Facades Market Share, Size, Trends, Industry Analysis Report

By Product Type (Ventilated, Non-Ventilated, Others); By Material; By Application Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1032

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

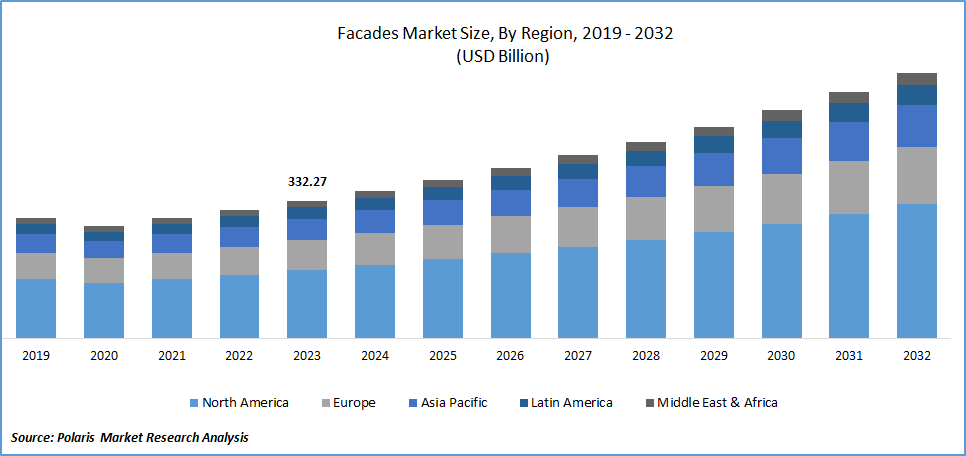

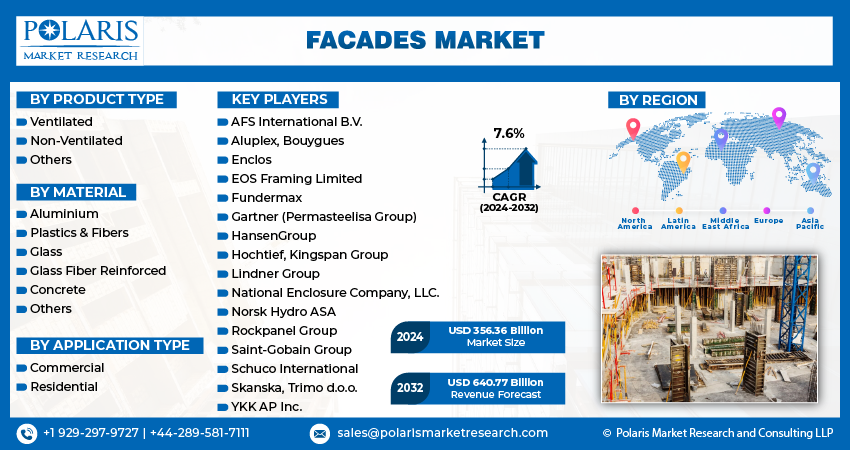

The global facades market was valued at USD 332.27 billion in 2023 and is expected to grow at a CAGR of 7.6% during the forecast period.

The use of metal and glass has heavily influenced the progression of modern architecture. These materials have stirred people's interest and fascination since their introduction into architecture and have prompted the development of construction techniques that allow architects to construct bolder and brighter buildings. These technical advancements in the construction and infrastructure industry have paved the way for the use of energy-efficient materials such as facades.

To Understand More About this Research: Request a Free Sample Report

Several factors have contributed to the increase in this technology, including the growing industrialization in the construction field, advantageous cost development, the progressive increase in labor costs relative to the cost of materials, and the growing demand for reliability, controlled planning, and maintenance. These materials not only protect the interiors of buildings but also enhance their appearance. Facade panels offer a cost-effective solution, reducing the need for expensive cement or adhesive purchases. They are also two to three times cheaper than stone decorations. In addition, facade panels are energy efficient, reducing the costs of air conditioning and heating in buildings. They significantly improve the building's aesthetics, which is in high demand these days. All these factors have led to a significant increase in the market for facades.

The construction industry in developing nations like India, China, and Brazil has experienced significant growth. Additionally, there has been a high demand for advanced materials that can reduce energy costs during fluctuating weather conditions. As a result, the use of facades has become increasingly popular worldwide. This trend has further boosted the market and is expected to continue during the forecast period.

Industry Dynamics

Growth Drivers

Increased construction activities have resulted in the expansion of the Facades Market.

As urbanization and infrastructure development continue to accelerate, there is a growing demand for aesthetically pleasing and functional building facades. Facades play a crucial role in enhancing the visual appearance and energy efficiency of structures while also protecting them from external elements.

With the increased focus on sustainable and eco-friendly construction practices, the demand for innovative facade materials and technologies has surged. This has paved the way for the introduction of advanced solutions such as green facades, ventilated facades, and intelligent facades. Along with this, the evolving architectural trends and the need for customization have further fuelled the growth of the Facades Market.

As a result of this, manufacturers and suppliers catering to this sector are experiencing significant growth opportunities, prompting them to invest in research and development to meet the evolving demands of the construction industry. The expansion of the Facades Market not only reflects the progress in construction activities but also signifies the industry's commitment to creating visually appealing, sustainable, and high-performance building exteriors.

Report Segmentation

The market is primarily segmented based on product type, material, application type, and region.

|

By Product Type |

By Material |

By Application Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

The ventilated facade is estimated to dominate the facade market in 2023.

The demand for ventilated facades is increasing due to their unique features that improve the building's functionality and aesthetics. The ventilation gap in these facades helps regulate the microclimate inside the building, creating a healthier and more comfortable environment for the occupants. The ability to control heat and moisture reduced the need for HVAC systems, thereby promoting energy efficiency.

Apart from that, ventilated facades also act as effective sound barriers, enhancing acoustic comfort inside the building. They offer increased fire resistance, making them a safer choice for high-rise constructions. The design of these facades facilitates easy installation and replacement of individual components, which significantly reduces maintenance and repair costs over time. Additionally, the increasing demand for customized aesthetic solutions and the wide variety of materials, textures, and colors available for ventilated facades positively impact their sales.

By Application Type Analysis

The commercial Sector is expected to hold the highest revenue share in 2023.

Many countries are now prioritizing energy efficiency when constructing commercial buildings and office spaces. The demand for facade installations is expected to increase due to the growing need to renovate old office buildings. Also, there has been a rise in the demand for aesthetically pleasing designs in commercial buildings, which has led to the expansion of the facade market.

Despite the recession, the commercial and industrial sectors have seen significant growth. The construction industry in the United States has outperformed that of Canada and Mexico in the last 18 months. For instance, in North America and Europe, there are many ongoing commercial projects, such as the Keystone Trade Center and the Eight Office Tower, which is a 25-story office tower in Bellevue, Washington, spanning 50,167 square meters. These projects are expected to drive the demand for facade installations.

Regional Insights

North America is estimated to dominate the market in 2023.

The North American region has a robust construction industry supported by a favorable economic climate and steady urbanization. This has led to a high demand for modern and visually appealing building facades, driving the growth of the market. Along with this, North America boasts advanced technological capabilities and innovative architectural practices, leading to the adoption of cutting-edge facade solutions. The region is known for its commitment to energy efficiency and sustainable building practices, which further drives the demand for energy-efficient facade systems.

The Asia Pacific region is currently undergoing a large number of construction projects, with a particular focus on external wall beautification and energy efficiency. This has resulted in an increased demand for facade installations in the area. Also, the rapid urbanization of developing countries such as India, Japan, and China has led to a surge in demand for these installations. For example, in September 2022, China unveiled the "Dance of Light" skyscraper, a 180-meter-tall tower that was covered with facades, making it the world's most twisted tower.

Along with this, India and Japan are actively adopting facade greening techniques as part of their efforts to achieve sustainability targets. Facade greening plays a significant role in urban areas, helping to mitigate the impact of rising temperatures due to climate change and building densification on the quality of life. Furthermore, this technology has been promoted by the green office concept.

Key Market Players & Competitive Insights

Market players, such as producers, suppliers, and service providers, define the competitive landscape of the facade systems market by offering innovative products, eco-friendly solutions, and value-added inspection services.

Some of the major players operating in the global facade market include:

- AFS International B.V.

- Aluplex

- Bouygues

- Enclos

- EOS Framing Limited

- Fundermax

- Gartner (Permasteelisa Group)

- HansenGroup

- Hochtief

- Kingspan Group

- Lindner Group

- National Enclosure Company, LLC.

- Norsk Hydro ASA

- Rockpanel Group

- Saint-Gobain Group

- Schuco International

- Skanska

- Trimo d.o.o.

- YKK AP Inc.

Recent Developments

- In May 2023, ClearVue Technologies Ltd, a company specializing in smart building materials, announced the launch of an enhanced product design for the ClearVue PV solar vision glass integrated glazing unit (IGU). The company has also released its new integrated Solar Facades Solutions.

- In October 2023, Evonik introduced a new product called TEGO Guard 9000, which is an additive designed to protect building facades from environmental damage. Unlike traditional high PVC (Pigment Volume Concentration) exterior facade coatings that take three hours or more to dry, TEGO Guard 9000 has a unique "Quick-Set" property that allows for high rain resistance within just a few minutes of application.

- In August 2023, SPAN FLOORS, a leading brand of wooden flooring and wooden facades, launched the Vulcan extra wide façade for the first time in India.

- In January 2020, Rauta released new ventilated facades with extra-large cassettes that come in three different product variations: Primo Skyline 100 for vertical installation, Primo Skyline 150 for horizontal installation, and Primo Skyline 1000, which can be installed both horizontally and vertically.

- In September 2020, CIN Coatings, a Portuguese company in the coatings market, launched a new product called CINGARD HI900. It protects water and other water-soluble agents and is ideal for waterproofing facades and building structures.

Facades Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 356.36 billion |

|

Revenue Forecast in 2032 |

USD 640.77 billion |

|

CAGR |

7.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Material, By Application Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the market dynamics of the 2024 Facades Market market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Facades Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our More Top Selling Reports:

Non-Invasive Prenatal Testing (Nipt) Market Size & Share

Dental Laboratory Welders Market Size & Share

Molecular Quality Controls Market Size & Share

FAQ's

Type, material, application type, and region are the key segments in the Facades Market.

The global facade market size is expected to reach USD 640.77 Billion by 2032

The global facades market is expected to grow at a CAGR of 7.6% during the forecast period.

North America regions is leading the global market

Need for Energy Conservation fuelling the sales of Facades are the key driving factors in Market