Biotechnology Market Size, Share, Trends & Industry Analysis Report

By Technology (PCR Technology, Nanobiotechnology, Cell-based Assays, DNA Sequencing), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 142

- Format: PDF

- Report ID: PM1011

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

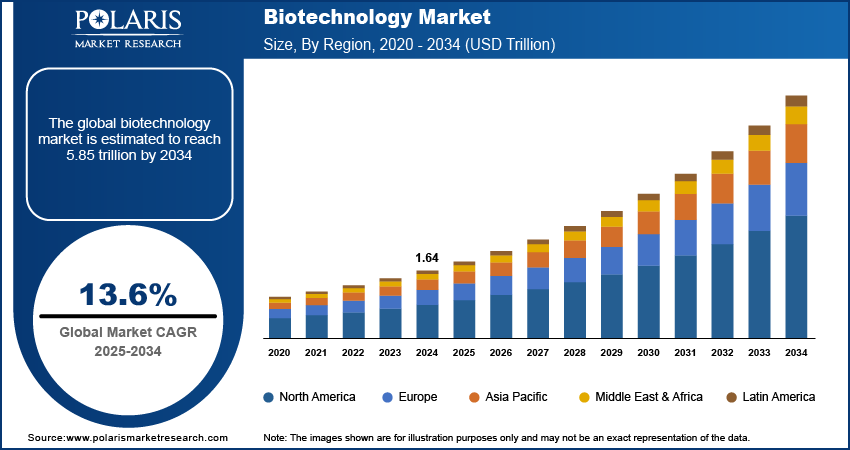

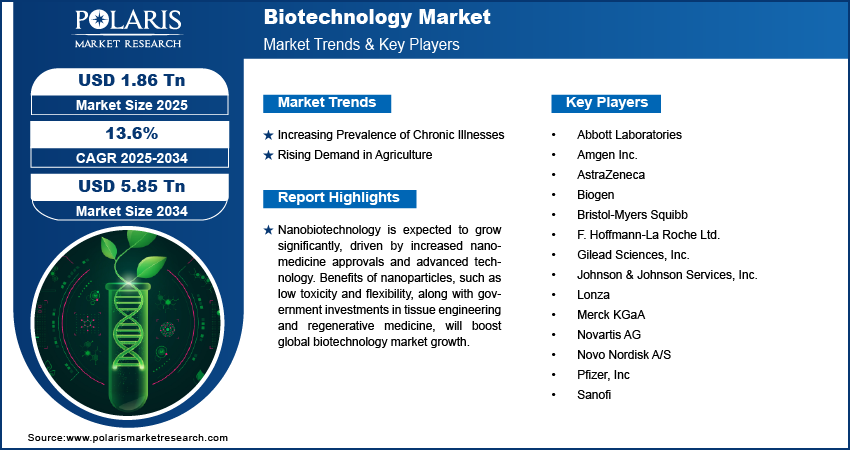

The global biotechnology market was valued at USD 1.64 trillion in 2024 and is expected to grow at a CAGR of 13.6% during 2025–2034. The drivers are developments in CRISPR-based gene therapy, AI-led drug discovery, heightened prevalence of chronic diseases, and government and R&D investments.

Key Insights

- The DNA sequencing segment dominated the market in 2024 due to growing government expenditures on genetic studies and development in the area.

- The health segment is poised for strong expansion as the global disease burden continues to rise.

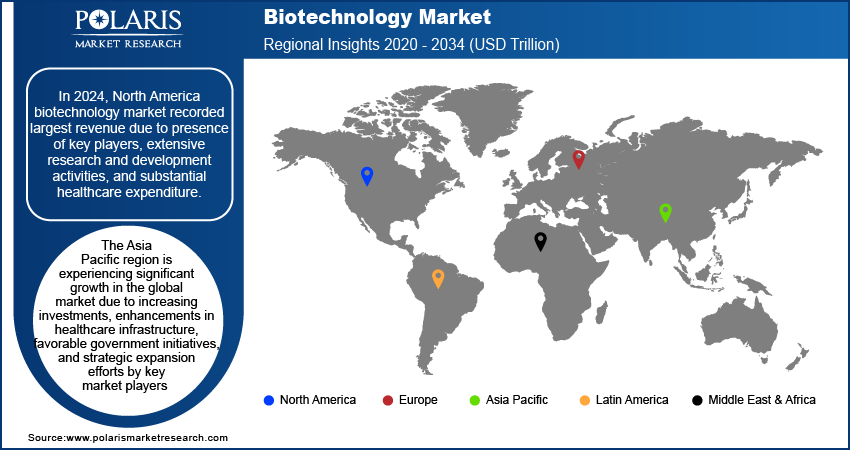

- North America accounted for over 40% of the global biotechnology market share in 2024, driven by leading players, strong R&D, and heavy healthcare spending.

- Asia Pacific biotechnology market is growing at a strong rate with higher investment, improved healthcare infrastructure, beneficial government policies, and strategic expansion by leading players.

Industry Dynamics

- Expansion of biotechnology innovation is being fueled by the development of personalized medicine and orphan drug formulations, drawing new businesses and increasing revenue in the market.

- The rise in chronic diseases, driven by urban lifestyles and a lack of exercise, is being compounded by advancements in biotechnology and personalized medicine, prompting the industry to develop more specific and innovative remedies for genetic and chronic conditions.

- The increasing requirement of biotechnology instruments for agriculture, with the acceptance of genetically modified plants and tissue culture technologies, is driving market growth.

- The major constraint to the biotechnology industry is the expensive and regulatory-intensive nature of research, development, and commercialization of new biotechnological products.

Market Statistics

2024 Market Size: USD 1.64 trillion

2034 Projected Market Size: USD 5.85 trillion

CAGR (2025-2034): 13.6%

North America: Largest Market Share

AI Impact on Biotechnology Market

- AI accelerates drug discovery by scanning large datasets and expediting the search for lead drug candidates.

- AI improves precision medicine through personalizing the treatment regime based on each person's genetic information, enhancing patient outcomes.

- Predictive analytics powered by AI assist in forecasting disease outbreaks, informing preventative actions, and early interventions.

- AI is applied in bioinformatics for the study of advanced biological information to assist in the creation of new vaccines and therapies.

- Machine learning models streamline clinical trials by finding appropriate candidates and forecasting results, saving time and money.

To Understand More About this Research: Request a Free Sample Report

Significant advancements in gene therapies, particularly those based on CRISPR technology, are unlocking new possibilities for curing genetic disorders. Additionally, artificial intelligence is accelerating drug discovery and development processes, leading to the increased integration of AI in drug discovery. The rising prevalence of chronic diseases, such as cancer and diabetes, is also driving the demand for innovative biotech solutions. Furthermore, government initiatives and increased investments in research and development are propelling the industry forward.

Biotechnology is the use of biological systems, organisms, or derivatives to develop or create products and technologies that benefit society. It combines knowledge from fields like biology, chemistry, and engineering to solve problems in areas such as medicine, agriculture, and environmental sustainability.

Government initiatives promoting regulatory modernization, streamlined approval processes, and enhanced reimbursement policies, along with standardized clinical studies, propel the market. The rise of personalized medicine and the expanding portfolio of orphan drug formulations create opportunities for biotechnology applications, attracting emerging innovative companies and contributing to market revenue growth.

A robust clinical trial pipeline and available funding opportunities in tissue engineering and regeneration technologies propel the biotechnology market. According to the Alliance for Regenerative Medicine, companies involved in cell and gene therapies received over USD 23.1 trillion in global investments in 2021, marking a 16% increase from the previous year's total of USD 19.9 trillion. The clinical success of key gene therapy players in 2021, such as positive outcomes from Intellia Therapeutics and Regeneron's in vivo CRISPR treatment for transthyretin amyloidosis, has a substantial impact on market growth.

Driver Analysis

Increasing Prevalence of Chronic Illnesses

Over time, there has been a rise in the prevalence of chronic diseases, attributed in part to an increasingly sedentary lifestyle accompanying the expansion of the middle class and accelerated urbanization. This trend contributes to higher rates of obesity and the increased occurrence of diseases such as malaria, HIV, diabetes, TB, and genetic abnormalities. The market is further driven by a growing frequency of target diseases and genetic anomalies, ongoing technological advancements in polymerase chain reaction technologies, and increased investments, funding, and grants for scientific research. The bio-pharmacy industry plays a crucial role in preventing chronic diseases, with a focus on developing personalized treatments. This approach is expected to pave the way for individualized procedural healthcare requirements and contribute to the treatment of hereditary genetic diseases. Additionally, innovative concepts like cell therapy are being introduced to the market, showing potential for the efficient treatment of certain cancers.

Rising Demand in Agriculture

The market experiences growth due to rising demand for biotechnology tools in agricultural applications, such as micro-propagation, molecular breeding, tissue culturing, conventional plant breeding, and the development of genetically modified crops. The increasing popularity of genetically modified crops, herbicide-tolerant, and insect-resistant seeds further contributes to market expansion. The adoption of tissue culture technology for producing novel rice variants and disease- and pest-free banana varieties in South Asia and Africa, along with its use in cloning disease-free and nutritious plant varieties, drives the application of biotechnology in agriculture, thereby driving the industry value.

Segment Analysis

Assessment by Technology Outlook

The biotechnology market segmentation based on technology includes fermentation, tissue engineering and regeneration, chromatography, PCR technology, nanobiotechnology, cell-based assays, DNA sequencing and others. The DNA sequencing segment accounted for the largest share in 2024 due to an increase in government funding in genetic research. Government funding in genetic research has facilitated the expanded applications of sequencing, facilitating a better understanding of diseases. For instance, in May 2021, the University of Pittsburgh Graduate School of Public Health and Washington University School of Medicine received a USD 10.7 trillion NIH grant for the exploration of the genetic foundation of Alzheimer's disease, showcasing an increase in funding for genetic research, thereby driving the segmental growth in the global industry.

Nanobiotechnology is anticipated to experience substantial growth at a high CAGR during the forecast period, propelled by the increasing approvals of nanomedicine and the introduction of advanced technology. The advantages of nanoparticles, such as low toxicity, smaller size, and chemical flexibility, prove beneficial in overcoming limitations associated with traditional routes of generic drug administration. Additionally, the field of tissue engineering and regenerative medicine commands a noteworthy share, supported by both government and private investments, substantial healthcare expenditure, and the presence of a significant number of established and emerging players. These factors are expected to propel growth in this segment throughout the forecast period in the global market.

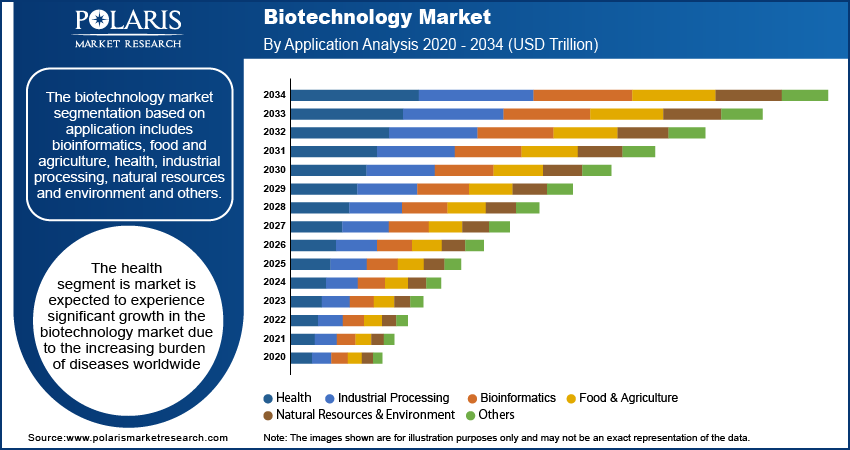

Assessment by Application Outlook

The biotechnology market segmentation, based on application, includes bioinformatics, food and agriculture, health, industrial processing, natural resources and environment, and others. The health segment of the market is expected to experience significant growth due to the increasing burden of diseases worldwide. The global population is aging, and the prevalence of chronic conditions like cancer, diabetes, and heart disease is rising, due to which there is a growing demand for advanced medical treatments and therapies. Biotechnology plays a key role in developing innovative medicines, vaccines, and diagnostic tools to address these health challenges. Additionally, advancements in personalized medicine and gene therapies are further driving the growth of this segment.

Regional Analysis

In 2024, North America biotechnology market accounted for more than 40% market share globally. The growth of the regional market is driven by various factors, including the presence of key players, extensive research and development activities, and substantial healthcare expenditure. The region exhibits a notable penetration of genomics, proteomics, and cell biology-based platforms, thereby accelerating the adoption of life sciences tools. Additionally, the increasing prevalence of chronic diseases and the growing adoption of personalized medicine applications for treating life-threatening disorders are anticipated to have a positive impact on biotechnology market growth in the North American region.

The Asia Pacific biotechnology market is experiencing significant growth. This growth is attributed to increasing investments, enhancements in healthcare infrastructure, favorable government initiatives, and strategic expansion efforts by key market players. Notably, in February 2022, Moderna Inc. disclosed plans for a geographic expansion of its commercial network in Asia, establishing new subsidiaries in Malaysia, Singapore, Hong Kong, and Taiwan. Furthermore, collaborations in the biopharmaceutical sector, such as the strategic partnership between Kiniksa Pharmaceuticals and Huadong Medicine for the development and commercialization of Kiniksa's ARCALYST and mavrilimumab in the Asia-Pacific region, showcase the strategic expansion efforts by key market players. These factors, in turn, are driving the growth of the biotechnology market in the Asia Pacific region

Key Players & Competitive Analysis Report

The biotechnology industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the industry by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the biotechnology market include Abbott Laboratories, Amgen Inc., AstraZeneca, Biogen, Bristol-Myers Squibb, F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., Johnson & Johnson Services, Inc., Lonza, Merck KGaA, Novartis AG, Novo Nordisk A/S, Pfizer, Inc., and Sanofi.

Roche, officially known as F. Hoffmann-La Roche Ltd, is a biotechnology firm dedicated to advancing medical solutions for various significant ailments. Its focus encompasses the development of drugs and diagnostic tools to combat major diseases, such as cancer, autoimmune disorders, central nervous system conditions, eye-related afflictions, infectious ailments, and respiratory issues. Roche also provides comprehensive diabetes management solutions, in vitro diagnostic systems, and cutting-edge cancer diagnostics based on tissue analysis. The company's operational structure revolves around two key segments: diagnostics and pharmaceuticals. Under the pharmaceutical domain, Roche concentrates on creating innovative medications in oncology, immunology, ophthalmology, infectious diseases, and neuroscience. Roche specializes in disease identification via in vitro diagnostic procedures in the diagnostic realm. Roche's pursuits extend to pioneering research and exploration of novel disease prevention, detection, and treatment strategies. Its broad range of offerings caters to diverse stakeholders, including hospitals, commercial laboratories, healthcare practitioners, researchers, and pharmacists.

Novartis AG is a healthcare company that specializes in the development and manufacture of generic pharmaceuticals and eye care products. With a global presence in 140 countries, it offers a wide range of products for the treatment of various medical conditions, including cancer, neurological disorders, cardiovascular diseases, respiratory diseases, hematologic diseases, immune disorders, infections, and dermatological conditions. The company has a strong focus on therapeutic areas such as renal, metabolic, cardiovascular, neuroscience, immunology, and oncology, as well as ophthalmology and hematology. The company has a collaboration and license agreement with Alnylam Pharmaceuticals to develop, manufacture, and commercialize inclisiran, a therapy to reduce LDL cholesterol. The Innovative Medicines division is responsible for researching, developing, manufacturing, distributing, and selling patented pharmaceuticals. This segment comprises two business units: Novartis Pharmaceuticals and Novartis Oncology. These units are dedicated to bringing new and innovative treatments to patients suffering from various diseases, including cancer, cardiovascular diseases, and neurological disorders.

Key Companies

- Abbott Laboratories

- Amgen Inc.

- AstraZeneca

- Biogen

- Bristol-Myers Squibb

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- Johnson & Johnson Services, Inc.

- Lonza

- Merck KGaA

- Novartis AG

- Novo Nordisk A/S

- Pfizer, Inc

- Sanofi

Industry Developments

In October 2024, The Unified Website for Biotechnology Regulation was launched by the USDA, EPA, and FDA, providing information on regulatory requirements for GM microorganisms, aiming to enhance transparency and coordination in biotech regulation.

In May 2023, Gilead Sciences, Inc. announced the completion of its acquisition of XinThera, obtaining all outstanding shares. This strategic maneuver bolsters Gilead's clinical development goals by integrating complementary pipeline assets concentrated on validated targets in oncology and inflammation.

In January 2023, Gero and Pfizer initiated a strategic research collaboration, leveraging Pfizer's domain expertise and Gero's advanced technology platform. This partnership is focused on uncovering genes and pathways linked to fibrotic diseases, representing a notable advancement in the biotechnology market.

Biotechnology Market Segmentation:

By Technology Outlook (Revenue USD Trillion, 2020–2034)

- Fermentation

- Tissue Engineering and Regeneration

- Chromatography

- PCR Technology

- Nanobiotechnology

- Cell-based Assays

- DNA Sequencing

- Others

By Application Outlook (Revenue USD Trillion, 2020–2034)

- Bioinformatics

- Food & Agriculture

- Health

- Industrial Processing

- Natural Resources & Environment

- Others

By Regional Outlook (Revenue USD Trillion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biotechnology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.64 trillion |

|

Market size value in 2025 |

USD 1.86 trillion |

|

Revenue Forecast in 2034 |

USD 5.85 trillion |

|

CAGR |

13.6% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD trillion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Biotechnology Market size was valued at USD 1.64 trillion in 2024 and is projected to grow to USD 5.85 trillion by 2034

The global market is projected to grow at a CAGR of 13.6% during the forecast period, 2025-2034.

North America had the largest share in the global market in 2024.

The key players in the market are Abbott Laboratories; Amgen Inc.; AstraZeneca; Biogen; Bristol-Myers Squibb; F. Hoffmann-La Roche Ltd.; Gilead Sciences, Inc.; Johnson & Johnson Services, Inc.; Lonza; Merck KGaA; Novartis AG; Novo Nordisk A/S; Pfizer, Inc and Sanofi.

The DNA sequencing segment accounted for largest share in 2024 due to increase in government fundings in the genetic research

The health segment is market is expected to experience significant growth in the biotechnology market due to the increasing burden of diseases worldwide.