U.S. Outdoor Air Quality Monitoring System Market Size, Share, Trends, Industry Analysis Report

By Type (Fixed Outdoor Systems, Portable Outdoor Systems), By Component, By Category, By Pollutants – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5911

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

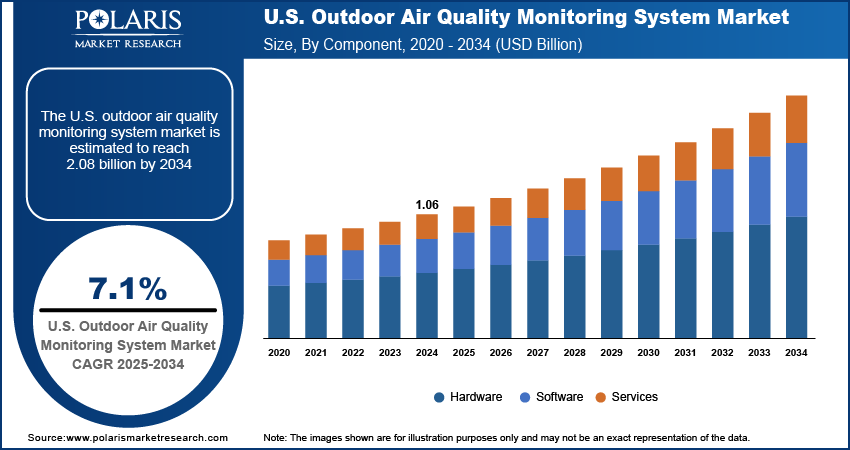

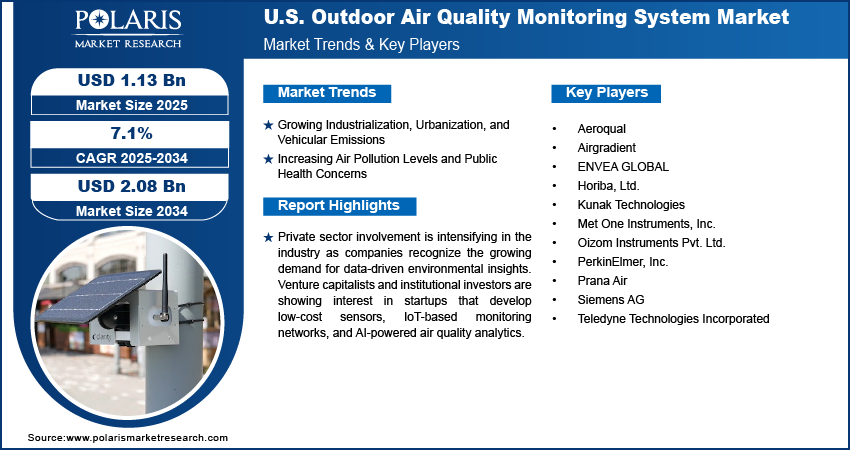

The U.S. outdoor air quality monitoring system market was valued at USD 1.06 billion in 2024 and is expected to register a CAGR of 7.1% from 2025 to 2034. The market growth is driven by the expansion of smart city projects and digital infrastructure and the implementation of government regulations and environmental policies.

The outdoor air quality monitoring system refers to the industry that develops, manufactures, and distributes systems and devices designed to monitor and analyze air pollution in open environments. These systems collect data on various air pollutants, including particulate matter (PM2.5 and PM10), nitrogen dioxide (NO₂), sulfur dioxide (SO₂), ozone (O₃), carbon monoxide (CO), and volatile organic compounds (VOCs). Outdoor air quality monitoring systems provide real-time and long-term assessments of ambient air conditions in urban, industrial, and rural areas by using a range of sensor technologies, satellite data, and networked devices.

One of the primary benefits of outdoor air quality monitoring systems is their role in public health protection. These systems help authorities issue timely health advisories and implement mitigation measures to reduce exposure by identifying harmful pollutants and tracking pollution levels over time. Long-term exposure to polluted air is linked to various respiratory illnesses, cardiovascular diseases, and even premature death. Thus, making early detection and preventive action against polluted air becomes vital. Outdoor air quality monitoring systems play a crucial role in supporting healthcare planning and enhancing public awareness.

To Understand More About this Research: Request a Free Sample Report

Private sector involvement is intensifying in the U.S. outdoor air quality monitoring system market as companies recognize the growing demand for data-driven environmental insights. Venture capitalists and institutional investors are showing interest in startups that develop low-cost sensors, IoT-based monitoring networks, and AI-powered air quality analytics. These innovative solutions are scalable and align well with smart city initiatives, offering a high return on investment (ROI). Several tech companies, including sensor manufacturers and environmental data firms, are entering partnerships with municipal governments and research institutions, creating strategic opportunities for penetration and technological advancements. Additionally, major players are focusing on mergers and acquisitions, and joint ventures to expand their product portfolios. Companies are acquiring smaller firms with specialized sensor technologies or data platforms to broaden their capabilities. There is also a clear trend toward integrating outdoor monitoring solutions with broader environmental intelligence systems, including weather forecasting, emission tracking, and health risk assessments. These strategic integrations are helping players deliver end-to-end solutions, improving market competitiveness and justifying larger capital investments.

In the U.S., air quality monitoring is governed by robust and long-standing regulations. The U.S. Environmental Protection Agency (EPA) enforces the Clean Air Act, which sets National Ambient Air Quality Standards (NAAQS) for pollutants considered harmful to public health and the environment. The EPA's AirNow program and State Implementation Plans (SIPs) require regular outdoor air monitoring, compelling both government agencies and industrial operators to invest in advanced monitoring systems.

Industry Dynamics

Growing Industrialization, Urbanization, and Vehicular Emissions

Air pollution has emerged as a critical issue due to rising industrialization, rapid urbanization, and growing vehicular emissions. In 2024, Princeton, Texas experienced a growth rate of 30.6%, according to the United States Census Bureau. Outdoor air quality monitoring systems are essential tools for identifying pollution hotspots, supporting regulatory enforcement, and guiding environmental policymaking. These systems are increasingly being integrated with advanced technologies such as IoT technology, AI, and cloud computing to enhance data accuracy, improve predictive capabilities, and enable remote access to air quality data. As a result, governments, environmental agencies, industries, and smart city planners are investing heavily in these solutions, thereby driving the U.S. outdoor air quality monitoring system market growth.

Increasing Air Pollution Levels and Public Health Concerns

Rising air pollution levels across major urban and industrial centers in the U.S. have become a critical concern, prompting governments and public institutions to seek accurate monitoring solutions. Pollutants such as PM2.5, NO₂, SO₂, and VOCs have been linked to a range of respiratory and cardiovascular illnesses, as well as increased mortality rates. Cities with high traffic congestion, industrial zones, and seasonal environmental issues (e.g., wildfires or crop burning) are witnessing a surge in demand for real-time outdoor air quality data to mitigate health risks. The strong correlation between poor air quality and chronic health conditions is encouraging healthcare professionals, environmental bodies, and policymakers to push for enhanced air monitoring infrastructure. This growing recognition of air pollution as a public health crisis has led to the development of early warning systems, public dashboards, and community engagement initiatives based on air quality data. These efforts are significantly driving the adoption of outdoor air quality monitoring systems across urban and semi-urban areas in the U.S.

Segmental Insights

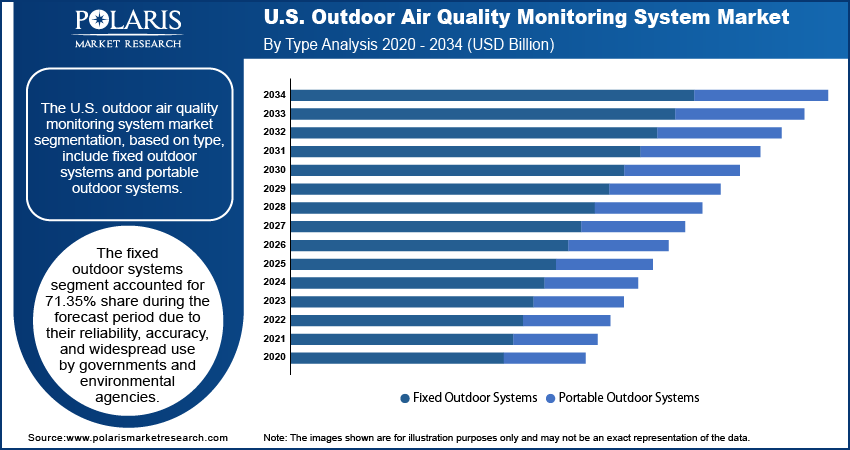

Type Analysis

The fixed outdoor systems segment accounted for 71.35% share of the U.S. outdoor air quality monitoring system market in 2024. Fixed stations are used by government agencies, municipalities, and large industrial facilities to comply with environmental regulations, generate long-term air quality data, and support urban planning or public health initiatives. These systems are known for their high accuracy and reliability, making them ideal for regulatory compliance and scientific research. They are usually connected to centralized data management platforms that collect and analyze data in real-time, allowing for trend analysis and historical comparison. Despite their higher cost and lack of mobility, fixed systems are considered the gold standard for national air quality monitoring networks due to their ability to provide consistent, calibrated, and standardized data over extended periods.

Component Analysis

The hardware segment accounted for 52.94% market share of the U.S. outdoor air quality monitoring system market in 2024. Hardware components include physical devices and instruments used to detect and measure air pollutants. These typically consist of sensors, analyzers, gas detectors, data loggers, weatherproof enclosures, power supply systems (such as solar panels or batteries), and communication modules. The sensors detect pollutants such as particulate matter (PM2.5, PM10), ozone (O₃), carbon monoxide (CO), sulfur dioxide (SO₂), nitrogen dioxide (NO₂), and volatile organic compounds (VOCs), providing the core data for air quality analysis. High-quality hardware is crucial for ensuring the accuracy, durability, and real-time capability of monitoring systems, especially in harsh outdoor environments. Hardware is becoming more compact, energy-efficient, and cost-effective with technological advancements, which facilitates large-scale deployment across cities, industrial zones, and remote regions. The growth of smart cities and regulatory mandates propels demand for sophisticated and scalable hardware that integrates seamlessly with digital platforms, boosting the overall investments in this component segment.

Category Analysis

The industrial perimeter segment accounted for USD 145.26 million in revenue in 2024. Industrial perimeter air quality monitoring refers to systems installed around the boundary of industrial facilities to measure pollutant emissions and ensure they do not exceed regulatory thresholds. These systems continuously assess the air quality at the edge of a facility, detecting harmful pollutants such as sulfur dioxide (SO₂), nitrogen oxides (NOx), particulate matter (PM), and volatile organic compounds (VOCs) that may pose risks to nearby communities and the environment. These monitoring systems are vital in industrial settings for ensuring regulatory compliance, environmental safety, and community transparency. Regulatory bodies often mandate perimeter monitoring to ensure industries do not negatively impact surrounding areas. It also supports emergency response by quickly identifying accidental releases or leakages. With increasing pressure on industries to operate sustainably, the demand for perimeter monitoring systems is rising, especially in sectors such as oil & gas, chemicals, cement, and metals.

Pollutant Analysis

The ozone segment accounted for USD 232.98 million in revenue in 2024. Ozone (O₃) at ground level is a harmful air pollutant formed by chemical reactions between nitrogen oxides (NOx) and volatile organic compounds (VOCs) in the presence of sunlight. Unlike the protective ozone layer in the stratosphere, ground-level ozone is a key component of smog and can trigger a variety of health problems, especially in children, the elderly, and people with respiratory conditions. Outdoor air quality monitoring systems use specialized ozone analyzers to detect and quantify O₃ concentrations in real-time. This data is critical for issuing smog alerts, enforcing air quality standards, and implementing pollution control strategies. Since ozone formation is influenced by weather and sunlight, continuous monitoring helps cities and environmental agencies anticipate high-risk periods and take preemptive action, such as restricting traffic or limiting industrial emissions during ozone peaks.

Key Players and Competitive Analysis

Business rivalry in the U.S. outdoor air quality monitoring system market is high, driven by a mix of established multinational corporations and a growing number of agile startups. Key players compete intensely on technology, pricing, accuracy, user interface design, and after-sales service. Companies strive to differentiate themselves through features such as AI-based analytics, mobile integration, and customizable data visualization tools. Competition is intensifying with small players entering the market as demand grows across the country, particularly in smart cities and developing states. Price wars, product innovation, and partnerships with government agencies or smart infrastructure providers are common strategies. While strong growth potential exists, high competition pressures companies to constantly innovate and maintain cost efficiency, making market dynamics both promising and highly competitive.

Key Players

- Aeroqual

- Airgradient

- ENVEA GLOBAL

- Horiba, Ltd.

- Kunak Technologies

- Met One Instruments, Inc.

- Oizom Instruments Pvt. Ltd.

- PerkinElmer, Inc.

- Prana Air

- Siemens AG

- Teledyne Technologies Incorporated

Industry Developments

April 2025: HORIBA STEC KOREA, Ltd., a HORIBA subsidiary that oversees the Group's semiconductor business in South Korea, acquired EtaMax Co., Ltd., a developer, manufacturer, and supplier of wafer inspection systems.

March 2024: Siemens AG reached an agreement to purchase ebm-papst's industrial drive technology (IDT) business. The company employs approximately 650 people and manufactures intelligent, integrated mechatronic systems in the protective extra-low voltage range, as well as unique motion control systems.

U.S. Outdoor Air Quality Monitoring System Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Fixed Outdoor Systems

- Portable Outdoor Systems

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Category Outlook (Revenue, USD Billion, 2020–2034)

- Industrial Perimeter

- Industrial Hygiene

- Ambient Air Quality Monitoring

- Construction Site Monitoring

- Smart City Air Monitoring

- Others

By Pollutants Outlook (Revenue, USD Billion, 2020–2034)

- Nitrogen Oxides

- Carbon Compounds

- Ozone

- Hydrogen Sulfide (H₂S)

- Others

U.S. Outdoor Air Quality Monitoring System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.06 Billion |

|

Market Size in 2025 |

USD 1.13 Billion |

|

Revenue Forecast by 2034 |

USD 2.08 Billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.06 billion in 2024 and is projected to grow to USD 2.08 billion by 2034.

The market is projected to register a CAGR of 7.1% during the forecast period.

A few of the key players in the market are Aeroqual; Airgradient; ENVEA GLOBAL; Horiba, Ltd.; Kunak Technologies; Met One Instruments, Inc.; Oizom Instruments Pvt. Ltd.; PerkinElmer, Inc.; Prana Air; Siemens AG; and Teledyne Technologies Incorporated.

The fixed outdoor system segment dominated the market share in 2024.

The ozone segment is expected to witness the fastest growth during the forecast period.