Abaca Pulp Market Share, Size, Trends, Industry Analysis Report

By Product (Medical Filter Papers, Food Preparation Papers, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4245

- Base Year: 2023

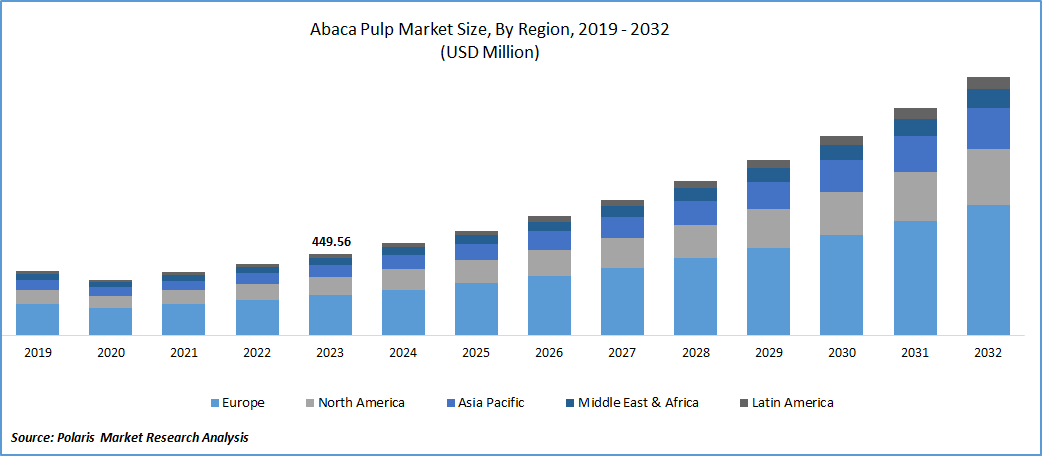

- Historical Data: 2019-2022

Report Outlook

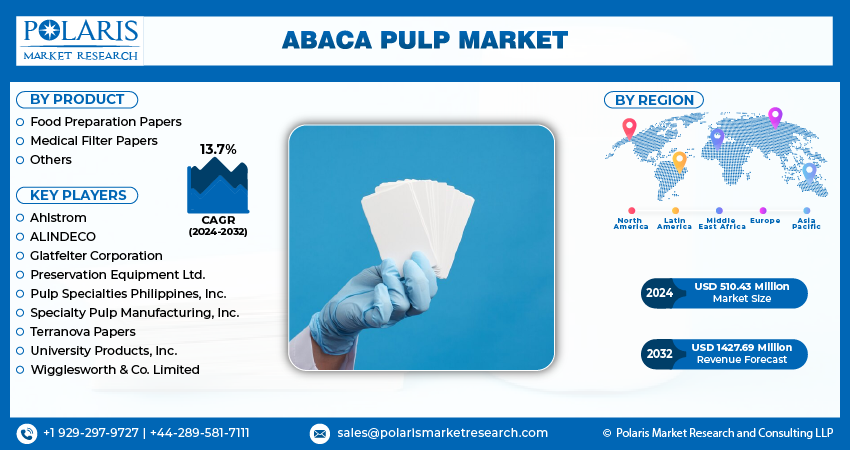

The global abaca pulp market was valued at USD 449.56 million in 2023 and is expected to grow at a CAGR of 13.7% during the forecast period.

Market is propelled by its diverse applications, notably in the manufacturing of various papers, including specialized papers used in food preparation. Abaca pulp, derived from the fibers of the abaca plant, is particularly valued for its remarkable tensile strength and biodegradable properties. These characteristics make it an ideal material for producing papers used in food-related applications, such as tea bags and filter papers. The increasing global consumption of tea and coffee, driven by factors such as rapid urbanization, the surge in e-commerce retail sales, and a growing preference among consumers for ready-to-drink (RTD) coffee and tea, is anticipated to fuel the demand for abaca pulp in the foreseeable future.

To Understand More About this Research: Request a Free Sample Report

The increasing usage of abaca pulp as an alternative to wood pulp in diverse paper and textile applications is poised to propel industry growth. Its expanding adoption in the paper industry, especially in specialty applications such as tea bags and coffee filters due to its exceptional durability, is a significant driver. Notably, the U.S. witnessed a notable surge in the import of abaca pulp from the Philippines in 2020. This surge was attributed to the growing acceptance of these fibers across various industries, contributing to overall market expansion. Moreover, the increasing embrace of sustainable fibers within the paper and specialty paper industry, aligning with global sustainable development goals (SDGs), is anticipated to generate new avenues for growth.

Abaca pulp stands out for its lengthy and robust fibers, rendering it a preferred material for specialty papers. Its frequent utilization in manufacturing tea bags, currency paper, and security documents is attributed to its durability, capable of withstanding wear and tear. The rise in disposable income among younger demographics in developing economies is fostering increased consumption of tea and coffee. Additionally, a growing awareness among consumers about the health risks linked to carbonated beverages is steering a shift towards ready-to-drink (RTD) tea & coffee alternatives.

Industry Dynamics

Growth Drivers

Sustainable and Eco-Friendly Properties

Abaca pulp, renowned for its high-tensile strength and biodegradable qualities, serves as a crucial material in the production of various papers. In the context of increasing awareness of environmental sustainability, companies engaged in the manufacturing of ready-to-drink (RTD) tea and tea bags, like Clipper Teas & Pukka Herbs, are opting for sustainable materials like abaca pulp market to align with their carbon reduction objectives. Moreover, the rising prevalence of chronic health conditions, including cancer, heart disease, and diabetes, due to rapid socioeconomic development, has led to a heightened focus on health benefits associated with RTD tea consumption. This has particularly resonated with the elderly population, contributing to an increased demand for these products and fostering market growth.

Report Segmentation

The market is primarily segmented based on product, and region.

|

By Product |

By Region |

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Food preparation papers segment accounted for the largest market share in 2023

Food preparation papers segment accounted for the largest share. Abaca pulp is extensively used in the manufacturing of tea bag filters, coffee bag filters, and other filter papers due to its robustness, durability, and elasticity. Its robust and permeable nature is crucial for maintaining product freshness over an extended period in food preparation papers. Additionally, the growing preference for sustainable and cost-effective materials is expected to boost the usage of abaca pulp in food preparation papers.

These papers need to possess sufficient strength to contain tea leaves and coffee grounds without tearing, while also being impermeable to water. The long and resilient fibers of abaca make it an ideal material for this purpose. The application of this pulp in medical filter papers is anticipated to increase in the forecast period. Its unique qualities, including fine fibers, strength, and filtration capabilities, make it well-suited for the manufacture of medical filter papers and face masks. These papers are crucial for ensuring accuracy and reliability in laboratory & medical procedures where effective filtration of matter or liquid is essential.

The product is extensively utilized in the manufacturing of filter papers for applications in laboratories, pharmaceuticals, environmental testing, and biotechnology. Abaca pulp-based medical filter papers are adept at capturing particles, making them suitable for chemicals, suspensions, and fluids in laboratory settings. Moreover, the production and processing of abaca pulp adhere to the necessary quality standards for materials used in manufacturing medical filter papers, ensuring uniformity and purity in medical processes. Additionally, the chemical compatibility of these filters is contributing to an increased usage in the production of medical filter papers.

Regional Insights

Europe region dominated the global market in 2023

Europe region dominated the global market. The predominantly cold climate in European countries has led to a heightened consumption of Ready-to-Drink (RTD) hot beverages, including various types of coffees and teas. The preference for tea bags made from the sustainable products, such as abaca pulp, has surged due to the growing awareness of climate change. Moreover, European governments frequently implement policies and incentives to encourage sustainable and eco-friendly practices across various industries.

The policies implemented by European governments to promote sustainability and eco-friendly practices can play a pivotal role in shaping consumer behavior and business practices. These initiatives create a conducive environment for businesses to adopt environmentally friendly materials, such as abaca pulp. The increasing awareness among consumers about environmental issues, coupled with the desire to make eco-conscious choices, has led to a growing preference for products made from sustainable sources.

As consumers in Europe become more environmentally conscious, there is a heightened demand for materials like abaca pulp, which is biodegradable and sourced from a renewable plant. Businesses that align with these sustainability trends may find themselves in a favorable position in the market. The potential benefits of using abaca pulp, such as its biodegradability, strength, and versatility, contribute to its attractiveness in the eyes of environmentally conscious consumers.

The Asia Pacific will grow with substantial pace. Region’s growth is driven by diverse applications across various industries. One key factor contributing to this growth is the increased usage of abaca pulp in critical applications such as medical masks, tobacco paper, tea bags, & specialty paper. The unique properties of abaca pulp, including its strength and fine fibers, make it an ideal material for these applications. Abaca pulp's characteristics, such as durability and resistance to wear and tear, are particularly advantageous to produce currency papers. The demand for secure and robust materials in currency production is likely to fuel the adoption of abaca pulp.

Furthermore, the regional market is anticipated to benefit from favorable trade policies implemented by countries like Japan and India. These policies create an environment conducive to the import of abaca pulp, fostering collaboration and trade partnerships. As a result, businesses operating in the abaca pulp industry can capitalize on these trade policies to expand their market presence and meet the growing demand for abaca pulp in the region.

Key Market Players & Competitive Insights

The market is characterized by both major and smaller-scale players, and these entities employ various strategies such as introducing new products, expanding their current manufacturing capacities, and enhancing their geographical presence. These approaches are aimed at securing a competitive edge over other players in the market.

Some of the major players operating in the global market include:

- Ahlstrom

- ALINDECO (Albay Agro-Industrial Development Corporation)

- Glatfelter Corporation

- Preservation Equipment Ltd.

- Pulp Specialties Philippines, Inc.

- Specialty Pulp Manufacturing, Inc.

- Terranova Papers

- University Products, Inc.

- Wigglesworth & Co. Limited

Recent Developments

- In September 2023, Glatfelter Corporation has revealed a collaboration with Ekman & Co. to distribute its abaca pulp product through the sales agency of the latter.

Abaca Pulp Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 510.43 million |

|

Revenue forecast in 2032 |

USD 1427.69 million |

|

CAGR |

13.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Abaca Pulp Market report covering key segments are product, and region

The global abaca pulp market size is expected to reach USD 1.42 billion by 2032

The global abaca pulp market is expected to grow at a CAGR of 13.7% during the forecast period.

Europe regions is leading the global market

Government Support and Regulations are the key driving factors in Abaca Pulp Market