Low Alcohol Beverages Market Share, Size, Trends, Industry Analysis Report

By Product Type (Beer, Wine, Spirit, and RTDs); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM2898

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

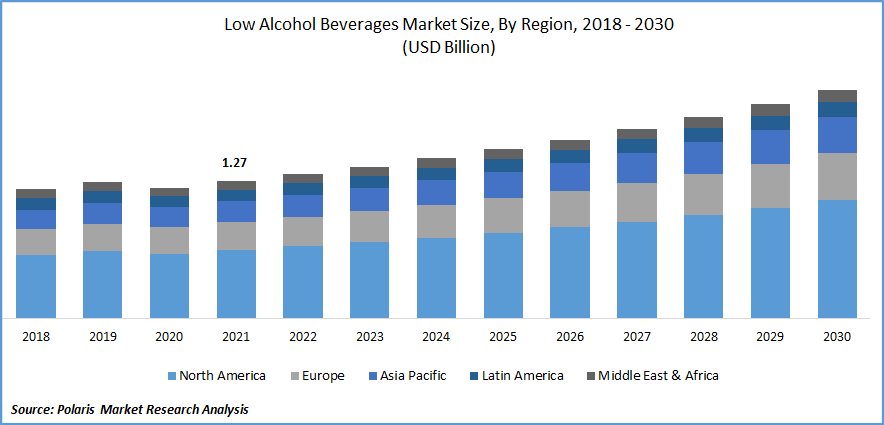

The global low alcohol beverages market was valued at USD 1.46 billion in 2024 and is expected to grow at a CAGR of 5.83% during the forecast period. Key factors driving the demand includes rising investments by the manufacturers of low-alcohol beverages, increasing awareness of health, and change in consumer preference towards healthy, tastier beverages.

Key Insights

- In 2024, the ready-to-drink segment accounted for the largest global revenue share, driven by the introduction of new flavors and the adoption of several effective marketing strategies.

- The online distribution channel segment is expected to grow at a high CAGR during the projected period. This is due to the rapid emergence of various online shopping platforms, as well as multiple services and facilities.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the presence of various untapped markets, increasing consumer disposable income, and a huge population.

- In 2024, North America dominated the low-alcohol beverages market due to the early adoption of advanced technology and innovative manufacturing methods in the region.

Industry Dynamics

- Increasing awareness of several adverse health effects associated with high consumption of alcoholic beverages is a major factor driving the growth of the global market.

- The increasing introduction of various types of low-alcoholic beverages by manufacturers worldwide drives the global market growth.

- Their lower-level status among consumers creates challenges for trial and repeat purchases.

- The demand for beverages that facilitate moderation and promote better lifestyles creates growth opportunities due to the rise in health and wellness trends.

Market Statistics

- 2024 Market Size: USD 1.46 billion

- 2034 Projected Market Size: USD 2.57 billion

- CAGR (2025-2034): 5.83%

- North America: Largest market in 2024

Know more about this report: Request for sample pages

What Does the Low Alcohol Beverage Landscape Look Like?

Low-alcohol beverages have an alcohol content below 1% by volume compared to standard spirits or wine. The rapid change in consumer preference towards healthy, tastier, and more innovative high-quality low alcohol beverages and drinks for maintaining their health goals during their everyday life routines, has forced global manufacturers to introduce products without any change in mouthfeel and taste to cater to the rising consumer demand across the globe are major factors propelling the growth of the global market at a healthy rate of growth. Moreover, rising investments by manufacturers of low-alcohol beverages to enhance product quality, variety, and taste are also likely to impact market growth during the projected period positively.

For instance, in October 2022, Radico Khaitan announced the launch of cocktail mixes containing 4.8% alcohol, which will be sold in cans. The company said the product would be available in three variants: cola, cosmopolitan, and mojito. The company is focusing on filling the void in the beverage market for those with low alcohol content with this product launch.

Furthermore, the rising popularity of “nolo” drinks, typically known as no and low-alcohol drinks, among 18-24 years old people and rapid growth in the consumption of low-alcohol beverages by young generation, especially in the Asia Pacific countries such as India and China due to high population and consumer base is likely to contribute significantly to the market growth over the coming years. According to a study done by British craft beer, 1/3 of young adults consumed alcohol and increased drinking ABV beers to quench their thirst.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

What are the Key Factors Driving the Market Expansion?

The continuously growing interest of consumers in health and wellness, along with increasing awareness of several adverse health effects associated with high consumption of alcoholic beverages, are major factors projected to drive the growth of the global market extensively over the anticipated period. In recent years, the demand for and penetration of high-quality, low-alcohol drinks that support health goals have significantly led market players to introduce new products, as these factors have cumulatively aided in augmenting market growth and demand.

Furthermore, increasing consumer disposable income and spending power, especially in developed countries such as the U.S., Canada, France, Germany, and Japan, coupled with the rising introduction of various types of low alcoholic beverages by manufacturers across the globe, are also likely to propel the global market to grow rapidly in the coming years.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, and region.

|

By Product Type |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Product Type Analysis

Which Segment by Product Type Accounted for the Largest Share of the Market?

The ready-to-drink segment accounted for the largest global revenue share in 2024 owing to a rapid increase in consumer awareness of the availability of these types of products and increasing young population across the world. Most global manufacturers are highly focused on introducing various new flavors and embracing several adequate marketing strategies, including attractive packaging, high investment in promotional activities, and others. This is projected to broaden the market demand and improve segment prospects shortly. Moreover, the rising adoption of healthier lifestyles and awareness of several types of benefits of these beverages. In addition, the availability of a wide range of flavors and soothing taste of these products are capturing the great attention of young consumers, adult population, and women segment has paved the way for high segment growth over the coming years.

Distribution Channel Analysis

Which of the Segments by Distribution Channel Impacted the Growth?

The online distribution channel segment is expected to grow at a high CAGR during the projected period. Rising prevalence of smartphones and internet facilities, coupled with the rapid emergence of various online shopping platforms due to multiple services and facilities offered by them to consumers including easy availability of various global brands, convenient payment methods, and free home delivery, are significant reasons fueling the growth of the segment around the world. In addition, ease of entry barriers for new companies on this platform and a growing number of new entrants in the market who are launching their products through various eCommerce platforms such as Amazon, Walmart, and eBay are further projected to boost the adoption of segment market.

The supermarkets/hypermarkets segment held the largest market revenue share in 2024 owing to availability of a wide range of products from several global brands under one roof and ability to check products physically coupled with a better shopping experience compared to other channels. Moreover, many large supermarkets, including Target, Aldi, Walmart, and Whole Foods, focus on expanding their product offerings to low-alcohol segments. For instance, in July 2021, Woolworths announced the expansion of its offerings of low-alcohol wine, beer, and spirits to cater to the surging consumer demand from global consumers.

Regional Analysis

Why Asia Pacific is Expected to Witness the Fastest Growth?

Asia Pacific is expected to witness the fastest growth during the forecast period attributed to the presence of various untapped markets, increasing consumer disposable income, and huge population. The region is majorly consolidated with several emerging economies like India, China, Malaysia, and Indonesia due to easy availability of low-cost labor and raw materials. In addition, growing government efforts and initiatives to support the low alcohol beverages market in these countries are attracting global market players to operate their businesses in the region.

What are the Factors for North America Market Domination?

North America dominated the low alcohol beverages market in 2024 owing to the large presence of developed economies and early adoption of advanced technology and innovative manufacturing methods in the region. Growing consumer knowledge of health risks connected with the high consumption of alcoholic beverages and extreme growth in the demand for various flavored and low-alcohol hard seltzers in the United States is likely to provide lucrative growth opportunities for beverage manufacturers in the area.

Competitive Insight

Key players include Bacardi Ltd., Abita Brewing Company, Bell’s Brewery Inc., Carlsberg breweries A/S, Blue Moon Brewing Company, Constellation Brands Inc., Hartwall Ltd., Heineken NV., HP Bulmer Ltd., Jack’s hard Cider, Farmageddon Brewery, Blake’s Hard Cider Co., Asahi Premium Beverages Pty. Ltd., Aftershock Brewing Co., and A. Le Coq Estonia.

Recent Developments

September 2025: HEINEKEN launched a Heineken 0.0 draught at its 10,000th outlet in Europe. The aim is to increase the acceptance of alcohol-free options in bars and restaurants across key markets, including the Netherlands, the UK, Spain, Ireland, and France.

January 2022: Katy Perry announced the launch of its new beverages brand De Soi with its business partner named Morgan McLachlan. The new beverage product line comes in three flavors golden hour, purple lune, and champignon dreams. De Soi is currently available to purchase online through 750ml bottles.

Low Alcohol Beverages Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.46 billion |

| Market size value in 2025 | USD 1.54 billion |

|

Revenue forecast in 2034 |

USD 2.57 billion |

|

CAGR |

5.83% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Bacardi Ltd., Abita Brewing Company, Bell’s Brewery Inc., Carlsberg breweries A/S, Blue Moon Brewing Company, Constellation Brands Inc., Hartwall Ltd., Heineken NV., HP Bulmer Ltd., Jack’s hard Cider, Farmageddon Brewery, Blake’s Hard Cider Co., Asahi Premium Beverages Pty. Ltd., Aftershock Brewing Co., and A. Le Coq Estonia. |

FAQ's

• The global market size was valued at USD 1.46 billion in 2024 and is projected to grow to USD 2.57 billion by 2034.

• The global market is projected to register a CAGR of 5.83% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market are Bacardi Ltd., Abita Brewing Company, Bell’s Brewery Inc., Carlsberg breweries A/S, Blue Moon Brewing Company, Constellation Brands Inc., Hartwall Ltd., Heineken NV., HP Bulmer Ltd., Jack’s hard Cider, Farmageddon Brewery, Blake’s Hard Cider Co., Asahi Premium Beverages Pty. Ltd., Aftershock Brewing Co., and A. Le Coq Estonia.

• In 2024, the ready-to-drink segment accounted for the largest global revenue share.

• The online distribution channel segment is expected to grow at a high CAGR during the projected period.