Europe Sterilization Container Systems Market Size, Share, Trends, Industry Analysis Report

By Product (Sterilization Container, Accessories), By Type, By Technology, By Material, By End User, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6275

- Base Year: 2024

- Historical Data: 2020-2023

Overview

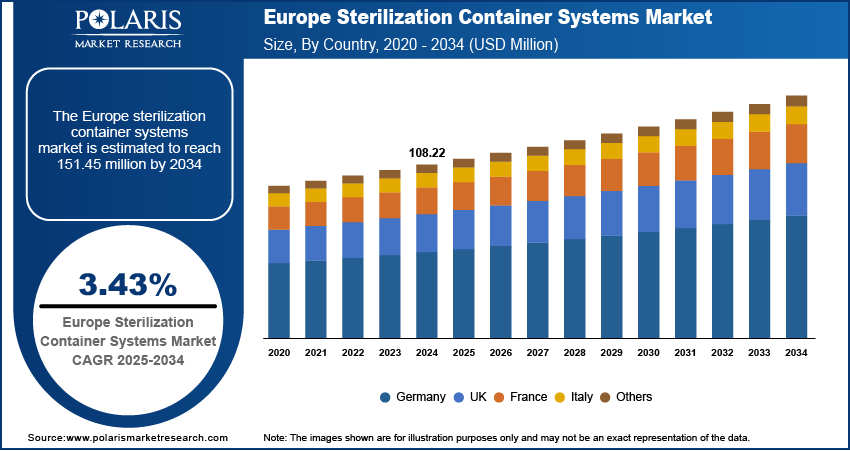

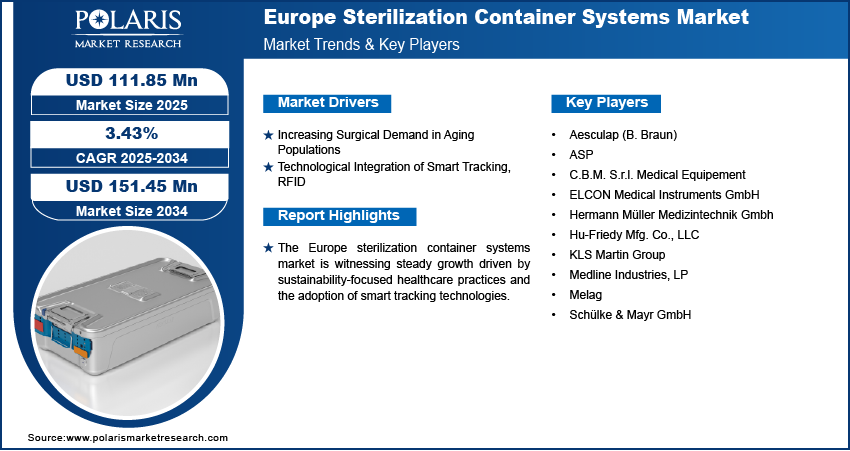

The Europe sterilization container systems market size was valued at USD 108.22 million in 2024, growing at a CAGR of 3.43% from 2025 to 2034. Key factors driving demand for sterilization container systems include sustainability push for reusable medical devices, increasing surgical demand, and technological integration of smart tracking systems.

Key Insights

- The sterilization containers segment led the Europe sterilization container systems market revenue in 2024, due to their durability, cost-efficiency, and contamination protection in healthcare settings.

- Stainless steel emerges as the fastest-growing segment, valued for its exceptional durability, corrosion resistance, and longevity through repeated sterilization cycles.

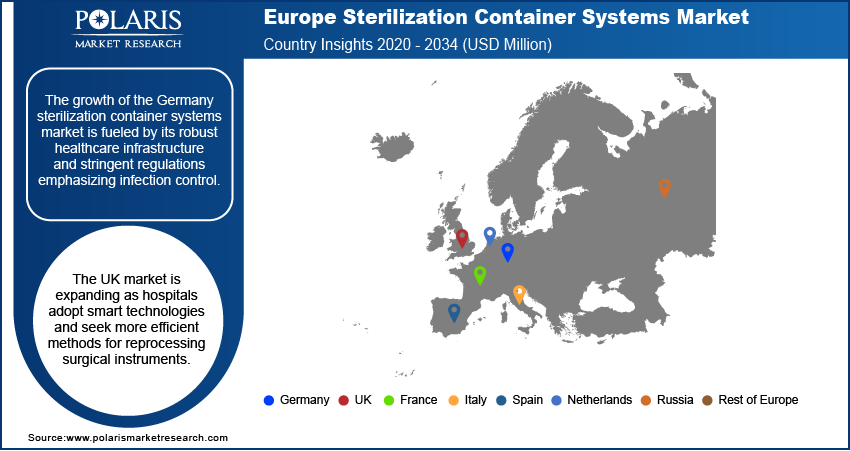

- The growth of the Germany market is fueled by its robust healthcare infrastructure and stringent regulations emphasizing infection control.

- The UK market is expanding as hospitals adopt smart technologies and aim for more efficient methods for reprocessing surgical instruments.

Industry Dynamics

- Europe's growing elderly population boosts surgical needs for orthopedic, cardiac, and cancer treatments, accelerating sterilization container adoption in hospitals.

- RFID-enabled containers gain traction in Europe, enabling real-time instrument tracking, inventory management, and sterilization verification for improved efficiency.

- Growing demand for reusable, sustainable containers in Europe's eco-conscious healthcare sector creates a strong revenue potential by 2027, driven by stricter EU waste regulations.

- High compliance costs for EU MDR/CE certification strain small manufacturers, slowing innovation and market entry despite rising surgical volumes.

Market Statistics

- 2024 Market Size: USD 108.22 million

- 2034 Projected Market Size: USD 151.45 million

- CAGR (2025–2034): 3.43%

AI Impact on Europe Sterilization Container Systems Market

- AI automates EU MDR/CE certification logs in sterilization containers, reducing manual errors and ensuring real-time regulatory compliance for hospitals.

- AI analyzes container usage data to forecast part replacements, cutting downtime in high-volume German and French surgical centers.

- AI enhances RFID-enabled containers by tracking instrument lifespans and sterilization cycles, aligning with the EU’s push for circular medical device economies.

- AI predicts regional container needs across Europe, helping manufacturers adjust production for aging-population-driven surgical booms in Italy, Spain, and Eastern EU states.

Sterilization container systems are rigid, reusable devices designed to securely hold surgical instruments during sterilization, storage, and transportation while maintaining their sterility. In Europe, the market is witnessing notable growth, largely driven by the region’s strong focus on sustainable healthcare practices. The shift away from single-use sterilization wraps toward reusable containers aligns with broader environmental goals and regulatory encouragement for waste reduction in medical environments. In December 2024, Bertin Technologies launched Sterilwave, an on-site hospital waste treatment system using microwave sterilization and shredding. It reduces infectious waste volume by 85% and weight by 25%, allowing disposal in regular waste streams. These containers offer long-term usability, minimize packaging waste, and provide cost-effective solutions for high-volume surgical environments. Their ability to ensure sterility over multiple cycles while reducing environmental impact makes them a preferred choice across hospitals and surgical centers.

Sterilization container systems are being adopted for their performance and also for their alignment with institutional sustainability objectives, as healthcare systems in Europe increasingly prioritize circular economy models and resource-efficient operations. This trend continues to support the expansion of reusable medical technologies across the region.

Drivers & Opportunities

Increasing Surgical Demand in Aging Populations: The increasing surgical demand driven by Europe’s aging population is a major factor accelerating the adoption of sterilization container systems. The incidence of age-related conditions requiring surgical intervention, including orthopedic, cardiovascular, and oncological procedures, increases as the elderly population grows. A February 2025 European Commission report revealed that as of January 2024, the EU's population reached 449.3 million, with 21.6% aged 65 or older, reflecting the increasing need for these systems. This surge places added pressure on healthcare facilities to ensure a steady, safe, and efficient turnover of surgical instruments. Sterilization container systems offer durability, high-volume handling, and sterility assurance, making them ideal for meeting the demands of increased surgical throughput. Their reusability and compatibility with hospital sterilization cycles further enhance their value in high-demand environments, supporting operational efficiency while maintaining patient safety.

Technological Integration of Smart Tracking, RFID: The technological integration of smart tracking systems, including radio-frequency identification (RFID), is also playing a transformative role in the European sterilization container systems market. Hospitals and surgical centers are increasingly adopting RFID-enabled containers to enable real-time tracking, inventory control, and sterilization validation. For instance, in February 2025, Identiv, Inc. partnered with Novanta Inc. to integrate Identiv’s RFID tags with Novanta’s ThingMagic readers, offering medical device OEMs end-to-end traceability solutions with improved cost efficiency and performance. These advanced systems reduce human error, streamline logistics, and improve traceability throughout the surgical workflow. Additionally, smart containers facilitate compliance with stringent regulatory requirements by providing data-driven insights into instrument usage, sterilization history, and lifecycle management. This digital shift enhances transparency, boosts operational accountability, and aligns with the broader trend of healthcare digitization across Europe.

Segmental Insights

Product Analysis

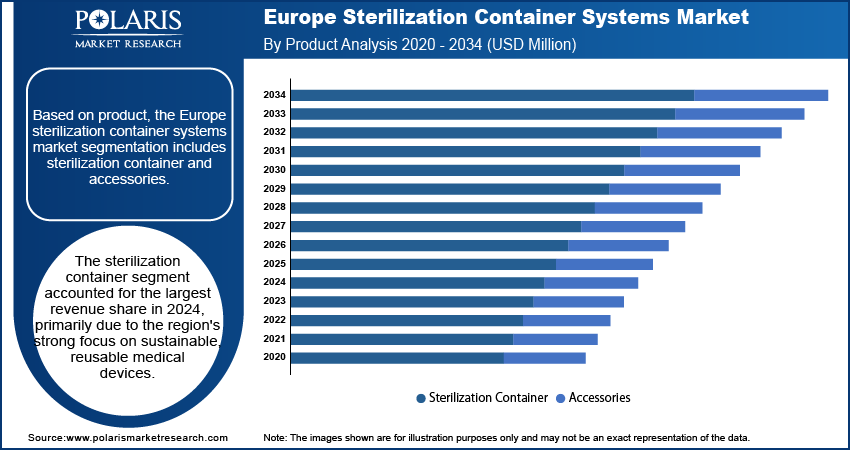

Based on product, the Europe sterilization container systems market segmentation includes sterilization container and accessories. The sterilization container segment accounted for the largest revenue share in 2024 primarily due to the region's strong focus on sustainable, reusable medical devices. The widespread adoption of rigid containers across European hospitals and surgical facilities is driven by their long-term cost-effectiveness, durability, and ability to maintain sterility more reliably than single-use wraps. These containers provide enhanced protection during instrument handling, transport, and storage, making them essential in high-volume surgical environments. Additionally, the shift toward environmentally responsible solutions reinforces the preference for reusable sterilization containers across Europe.

Material Analysis

Based on material, the segmentation includes aluminum, stainless steel, and other material. The stainless steel segment is expected to witness the fastest growth during the forecast period driven by the material's exceptional durability, resistance to corrosion, and ability to withstand repeated sterilization cycles without degradation. Stainless steels non-porous, inert surface ensures compatibility with a wide range of sterilization methods, such as steam, gas, and low-temperature systems commonly used in European hospitals. Therefore, as healthcare facilities across Europe continue to prioritize long-lasting, hygienic, and low-maintenance solutions, stainless steel containers are becoming the material of choice.

Country Analysis

Germany Sterilization Container Systems Market Analysis

The market growth in Germany is driven by the country’s well-established healthcare infrastructure and strong regulatory focus on infection prevention. German hospitals continue to adopt high-quality, reusable sterilization containers to meet strict hygiene standards and improve surgical efficiency. Additionally, the country's focus on medical technology innovation and sustainability supports the transition from single-use wraps to rigid, long-lasting container systems. This shift aligns with national goals to reduce medical waste and enhance operational reliability in surgical workflows.

UK Sterilization Container Systems Market Assessment

The UK market is witnessing growth due to the increasing demand for efficient surgical instrument reprocessing and the integration of smart technologies in hospital settings. The NHS and private healthcare providers are investing in solutions that offer traceability and standardization, making sterilization containers with RFID or barcode capabilities highly desirable. Furthermore, the UK’s focus on minimizing hospital-acquired infections has led to a greater focus on secure, tamper-evident sterilization solutions that support best practices in sterile processing departments.

Key Players and Competitive Analysis

The Europe sterilization container systems market is witnessing revenue growth driven by stringent EU regulations and aging populations requiring more surgical interventions. Key players such as Aesculap and KLS Martin dominate through strategic investments in reusable, smart-tracked containers, while small and medium-sized businesses such as C.B.M. S.r.l. compete with niche solutions. Technological advancements such as RFID integration and advanced filters address latent demand for compliance with updated EU GMP standards. Supply chain disruptions from geopolitical tensions pose challenges, but sustainable value chains mitigate risks. Expert insights highlight a total addressable market expansion, particularly in Eastern Europe's emerging healthcare infrastructure. Joint ventures accelerate innovation, while pricing insights reveal premiumness for AI-enabled containers. Growth projections remain strong, fueled by industry trends toward outpatient surgeries and ASC growth.

A few major companies operating in the Europe sterilization container systems market include Aesculap; ASP; C.B.M. S.r.l. Medical Equipement; ELCON Medical Instruments GmbH; Hermann Müller Medizintechnik Gmbh; Hu-Friedy Mfg. Co., LLC; KLS Martin Group; Medline Industries, LP; Melag; and Schülke & Mayr GmbH.

Key Players

- Aesculap (B. Braun)

- ASP

- C.B.M. S.r.l. Medical Equipement

- ELCON Medical Instruments GmbH

- Hermann Müller Medizintechnik Gmbh

- Hu-Friedy Mfg. Co., LLC

- KLS Martin Group

- Medline Industries, LP

- Melag

- Schülke & Mayr GmbH

Europe Sterilization Container Systems Industry Developments

- March 2022: Aesculap, Inc. launched the Aicon Sterile Container System, featuring synchronized containers/baskets and an Enhanced Drying System (EDS) that reduces dry time by 47% while expanding sterile aseptic area efficiency.

Europe Sterilization Container Systems Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Sterilization Container

- Accessories

By Type Outlook (Revenue, USD Million, 2020–2034)

- Perforated

- Non-perforated

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Filter

- Valves

By Material Outlook (Revenue, USD Million, 2020–2034)

- Aluminum

- Stainless Steel

- Other Material

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Others

By Country Outlook (Revenue, USD Million, 2020–2034)

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

Europe Sterilization Container Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 108.22 Million |

|

Market Size in 2025 |

USD 111.85 Million |

|

Revenue Forecast by 2034 |

USD 151.45 Million |

|

CAGR |

3.43% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 108.22 million in 2024 and is projected to grow to USD 151.45 million by 2034.

The market is projected to register a CAGR of 3.43% during the forecast period.

A few of the key players in the market are Aesculap; ASP; C.B.M. S.r.l. Medical Equipement; ELCON Medical Instruments GmbH; Hermann Müller Medizintechnik Gmbh; Hu-Friedy Mfg. Co., LLC; KLS Martin Group; Medline Industries, LP; Melag; and Schülke & Mayr GmbH.

The sterilization container segment accounted for the largest revenue share in 2024.

The stainless steel segment is expected to witness fastest growth during the forecast period.