UK Macarons Market Size, Share, Trends, Industry Analysis Report

By Type (Basic, Chocolate, Strawberry, Lemon, Lavender Coconut, Others), By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5918

- Base Year: 2024

- Historical Data: 2020-2023

Overview

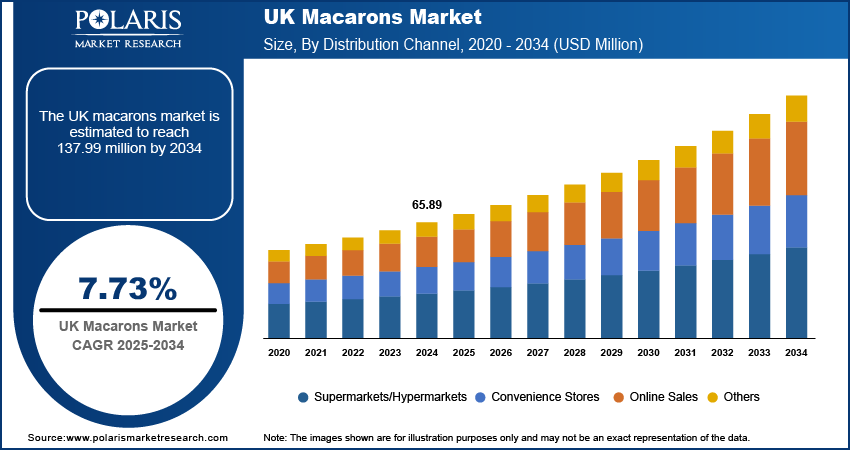

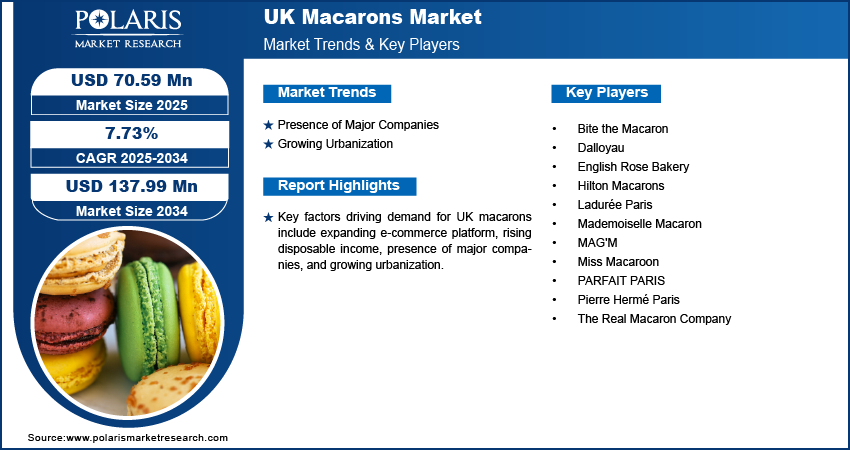

The UK macarons market size was valued at USD 65.89 million in 2024, growing at a CAGR of 7.73% from 2025 to 2034. Key factors driving demand for macarons in the country include adoption of e-commerce platforms, rising disposable income, presence of major companies, and growing urbanization.

A macaron is a delicate and colorful French confection consisting of two small, round, smooth-surfaced meringue-based cookies sandwiched together with a flavorful filling. The cookies are primarily made with egg whites, almond flour, sugar, almond butter, and food coloring. The fillings vary widely and include buttercream, chocolate ganache, jam, marzipan, and fruit compote. Macarons serve multiple purposes beyond being a sweet treat. They often appear as elegant desserts at formal events, weddings, and tea parties due to their refined appearance and variety of flavors.

The increasing adoption of e-commerce platforms drives the UK macarons market growth. These platforms remove geographical barriers, allowing customers from different regions to purchase macarons easily. They also showcase a variety of flavors and brands, attracting buyers who may not find such options locally. Detailed product descriptions, high-quality images, and customer reviews offered by e-commerce platforms build trust and influence consumers to try macarons. Special promotions, discounts, and bundled offers on e-commerce sites further propel purchases.

The UK macarons market expansion is driven by the rising disposable income. Higher disposable income allows consumers to purchase luxury desserts such as macarons, which are often seen as premium treats due to their delicate craftsmanship, colorful appearance, and association with French patisserie culture. Individuals with higher disposable income seek unique and aesthetically pleasing products that enhance their lifestyle and social experiences, driving them toward artisanal and gourmet options such as macarons. Additionally, these consumers visit cafes, bakeries, and patisseries frequently where macarons are commonly sold, further expanding demand. Hence, as the disposable income rises in the UK, the demand for macarons increases.

Industry Dynamics

Presence of Major Companies

The presence of major companies such as Ladurée Paris, Hilton Macarons, Miss Macaroon, and others in the UK propels the UK macarons market by increasing visibility, accessibility, and consumer trust. These companies are distributing their products through supermarkets, cafes, and online platforms, making macarons easier to find and purchase. The established reputation of these companies assures consumers of consistent taste and quality, reducing hesitation among first-time buyers. These players are further introducing innovative flavors and packaging, keeping the product exciting and encouraging repeat purchases. Additionally, collaborations of these companies with influencers, cafes, and events are further popularizing macarons, turning them into a mainstream treat rather than a niche luxury.

Growing Urbanization

Urban areas feature a diverse range of cafes, bakeries, and gourmet food stores that consistently introduce consumers to premium desserts, such as macarons, thereby driving market expansion. Further, urban consumers have higher disposable incomes and a greater appetite for trying international and aesthetically appealing desserts, contributing to higher macarons consumption. Moreover, the dense population and rising café culture in urban areas are creating an opportunity for macaron brands to expand their customer base. Therefore, the growing urbanization is fueling the UK macarons market growth.

Segmental Insights

Type Analysis

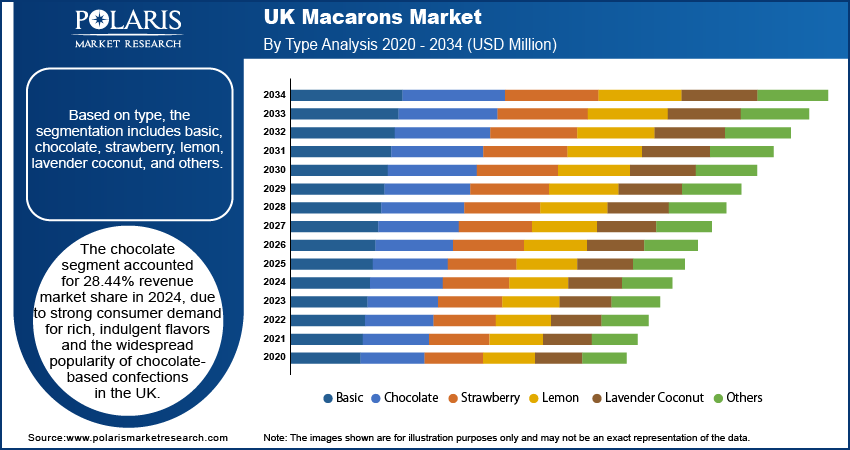

Based on type, the UK macarons market segmentation includes basic, chocolate, strawberry, lemon, lavender coconut, and others. The chocolate segment accounted for 28.44% of revenue share in 2024, due to strong consumer demand for rich, indulgent flavors and the widespread popularity of chocolate-based confections in the UK. Consumers in the country consistently prioritized chocolate macarons due to their familiar taste profile, which blends seamlessly with premium ingredients such as dark cocoa, milk chocolate, and chocolate ganache. Major patisseries and dessert brands also favored this variety in their offerings, by introducing limited-edition and artisanal chocolate flavors that attracted both repeat and new customers. Additionally, gifting trends and seasonal promotions heavily featured chocolate variants, further boosting their market presence throughout the year.

The basic segment is projected to register a CAGR of 8.19% during 2025–2034 due to its widespread consumer acceptance, affordability, and consistent availability across retail outlets. Consumers are increasingly favoring classic vanilla-almond flavor macarons due to their versatility and suitability for casual consumption and formal gifting. Bakeries and patisseries are maintaining a strong focus on this variant as it serves as a staple product that appeal to traditional palates and first-time buyers alike. Additionally, basic macarons often serve as a neutral base for custom orders and seasonal variations, which is driving its demand across different customer segments.

Distribution Channel Analysis

In terms of distribution channel, the UK macarons market segmentation includes supermarkets/hypermarkets, convenience stores, online sales, and others. The supermarkets/hypermarkets segment held 38.76% revenue market share in 2024 due to their wide distribution networks, strong consumer footfall, and ability to offer a broad selection of macaron brands and flavors. Consumers preferred these retail outlets as they provided convenient access to both premium and affordable options under one roof. Major supermarket chains strategically positioned macarons in bakery sections and near checkout counters to drive impulse purchases. Promotional pricing, loyalty programs, and seasonal packaging also contributed to the high sales volume through this channel. The presence of refrigerated and ambient display units further enhanced product visibility and shelf life, making supermarkets the go-to choice for regular and occasional buyers.

The online sales segment is projected to reach USD 41.89 million by 2034. This growth is attributed to the rapid growth of e-commerce platforms and evolving consumer buying behavior. Consumers are increasingly ordering macarons online, especially during holidays, birthdays, and gifting seasons. The convenience of browsing a wider variety of products, along with options for personalization and nationwide shipping, is driving strong growth in the segment. Furthermore, artisanal bakeries and boutique brands are leveraging e-commerce platforms to reach a broader audience, offering customization, subscription boxes, and limited-edition flavors that attract niche buyers.

Key Players and Competitive Analysis

The UK macaron market is highly competitive, featuring a mix of premium French patisserie brands, local artisanal producers, and boutique bakeries competing for consumer attention. Established luxury brands such as Ladurée Paris and Pierre Hermé Paris dominate the high-end segment, leveraging their French heritage and global reputation to attract affluent customers through exclusive department store concessions and upscale retail locations. Dalloyau and PARFAIT PARIS also maintain a strong presence, emphasizing traditional craftsmanship and premium ingredients. UK-based brands such as Miss Macaroon focus on local production, sustainability, and ethical sourcing, appealing to socially conscious consumers. Boutique players such as Mademoiselle Macaron and Bite the Macaron cater to niche markets with innovative flavors and personalized offerings, often sold through online platforms, pop-up stores, and events. Key competitive factors include flavor innovation, brand prestige, pricing strategies, and distribution channels.

A few major companies operating in the UK macarons market are Bite the Macaron, Dalloyau, English Rose Bakery, Hilton Macarons, Ladurée Paris, Mademoiselle Macaron, MAG'M, Miss Macaroon, PARFAIT PARIS, Pierre Hermé Paris, and The Real Macaron Company.

Key Players

- Bite the Macaron

- Dalloyau

- English Rose Bakery

- Hilton Macarons

- Ladurée Paris

- Mademoiselle Macaron

- MAG'M

- Miss Macaroon

- PARFAIT PARIS

- Pierre Hermé Paris

- The Real Macaron Company

Industry Developments

May 2025: Hilton Macarons announced its expansion by launching three new product lines and transferring its production sites across Suffolk, UK.

December 2023: Pâtissier Tipiak, a France-based company, launched its stunning heart-shaped macarons range into the UK food service sector.

UK Macarons Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Basic

- Chocolate

- Strawberry

- Lemon

- Lavender Coconut

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Sales

- Others

UK Macarons Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 65.89 Million |

|

Market Size in 2025 |

USD 70.59 Million |

|

Revenue Forecast by 2034 |

USD 137.99 Million |

|

CAGR |

7.73% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 65.89 million in 2024 and is projected to grow to USD 137.99 million by 2034.

The market is projected to register a CAGR of 7.73% during the forecast period.

A few of the key players in the market are Bite the Macaron, Dalloyau, English Rose Bakery, Hilton Macarons, Ladurée Paris, Mademoiselle Macaron, MAG'M, Miss Macaroon, PARFAIT PARIS, Pierre Hermé Paris, and The Real Macaron Company.

The chocolate segment dominated the market share in 2024.

The online sales segment is expected to witness the fastest growth during the forecast period.