allergy Diagnostics, Autoimmune Disease Diagnostics), By Test Type, By Diagnostics Type, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6281

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

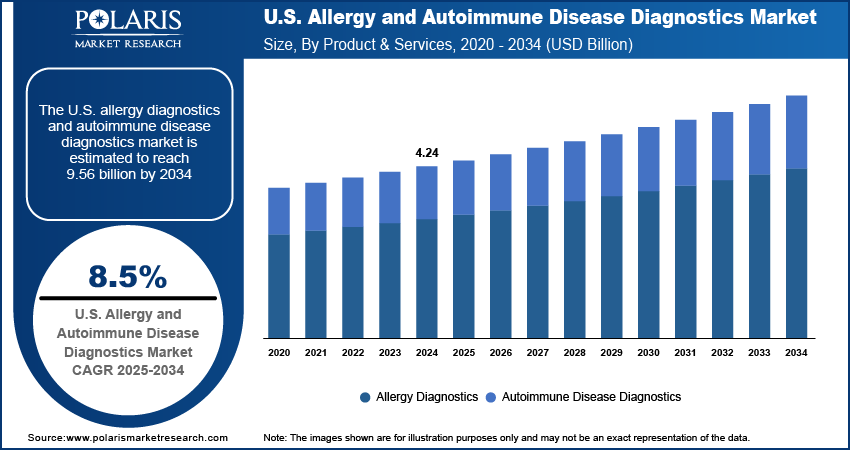

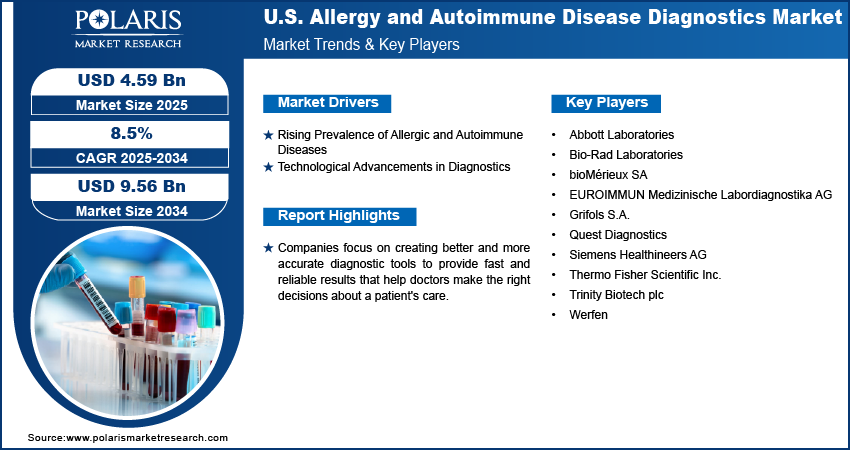

The U.S. allergy and autoimmune disease diagnostics market size was valued at USD 4.24 billion in 2024 and is anticipated to register a CAGR of 8.5% from 2025 to 2034. The growing prevalence of allergic and autoimmune diseases and increasing public and clinical awareness about the importance of early diagnosis drive the market growth. Additionally, advancements in diagnostic technology are improving the accuracy and speed of testing.

Key Insights

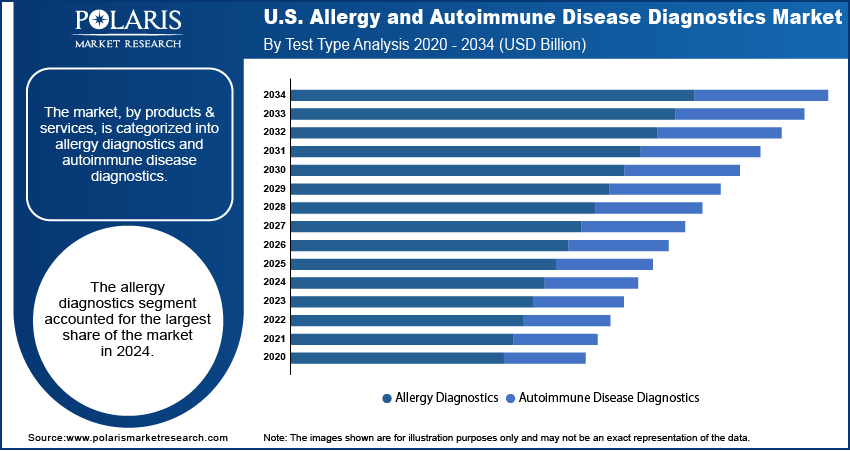

- Based on product & services, the allergy diagnostics segment held the largest share in 2024. This leadership is attributed to the widespread prevalence of conditions such as asthma, allergic rhinitis, and food allergies in the U.S. population.

- Based on test type, the allergy diagnostics segment held the largest share in 2024. This dominance is attributed to the frequent use of diagnostic tests that identify common allergens such as pollen, foods, and environmental triggers.

- Based on diagnostics type, the allergy diagnostics segment held the largest share in 2024. This trend is supported by rising public awareness and a growing need for quick, accurate allergy identification.

- Based on end use, the hospitals and clinics segment dominated in 2024 due to their large patient volumes and access to advanced equipment.

Industry Dynamics

- Rising incidence of allergic and autoimmune diseases in the U.S. drives the market expansion. Conditions such as asthma, rheumatoid arthritis, and lupus are becoming more common. This rise in cases directly boosts the demand for diagnostic testing to identify and manage these diseases early.

- Another key factor is the constant improvement in diagnostic technologies. New, more accurate, and faster diagnostic tools, such as multiplex immunoassays and molecular diagnostics, are being developed. These innovations are helping doctors get better insights into a patient's condition, which drives the adoption of these new tests.

- A growing focus on early diagnosis and personalized medicine is boosting the demand for diagnostics. As people and healthcare providers become more aware of these diseases, there's a greater emphasis on finding them early. This helps create more tailored treatment plans, which leads to a higher demand for specific tests.

Market Statistics

- 2024 Market Size: USD 4.24 billion

- 2034 Projected Market Size: USD 9.56 billion

- CAGR (2025-2034): 8.5%

AI Impact on U.S. Allergy and Autoimmune Disease Diagnostics Market

- AI algorithms analyze immunologic datasets to detect patterns in symptoms, biomarkers, and genetic profiles. It helps in earlier and accurate diagnoses of various conditions such as rheumatoid arthritis, lupus, and allergic rhinitis.

- The technology forecasts disease progression by continuously learning from patient data, which assists clinicians in intervening proactively.

- Hospitals and labs across the U.S. are increasingly investing in AI-enabled platforms to streamline workflows and reduce diagnostic errors.

- Startups and tech firms are entering the market with AI-integrated allergy testing kits and autoimmune screening tools.

- Regulatory Bodies are introducing guidelines to address privacy and ethical concerns around AI in immunologic diagnostics

The U.S. allergy and autoimmune disease diagnostics market involves a range of tests, from simple blood tests to more complex genetic screening and services. These are used to find and monitor conditions where a person's immune system wrongly attacks their own body or overreacts to something in the environment.

Growing preference for personalized medicine drives the industry expansion. Instead of a one-size-fits-all approach, doctors are trying to create treatments and care plans for each patient suffering from allergy diagnostics and therapeutics. Diagnostic tests are a key part of this. They help identify specific biomarkers and genetic traits that can show how a person might respond to certain drugs. This focus on individual patient data is a significant factor in the demand for more advanced diagnostic tools.

Patient education and awareness are positively impacting the market. As more people learn about the signs and symptoms of allergy and autoimmune diseases, they are more likely to seek out an early diagnosis. This increased public awareness is being supported by organizations such as the National Institute of Allergy and Infectious Diseases (NIAID), a part of the NIH. The NIAID and other groups help educate the public about various immune-system related disorders and the importance of timely and accurate diagnosis.

Drivers and Trends

Rising Prevalence of Allergic and Autoimmune Diseases: The increasing incidence of allergic and autoimmune diseases in the U.S. is a primary factor driving the demand for diagnostics. These conditions, which involve the immune system malfunctioning, are becoming more widespread. As a result, there is a greater need for diagnostic tests to accurately identify these diseases, which can often present with similar symptoms. This growing patient population directly leads to a higher volume of tests being performed.

A 2025 report from the Asthma and Allergy Foundation of America titled "AAFA Allergy Facts and Figures" found that more than 100 million people in the U.S. experience some form of allergy each year. This includes seasonal allergies, eczema, and food allergies. This high number of people affected by allergies propels the demand for diagnostic products and services to help manage their conditions.

Technological Advancements in Diagnostics: Innovations in diagnostic technology are a key driver for the market. These advancements are leading to tests that are more accurate, faster, and easier to use. New technologies, such as multiplex immunoassays and molecular diagnostics, allow for the detection of multiple allergens or autoantibodies from a single sample. This improved efficiency and precision help doctors make a quicker and more accurate diagnosis, which is crucial for starting the right treatment.

Segmental Insights

Product & Service Analysis

Based on product & services, the U.S. allergy and autoimmune disease diagnostics market segmentation includes allergy diagnostics and autoimmune disease diagnostics. The allergy diagnostics segment held the largest share in 2024. This leadership is attributed to the widespread prevalence of conditions such as asthma, allergic rhinitis, and food allergies in the U.S. The demand for reliable and easily accessible testing has grown in clinical, outpatient, and at-home settings. Increasing public awareness, broader availability of allergy tests, and advancements in in-vitro diagnostics continue to propel this segment. The transition toward decentralized care and the rise in usage of home-based test kits further enhance its adoption by enabling early detection in more convenient and cost-effective ways. In June 2024, Kenota Health secured FDA 510(k) clearance and a CLIA waiver for its Point-of-Care Allergy Test System, allowing for rapid, laboratory-free testing, thus reinforcing the movement toward decentralized diagnostic solutions. The segment is expected to witness growth in the coming years due to ongoing innovation in at-home testing technologies and greater integration with digital health platforms and remote care delivery systems.

The autoimmune disease diagnostics segment is anticipated to register the highest growth rate during the forecast period. This trend is supported by the increasing incidence of chronic immune-related disorders, including rheumatoid arthritis, systemic lupus erythematosus (SLE), and type 1 diabetes. Greater public and medical community awareness, along with improved access to autoantibody-based testing and more advanced disease-specific panels, are key contributors. Early diagnosis is critical for effective long-term disease management. Innovations in molecular diagnostics, novel biomarker identification, and improvements in digital immunoassay platforms are further driving adoption in hospitals, specialty clinics, and diagnostic labs. Given that many autoimmune conditions present with overlapping symptoms, the demand for precise diagnostic tools continues to grow.

Test Type Analysis

Based on test type, the U.S. allergy and autoimmune disease diagnostics market segmentation includes allergy diagnostics and autoimmune disease diagnostics. The allergy diagnostics segment held the largest share in 2024. This dominance is attributed to the frequent use of diagnostic tests that identify common allergens such as pollen, foods, and environmental triggers. Techniques such as skin prick tests, specific IgE blood tests, and patch testing are widely used due to their simplicity, reliability, and compatibility with routine clinical procedures. According to the CDC, over 50 million people in the U.S. suffer from allergies each year, making it a leading chronic health issue. The segment continues to benefit from rising awareness, growing interest in early diagnosis, and the development of direct-to-consumer testing models. Well-established protocols and increasing demand for efficient diagnostics support the segment’s stronghold in the market.

The autoimmune disease segment is anticipated to register the highest growth rate during the forecast period, supported by a rise in prevalence of immune-related disorders and the need for precise diagnostic tools. As symptoms often resemble those of other diseases, early and specific testing becomes essential. Common tests include antinuclear antibody (ANA) panels, autoantibody screenings, and molecular-based diagnostics. In January 2025, Exagen Inc. expanded its AVISE CTD platform by introducing seven new biomarker assays, including TC4d, TIgG, TIgM, and anti-RA33 in multiple variants, plus anti-CarP, all designed to improve diagnostic accuracy for SLE and RA. Enhanced accuracy, rapid lab processing, and greater access to specialized testing are all contributing to the segment's growth. With the shift toward personalized care, more healthcare facilities are incorporating autoimmune diagnostic services. Advancements in immunology research continue to expand the range and utility of available testing methods.

Diagnostics Type Analysis

Based on diagnostics type, the U.S. allergy and autoimmune disease diagnostics market segmentation includes allergy diagnostics and autoimmune disease diagnostics. The allergy diagnostics segment held the largest share in 2024. This trend is supported by rising public awareness and a growing need for quick, accurate allergy identification. Standard testing methods such as skin prick, IgE blood tests, and immunoassays are known for their ease of use and consistent performance across healthcare settings. These tests are widely available in hospitals and labs as well as in home-use formats. Innovations such as automated allergen panels, higher test sensitivity, and digital reporting platforms are pushing the segment forward. In August 2024, researchers developed a real-time inflammation monitoring patch capable of tracking immune responses through the skin, aligning with the broader trend of non-invasive, real-time health monitoring tools. As individuals seek early allergy detection and prefer convenient testing options, the demand for allergy diagnostics continues to expand. Its simplicity and adaptability make it a key component of the overall diagnostics landscape.

The autoimmune diagnostics segment is anticipated to register the highest growth rate during the forecast period. Diseases such as celiac disease, RA, and lupus often present diagnostic challenges, necessitating advanced testing solutions. The wider application of multiplex immunoassays, indirect immunofluorescence, and molecular techniques is supporting this shift. These methods help identify specific autoantibodies and genetic markers linked to immune disorders. Emerging technologies such as AI-powered diagnostics, digital testing systems, and high-speed screening platforms are improving both efficiency and accuracy. As healthcare systems prioritize personalized treatment plans and continuous monitoring, the role of autoimmune diagnostics continues to grow in importance.

End Use Analysis

Based on end use, the U.S. allergy and autoimmune disease diagnostics market segmentation includes allergy diagnostics and autoimmune disease diagnostics. The allergy diagnostics segment held the largest share in 2024. Primary users include hospitals, clinics, diagnostic labs, and research institutions. The hospitals and clinics segment dominates this segment due to their large patient volumes and access to advanced equipment. In June 2025, Mount Sinai Health System received a $5 million donation aimed at expanding its services for eczema and other allergy-related conditions. This funding has been used to enhance diagnostic capabilities, recruit more clinical staff, and invest in research, reflecting how major U.S. healthcare providers are scaling efforts to meet growing demand. Laboratories continue to play a central role in processing high volumes of tests, while research centers are focused on innovation and method optimization. These stakeholders collectively reinforce the strong market position of allergy diagnostics.

The autoimmune diagnostics segment is anticipated to register the highest growth rate during the forecast period. Rising awareness of autoimmune disorders and a strong push toward early, precise diagnosis are central to this trend. Hospitals and clinics use these tests to detect conditions such as RA and SLE at early stages, often leading to better patient outcomes. Diagnostic laboratories handle extensive testing with the help of specialized molecular tools and disease-specific panels. Research centers are also driving the segment growth by identifying new biomarkers and refining diagnostic protocols. As test technologies become more advanced and healthcare emphasizes individualized care, autoimmune diagnostics is expected to become an integral part of diagnostic practices in various healthcare settings.

Key Players and Competitive Insights

The U.S. allergy and autoimmune disease diagnostics market is highly competitive with a number of key players. These companies are focused on developing new and better diagnostic tools to meet the rising demand for both allergy and autoimmune disease testing. Companies often compete on factors such as the accuracy, speed, and ease of use of their diagnostic platforms. This competitive landscape is marked by continuous innovation, with companies investing in research to find new biomarkers and improve existing testing technologies. The focus is on offering comprehensive solutions that can integrate with existing laboratory systems and help doctors make faster, more informed decisions for patients.

A few prominent companies in the U.S. allergy and autoimmune disease diagnostics market include Abbott Laboratories, Bio-Rad Laboratories, Quest Diagnostics, Siemens Healthineers AG (Siemens AG), Thermo Fisher Scientific (Phadia AB), Grifols S.A, bioMérieux SA, Trinity Biotech plc, Werfen, and EUROIMMUN Medizinische Labordiagnostika AG.

Key Players

- Abbott Laboratories

- Bio-Rad Laboratories

- bioMérieux SA

- EUROIMMUN Medizinische Labordiagnostika AG (Revvity, Inc.)

- Grifols S.A.

- Quest Diagnostics

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Trinity Biotech plc

- Werfen

U.S. Allergy and Autoimmune Disease Diagnostics Industry Developments

April 2025: Siemens AG announced it would acquire Dotmatics, a software provider for the life sciences industry. This acquisition is aimed at expanding Siemens' software portfolio and bringing AI-powered tools to research and development.

April 2025: Thermo Fisher Scientific opened a new Advanced Therapies Collaboration Center in San Diego. The goal of this new center is to help speed up the development of cell therapies, which are a growing area of treatment.

U.S. Allergy and Autoimmune Disease Diagnostics Market Segmentation

By Products & Services Outlook (Revenue – USD Billion, 2020–2034)

- Allergy Diagnostics

- Instruments

- Consumables

- Services

- Autoimmune Disease Diagnostics

- Instruments

- Consumables

- Services

By Test Type Outlook (Revenue – USD Billion, 2020–2034)

- Allergy Diagnostics

- In vivo Test

- Skin Prick Test

- Intradermal Test

- Patch Test

- In vitro Test

- In vivo Test

- Autoimmune Disease Diagnostics

- Antinuclear Antibody Tests

- Autoantibody Tests

- C-reactive Protein (CRP)

- Complete Blood Count (CBC)

- Urinalysis

- Others

By Diagnostics Type Outlook (Revenue – USD Billion, 2020–2034)

- Allergy Diagnostics

- Food

- Dairy Products

- Poultry Product

- Tree Nuts

- Peanuts

- Shellfish

- Wheat

- Soys

- Other Food Allergens

- Inhaled

- Drug

- Other Allergens

- Food

- Autoimmune Disease Diagnostics

- Systemic Autoimmune Disease Diagnostics

- Rheumatoid Arthritis

- Ankylosing Spondylitis

- Systemic Lupus Erythematosus (SLE)

- Others

- Localized Autoimmune Disease Diagnostics

- Multiple Sclerosis

- Type 1 Diabetes

- Hashimoto's Thyroiditis

- Idiopathic Thrombocytopenic Purpura

- Others

- Systemic Autoimmune Disease Diagnostics

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Allergy Diagnostics

- Hospitals & Clinics

- Diagnostics Laboratories

- Research Institutions

- Others

- Autoimmune Disease

- Hospitals & Clinics

- Diagnostics Laboratories

- Research Institutions

- Others

U.S. Allergy and Autoimmune Disease Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.24 billion |

|

Market Size in 2025 |

USD 4.59 billion |

|

Revenue Forecast by 2034 |

USD 9.56 billion |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.24 billion in 2024 and is projected to grow to USD 9.56 billion by 2034.

The market is projected to register a CAGR of 8.5% during the forecast period.

A few key players in the market include Abbott Laboratories, Bio-Rad Laboratories, Quest Diagnostics, Siemens Healthineers AG (Siemens AG), Thermo Fisher Scientific (Phadia AB), Grifols S.A., bioMérieux SA, Trinity Biotech plc, Werfen, and EUROIMMUN Medizinische Labordiagnostika AG.

The allergy diagnostics segment accounted for the largest share of the market in 2024.

The autoimmune disease segment is expected to witness the fastest growth during the forecast period.