Europe Gout Therapeutics Market Size, Share, Trend, Industry Analysis Report

By Disease Condition (Acute Gout, Chronic Gout), By Drug Class, By Distribution Channel, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6280

- Base Year: 2024

- Historical Data: 2020-2023

Overview

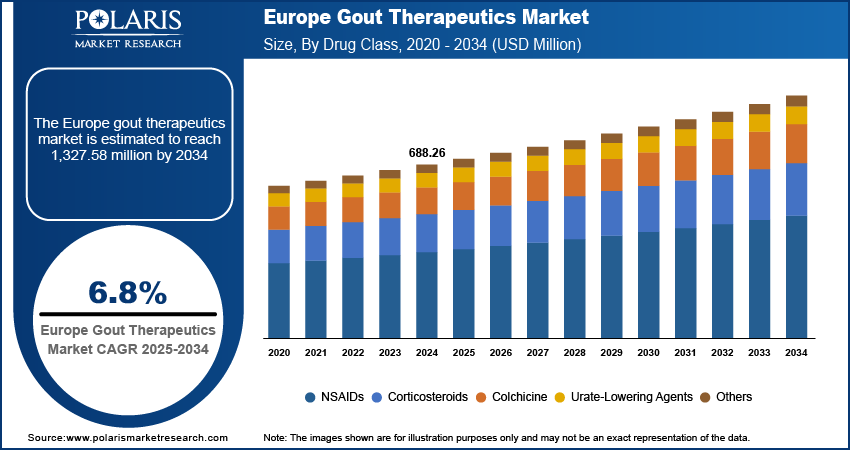

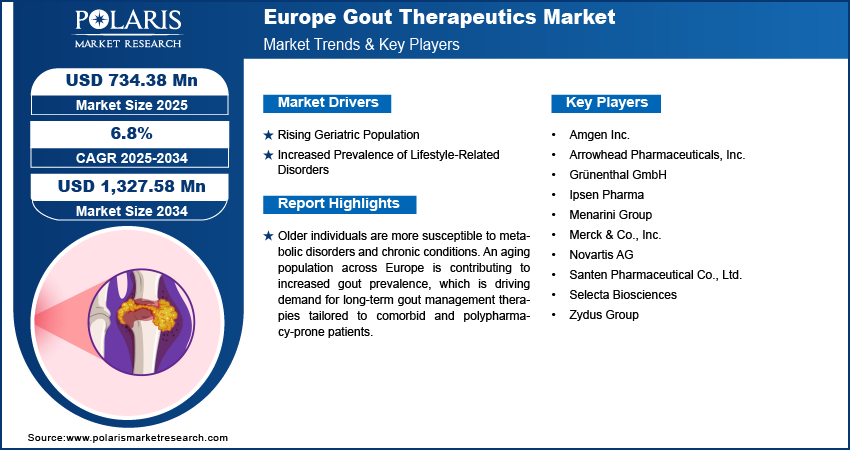

The Europe gout therapeutics market size was valued at USD 688.26 million in 2024, growing at a CAGR of 6.8% from 2025 to 2034. Older individuals are more susceptible to metabolic disorders and chronic conditions. An aging population across Europe is driving demand for long-term gout management therapies tailored to comorbid and polypharmacy-prone patients.

Key Insights

- The NSAIDs segment led the market in 2024 with ~46% revenue share, owing to fast relief during acute gout flares.

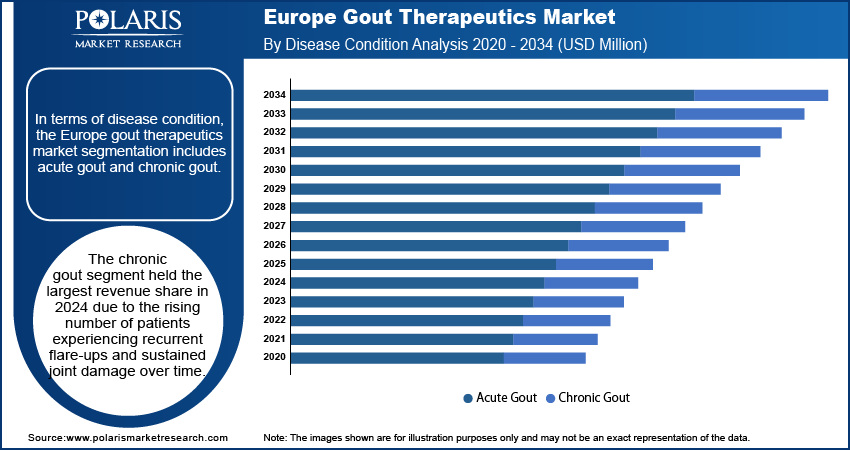

- The chronic gout segment held the largest share in 2024, due to rising cases of recurrent flares and long-term joint damage.

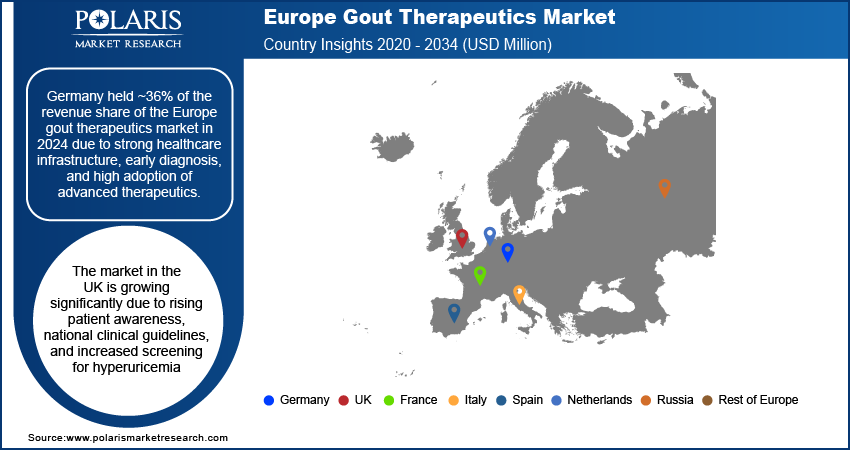

- Germany captured ~36% of the market in 2024, driven by advanced healthcare and high treatment adoption.

- The market in UK is growing rapidly, supported by increased awareness, screening, and clinical guidelines.

- The market in France is projected to register the highest CAGR from 2025 to 2034 due to the rising prevalence of metabolic disorders and gout.

- The market in Italy is expanding quickly, fueled by better diagnostics and broader access to advanced therapies.

Industry Dynamics

- Rising gout prevalence linked to aging populations and lifestyle factors is increasing demand for effective long-term treatment across European countries.

- Growing focus on biosimilars and cost-effective therapies is driving adoption of affordable uric acid-lowering drugs in public healthcare systems.

- Integration of gout management into chronic disease programs enhances early diagnosis and treatment adherence through centralized patient monitoring and digital health tools.

- Stringent pricing controls and reimbursement delays across EU nations slow down market entry and limit patient access to innovative gout therapies.

Market Statistics

- 2024 Market Size: USD 688.26 million

- 2034 Projected Market Size: USD 1,327.58 million

- CAGR (2025–2034): 6.8%

- Asia Pacific: Largest market in 2024

AI Impact on Europe Gout Therapeutics Market

- AI-driven gout management systems in Europe have shown improved target serum urate achievement and reduced CKD progression compared to standard EMR-based clinics.

- Integration of real-time patient data, lab fusion tools, and mobile apps supports personalized treatment and improves adherence.

- Adoption of digital health solutions, including telemedicine and e-pharmacies, enhances patient access and engagement across European markets.

- AI enables precision therapeutics through pharmacogenomic profiling and wearable tech, optimizing diagnosis and treatment outcomes.

The gout therapeutics market comprises pharmaceutical products and treatment approaches aimed at managing and alleviating symptoms of gout, a form of inflammatory arthritis caused by uric acid crystal deposition. The market includes urate-lowering therapies, anti-inflammatories, and novel biologics designed to prevent flare-ups, reduce uric acid levels, and address chronic complications. It serves a growing patient population driven by aging demographics, lifestyle factors, and the increasing prevalence of metabolic disorders. Growing investments in pharmaceutical R&D and the presence of active clinical trial networks across Europe are accelerating the development of new gout therapies focused on safety, efficacy, and improved patient outcomes.

The move toward personalized medicine is enabling the use of genetic and biomarker-based profiling to optimize gout treatment, reducing adverse effects and improving therapeutic efficacy across diverse patient populations. Moreover, Innovation in drug delivery mechanisms, such as extended-release formulations and orally available biologics, is enhancing patient compliance and convenience, fostering greater market uptake of new treatment options.

Drivers & Opportunities

Rising Geriatric Population: Europe’s growing elderly population is significantly impacting the demand for gout therapeutics. According to the UK Office for National Statistics (ONS) in February 2024, the number of people aged 65 and over in the UK reached a record 12.4 million in 2023, accounting for 18.9% of the population. Older adults are more prone to metabolic disorders, such as chronic kidney disease and impaired renal function, which disrupts uric acid excretion. This increases the likelihood of developing gout and its associated complications. Many geriatric patients also suffer from multiple comorbidities and require complex treatment regimens. Rising life expectancy and healthcare access are further amplifying this trend. This shift is pushing healthcare providers to adopt more personalized gout treatment approaches that ensure effective management while minimizing interactions with other medications commonly prescribed in elderly populations.

Increased Prevalence of Lifestyle-Related Disorders: Rapid changes in lifestyle across many European countries have led to a sharp increase in cases of conditions such as obesity, type 2 diabetes, and hypertension. All of these are directly linked to higher uric acid levels. According to Public Health France, September 2023, "National data shows that 5.9 million people in France had type 2 diabetes in 2023, an increase of 30% over the past decade strongly associated with sedentary lifestyles and rising obesity. Gout, a metabolic condition triggered by excess uric acid, is becoming more common among adults with poor dietary habits, frequent alcohol intake, and low physical activity. Urban populations are particularly affected due to fast-paced routines and processed food consumption. These lifestyle-related disorders complicate gout management, often requiring combination therapies to target both the underlying condition and uric acid buildup. Healthcare systems are recognizing this correlation and are expanding early screening programs and educational campaigns to promote lifestyle interventions alongside pharmacological treatment.

Segmental Insights

Disease Condition Analysis

In terms of disease condition, the segmentation includes acute gout and chronic gout. The chronic gout segment held the largest revenue share in 2024 due to the rising number of patients experiencing recurrent flare-ups and sustained joint damage over time. This condition requires continuous therapeutic management to prevent complications such as tophi formation and joint deformities. The chronic nature of the disease has prompted increased physician vigilance and long-term prescribing patterns. Public health campaigns across Europe have helped improve awareness of early-stage gout progression, enabling earlier diagnosis and sustained treatment. Moreover, the segment benefits from greater reliance on combination therapies, including urate-lowering agents and adjunct medications, which results in higher per-patient pharmaceutical spending.

The acute gout segment is witnessing increasing traction due to increased diagnosis of first-time flare-ups and higher patient visits to emergency and primary care settings for joint pain. Physicians are becoming more adept at identifying the signs of initial gout attacks, often triggered by dietary or metabolic stressors. Newer formulations of fast-acting treatments like colchicine and corticosteroids offer quick symptom control, making acute gout episodes more manageable in outpatient care. Demand is also driven by improved awareness among younger and middle-aged adults, who are presenting with lifestyle-induced hyperuricemia. This growing attention to episodic flare management is expanding the market for acute-phase therapeutics.

Drug Class Analysis

Based on drug class, the segmentation includes NSAIDs, corticosteroids, colchicine, urate-lowering agents, and others. The NSAIDs segment dominated the market in 2024 with ~46% of the revenue share due to their rapid efficacy in managing acute gout flares. Physicians frequently prescribe NSAIDs as first-line treatment for their ability to quickly reduce pain and inflammation without the need for long-term systemic intervention. Strong clinical familiarity, wide availability, and cost-effectiveness contribute to their preference in both hospital and outpatient settings. Patients often rely on NSAIDs for immediate relief, especially during the onset of flare-ups. Their inclusion in standard treatment protocols across Europe, along with over-the-counter accessibility in many regions, has reinforced their leading position in the market.

The urate-lowering agents segment is expected to register the highest CAGR from 2025 to 2034 due to rising focus on long-term disease management and prevention of recurrent gout attacks. These agents target the underlying cause of gout hyperuricemia rather than just treating symptoms. Increasing adoption of xanthine oxidase inhibitors and uricosuric drugs is supported by updated European treatment guidelines that emphasize serum urate level control. The segment is benefiting from improved diagnostic screening, particularly in primary care, that identifies chronic hyperuricemia earlier. Pharmaceutical innovation, including newer agents with better safety profiles and fewer contraindications, is encouraging both physicians and patients to transition from flare management to urate-lowering maintenance therapies.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment held the largest revenue share in 2024 as the primary point of access for prescription and over-the-counter gout medications. Most patients managing chronic or recurrent gout conditions rely on ongoing prescriptions, which are conveniently filled through neighborhood or chain retail pharmacies. The ease of in-person pharmacist consultation, especially for dosage guidance and drug interactions, enhances the patient experience. Insurance reimbursements and pharmacy-led compliance programs further support strong sales through this channel. In many regions, retail pharmacies also offer automated refills and loyalty-based pricing, which encourages regular medication adherence. Their widespread distribution ensures accessibility even in semi-urban and rural areas.

The online pharmacy segment is gaining momentum due to growing demand for discreet, convenient, and time-saving options for medication delivery. Chronic gout patients, especially those on long-term urate-lowering therapies, increasingly prefer scheduled home deliveries for improved adherence. Regulatory clarity around e-prescriptions and growing e-health adoption support this shift. Many platforms now provide access to pharmacist consultations, refill reminders, and subscription-based discounts. This channel is particularly beneficial for patients managing multiple comorbidities, as it reduces the need for physical visits. Rising internet penetration and consumer trust in digital healthcare services are expected to further accelerate online pharmacy adoption over the forecast period.

Country Analysis

The Germany gout therapeutics market accounted for ~36% of the revenue share in 2024 due to strong healthcare infrastructure, early diagnosis, and high adoption of advanced therapeutics. Public and private insurance coverage has enabled greater access to gout medications, including urate-lowering agents and biologics. Patients in Germany benefit from structured treatment protocols and consistent physician follow-ups, which ensure long-term adherence to therapy. The country also witnesses a higher burden of chronic lifestyle conditions such as obesity and hypertension, contributing to increased gout incidence. Active R&D presence and favorable pricing regulations have further supported market dominance, making Germany a key revenue contributor in the region.

UK Europe Gout Therapeutics Market Insights

The UK market is growing significantly due to rising patient awareness, national clinical guidelines, and increased screening for hyperuricemia. Initiatives from the National Health Service have helped identify and manage gout cases more proactively, especially in high-risk groups. Primary care physicians are increasingly focusing on urate-lowering therapies as part of long-term disease control, leading to a shift from acute to preventive care. The country has also seen a growing trend of digital consultations and remote prescription refills, helping expand therapeutic access. Market players are focusing on improving the availability of generics, which is making treatment more affordable and accessible to a larger population.

France Europe Gout Therapeutics Market Trends

The market in France is expected to register a significant CAGR from 2025 to 2034 due to a surge in lifestyle-related metabolic disorders, which has increased the prevalence of gout. Rising demand for non-steroidal anti-inflammatory drugs and new-generation urate-lowering agents is encouraging pharmaceutical investments in the region. Healthcare professionals are also increasingly recognizing the impact of poorly managed gout, leading to a shift toward early intervention and chronic care. Patient education programs are being supported through hospital networks, improving treatment adherence. Furthermore, clinical trials for innovative therapies are gaining traction in France, positioning the country as a hub for emerging gout treatments over the forecast period.

Italy Europe Gout Therapeutics Market Overview

The market in Italy is growing rapidly due to improved diagnostic capabilities and increased availability of advanced therapeutics in both public and private sectors. The demand for personalized care plans has grown, particularly in managing chronic gout, where long-term drug regimens are critical. Efforts from healthcare providers to integrate gout management into metabolic syndrome clinics have expanded access to target populations. Retail pharmacies are stocking a wider range of colchicine and urate-lowering drugs, ensuring patients receive timely treatment. Awareness campaigns by local medical associations are helping reduce the stigma around gout and encouraging early medical consultation, which is contributing to faster treatment initiation and market growth.

Key Players & Competitive Analysis

The competitive landscape of the Europe gout therapeutics market is marked by intense industry analysis, focused on identifying pipeline differentiation and unmet clinical needs. Market expansion strategies are being driven by increasing investments in R&D for novel urate-lowering therapies and optimized formulations. Companies are engaging in strategic alliances with academic institutions and research centers to accelerate clinical trials and strengthen intellectual property portfolios. Joint ventures and mergers and acquisitions are being pursued to expand geographic reach, diversify drug class offerings, and enhance manufacturing capabilities.

Post-merger integration efforts are centered on streamlining operations, consolidating distribution networks, and leveraging synergies in regulatory compliance and market access. Technology advancements in drug delivery systems and precision medicine are reshaping product development strategies. Key players are aligning their commercialization plans with real-world evidence and payer requirements to improve access and reimbursement. The competitive dynamics are further shaped by evolving treatment guidelines, biosimilar penetration, and increasing physician awareness of targeted therapies.

Key Players

- Amgen Inc.

- Arrowhead Pharmaceuticals, Inc.

- Grünenthal GmbH

- Ipsen Pharma

- Menarini Group

- Merck & Co., Inc.

- Novartis AG

- Santen Pharmaceutical Co., Ltd.

- Selecta Biosciences

- Zydus Group

Europe Gout Therapeutics Industry Developments

May 2025: ANI Pharmaceuticals commenced a Phase 4 clinical trial evaluating Purified Cortrophin Gel for its efficacy in managing acute gout flares.

December 2023: LG Chem secured conditional approval from the Italian Medicines Agency (Agenzia Italiana del Farmaco, AIFA) to initiate a phase 3 clinical trial (EURELIA 2) for its investigational gout therapy, tigulixostat (LC350189).

Europe Gout Therapeutics Market Segmentation

By Disease Condition Outlook (Revenue, USD Million, 2020–2034)

- Acute Gout

- Chronic Gout

By Drug Class Outlook (Revenue, USD Million, 2020–2034)

- NSAIDs

- Corticosteroids

- Colchicine

- Urate-Lowering Agents

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Country Outlook (Revenue, USD Million, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Gout Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 688.26 million |

|

Market Size in 2025 |

USD 734.38 million |

|

Revenue Forecast by 2034 |

USD 1,327.58 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Europe market size was valued at USD 688.26 million in 2024 and is projected to grow to USD 1,327.58 million by 2034.

The Europe market is projected to register a CAGR of 6.8% during the forecast period.

Germany accounted for ~36% of the revenue share of the Europe gout therapeutics market in 2024 due to strong healthcare infrastructure, early diagnosis, and high adoption of advanced therapeutics.

A few of the key players in the market are Amgen Inc.; Arrowhead Pharmaceuticals, Inc.; Grünenthal GmbH; Ipsen Pharma; Menarini Group; Merck & Co., Inc.; Novartis AG; Santen Pharmaceutical Co., Ltd.; Selecta Biosciences; and Zydus Group.

NSAIDs segment dominated the market with ~46% of the revenue share in 2024 due to their rapid efficacy in managing acute gout flares.

The chronic gout segment held the largest revenue share in 2024 due to the rising number of patients experiencing recurrent flare-ups and sustained joint damage over time.