Accounts Receivable Automation Market Share, Size, Trends, Industry Analysis Report

By Deployment (Cloud and On-premises); By Vertical; By Component; By Region; Segment Forecast, 2022 -2030

- Published Date:Nov-2022

- Pages: 114

- Format: PDF

- Report ID: PM2845

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

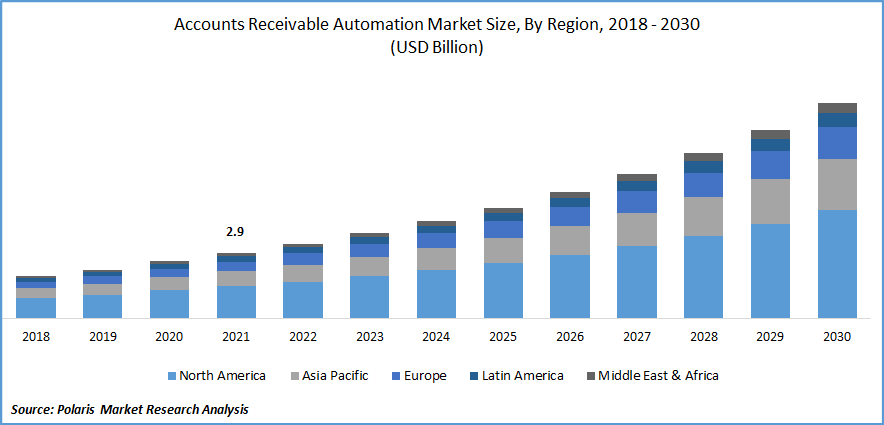

The global accounts receivable automation market was valued at USD 2.9 billion in 2021 and is expected to grow at a CAGR of 14.1% during the forecast period.

Extensive adoption of smart technologies, high digitization, and growing automation by several large and small organizations across the globe are likely to significantly boost the growth and demand of the market significantly over the forecast period. Around 90% of total enterprises in the U.S. are small and medium in nature, and only 8-10% are large enterprises. So, the majority of small-medium-sized enterprises looking forward to integrating and enhancing their workflow with the help of automation technologies to gain better operational efficiency are further expected to be the significant factors fueling the growth of the global market over the coming years.

Know more about this report: Request for sample pages

Additionally, the increasing need for technologically advanced digital platforms for monitoring day-to-day accounting activities and rising implementation of several business developing strategies such as collaboration, acquisitions, mergers, and partnerships by large market players to strengthen their market position and product portfolio is anticipated to contribute significantly to the market demand and growth. For instance, in January 2022, Sage Group announced the completion of its acquisition of “Brightpearl,” a cloud-native multi-channel retail solutions company. With this acquisition, the company aims to create a robust solution for retailers & wholesalers.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of several large and small enterprises across various industry verticals around the world. However, the COVID-19 pandemic has positively impacted the growth of the accounts receivable automation market for small and large businesses in various industries. Since accounts receivable automation provides solutions to many pandemic issues like collecting payments and reducing overheads, which has fueled the demand for these solutions during the pandemic. According to our findings, around 64% of global firms are shifting away from the physical mode of invoices, and nearly 67% of firms are receiving more payments digitally due to COVID-19.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

An extensive rise in the demand for quick invoicing solutions and growing need for managing transactions for complete and improved client experience across the globe are the key factors influencing the market growth. Automating account receivable solutions helps shorten the time between sending invoices and getting paid by sending bills to customers and clients on time without any errors. Customers can view their invoices directly by clicking on links immediately, which drives the market’s growth significantly.

In addition, rising adoption of artificial intelligence and ML based accounts automation provides high growth opportunities by helping finance & accounting executives to increase ^ & improve their financial efficiency with the help of offering deep insights into the business process, are some other factors fueling the growth and demand of the global market at a significant rate of growth.

Report Segmentation

The market is primarily segmented based on deployment, vertical, component, and region.

|

By Deployment |

By Vertical |

By Component |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Cloud segment is anticipated to witness the fastest market growth

Capabilities of cloud-based accounts receivable automation solutions for managing various significant data issues efficiently and cost-effectiveness are the major key factors expected to drive the segment market growth during the forecast period. Cloud-based automation solutions provide several advantages like adaptability, scalability, cost-effectiveness, and easy deployment, which has resulted in higher adoption of cloud deployment automation solutions across several organizations worldwide.

Furthermore, the on-premises segment is expected to grow rapidly over the forecast period due to its high usage among several enterprises, as it offers complete control over infrastructure and assets. In addition, rising cyber-attacks, data privacy, and security are major reasons likely to boost the adoption of on-premises accounts receivable automation solutions across the globe over the coming years.

Healthcare segment accounted for the largest market share in 2021

The healthcare sector garnered the largest market share, in 2021, and is anticipated to continue its dominance throughout the study period. Higher implementation and rapid adoption of advanced and innovative technologies by various healthcare organizations to offer improved and hassle-free services to patients are major factors driving the market growth. Organizations related to healthcare industry require efficient payment acceptance technologies to streamline their operations and increase customer experience.

Moreover, the BFSI segment is expected to be the fastest growing segment during the forecast period owing to increasing prevalence of the BFSI vertical as an early adopter in newly developed and innovative technologies. The AR automation solutions enable financial organizations and institutions to improve and enhance their cash collection from customers, maximize the productivity of staff, and verify invoices to generate accurate reports, which is likely to create lucrative growth opportunities for the growth of the segment market at a significant growth rate over the coming years.

Solution sector held the largest market revenue share in 2021

The segment’s growth is mainly attributed to continuously increasing demand for accounts receivable automation solutions from the BFSI sector across the world. BFSI sector is highly implementing and opting for these solutions to provide better payment acceptance services to their consumers and reduce the number of invoicing errors by the invoice verifying capabilities of these solutions, which has paved the way for higher growth of the segment market in the coming years.

In addition, employment of these types of services is also surging in several businesses owing to various attributes, including calcite the average balance, calculating net annual credit sales, and dividing the net yearly credit sales by the average account receivables.

Asia Pacific is expected to witness fastest growth over the forecast period

High economic developments, rapid globalization, digitalization, and increased internet penetration are the primary reasons for the growth of the market in the region for the coming years. Japan & China are the prominent market leaders and are the most technologically advanced countries in the region, fostering the growth and demand for the market at a significant rate. Moreover, rising government initiatives to promote digital infrastructure are other factors driving the higher adoption of AR automation solutions across the region. For instance, Fuji Xerox announced to extend its partnership with Esker, a business process & document automation vendor, to launch its dedicated “Esker Accounts Receivable” service in the region.

However, North America accounted for the largest market revenue share in 2021, owing to a well-developed economy, higher penetration and implementation of novel technologies, and greater regional competitiveness. In addition, presence of many prominent market players in the region, such as Oracle Corporation, Workday, BlackLine, and Bottomline Technologies, is also a key factor propelling the market growth and demand for these solutions in the region.

Competitive Insight

Some of the major key players operating in the global market include SAP SE, Oracle Corporation, Kofax Inc., SK Global Software, Bottomline Technologies, Vanguard Systems, Microsoft Corporation, IBM Corporation, Workday Inc., HighRadius Corporation, Zoho Corporation, Comarch, Sage Group, BlackLine, Esker S.A., YayPay, Emagia Corporation., and Invoiced.

Recent Developments

In January 2022: Oracle Corporation announced its Oracle NetSuite Cash 360 to enhance forecasting and help various businesses make better strategic cash decisions. The new product launched by the company simplifies management of cash with the help of a configurable dashboard that includes important links to key cash management activities and cash flow trends.

Furthermore, in January 2022, BlackLine acquired FourQ Systems. With the acquisition, the company aims to improve and strengthen its accounting automation capabilities and market position by accelerating the seamless automation of accounting procedures & improving modernization.

Accounts Receivable Automation Market Report Scope

|

Report Attributes |

Details |

|

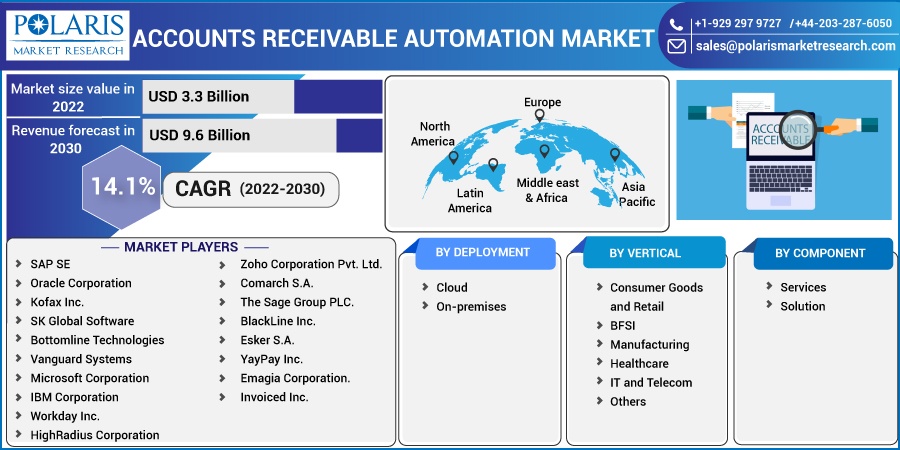

Market size value in 2022 |

USD 3.3 billion |

|

Revenue forecast in 2030 |

USD 9.6 billion |

|

CAGR |

14.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Deployment, By Vertical, By Component, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

SAP SE, Oracle Corporation, Kofax Inc., SK Global Software, Bottomline Technologies, Vanguard Systems, Microsoft Corporation, IBM Corporation, Workday Inc., HighRadius Corporation, Zoho Corporation Pvt. Ltd., Comarch S.A., The Sage Group PLC., BlackLine Inc., Esker S.A., YayPay Inc., Emagia Corporation., and Invoiced Inc. |