Aerospace Fasteners Market Size, Share, Trends, Industry Analysis Report

By Product (Screws, Nuts and Bolts, Rivets, Pins, Others); By Material; By Aircraft; By Application; By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM2001

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global aerospace fasteners market size was valued at USD 6.24 billion in 2024. It is projected to grow at a CAGR of 6.3% from 2025 to 2034. Innovations in aerospace fasteners, consistent growth of the aviation sector, and rising momentum in space exploration and satellite deployment drive the demand for aerospace fasteners.

Market Insights

- Based on aircraft, the narrow-body aircraft segment dominated the market, with a valuation of USD 2.77 billion in 2024. Its prominence is attributed to the large-scale production of narrow-body aircraft, primarily due to widespread deployment in short- to medium-haul commercial routes.

- Among all applications, the engine segment is expected to witness the highest CAGR of 6.2% during the forecast period. Aircraft engine components require fasteners that can tolerate extreme temperatures, pressure variations, and mechanical burden.

- North America accounted for 37.76% of the market in 2024, driven by the prominence of the aerospace manufacturing ecosystem, the strong presence of major OEMs, and continued investments in various aviation programs.

- The US occupied the largest share, 77.79%, of the North American market in 2024.

- The Asia Pacific market is projected to register a CAGR of 4.80% from 2025 to 2034. Projected growth will be driven by rising aircraft production operations, increasing air passenger traffic, and surging defense budgets.

Market Dynamics

- Aerospace fasteners are built tough to handle extreme conditions such as high heat, pressure, and stress during flight gain significant traction. Their design and materials need special attention to ensure safety and performance.

- The flourishing aviation industry is creating greater demand for fasteners. Fastener manufacturers plan to capitalizes on business opportunities created by the increasing purchases of planes by airlines to meet rising air travel needs.

- Strict aviation and defense certification methods lead to delays in product approvals, limiting market entry for new fastener suppliers and hindering the adoption of novel solutions in aviation.

- Newer generations of aircraft utilize advanced composite materials, which necessitate fasteners with specialized properties such as corrosion resistance, lightweight, high strength, driving up R&D and production costs for manufacturers.

Market Statistics

Market Size in 2024: USD 6.24 billion

Projected Market Size in 2034: USD 11.52 billion

CAGR, 2025–2034: 6.3%

Largest Regional Market, 2024: North America

AI Impact on Aerospace Fasteners Market

- Inspection systems enhanced with AI bring precision in detecting defects in aerospace fasteners, which form major part of the safety standards compliance process.

- AI can optimize machining, forging, and coating processes in fastener manufacturing, which helps uplift operational efficiencies through waste reduction and yield optimization.

- AI-based simulations can speed up the development and production of fasteners, especially for those required in aircraft of newer generations. These carriers need lighter and stronger variants that aid in improved fuel efficiency and sustainability.

- AI tools can be integrated into inventory management systems to shorten lead times through the analysis if demand patterns, which allows for smooth and uninterrupted supply.

- Integration of smart sensors with AI can increase the effectiveness of fastener integrity monitoring in aircraft, in turn facilitating predictive maintenance and reducing downtime.

To Understand More About this Research: Request a Free Sample Report

Aerospace fasteners are critical mechanical components used to securely join parts in aircraft, spacecraft, and related structures, ensuring safety and structural integrity under extreme conditions. The growing momentum in space exploration and satellite deployment is driving the demand for these components. A January 2025 space exploration report highlighted that in 2024, a total of 259 launches took place, averaging one every 34 hours, which was five hours more frequent than the previous year. The need for high-performance fasteners that can withstand vibration, pressure fluctuations, and thermal extremes becomes increasingly essential as global interest intensifies in deep space missions, Low-Earth orbit satellites, and commercial space programs. Additionally, these fasteners play a major role in assembling launch vehicles, payload components, and spacecraft systems, making them essential to the expanding aerospace supply chain.

The rising demand for Urban Air Mobility (UAM) platforms, especially electric vertical take-off and landing (eVTOL) aircraft, is further accelerating the adoption of advanced aerospace fasteners. Government and private investments are driving rapid advancements in the sector, as evidenced by recent funding. In June 2025, Eve Air Mobility secured a USD 15.8 million grant from Brazil's FINEP, bringing the total project funding to USD 33.8 million. These next-generation aerial vehicles require lightweight, high-strength fastening solutions to meet stringent safety, performance, and weight reduction standards. The structural complexity and frequency of production will drive fastener innovation as eVTOL aircraft move closer to commercial deployment for short-distance air travel in urban areas. This trend highlights a transformative shift in aviation design and manufacturing, positioning aerospace fasteners as critical enablers of this evolving mobility ecosystem.

Innovations in Aerospace Fasteners: Aerospace equipment, components, and technology often require operation in harsh environments and challenging situations. Extreme wind speeds, high pressure, extreme temperatures, and other external factors must be considered when designing and manufacturing aerospace equipment and components, such as aerospace fasteners. Considering this scenario, several recent developments have taken place regarding operations, manufacturing, customer support, and company policies, resulting in the production of high-quality fasteners. In January 2023, Sherex Fastening Solutions launched Optisert, a round-body rivet nut featuring diamond knurls for enhanced grip. Testing showed that M6 Optisert achieves a spin-out resistance of over 20Nm in composites and aluminum, outperforming standard round-body rivet nuts (12Nm) and rivaling hex designs, while maintaining easier installation.

The origin of novel technologies, such as augmented reality (AR), is being leveraged for the development of a new product portfolio. The industry is witnessing the introduction of technology platforms that are utilizing AR for faster and better output. For example, WorkLink Create is a platform that enables engineers to create and share their AR work within the workspace. These platforms eliminate the need to code and offset the requirement to have prior 3D experience. Such platforms are intended to reduce the overall ramp-up time, thus ensuring high productivity. Hence, the rising innovations in aerospace fasteners boost the market growth.

Growing Aviation Sector: The growing aviation sector is driving growth opportunities for fasteners, as the increasing demand for new aircraft across commercial, defense, and general aviation segments is fueling demand for these components. The production of aircraft correspondingly surges, directly amplifying the demand for fasteners as global passenger traffic rises and airlines expand their fleets to meet connectivity needs. According to a January 2025 IATA report, global air traffic in 2024, measured by revenue passenger kilometers (RPKs), increased by 10.4% year-over-year compared to 2023. Additionally, fleet modernization, retrofitting programs, and growing maintenance activities contribute to consistent consumption of fasteners. The rising demand in commercial and general aviation is attributed to growing industrialization and globalization, which has given a major thrust to the aviation industry. This is expected to generate substantial demand for aerospace fasteners, thereby enhancing its market size and driving demand for these fasteners during the forecast period.

Segmental Insights

Product Analysis

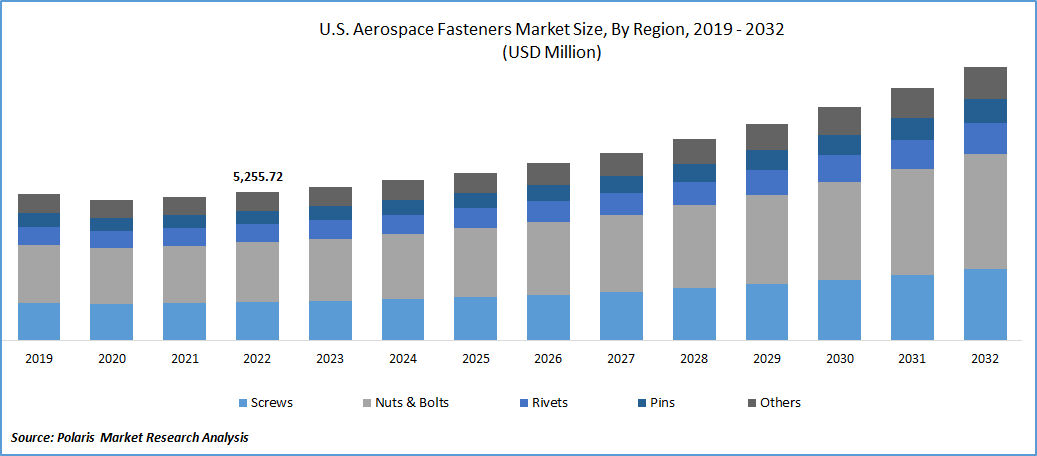

Based on product, the segmentation includes screws, nuts & bolts, rivets, pins, and other products. The nuts & bolts segment was valued at USD 2.45 billion in 2024 owing to its widespread use in high-load-bearing structural applications across both commercial and defense aerospace sectors. These fasteners provide exceptional strength and durability, making them essential for joining critical components such as airframes, landing gear assemblies, and engine mounts. Their compatibility with various materials, ease of inspection, and capability to endure dynamic loads contribute to their continued relevance in aircraft assembly and maintenance. Additionally, the modularity of nuts and bolts allows for efficient disassembly and replacement, which is crucial for aircraft servicing and lifecycle management.

The screws segment is projected to grow at a robust pace in the coming years, due to the growing demand for lightweight fastening solutions that offer high precision and secure installation in tight or complex geometries. Screws are increasingly favored in applications that require precise control over torque and alignment, particularly in interior cabin structures, avionics compartments, and lightweight composite panels. Advancements in thread design, material strength, and anti-corrosion coatings further enhance their performance and suitability for aerospace environments. Moreover, the increasing incorporation of composite materials and modular assembly processes in new aircraft platforms is also driving the adoption of specialty aerospace screws.

Material Analysis

In terms of material, the segmentation includes aluminum, steel, titanium, and super alloys. The super alloys segment captured 34.91% share of the market in 2024 due to their exceptional mechanical strength, resistance to high temperatures, and superior fatigue and corrosion performance. These properties make them essential in fastening applications within jet engines, turbine assemblies, and structural areas exposed to extreme thermal and mechanical stress. Their use is especially dominant in military and high-performance commercial aircraft, where durability and reliability under extreme conditions are essential. Additionally, the ongoing advancement in propulsion systems and the demand for long-term performance in harsh operating environments are further boosting the preference for super alloy-based fasteners.

The titanium segment is projected to grow at a rapid pace in the coming years, owing to its excellent strength-to-weight ratio, corrosion resistance, and compatibility with carbon fiber-reinforced composites. These characteristics make titanium fasteners highly suitable for next-generation aircraft, where weight reduction is crucial for improving fuel efficiency and reducing emissions. Titanium's ability to maintain structural integrity under high thermal stress conditions makes it ideal for both airframe and engine applications. Moreover, the push toward light weighting strategies across the aerospace sector, particularly in narrow-body and electric aircraft, continues to drive demand for titanium-based fastening systems.

Aircraft Analysis

Based on aircraft, the segmentation includes narrow-body aircraft, wide-body aircraft, regional jet, general aviation, military aircraft, and other aircraft. The narrow-body aircraft segment dominated the market with a valuation of USD 2.77 billion in 2024 due to their high production volume and widespread deployment in short- to medium-haul commercial routes. These aircraft rely heavily on a high density of fasteners across various subsystems, such as fuselage, wings, and interior structures, to ensure structural stability and ease of maintenance. The segment benefits from increasing airline demand for fuel-efficient and cost-effective aircraft, which accelerates the need for advanced fastening solutions. Additionally, frequent upgrades, retrofitting activities, and maintenance schedules in the global narrow-body fleet further support consistent demand for high-performance aerospace fasteners.

The military aircraft segment is expected to witness a CAGR of 6.4% during the forecast period, owing to increased investments in defense aviation and the modernization of air fleets. Military aircraft demand fasteners with enhanced tensile strength, fatigue resistance, and tolerance to harsh operational environments. The need for reliable and high-specification fasteners has risen, especially with the deployment of advanced fighter jets, surveillance aircraft, and unmanned aerial systems. Furthermore, national defense strategies highlighting increasing production and fleet expansion are expected to accelerate the manufacturing and procurement of aerospace-grade fasteners for military applications.

Application Analysis

In terms of application, the segmentation includes airframe, interiors, engine, control surfaces, landing gear, and wheels & brakes. The airframe segment is projected to capture a 52.74% share by 2034 due to the sheer volume of fasteners required in primary structural assemblies. Fasteners are crucial in joining fuselage sections, wing structures, and empennages, thereby ensuring the overall integrity and safety of the aircraft. The increasing use of composite materials in airframe design demands advanced fastening solutions with high strength and compatibility, further fueling segment growth. Additionally, the focus on modular design and ease of maintenance underscores the crucial role of fasteners in contemporary airframe architecture across commercial, military, and private aviation.

The engine segment is expected to witness fastest growth with a CAGR of 6.2% during the forecast period as aircraft engine components require precision fasteners that can withstand high temperatures, pressure variations, and mechanical loads. The need for high-performance, heat-resistant fasteners is increasing with advancements in jet propulsion technologies and the development of more efficient engines. Engine manufacturers are also integrating lightweight materials and innovative designs, which necessitate compatible fastening solutions. Furthermore, this trend is particularly noticeable in newer generation engines with stricter performance and durability standards, driving fastener innovation and increasing demand within this segment.

Regional Analysis

The North America aerospace fasteners market accounted for 37.76% of the global market share in 2024. This dominance is attributed to its well-established aerospace manufacturing ecosystem, strong presence of major OEMs and tier suppliers, and continued investments in defense and commercial aviation programs. For instance, Northrop Grumman announced a USD 50 million investment in June 2025 to advance its collaboration with Firefly Aerospace on Eclipse, a new medium-lift rocket capable of carrying 16 metric tons. The region leads in aircraft production volumes, especially for narrow-body and defense aircraft, which drives sustained demand for high-performance fastening solutions. Furthermore, ongoing R&D initiatives, technological innovation, and a focus on lightweight and durable materials improve North America's leadership position. The presence of advanced infrastructure and robust supply chain networks also supports regional growth and the expansion of fasteners.

U.S. Aerospace Fasteners Market Insight

The U.S. held 77.79% revenue share of the North America aerospace fasteners landscape in 2024, owing to its strong manufacturing base, advanced R&D capabilities, and continuous investments in commercial and defense aviation programs. The presence of major aircraft OEMs and a highly integrated supply chain has further reinforced domestic production and demand for high-performance fastening solutions. Additionally, the country’s leadership in aerospace innovation and fleet modernization programs continues to drive sustained industry expansion.

Asia Pacific Aerospace Fasteners Market

The Asia Pacific market is projected to register a CAGR of 4.80% from 2025 to 2034, driven by rising aircraft production, increasing air passenger traffic, and expanding regional defense budgets. According to IATA's January 2025 report, airlines in Asia Pacific had the biggest passenger growth worldwide in 2024, up 26% from 2023. They flew 24.7% more flights while filling 83.8% of seats (an increase of 0.8%), showing a strong growth opportunity for fasteners. Rapid industrialization and the emergence of aircraft manufacturing programs across the region are fueling demand for domestic sourcing of aerospace components, including fasteners. Moreover, the growth of low-cost carriers and infrastructure investments in aviation are increasing MRO activities, thereby contributing to higher fastener consumption. The region’s proactive shift toward technology adoption and vertical integration within the aerospace sector also supports its projected market acceleration.

India Aerospace Fasteners Market Overview

The industry growth in India is driven by increasing indigenous aircraft production, defense modernization initiatives, and the development of local aerospace supply chains. The government's support for domestic manufacturing, as seen in initiatives such as "Make in India," is encouraging investments in aerospace component manufacturing, including fasteners. Rising demand for commercial aviation and growth in MRO activities are further fueling the industry growth.

Europe Aerospace Fasteners Market Assessment

Europe is projected to capture 32.71% share by 2034 due to its strong aerospace heritage, advanced engineering capabilities, and its commitment to sustainable aviation initiatives. The region benefits from the presence of leading aircraft and engine manufacturers focused on innovation in lightweight structures and alternative propulsion systems. European regulatory frameworks also encourage the adoption of high-performance, eco-friendly fasteners aligned with long-term sustainability goals. Additionally, robust collaboration among industry stakeholders, research institutions, and government bodies fosters the development of next-generation aerospace technologies, strengthening the regional demand for specialized fastening solutions.

Germany Aerospace Fasteners Analysis

The Germany aerospace fasteners industry accounted for USD 471.31 million revenue share in 2024, supported by its strong industrial engineering capabilities and its position as a major hub for aircraft component manufacturing in Europe. The country’s focus on precision manufacturing, advanced materials, and sustainability in aerospace production has boosted the adoption of innovative fastener solutions. Moreover, strategic collaborations between aerospace OEMs and suppliers in Germany continue to drive technological advancements and bolster market growth.

Key Players and Competitive Analysis

The aerospace fasteners sector is witnessing intense competition driven by emerging technologies and strategic investments from both established players and small and medium-sized businesses. Key industry trends include lightweight material adoption and automation, creating revenue opportunities for innovators. Competitive intelligence reveals that leading vendors are focusing on sustainable value chains and technological advancements to address supply chain disruptions. Economic and geopolitical shifts are influencing vendor strategies, with localization gaining traction. Growth projections highlight latent demand for high-strength, corrosion-resistant fasteners, particularly in eVTOL and space applications. Expert insights suggest that future development strategies will prioritize digital integration and agile manufacturing to capitalize on revenue growth. Competitive positioning now hinges on innovation speed, cost efficiency, and compliance with evolving aerospace standards.

A few major companies operating in the aerospace fasteners industry include Acument Global Technologies; B&B Specialties, Inc.; Boeing Distribution Services Inc.; Consolidated Aerospace Manufacturing; HC Pacific; Howmet Aerospace; LISI AEROSPACE; MS Aerospace; National Aerospace Fasteners Corporation; Precision Castparts Corp.; Stanley Black & Decker, Inc.; TFI Aerospace Corporation; TPS Aviation, Inc.; TriMas Corporation; and Wurth Group.

Key Players

- Acument Global Technologies

- B&B Specialties, Inc.

- Boeing Distribution Services Inc.

- Consolidated Aerospace Manufacturing

- HC Pacific

- Howmet Aerospace

- LISI AEROSPACE

- MS Aerospace

- National Aerospace Fasteners Corporation

- Precision Castparts Corp.

- Stanley Black & Decker, Inc.

- TFI Aerospace Corporation

- TPS Aviation, Inc.

- TriMas Corporation

- Wurth Group

Industry Developments

- June 2025: NAFCO and MTU Aero Engines expanded their partnership with a five-year agreement, extending collaboration beyond aerospace fasteners to include precision machining in Suzhou.

- January 2025: Bossard Group completed its acquisition of Germany's Ferdinand Gross Group, a leading fastening technology distributor with operations in Hungary and Poland.

- February 2024: TriMas Aerospace secured a multi-year global contract with Airbus, covering its Monogram, Allfast, and Mac Fasteners brands. The expanded agreement broadens TriMas' supply scope across Airbus operations, reinforcing its role in the aircraft manufacturer's global fastener supply chain.

Aerospace Fasteners Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Screws

- Nuts & Bolts

- Rivets

- Pins

- Other Products

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Aluminum

- Steel

- Titanium

- Super alloys

By Aircraft Outlook (Revenue, USD Billion, 2020–2034)

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jet

- General Aviation

- Military Aircraft

- Other Aircrafts

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Airframe

- Interiors

- Engine

- Control Surfaces

- Landing Gear

- Wheels & Brakes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerospace Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.24 Billion |

|

Market Size in 2025 |

USD 6.62 Billion |

|

Revenue Forecast by 2034 |

USD 11.52 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.24 billion in 2024 and is projected to grow to USD 11.52 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America dominated the market in 2024, holding 51.16% share.

A few of the key players in the market are Acument Global Technologies; B&B Specialties, Inc.; Boeing Distribution Services Inc.; Consolidated Aerospace Manufacturing; HC Pacific; Howmet Aerospace; LISI AEROSPACE; MS Aerospace; National Aerospace Fasteners Corporation; Precision Castparts Corp.; Stanley Black & Decker, Inc.; TFI Aerospace Corporation; TPS Aviation, Inc.; TriMas Corporation; and Wurth Group.

The narrow-body aircraft segment dominated the market with a valuation of USD 2.77 billion in 2024.

The engine segment is expected to witness the highest CAGR of 6.2% during the forecast period.