Europe Fiber Cement Market Size, Share, Trends, Industry Analysis Report

By Material (Portland, Silica, Cellulosic, Others), By Product, By Application, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6278

- Base Year: 2024

- Historical Data: 2020-2023

Overview

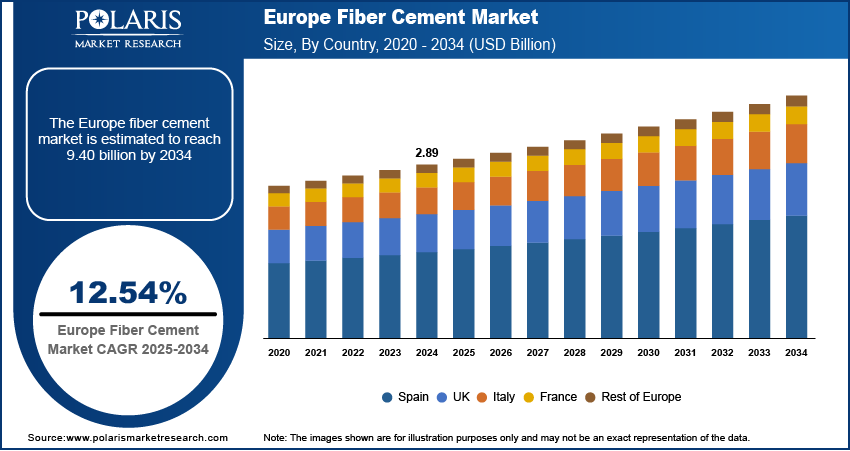

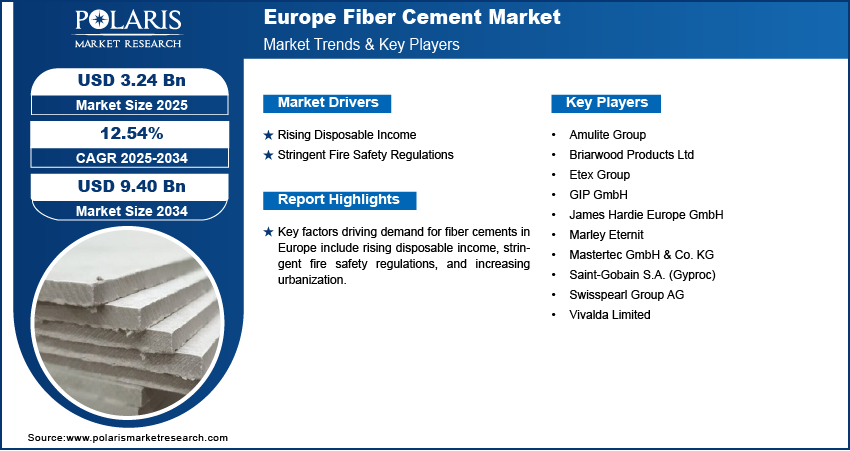

The Europe fiber cement market size was valued at USD 2.89 billion in 2024, growing at a CAGR of 12.54% from 2025 to 2034. Key factors driving demand for fiber cements in Europe include rising disposable income, stringent fire safety regulations, and increasing urbanization.

Key Insights

- The portland segment held the largest revenue share in 2024 due to its widespread availability and durability.

- The cladding segment dominated the revenue share in 2024 as it plays a critical role in providing thermal insulation.

- The UK fiber cement market accounted for the largest Europe fiber cement market share in 2024, owing to the imposition of stringent building regulations.

- The market in France is expected to register the highest CAGR from 2025 to 2034, due to a shift toward sustainable and high-performance building materials.

Industry Dynamics

- The rising disposable income encourages people to prioritize premium building solutions, such as fiber cement, as it offers long-term benefits such as weather resistance. This factor is fueling the demand for fiber cement across Europe.

- The stringent fire safety regulations in Europe are driving the adoption of fiber cement as it naturally resists fire.

- The rising government spending on infrastructure development is projected to create a lucrative market opportunity during the forecast period.

- The high cost of installation of fiber cement products hinders the market growth.

Artificial Intelligence (AI) Impact on Europe Fiber Cement Market

- AI is projected to optimize manufacturing processes, reducing waste and energy use in fiber cement production.

- The technology is estimated to analyze market trends, improving inventory management and supply chain responsiveness.

- AI-powered sensors are expected to detect defects early, ensuring consistent product quality.

- AI is accelerating R&D for eco-friendly fiber cement formulations, aligning with Europe’s green building goals.

Market Statistics

- 2024 Market Size: USD 2.89 Billion

- 2034 Projected Market Size: USD 9.40 Billion

- CAGR (2025–2034): 12.54%

Fiber cement is a durable construction material made from a mixture of cement, sand, and cellulose fibers. It offers excellent resistance to moisture, fire, pests, and harsh weather conditions, making it ideal for external cladding, roofing, and siding applications. Fiber cement is low-maintenance, long-lasting, and eco-friendly, as it usually includes recycled materials. Fiber cement's ability to mimic wood, stone, or brick while offering greater durability makes it a popular choice for residential, commercial, and industrial buildings.

In Europe, the popularity of fiber cement is growing rapidly due to rising demand for sustainable and energy-efficient construction materials. Stricter regulations regarding fire safety and environmental impact are also driving widespread adoption across residential and nonresidential sectors. Countries such as Germany, the UK, and France are leading the market, supported by ongoing renovations of aging infrastructure and increasing green building initiatives. The region's focus on durable, weather-resistant, and low-maintenance materials is further boosting demand for fiber cement products in façades, roofing, and partitioning systems.

The Europe fiber cement market demand is driven by the increasing urbanization. European Commission, in its report, stated that urbanization in Europe is expected to increase to approximately 83.7% by 2050. This is leading to the development of higher residential and commercial buildings, where fiber cements are preferred due to their fire resistance, low maintenance, and sustainability capabilities. Governments and developers in urban areas are also prioritizing resilient infrastructure, and fiber cement meets these needs while complying with stricter building codes. Additionally, urbanization is increasing the demand for lightweight, versatile materials that speed up construction and reduce costs, making fiber cement a preferred choice in modern urban projects.

Drivers & Opportunities/Trends

Rising Disposable Income: Greater disposable income is allowing people to have financial flexibility, which is encouraging them to prioritize premium building solutions such as fiber cement, as it offers long-term benefits such as weather resistance, low maintenance, and aesthetic appeal. According to the 2021 census, gross disposable household income (GDHI) in the UK in 2022 grew by 6.3% when compared with 2021. Additionally, higher disposable income is propelling renovations and upgrades, further driving demand for fiber cement in both new construction and remodeling projects. Developers are also catering to this trend by incorporating fiber cement into premium housing projects, strengthening its market growth.

Stringent Fire Safety Regulations: Fiber cement naturally resists fire, making it a preferred choice for cladding, roofing, and facades in high-risk areas. Authorities in the region are enforcing tighter building codes after incidents such as the Grenfell Tower fire. Such incidents prompt contractors to use fiber cement due to its Class A fire rating, ensuring compliance while maintaining design flexibility. The growing emphasis on fireproof construction in residential and commercial projects is further boosting fiber cement adoption across Europe.

Segmental Insights

Material Analysis

Based on material, the segmentation includes portland, silica, cellulosic, and others. The portland segment held the largest revenue share in 2024 due to its superior strength, durability, and widespread availability. Construction companies across Europe are increasingly opting portland-based composites for external siding, roofing, and façade applications, especially in regions with harsh weather conditions. The material's resistance to fire, moisture, and pests contributed to its dominance, particularly in residential and commercial building projects. Additionally, the growing focus on cost-effective and long-lasting construction materials supported the demand for portland-based fiber cement, as it offers a balanced blend of affordability and performance.

The silica segment is estimated to grow at a robust pace in the coming years, owing to its lightweight nature and enhanced workability. Architects and builders are showing growing interest in silica fiber cement boards due to their ability to reduce structural load and improve energy efficiency. The push for sustainable construction solutions across European Union nations, aligned with green building certifications and low-carbon initiatives, is further boosting the appeal of silica-infused materials. Innovations in silica formulations, offering greater flexibility and design versatility, are expected to propel their adoption across both new construction and renovation sectors.

Product Analysis

In terms of product, the segmentation includes cladding, siding/weatherboard, roofing, molding & trim, and others. The cladding segment dominated the revenue share in 2024 due to its critical role in enhancing building aesthetics and providing thermal insulation. Construction firms across urban centers in countries such as Germany, the UK, and France prioritized fiber cement cladding panels for their resistance to fire, moisture, and rot, especially in high-rise and commercial buildings. The demand for cladding also increased due to stringent EU regulations promoting energy-efficient and fire-resistant construction materials. Additionally, the surge in renovation activities and the demand for ventilated façade systems in older structures further strengthened the dominance of cladding products.

Application Analysis

In terms of application, the segmentation includes residential, commercial, industrial, education/institutional, agricultural, and others. The residential segment accounted for a major revenue share in 2024 due to strong demand for cost-effective, durable, and aesthetically appealing building materials in housing projects. Governments across the region promoted energy-efficient residential construction through incentives and regulatory frameworks, which increased the adoption of fiber cement for façades, flooring, roofing, and siding applications. Homebuilders favored the material for its fire resistance, moisture durability, and low maintenance, particularly in single-family and multi-family developments. Renovation programs in aging residential infrastructure across Western and Northern Europe also contributed to the segment’s dominance.

The commercial segment is expected to grow at a rapid pace during the forecast period owing to rapid urbanization and increasing investments in infrastructure development, such as office buildings, shopping centers, and hospitality projects. Commercial project developers are opting for fiber cement products as they combine visual appeal with functional benefits such as weather resistance and acoustic insulation. Additionally, green building initiatives and ESG-focused construction practices are prompting commercial stakeholders to adopt fiber cement that aligns with sustainability goals.

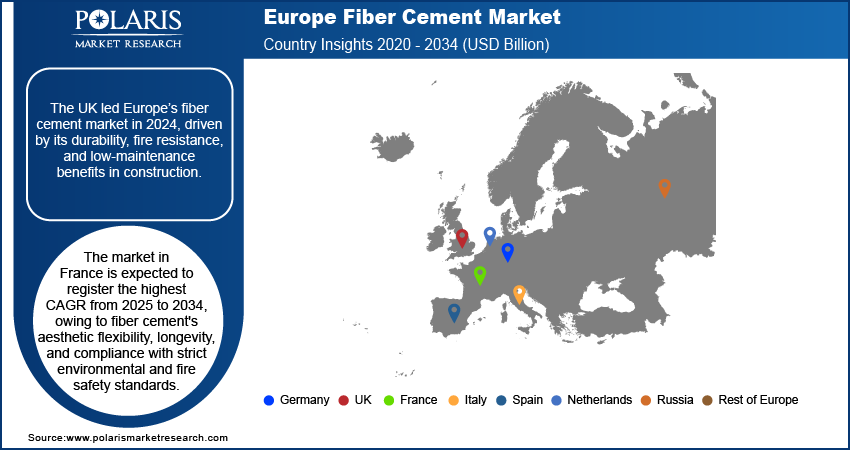

Country Analysis

The UK fiber cement market accounted for the largest Europe fiber cement market share in 2024. This is attributed to the benefits of fiber cement such as durability, fire resistance, and low maintenance requirements, making it a preferred material for both residential and commercial construction. The UK’s stringent building regulations, which emphasized fire safety and energy efficiency, further boosted its adoption, particularly in high-rise buildings following the Grenfell Tower tragedy. Additionally, the growing trend toward sustainable construction has increased the use of fiber cement, as it is an eco-friendly alternative to traditional materials such as timber and vinyl. The material’s versatility in applications such as cladding, roofing, and facades, combined with its resistance to harsh weather conditions, has also contributed to its rising popularity in the UK market.

The market in France is expected to register a robust CAGR from 2025 to 2034, owing to fiber cement's aesthetic flexibility, longevity, and compliance with strict environmental and fire safety standards. The French construction industry is witnessing a shift toward sustainable and high-performance building materials, with fiber cement being favored for its low carbon footprint and recyclability. Urbanization and the renovation of older buildings in France are also driving demand for fiber cement as it is used in modern facades and roofing for its weather-resistant properties. Furthermore, France’s focus on reducing energy consumption in buildings aligns with fiber cement’s thermal insulation benefits, making it a key material in energy-efficient construction projects.

Key Players & Competitive Analysis

The Europe fiber cement market is highly competitive, with key players such as Saint-Gobain (Gyproc), Etex Group, and James Hardie Europe GmbH dominating the industry. These companies leverage strong brand recognition, extensive distribution networks, and advanced product innovation to maintain their market positions. Saint-Gobain focuses on sustainability and high-performance building solutions, while Etex Group excels in fire-resistant and durable fiber cement products. James Hardie is a leader in fiber cement cladding and siding, emphasizing weather-resistant solutions. Mid-sized players such as Swisspearl Group AG, Vivalda Limited, and Marley Eternit compete through specialized offerings, including lightweight panels and architectural finishes. Regional manufacturers such as GIP GmbH, Mastertec GmbH & Co. KG, Briarwood Products Ltd, and Amulite Group cater to niche segments with cost-effective and customized solutions. The market is witnessing increased consolidation, technological advancements, and a shift toward eco-friendly materials, driving competition further. Companies are also expanding through strategic partnerships, mergers, and acquisitions to strengthen their foothold in Europe’s growing construction sector.

A few major companies operating in the Europe fiber cement market include Amulite Group, Briarwood Products Ltd, Etex Group, GIP GmbH, James Hardie Europe GmbH, Marley Eternit, Mastertec GmbH & Co. KG, Saint-Gobain S.A. (Gyproc), Swisspearl Group AG, and Vivalda Limited.

Key Players

- Amulite Group

- Briarwood Products Ltd

- Etex Group

- GIP GmbH

- James Hardie Europe GmbH

- Marley Eternit

- Mastertec GmbH & Co. KG

- Saint-Gobain S.A. (Gyproc)

- Swisspearl Group AG

- Vivalda Limited

Europe Fiber Cement Industry Developments

In December 2023, Etex, a building material manufacturer, enhanced its architectural design with the acquisition of SCALAMID, a manufacturer of fiber cement panels.

In January 2023, Cedral, the UK’s major provider of fiber cement cladding and a part of Etex Group, launched a new and refreshed collection of colors for its facade range.

Europe Fiber Cement Market Segmentation

By Material Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Portland

- Silica

- Cellulosic

- Others

By Product Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Cladding

- Rainscreen/Ventilated

- Direct‑fix/Non‑ventilated

- Siding/Weatherboard

- Roofing

- Molding & Trim

- Other

By Application Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Residential

- Commercial

- Industrial

- Education/Institutional

- Agricultural

- Others

By Country Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Fiber Cement Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.89 Billion |

|

Market Size in 2025 |

USD 3.24 Billion |

|

Revenue Forecast by 2034 |

USD 9.40 Billion |

|

CAGR |

12.54% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kiloton, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.89 billion in 2024 and is projected to grow to USD 9.40 billion by 2034.

The market is projected to register a CAGR of 12.54% during the forecast period.

The UK dominated the market in 2024.

A few of the key players in the market are Amulite Group, Briarwood Products Ltd, Etex Group, GIP GmbH, James Hardie Europe GmbH, Marley Eternit, Mastertec GmbH & Co. KG, Saint-Gobain S.A. (Gyproc), Swisspearl Group AG, and Vivalda Limited.

The portland segment dominated the market revenue share in 2024.

The commercial segment is projected to witness the fastest growth during the forecast period.