U.S. Fiber Cement Market Size, Share, Trends, Industry Analysis Report

By Material (Portland, Silica, Cellulosic, Others), By Product, By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6277

- Base Year: 2024

- Historical Data: 2020-2023

Overview

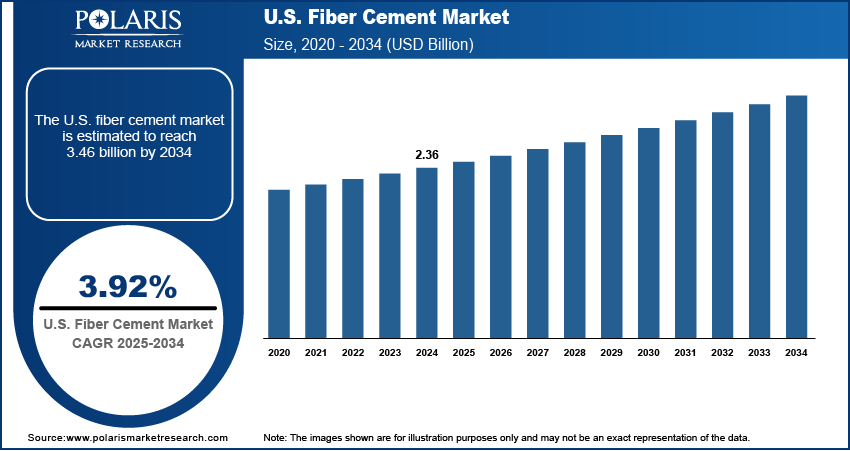

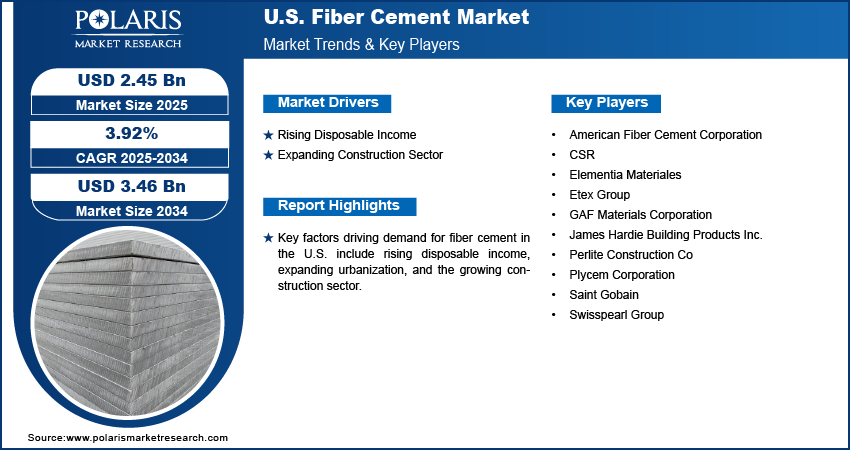

The U.S. fiber cement market size was valued at USD 2.36 billion in 2024, growing at a CAGR of 3.92% from 2025 to 2034. Key factors driving demand for fiber cement in the U.S. include rising disposable income, expanding urbanization, and the growing construction sector.

Key Insight

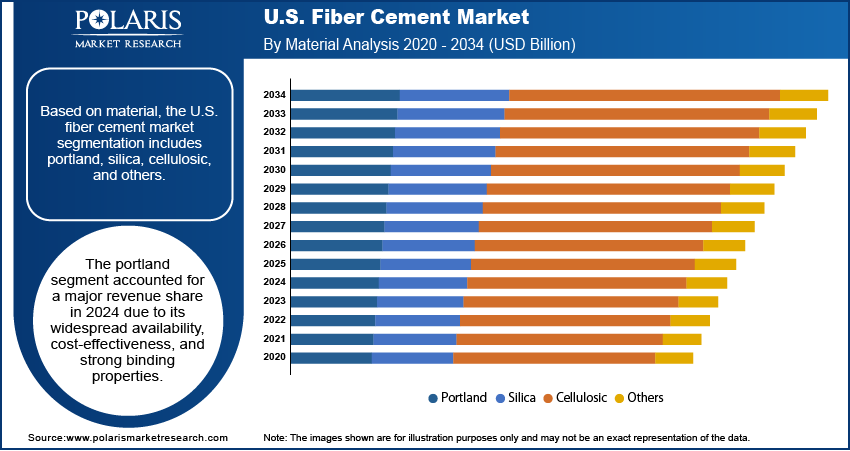

- The portland segment accounted for a major revenue share in 2024 due to its strong binding properties and cost-effectiveness.

- The siding/weatherboard segment held the largest revenue share in 2024 due to its rising residential construction and renovation projects.

- The residential segment dominated the revenue share in 2024 due to growing home improvement activities.

Industry Dynamics

- The rising disposable income encourages consumers in the U.S. to prioritize long-term value over short-term savings in building construction, which fuels the demand for fiber cement.

- The expanding construction sector is driving the U.S. fiber cement market growth as commercial and infrastructure development requires high-performance building solutions.

- Increasing investments in the development of smart cities across the U.S. is creating a lucrative market opportunity.

- The high cost associated with fiber cement products, such as fiber cement boards, restrains the U.S. fiber cement market expansion.

Artificial Intelligence (AI) Impact on U.S. Fiber Cement Market

- AI-driven predictive analytics optimize demand forecasting and inventory management for fiber cement manufacturers.

- AI-powered enterprise automation enhances production efficiency, reducing waste and energy consumption.

- AI-integrated quality control systems improve product consistency and defect detection in real-time.

- AI-powered design tools assist architects in customizing fiber cement applications for residential and commercial use.

Market Statistics

- 2024 Market Size: USD 2.36 Billion

- 2034 Projected Market Size: USD 3.46 Billion

- CAGR (2025–2034): 3.92%

Fiber cement is a durable building material composed of cement, sand, and cellulose fibers. This combination creates a strong, weather-resistant product that mimics the appearance of wood, stucco, stone, or brick while offering superior resistance to fire, moisture, and pests. It is commonly used in siding, roofing, and façade applications due to its longevity, low maintenance, and aesthetic versatility. Fiber cement, ideal for both residential and commercial construction, provides a cost-effective alternative to traditional materials while delivering excellent performance in a variety of climates and environments.

In the U.S., fiber cement has gained significant popularity in the construction sector, especially for residential and multifamily housing. Its ability to withstand extreme weather conditions such as hurricanes, wildfires, and freezing temperatures makes it a preferred material across diverse geographic regions. Builders and homeowners favor it for its aesthetic appeal, resembling wood without the maintenance challenges. Increasing focus on fire-resistant building materials, particularly in wildfire-prone states such as California, has further driven adoption. Additionally, sustainability concerns and demand for long-lasting, eco-friendly materials support its continued growth.

The U.S. fiber cement market demand is driven by the expanding urbanization. Fiber cement offers fire resistance, weather durability, and low maintenance, making it ideal for high-density urban construction. Developers and architects in urban areas are favoring it for residential, commercial, and industrial projects as it combines affordability with long-term performance. Additionally, stricter building codes in urban areas are mandating the use of materials such as fiber cement, as they enhance safety and energy efficiency. Therefore, as cities expand, the need for versatile, high-performance construction solutions drives demand for fiber cement.

Drivers & Opportunities

Rising Disposable Income: Rising disposable income is encouraging people to prioritize long-term value over short-term savings. As a result, fiber cement is preferred due to its resistance to weathering, fire, and pests. Bureau of Economic Analysis, in its report, stated that the disposable personal income in the U.S. increased by 0.6% in April 2025 from March 2025. People with high disposable income also favor premium home upgrades, such as modern siding and roofing, where fiber cement outperforms traditional materials such as wood or vinyl. Additionally, higher disposable income is encouraging renovations and custom home projects, further increasing the need for versatile, low-maintenance building solutions such as fiber cement.

Expanding Construction Sector: Growing residential, commercial, and infrastructure development requires high-performance building solutions, and fiber cement’s resistance to fire, moisture, and pests makes it a preferred choice. Architects and builders increasingly favor it for siding, roofing, and facade applications due to its longevity and low maintenance. Additionally, stricter environmental regulations and green building trends are pushing the industry toward eco-friendly materials such as fiber cement. Therefore, as the construction industry expands in the U.S., the need for versatile, high-quality materials drives fiber cement’s growing adoption in modern building projects. According to the U.S. Bureau of Labor Statistics, the construction industry in the U.S. is projected to grow 4.7% from 2023 to 2033.

Segmental Insights

Material Analysis

Based on material, the segmentation includes portland, silica, cellulosic, and others. The portland segment accounted for a major revenue share in 2024 due to its widespread availability, cost-effectiveness, and strong binding properties. Builders across residential and commercial sectors consistently chose portland-based products for their superior durability, weather resistance, and compatibility with other construction materials. The segment benefited significantly from ongoing infrastructure development and increasing housing projects, particularly in southern and western regions where climatic conditions demand long-lasting, moisture-resistant solutions. Additionally, manufacturers continued to invest in improving the formulation and performance of Portland-based products, further strengthening their market dominance.

The cellulosic segment is projected to register a rapid CAGR from 2025 to 2034, owing to rising demand for environmentally sustainable construction materials and stricter regulations on emissions and waste. Cellulosic products offer a greener alternative, as they incorporate natural cellulose fibers derived from wood pulp, reducing reliance on synthetic components. The lightweight nature of cellulosic improved thermal insulation and ease of installation, making them increasingly attractive for both residential and light commercial applications. Furthermore, innovations in fiber reinforcement technology and increased consumer awareness about eco-friendly materials are expected to accelerate adoption across urban and suburban construction projects.

Product Analysis

In terms of product, the segmentation includes cladding, siding/weatherboard, roofing, molding & trim, and others. The siding/weatherboard segment held the largest revenue share in 2024 due to its widespread use in residential construction and renovation projects. Builders and homeowners favored this product for its superior resistance to fire, moisture, and pests, making it an ideal substitute for wood and vinyl siding. Its aesthetic versatility, which allows it to mimic natural wood grains and various textures, also contributed to increased adoption across suburban and rural housing developments. The rise in single-family home construction, particularly in states such as Texas, Florida, and California, propelled demand for siding/weatherboard, supported by favorable building codes and long-term maintenance advantages.

Application Analysis

In terms of application, the segmentation includes residential, commercial, industrial, education/institutional, agricultural, and others. The residential segment dominated the revenue share in 2024 due to rising single-family housing construction and home improvement activities. Homeowners prioritized durable, low-maintenance, and fire-resistant materials for exterior applications, especially in wildfire-prone states such as California and Colorado. Fiber cement products met these needs effectively while also offering enhanced curb appeal through versatile textures and finishes. The surge in home remodeling projects, supported by favorable mortgage rates and rising property values, further increased product demand. Additionally, developers adopted these materials widely in multi-family housing projects to meet long-term cost-efficiency and safety standards.

The commercial segment is expected to grow at a robust pace in the coming years, owing to the rising investments in infrastructure and nonresidential construction. Businesses and property developers increasingly select fiber cement for cladding, façade systems, and decorative trims in office buildings, retail centers, and hospitality projects due to its weather resistance, long service life, and minimal upkeep. Sustainability goals and energy efficiency regulations also influence this shift, as the material supports thermal insulation and green building certifications. Urban expansion and redevelopment initiatives in cities such as Chicago, New York, and Atlanta are projected to continue to drive demand across the commercial sector.

Key Players & Competitive Analysis

The U.S. fiber cement market is highly competitive, with key players such as James Hardie Building Products Inc. dominating as the industry leader, known for its strong brand recognition and innovative solutions. GAF Materials Corporation and Plycem Corporation compete closely, offering durable and weather-resistant products. Etex Group and Saint Gobain bring global expertise, providing high-performance materials for diverse applications. American Fiber Cement Corporation and CSR focus on niche segments, while Elementia Materiales expands through strategic acquisitions. Swisspearl Group emphasizes premium architectural solutions, and Perlite Construction Co. contributes specialized formulations. The market is driven by demand for sustainable, fire-resistant siding, with companies competing on product quality, distribution networks, and technological advancements.

A few major companies operating in the U.S. fiber cement market include American Fiber Cement Corporation, CSR, Elementia Materiales, Etex Group, GAF Materials Corporation, James Hardie Building Products Inc., Perlite Construction Co, Plycem Corporation, Saint Gobain, and Swisspearl Group.

Key Companies

- American Fiber Cement Corporation

- CSR

- Elementia Materiales

- Etex Group

- GAF Materials Corporation

- James Hardie Building Products Inc.

- Perlite Construction Co

- Plycem Corporation

- Saint Gobain

- Swisspearl Group

U.S. Fiber Cement Industry Developments

In March 2025, American Fiber Cement (AFC) introduced seven new innovative Swisspearl products and an entire new line of AFC products to expand its existing product lineup. These new products offer architects and builders a diverse range of high-quality cladding solutions.

In December 2023, Etex, a global building material manufacturer, announced the acquisition of SCALAMID, a manufacturer of fiber cement panels, to enhance its architectural design.

U.S. Fiber Cement Market Segmentation

By Material Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Portland

- Silica

- Cellulosic

- Others

By Product Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Cladding

- Rainscreen/Ventilated

- Direct‑fix/Non‑ventilated

- Siding/Weatherboard

- Roofing

- Molding & Trim

- Other

By Application Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Residential

- Commercial

- Industrial

- Education/Institutional

- Agricultural

- Others

U.S. Fiber Cement Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.36 Billion |

|

Market Size in 2025 |

USD 2.45 Billion |

|

Revenue Forecast by 2034 |

USD 3.46 Billion |

|

CAGR |

3.92% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.36 billion in 2024 and is projected to grow to USD 3.46 billion by 2034.

The market is projected to register a CAGR of 3.92% during the forecast period.

A few of the key players in the market are American Fiber Cement Corporation, CSR, Elementia Materiales, Etex Group, GAF Materials Corporation, James Hardie Building Products Inc., Perlite Construction Co, Plycem Corporation, Saint Gobain, and Swisspearl Group.

The portland segment dominated the market share in 2024.

The commercial segment is expected to witness the fastest growth during the forecast period.