Aerospace Foam Market Size, Share, Trends & Industry Analysis Report

: By Application (Flight Deck pads, Carbon Walls & Ceilings, Aircraft Seats, Aircraft Floor, and Others), By Type, By End Use, and By Region– Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 116

- Format: PDF

- Report ID: PM3446

- Base Year: 2024

- Historical Data: 2020-2023

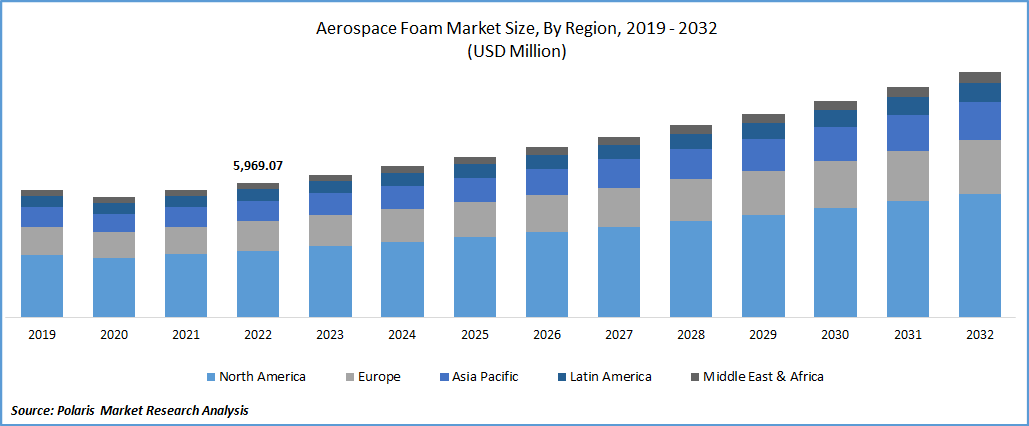

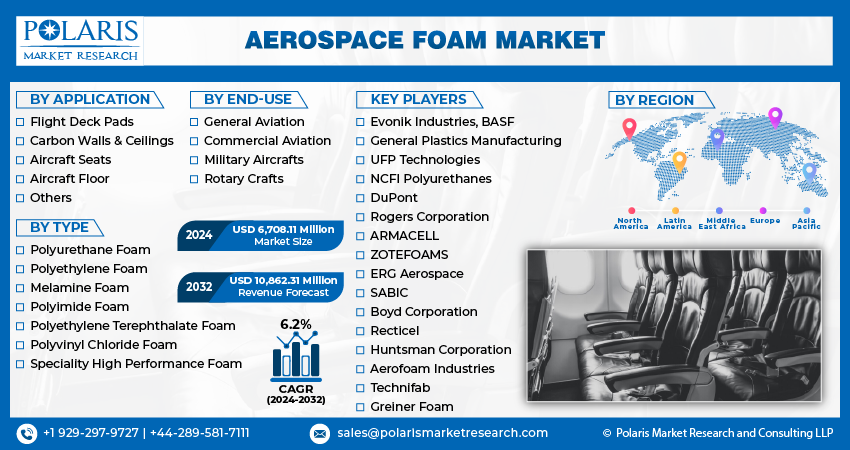

The aerospace foam market size was valued at USD 6.07 billion in 2024, exhibiting a CAGR of 6.4% during 2025–2034.

The aerospace foam market is driven by the increasing demand for lightweight and fuel-efficient aircraft, advancements in aerospace technology, and the growing need for materials that offer thermal insulation and vibration damping.

Market Overview

The Aerospace Foam Market is defined by the production and application of foam materials in the aerospace manufacturing sector. These materials, including polyurethane, polyethylene, and metal foams, are essential for creating lightweight yet durable components in both aircraft and spacecraft. Aerospace foams are valued for their exceptional properties, such as a high strength-to-weight ratio, excellent thermal insulation, and resistance to impact and vibration. These engineered materials play a crucial role in various applications, from enhancing passenger comfort and safety in cabin interiors to improving fuel efficiency by reducing aircraft weight.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for fuel-efficient aircraft and the aerospace industry's focus on sustainability are key drivers pushing the adoption of advanced, lightweight materials. The continuous emphasis on enhancing passenger comfort and safety also boosts the demand for foam materials in cabin interiors, seating, insulation, and soundproofing applications. Furthermore, the expansion of aerospace manufacturing in emerging and ongoing advancements in flexible foam technology, including the development of sustainable and eco-friendly foam solutions, contribute to the growth. The increasing number of air travelers and rising military expenditure also drive the demand for new aircraft, which in turn boosts the aerospace foam market.

Industry Dynamics

Focus on Lightweighting and Fuel Efficiency

The aerospace industry consistently prioritizes reducing aircraft weight to enhance fuel efficiency and lower operational costs. Foam materials are crucial in achieving this objective due to their excellent strength-to-weight ratio, allowing for significant mass reduction compared to traditional materials. Even a small reduction in aircraft weight can lead to substantial fuel savings and emission reductions. For instance, a 1 kg (2.2 lbs) weight reduction on an aircraft can result in an estimated annual fuel saving of approximately $4,210 and a tangible reduction in CO2 emissions. International Civil Aviation Organization (ICAO) agreements are pushing for new binding standards for aircraft fuel efficiency. Commercial electric aircraft seeking certification after December 31, 2031, will need to achieve a minimum 10% reduction in fuel consumption at the certification point compared to current models. This new generation of aircraft is expected to be around 35% more efficient than the 2000 models. This persistent push for lighter aircraft and lower fuel burn directly impacts the demand for innovative aerospace foam solutions, driving the overall aerospace foam growth.

Increasing Demand for Passenger Comfort and Safety

The rising global air passenger traffic and the evolving expectations of travelers are significant dynamics. Modern aircraft designs increasingly incorporate advanced foam materials to improve cabin acoustics, vibration damping, and thermal insulation, leading to a more comfortable flight experience. Beyond comfort, the integration of specialized fire-retardant and impact-absorbing foams is vital for enhancing passenger safety and adhering to rigorous aviation safety standards. This demand for enhanced comfort and safety features in aircraft interiors, including seating, galleys, and overhead bins, necessitates the use of high-performance foam solutions that meet both regulatory requirements and passenger expectations. Consequently, this focus on passenger experience acts as a strong driver for advanced aerospace foam products, contributing to the expansion of the aerospace foam market.

Advancements in Manufacturing Technologies and Materials

Continuous innovation in manufacturing processes and material science is a key development for the aerospace foam industry. The development of new foam compositions with enhanced properties, such as improved fire resistance, higher structural integrity, and better sound absorption, continually expands the potential applications for these materials in aerospace. Furthermore, advancements in manufacturing techniques, including additive manufacturing (3D printing) of foam structures, enable the creation of complex geometries and customized components with greater precision and efficiency. These technological leaps facilitate the production of more advanced and versatile foam solutions, catering to the specific and evolving needs of aircraft manufacturers. Such continuous innovation and material development are pivotal growth factors, propelling the aerospace foam market forward.

Segmental Insights

Market Assessment By Application

The market is segmented by application into flight deck pads, carbon walls & ceilings, aircraft seats, aircraft floor, and others. Among these, aircraft seats typically represent the sub-segment holding the highest share. This is primarily due to the ubiquitous requirement for seating across all types of aircraft, from commercial passenger planes to private jets. Each seat necessitates multiple layers of foam for various functions, including ergonomic support, vibration dampening, sound insulation, and crucial fire retardation properties. The sheer volume of seats in a single aircraft, combined with the stringent safety and comfort standards mandated by aviation authorities, drives substantial and consistent demand for specialized foam materials in this application. The importance of passenger experience and safety makes this a critical and high-volume area for foam utilization.

The carbon walls & ceilings sub-segment is poised for the highest growth rate. This anticipated growth is fueled by the continuous drive within the aerospace industry towards lightweighting and enhanced fuel efficiency. Manufacturers are increasingly integrating advanced aerospace composite structures, often incorporating foam cores, into aircraft interiors to reduce overall weight without compromising structural integrity. Carbon walls and ceilings offer significant weight-saving potential compared to traditional materials, directly contributing to improved aircraft performance and lower operational costs. As airlines and aircraft original equipment manufacturers (OEMs) prioritize modern, lighter cabin designs and more sustainable solutions, the adoption of foam materials in carbon composite applications for walls and ceilings is expected to experience robust development.

Market Evaluation By Type

The market is segmented by type into polyurethane foam, polyethylene foam, melamine foam, polyimide foam, polyethylene terephthalate foam, polyvinyl chloride foam, and specialty high performance foam. Polyurethane foam typically commands the largest share. This widespread penetration is attributable to its versatile properties, including excellent durability, superior thermal insulation, and a favorable strength-to-weight ratio. Polyurethane foam is extensively utilized across numerous aerospace applications, such as seating, cabin interiors, and various insulation requirements, where comfort, safety, and performance are paramount. Its adaptability to meet stringent aerospace standards, coupled with its inherent ability to adhere to fire resistance regulations, solidifies its prominent position in the industry. The consistent demand for these characteristics ensures polyurethane foam maintains a significant presence.

The polyimide foam sub-segment is demonstrating a robust growth rate. This elevated development is primarily driven by its exceptional performance characteristics, particularly its superior high-temperature resistance and inherent flame-retardant properties, which are increasingly crucial in demanding aerospace environments. Polyimide foam finds growing application in areas requiring extreme thermal stability and fire safety, such as engine compartments, specialized insulation for critical systems, and certain structural components where conventional foams may not suffice. The ongoing industry trends towards enhanced safety standards and operational efficiency in high-stress applications further propel the adoption of polyimide foam, positioning it as a rapidly expanding segment.

Market Evaluation By End Use

The market is segmented by end use into general aviation, commercial aviation, military aircrafts, and rotary crafts. Commercial aviation typically holds the largest share. This dominance stems from the vast global fleet of commercial passenger and cargo aircraft, which are continually in operation and undergo regular maintenance and modernization. Foam materials are extensively utilized in commercial aircraft for passenger seating, cabin insulation, overhead stow bins, and flooring, all contributing to passenger comfort, safety, and operational efficiency. The high volume of new aircraft deliveries and the consistent demand for refurbishment and upgrades in existing fleets, driven by the increasing global air passenger traffic, underscore the substantial demand for aerospace foams in this sector.

The military aircrafts sub-segment is anticipated to exhibit a strong growth rate. This projected growth is largely influenced by increasing defense budgets worldwide and the ongoing modernization efforts of military fleets across various nations. Military aircraft require highly specialized and durable foam materials for critical applications such as impact absorption, blast mitigation, soundproofing for stealth capabilities, and insulation in extreme operational environments. The development of advanced military platforms, coupled with the need for enhanced protection and performance in combat and transport aircraft, drives the demand for innovative and high-performance aerospace foam solutions in this end-use segment.

Regional Analysis

North America aerospace foam market consistently holds the largest share. This dominance is largely attributed to the presence of major global aircraft manufacturers, including prominent commercial and defense aerospace companies. The region benefits from a robust and mature aerospace ecosystem, characterized by extensive research and development capabilities, advanced manufacturing facilities, and substantial government investments in both civilian and military aviation programs. The high volume of aircraft production, combined with a strong emphasis on continuous innovation in aircraft design and materials for fuel efficiency and performance, ensures a sustained and significant demand for advanced aerospace foam solutions across various applications.

Asia Pacific aerospace foam market is anticipated to demonstrate the highest growth rate. This rapid expansion is driven by a surging demand for air travel, particularly from a growing middle class and expanding economies in countries like China and India. The region is witnessing significant investments in new airport infrastructure and the expansion of commercial aircraft fleets to meet the escalating passenger traffic. Furthermore, increasing defense spending and modernization efforts in several Asia Pacific nations are contributing to the demand for specialized foams in military aircraft. The establishment of new manufacturing hubs and maintenance, repair, and overhaul (MRO) facilities further supports the region's burgeoning aerospace industry, making it a key driver.

Key Players and Competitive Insights

The aerospace foam market features a diverse range of active players providing advanced material solutions. Prominent companies in this specialized field include Armacell, BASF SE, Boyd Corporation, DuPont, ERG Aerospace Corporation, Evonik Industries AG, General Plastics Manufacturing Company, Greiner Foam International GmbH, Rogers Corporation, Solvay, UFP Technologies Inc., and Zotefoams plc. These entities are actively involved in the development, manufacturing, and supply of various foam types tailored for the stringent demands of aircraft and spacecraft applications.

The competitive landscape is characterized by a mix of global chemical conglomerates and specialized foam manufacturers. Companies engage in robust research and development to introduce innovative foam materials with enhanced properties, such as superior fire resistance, lightweighting capabilities, and improved acoustic performance, to meet evolving regulatory standards and customer specifications. Strategic partnerships and targeted investments in manufacturing capabilities are common strategies to strengthen penetration and address the specific needs of aircraft OEMs and component suppliers. The demand for high-performance, sustainable, and customizable foam solutions drives continuous innovation and strategic positioning among these industry participants.

List of Key Companies

- Armacell

- BASF SE

- Boyd Corporation

- DuPont

- ERG Aerospace Corporation

- Evonik Industries AG

- General Plastics Manufacturing Company

- Greiner Foam International GmbH

- Rogers Corporation

- Solvay

- UFP Technologies Inc.

- Zotefoams plc

Industry Developments

- September 2024: L&L Products introduced its InsituCore foam materials. This development represents a key advancement in lightweight composite manufacturing processes for the aerospace sector.

- June 2023: Trelleborg, a prominent company in engineered polymer solutions, acquired 4M Company Inc. for an undisclosed amount. 4M Company Inc. specializes in aerospace sealing solutions, including aerospace foams. Through this strategic acquisition, Trelleborg aims to address the increasing demand for aerospace seals and expand its product range, integrating specialized aerospace foam solutions.

Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Flight Deck pads

- Carbon Walls & Ceilings

- Aircraft Seats

- Aircraft Floor

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Polyurethane Foam

- Polyethylene Foam

- Melamine Foam

- Polyimide Foam

- Polyethylene Terephthalate Foam

- Polyvinyl Chloride Foam

- Specialty High Performance Foam

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- General Aviation

- Commercial Aviation

- Military Aircrafts

- Rotary Crafts

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.07 billion |

|

Market Size Value in 2025 |

USD 6.44 billion |

|

Revenue Forecast by 2034 |

USD 11.25 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The market has been segmented into detailed segments of application, type, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: The growth and marketing strategies are intrinsically linked to addressing key industry trends and demands. Companies often focus on continuous innovation, developing advanced foam materials with enhanced properties such as improved fire resistance, lighter weight, and greater durability to meet evolving aerospace standards and performance requirements. Strategic collaborations with major aircraft manufacturers and tier-1 suppliers are crucial for product development and penetration. Furthermore, marketing efforts emphasize the unique benefits of their foam solutions in contributing to fuel efficiency, passenger safety, and comfort, targeting specific end-use segments like commercial aviation and military aircraft with tailored product offerings and technical support to drive development.

FAQ's

The global market size was valued at USD 6.07 billion in 2024 and is projected to grow to USD 11.25 billion by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some companies in the market include Armacell, BASF SE, Boyd Corporation, DuPont, ERG Aerospace Corporation, Evonik Industries AG, General Plastics Manufacturing Company, Greiner Foam International GmbH, Rogers Corporation, Solvay, UFP Technologies Inc., and Zotefoams plc.

The aircraft seats segment accounted for the largest share of the market in 2024.

Following are some of the market trends: ? Growing Emphasis on Lightweighting and Fuel Efficiency: There's a continuous market drive for lighter materials in aircraft to reduce overall weight, directly improving fuel efficiency and lowering carbon emissions, which boosts demand for advanced aerospace foams. ? Increasing Focus on Sustainability and Eco-Friendly Materials: The industry is seeing a shift towards sustainable foam solutions, including bio-based and recyclable materials, driven by stricter environmental regulations and the aviation sector's commitment to reducing its environmental footprint.

Aerospace foam refers to a specialized category of lightweight, cellularly structured materials specifically engineered for diverse applications within the aerospace industry. These foams are crucial for enhancing the performance, safety, and efficiency of both aircraft and spacecraft. They are typically made from various polymer foam, metals, or ceramics, with common types including polyurethane, polyimide, polyethylene, and melamine foams, as well as specialty high-performance formulations and even metal foams.